Onchain Accumulation, ETF Stabilization Offset Persistent Selling Pressure for Bitcoin

Bitcoin is maintaining its position near the $70,000 mark following one of the most significant sell-offs in this cycle, resulting in a divided outlook among market participants regarding future moves.

Is Bitcoin preparing for another upward advance, or is it setting itself up for a possible decline?

This is the key question arising from the conflicting patterns presented by the current on-chain data, ETF flows, and market structure signals.

Bitcoin is currently trading around $70,000, reflecting a sharp pullback from its late-January peak near $90,000. The downturn was abrupt and led to a rapid deterioration in confidence. As a result, market participants have become increasingly focused on a narrow trading range between $60,000 and $65,000.

Source: CoinGecko

Source: CoinGecko

Several support levels were breached during the decline, prompting traders to adopt a cautious, wait-and-see approach. Major capital deployment remains on hold as investors look for confirmation that a sustainable local bottom has formed.

Onchain Signals Paint a Mixed Picture

A key metric to monitor is the relationship between Bitcoin’s market value and its realized capitalization. Currently, this indicator sits in negative territory — a condition that has historically coincided with elevated selling pressure.

When the realized cap grows faster than the market cap, it suggests coins are being redistributed at lower prices rather than driven upward by fresh demand. In previous cycles, this dynamic has often limited the durability of price rallies, as sellers reacted quickly to upward moves.

However, despite this backdrop, broader demand appears to be absorbing consistent sell pressure. Bitcoin recently rebounded above $68,000 and has since stabilized near $70,000, indicating that buyers are still present at current levels.

Liquidations, Fear, and Positioning

Source: TradingView

Source: TradingView

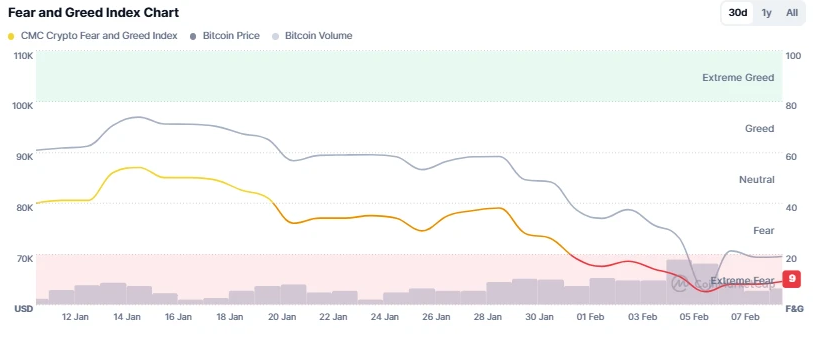

Market sentiment remains deeply pessimistic. The Crypto Fear & Greed Index recently dropped to an extreme low of 7, signaling widespread fear among participants.

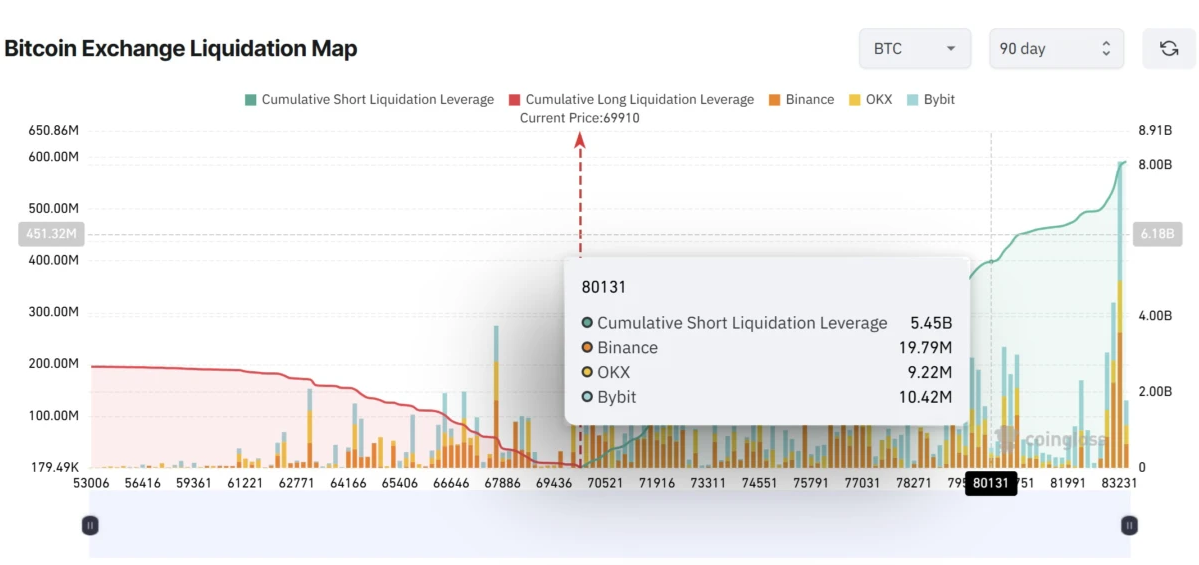

At the same time, liquidation data presents a notable asymmetry. Over $5.5 billion in short liquidations sit above current prices, compared with approximately $2.4 billion in liquidations expected if Bitcoin were to revisit $60,000. This imbalance suggests that a price increase could force short sellers to unwind positions, potentially triggering a sharp upward move.

Source: CoinGlass

Source: CoinGlass

Conversely, declining prices combined with increased derivatives selling still leave the door open for a drop below $60,000 should selling pressure intensify.

Accumulation Trends Offer Structural Support

Onchain accumulation data tells a markedly different story. During the most recent downturn, Bitcoin experienced an all-time-high single-day influx into long-term accumulation addresses. Historically, such spikes have tended to appear near market lows rather than tops.

While accumulation does not guarantee an immediate rally, it does indicate that large holders are building positions rather than distributing them. This behavior can create a buffer against deeper declines by absorbing available supply.

Bitcoin is also trading well above its realized price, which currently sits in the mid-$50,000 range. Historically, prolonged bear markets have tended to develop when prices remain below realized levels for extended periods. At present, Bitcoin remains within a neutral-to-positive structural framework.

ETF Flows Show Signs of Stabilization

US spot Bitcoin ETFs experienced significant outflows during the recent market downturn. However, flows shifted back to net inflows as prices stabilized between $60,000 and $65,000.

This change suggests that the most intense selling pressure may now be behind the market. That said, ETF demand has not yet returned to levels typically associated with sustained bullish momentum.

Source: SoSoValue

Source: SoSoValue

Taken together, the data reflects a market in transition – balancing between accumulation and distribution. Onchain buying and stabilizing ETF flows provide downside support, while ongoing selling pressure and cautious sentiment continue to limit upside potential.

In the near term, Bitcoin appears more likely to remain range-bound near $70,000 rather than experience a decisive breakout or breakdown.

You May Also Like

Upexi Posts $179M Q4 Loss as Solana Slides Near $78

Trump's 'tin-pot dictator' move guarantees his impeachment: conservative