Bitcoin (BTC) Price: Bernstein Sees $150,000 Ahead as Record Fear Signals Potential Bottom

TLDR

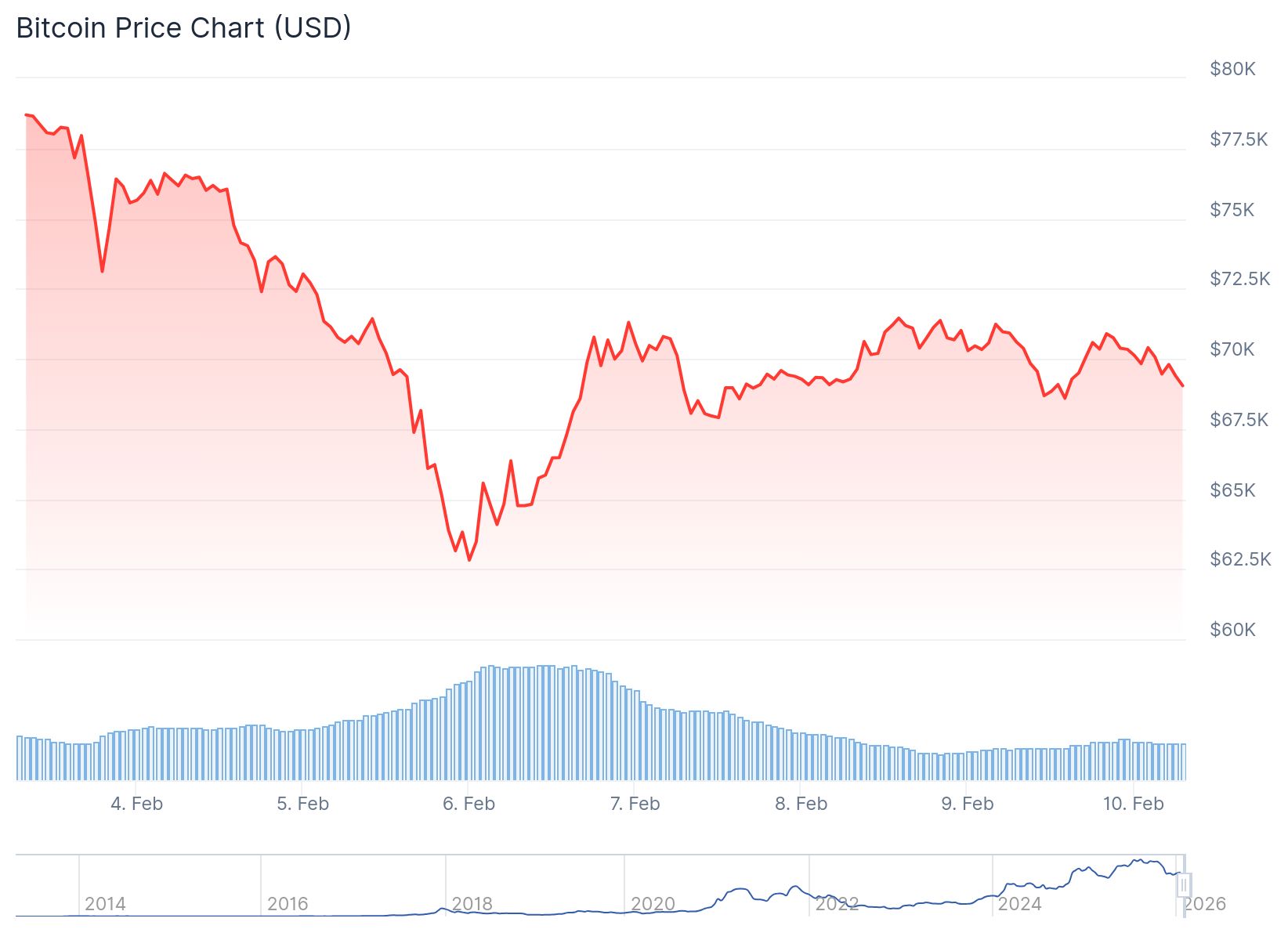

- Bitcoin climbed back above $70,800 on February 9 after dropping to $68,000 earlier in the day

- Wall Street firm Bernstein reaffirmed its $150,000 year-end price target for BTC

- Crypto Fear & Greed Index hit a record low of 7, showing extreme fear in the market

- The Coinbase Premium Index improved from -0.22% to -0.05%, indicating U.S. buyers stepped in

- Bitcoin mining difficulty dropped by its largest amount since 2021 as some miners shut down operations

Bitcoin recovered to $70,800 during U.S. afternoon trading on February 9, 2026. The price rebounded more than 3% from the day’s low of just above $68,000.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The move put bitcoin up 0.5% over a 24-hour period. Other major cryptocurrencies like ether, XRP and solana gained around 1.5% during the same timeframe.

Chhugani said nothing fundamental had broken in the bitcoin ecosystem. He criticized media outlets for writing premature obituaries about the cryptocurrency.

The broader risk asset market showed strength on Monday. The Nasdaq rose 1% while the S&P 500 gained 0.5%. Gold climbed 1.9% to $5,075 per ounce and silver jumped 7.4% to $82.50 per ounce.

Market Sentiment Hits Record Lows

The Crypto Fear & Greed Index dropped to 7 over the weekend. This marked the lowest reading in the index’s history. The metric measures overall market sentiment across the crypto sector.

Analyst Michaël van de Poppe compared current conditions to previous market bottoms. He noted that bitcoin’s daily relative strength index fell to 15, indicating deeply oversold conditions. Similar readings appeared during the 2018 bear market and March 2020 COVID-19 crash.

CoinGlass data shows over $5.45 billion in short liquidations positioned above current prices. Only $2.4 billion in liquidations exist on a move back to $60,000. This imbalance could trigger forced short covering if prices rise.

U.S. Demand Shows Signs of Recovery

The Coinbase Bitcoin Premium Index improved from around -0.22% during the selloff to roughly -0.05%. The narrowing gap suggests U.S.-based investors bought bitcoin at lower prices.

Source Glassnode

Source Glassnode

The index tracks the price difference between bitcoin on Coinbase and the global market average. Coinbase serves as a proxy for institutional and dollar-based flows into crypto.

A deeply negative premium typically means U.S. investors are selling or staying out of the market. The move toward neutral territory indicates selective buying interest emerged.

However, the premium has not turned positive yet. Positive readings historically coincide with sustained accumulation by U.S. funds. Trading volumes across major exchanges remain below late-2025 highs according to Kaiko data.

Mining Sector Shows Stress

Bitcoin mining difficulty just dropped by its largest amount since 2021. Some miners with less efficient equipment shut down operations temporarily as prices fell.

Schwab analyst Jim Ferraioli noted that mining difficulty adjustments can help identify market bottoms. As miners leave the network, difficulty falls. When difficulty starts rising again, it may confirm the bottom is in.

Previous bitcoin selloffs have typically bottomed near the cryptocurrency’s cost of production. This forces less efficient miners to pause operations until prices recover.

Crypto stocks rallied across the board on February 9. Bullish led the sector with a 14.2% gain. Galaxy Digital rose 8.2% while Circle Financial added 5.1%. Strategy climbed 3% and Coinbase gained 1%.

Bitcoin mining stocks pivoting to AI infrastructure posted strong gains. Morgan Stanley initiated positive coverage on TeraWulf and Cipher Mining, both rising 14%. Hut 8, IREN and Bitfarms each advanced about 7%.

Bitcoin remains below its 50-day moving average near $87,000 and 200-day moving average around $102,000 according to CryptoQuant data.

The post Bitcoin (BTC) Price: Bernstein Sees $150,000 Ahead as Record Fear Signals Potential Bottom appeared first on CoinCentral.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference