Daily Market Update: Stock Futures Push Higher While Bitcoin Battles to Hold $70K Support

TLDR

- Stock futures climb modestly overnight with S&P 500 futures up 0.2% as markets await delayed January jobs report

- Bitcoin drops 2% to high-60,000s, down 30% from year-ago levels as crypto sentiment remains in extreme fear zone

- Economists expect 68,000 jobs added in January with unemployment holding at 4.4% after government shutdown delay

- South Korean exchange Bithumb reports 40-billion-won system error raising fresh concerns about exchange infrastructure

- Stalled crypto legislation keeps institutional capital cautious despite Trump administration’s pro-digital asset stance

US stock futures posted modest gains in overnight trading as investors prepared for a critical employment report. The January jobs data has been delayed by weeks due to the recent partial government shutdown.

Source: Forex Factory

Source: Forex Factory

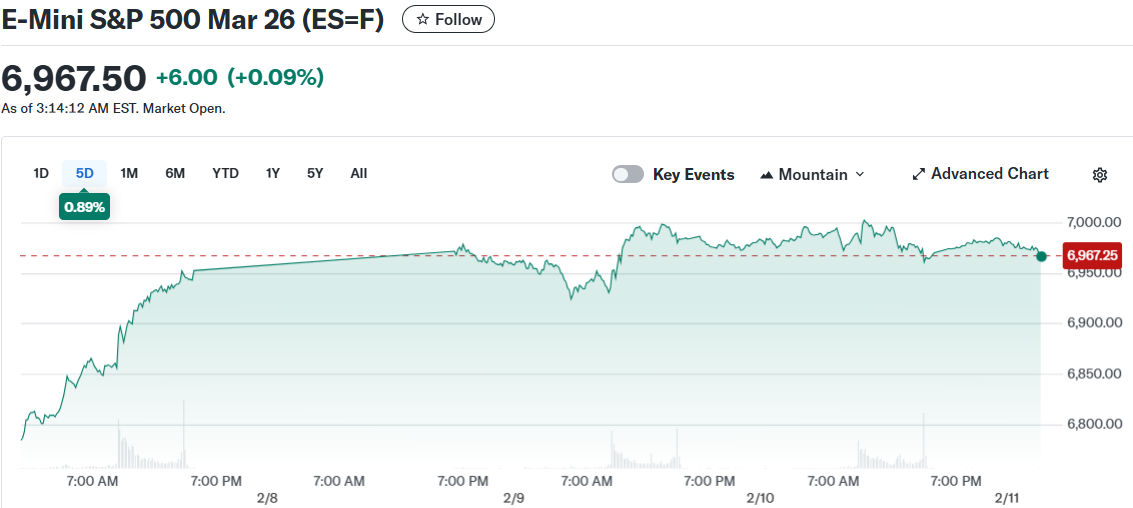

Futures linked to the S&P 500 advanced 0.2% while Nasdaq 100 futures climbed 0.2%. Dow Jones Industrial Average futures rose approximately 0.1%. The overnight gains followed the Dow’s third consecutive record close during Tuesday’s session.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Market participants are focused on nonfarm payrolls data from the Bureau of Labor Statistics. Economists surveyed by Bloomberg forecast a median addition of 68,000 jobs for January. The unemployment rate is expected to remain steady at 4.4%.

Trade counselor Peter Navarro told Fox News that expectations need to be revised downward for monthly job figures. His comments suggest the White House is preparing for potentially disappointing numbers. Markets already faced pressure Tuesday after December consumer spending came in flat, missing forecasts for 0.4% growth.

During regular trading, the S&P 500 declined 0.3% on worries about AI disruption in financial services. The Nasdaq Composite fell 0.6%. The Dow bucked the trend, gaining 0.1% to reach another record high.

Bitcoin Struggles as Crypto Market Cap Declines

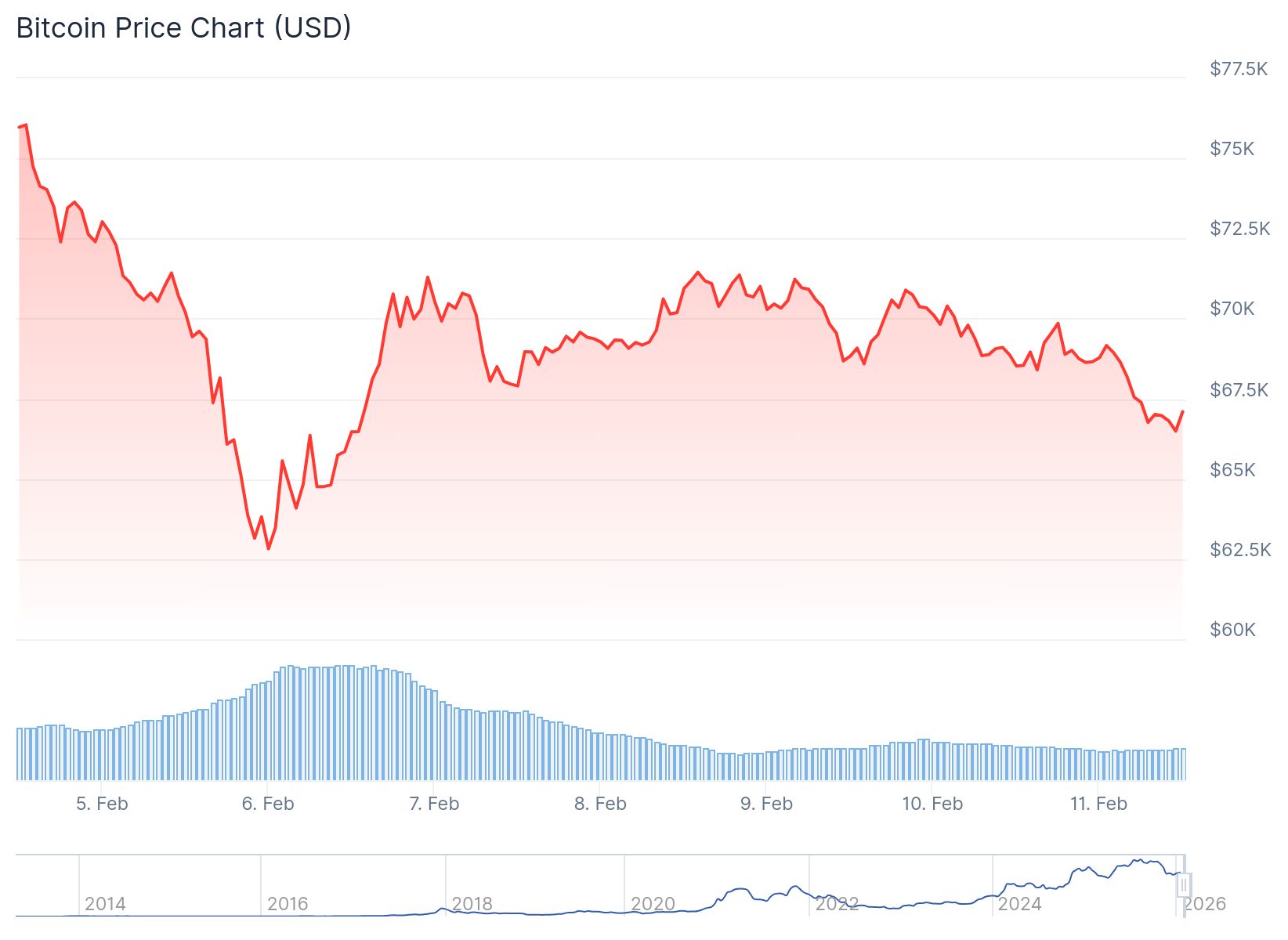

Bitcoin traded in the high-60,000s, representing a roughly 2% decline from the previous day. The leading cryptocurrency now sits nearly 30% below its price from one year ago. Market analysts characterize the current phase as early-stage bottoming with reduced trading volumes.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Total cryptocurrency market capitalization fell for the second straight day. Smaller altcoins underperformed as traders rotated capital into Bitcoin and stablecoins. Major sentiment gauges remain locked in extreme fear territory, indicating risk reduction without sufficient capitulation for a reversal.

Crypto markets face headwinds from multiple directions. A White House-supported effort to pass comprehensive digital asset legislation stalled again this month. A high-profile meeting failed to produce agreement on market structure and stablecoin regulations.

The regulatory situation presents a paradox for investors. The Trump administration has taken a more favorable stance toward crypto. New SEC leadership has floated ideas like innovation exemptions for token projects. However, without final legislative text, major institutional allocators remain cautious about deploying capital.

Exchange Error Highlights Infrastructure Risks

South Korean exchange Bithumb disclosed overnight that internal system problems caused a 40-billion-won transaction error. The platform characterized the incident as a technical glitch rather than a security breach. Nevertheless, the episode revived concerns about centralized exchange infrastructure.

The error briefly impacted Korean trading pairs but showed no signs of spreading to other markets. The incident reinforced trader demand for proven reserves, quality venues, and self-custody options. It also gave regulators additional ammunition for arguing in favor of stricter exchange oversight.

Traders are monitoring whether Bitcoin can hold the $65,000-to-$70,000 range. A sustained period of stability could enable a gradual recovery led by Bitcoin and large-cap tokens. A breakdown below that zone would validate bearish views that the post-ETF cycle has further to decline.

McDonald’s, Kraft Heinz, and Cisco report earnings Thursday. Friday brings the consumer price index, the Federal Reserve’s preferred inflation measure.

The post Daily Market Update: Stock Futures Push Higher While Bitcoin Battles to Hold $70K Support appeared first on Blockonomi.

You May Also Like

Pikachu Illustrator PSA 10 sets record at Goldin sale

SEC clears framework for fast-tracked crypto ETF listings