Ethereum (ETH) Price Prediction: Tom Lee Predicts V-Shaped Recovery After Recent Crash

TLDR

- Ethereum price bounced 22% from $1,750 low to reclaim $2,100 level after a 43% nine-day crash

- ETH futures premium sits at 3% on Monday, below the 5% neutral threshold, showing continued bearish sentiment

- Open interest dropped to $24.1 billion, the lowest level in nine months, potentially signaling a contrarian buy opportunity

- Tom Lee-backed Bitmine Immersion Technologies acquired another 40,000 ETH for $83.4 million on Monday

- ETH inflation reached 0.8% annually as network activity slowed and the base layer struggled to maintain deflationary status

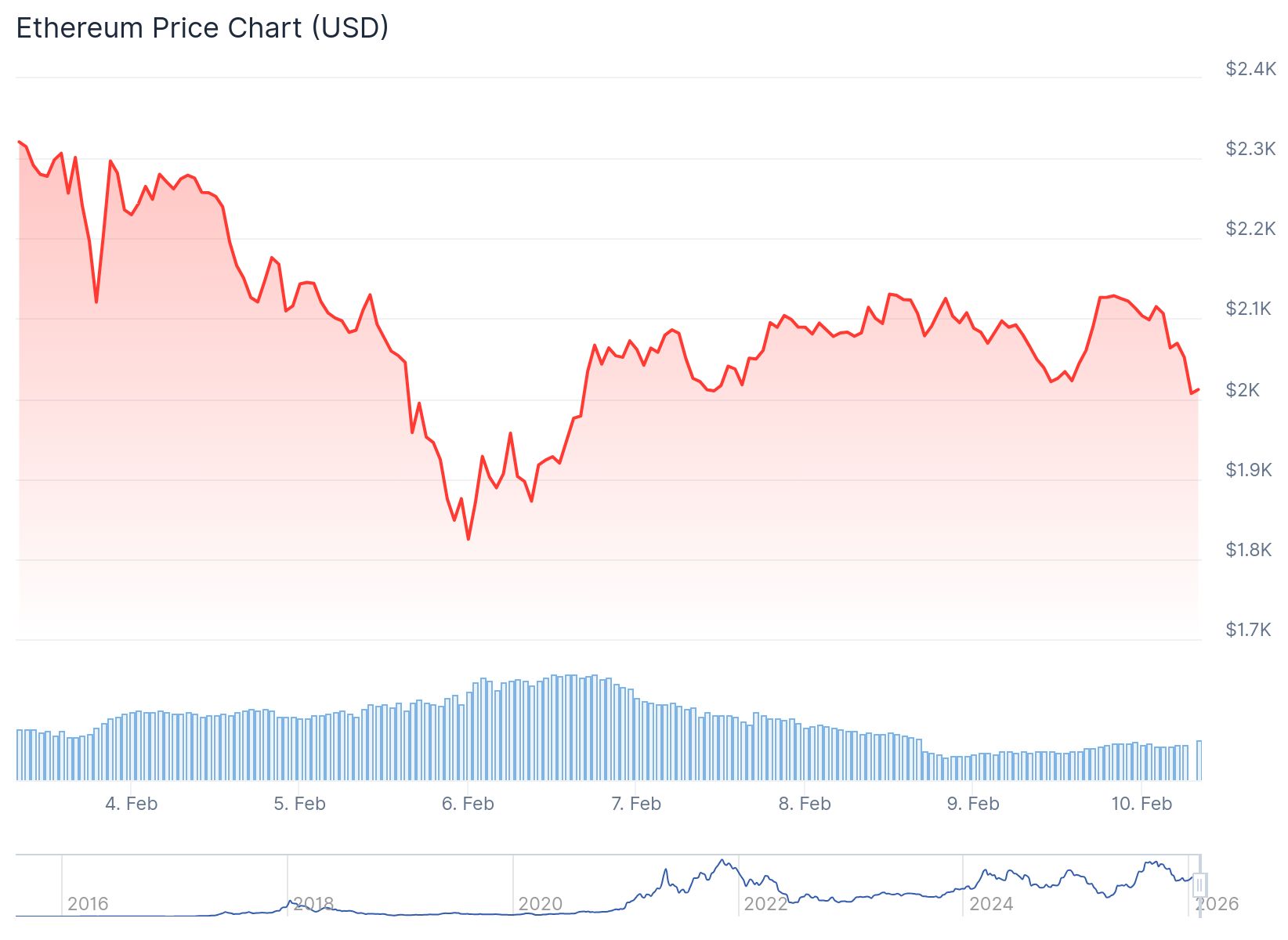

Ethereum price recovered to the $2,100 level on Monday following a sharp decline that saw the cryptocurrency drop 43% over nine days. The altcoin hit a low of $1,750 on Friday before staging a 22% relief bounce.

Ethereum (ETH) Price

Ethereum (ETH) Price

The recovery comes as Bitcoin and US stock markets also rallied. However, ETH derivatives markets continue to show bearish sentiment among traders.

ETH monthly futures traded at a 3% premium relative to spot markets on Monday. This sits below the 5% threshold that typically indicates neutral market conditions.

The lack of optimism has persisted throughout the past month. Traders showed no signs of increased confidence even as the price approached $1,800.

Open interest in Ethereum futures currently stands at $24.1 billion according to CoinGlass data. This marks the lowest level since May 2025.

Source; Coinglass

Source; Coinglass

The last time open interest reached similar depths, Ethereum was trading around $1,400. Three months later in August 2025, the price had climbed to $4,000.

Institutional Buying Continues

Bitmine Immersion Technologies reportedly purchased another 40,000 ETH on Monday for approximately $83.4 million. The acquisition follows an earlier disclosure that the company had already added 40,000 ETH over the previous week.

Executive chairman Tom Lee maintains a bullish outlook for Ethereum in 2026. He expects the cryptocurrency to stage a V-shaped recovery similar to previous major drawdowns.

Network Activity and Supply Concerns

Ethereum has underperformed the broader cryptocurrency market by 9% in 2026. The network still maintains dominance in total value locked metrics.

Source: DefiLlama

Source: DefiLlama

Deposits on the Ethereum base layer account for 58% of the entire blockchain industry. When including layer-2 solutions like Base, Arbitrum and Optimism, that figure exceeds 65%.

The Ethereum base layer generated $19 million in fees over the past 30 days. Layer-2 networks contributed an additional $14.6 million.

ETH supply growth has become a concern for investors. The annualized growth of total ETH issued reached 0.8% over the last 30 days.

This represents a shift from one year ago when inflation was near 0%. The change stems from reduced network activity affecting the built-in burn mechanism.

Vitalik Buterin commented Tuesday that Ethereum should prioritize base layer scalability. The co-founder noted that the layer-2 path to decentralization proved more difficult than expected.

Current layer-2 solutions rely on multisig-controlled bridges. These do not meet the security standards required by Ethereum’s original vision according to Buterin.

The Fear and Greed Index hit a record low of 5, indicating extreme panic conditions. Trading volumes for ETH remain high at nearly 9% of the token’s circulating market cap despite retreating 36% in the past 24 hours.

On Monday night, Ethereum held above the $2,000 mark with a 1.8% decline over 24 hours.

The post Ethereum (ETH) Price Prediction: Tom Lee Predicts V-Shaped Recovery After Recent Crash appeared first on CoinCentral.

You May Also Like

WLFI Expands Into Forex With World Swap Launch

BUZZ HPC Closes Acquisition of 7.2 MW Toronto Site to Build Data Centre for Sovereign AI Infrastructure

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more