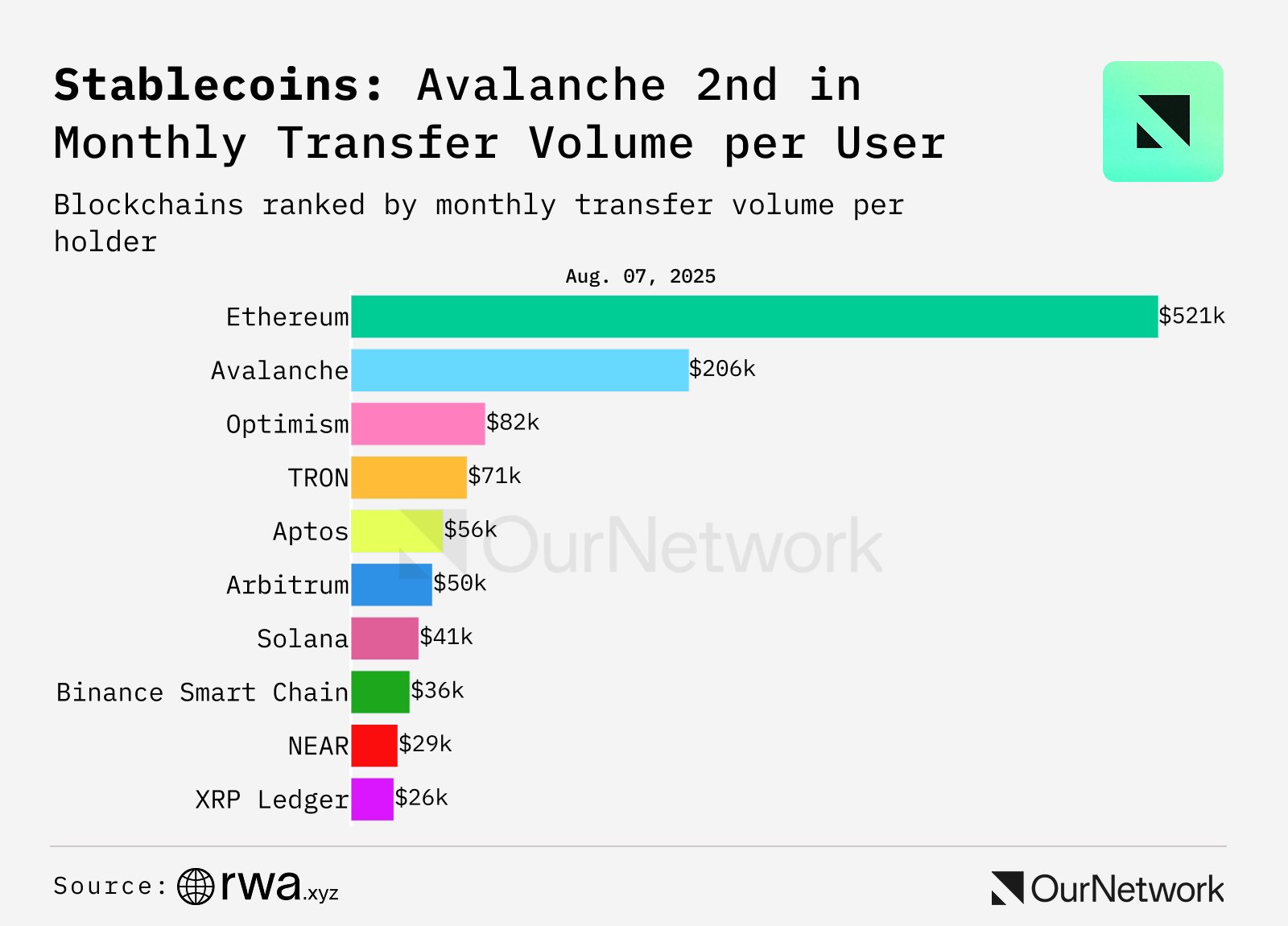

Ethereum Dominates Monthly Stablecoin Transfer Volume With $521K Per User

Ethereum steadies its dominance in the stablecoin market, as it commands a staggering monthly transfer volume per holder. Stablecoins mostly flow on the Ethereum network, according to recent data from the on-chain analytical platform Our Network. The report, shared by the head of research at Onchain Foundation, Leon Waidemann, identified that Ethereum has the largest share of monthly stablecoin transactions in the crypto space. Ethereum Averages $521K Stablecoin Transfer Per User For context, the report ranked blockchains by monthly transfer volume per holder. Unsurprisingly, Ethereum led the chart, with an impressive $521,000 moved per holder over 30 days in the network. Notably, this indicates that massive capital flows through Ethereum and stablecoins account for a considerable part of it. This comes as no surprise, as the smart contract-infused blockchain hosts 51% of the total stablecoin market cap, around $142.6 billion. Meanwhile, this further confirms a trend of massive institutional stablecoin use case, especially on Ethereum. Fiat-pegged cryptocurrencies are gaining increasing attention from large financial institutions, which have identified their use case in settlements. Interestingly, the total stablecoin market cap is slowly growing, as issuers inject more liquidity into the market in response to user demand. The total stablecoin market has grown to $275.5 billion, adding $9.06 billion (3.40%) in the past seven days alone. The majority of these supplies are being transacted on Ethereum, providing use cases and fee revenue for the network. Some believe this would boost revenue, increase Ether’s utility, and consequently drive prices to unprecedented levels. A New Contender to Ethereum’s Stablecoin Dominance? Meanwhile, despite holding a mere 0.64% ($1.77 billion) of the stablecoin supply, Avalanche recorded an impressive monthly transfer volume per holder. Users moved stablecoins on the chain at an average volume of $206,000 per holder, signaling stablecoin interest on Avalanche.

You May Also Like

TROPTIONS Corporation Announces Strategic Partnership with Luxor Holdings to Bridge Real-World…

Wanxiang A123 Unveils World’s First Semi-Solid-State Immersion Energy Storage System, Redefining Safety Standards