Another Celebrity Scam? Kanye West Memecoin Launch Leaves 60% Of Investors In The Red

Amid the controversial launch of Kanye West’s official memecoin on Solana, the crypto community has sounded the alarm for another potential celebrity token scam, with insider trading allegations outshining Ye’s party.

The Rise And Fall Of YZY

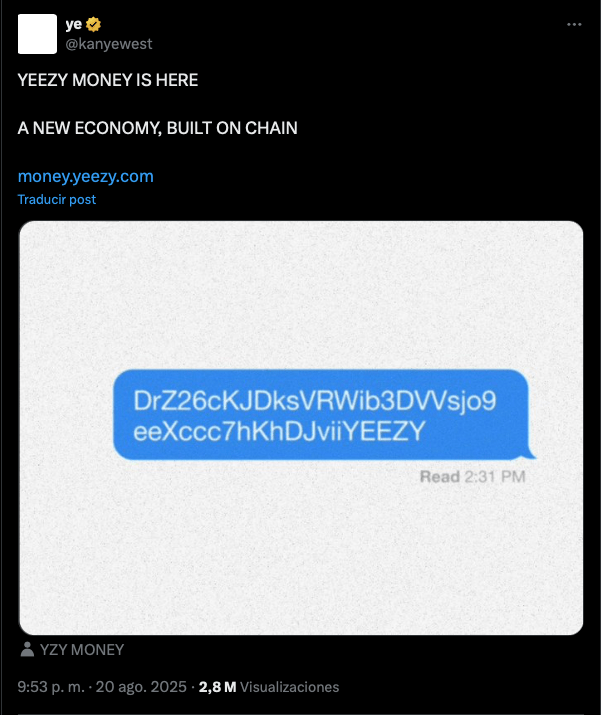

On Wednesday night, controversial Hip-Hop artist and public figure Ye, better known as Kanye West, launched his official memecoin, YZY, on the Solana blockchain. West announced the token in his X account, posting the contract address (CA) in a picture with the caption “YEEZY MONEY IS HERE. A NEW ECONOMY, BUILT ON CHAIN.”

After the announcement, the memecoin skyrocketed to a market capitalization of $3.1 billion before quickly dropping 65% to the $1.1 billion mark in the following hours. Meanwhile, YZY’s price went from an all-time high (ATH) of $3.16 to hover between the $0.95-$1.30 price range.

The crypto community reported multiple red flags, including allegations of insider trading and a lawsuit waiver. Notably, the official website has a controversial waiver that raised concerns among investors.

In the “What Else Should I Know?” section, the website stated that by purchasing the token, investors agree they “will not bring, join or participate in any class action lawsuit as to any claim, dispute or controversy” that they may have against any of the “Covered Parties.”

“if you’re buying this ur literally giving them permission to rug you without consequences,” a community member noted.

Nonetheless, investors may opt out of the dispute resolution provision by “providing written notice of your decision within thirty (30) days of the date that you first access the Website,” the page reads.

Ye’s Memecoin Supply Owned By Insiders

Conor Grogan, director at Coinbase, estimated that at least 94% of the supply was owned by insiders, with 87% of the token being held by a single multisig wallet before it was distributed to multiple wallets.

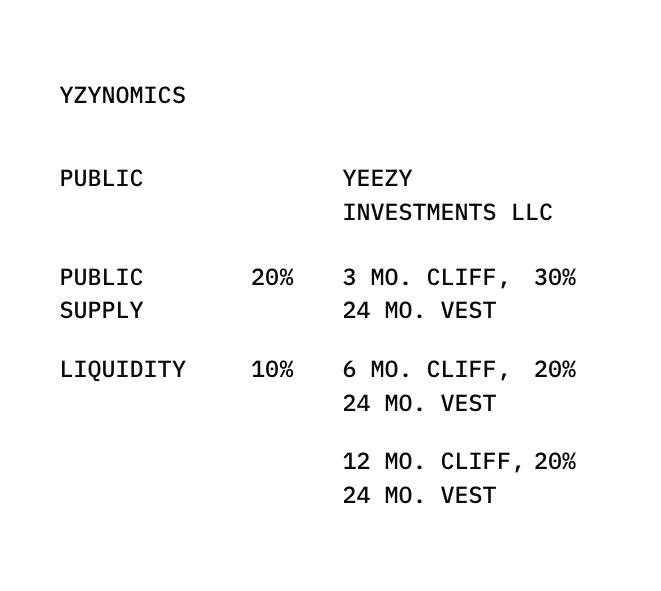

According to the “YZYNOMICS”, 20% of the token’s distribution would be for public supply, 10% for liquidity, and 70% for Yeezy Investments LLC.

On-chain analytics firm Bubblemaps affirmed that “the bubble map of YZY mostly MATCHES the distribution on Kanye’s website,” cautioning that “the 17% address ‘public supply’ is UNLOCKED and can sell at any time.”

Lookonchain highlighted that only YZY had been added to the liquidity pool, with no USDC, warning that the “Dev may sell YZY by adding/removing liquidity, similar to LIBRA.”

Additionally, they noted that multiple insider wallets had prepared funds in advance and bought the memecoin, with one address knowing the CA and attempting to purchase YZY yesterday.

The on-chain wallet tracker also cautioned that West had added 30 million YZY, worth $34 million, to the liquidity pool with a price range of $3.17-$4.49, signaling that “once the price climbs above $3.1716, he’ll start earning fees while gradually selling YZY for USDC. If the price rises above $4.4929, all 30M YZY will be sold.”

Investors See Red NumbersOn-chain researcher Defioasis affirmed that the YZY launch was “more of the same,” revealing that, so far, most wallets holding West’s memecoin are in the red.

According to their analysis, 56,050 addresses traded the token in the past 13 hours, with 25,166, or 44.9% of the wallets, engaging in one-sided transactions. Out of these addresses, 23,723 only bought the memecoin, while 1,443 only sold it.

They suggested that “some of the former may be dust addresses aimed at increasing the number of addresses, while others are either holding onto their positions or stuck in losses,” adding, “The latter are primarily project teams/large holders using multiple addresses to sell, making it harder to track them directly.”

Meanwhile, 30,884 addresses had two-way transactions, with 38.07% of addresses registering realized profits. 30% of these wallets had a profit of up to $500, while only 1.31% of them had profits exceeding $10,000. Among this 1%, only 5 addresses had over $1 million in profits, with one of them being identified as an insider.

On the contrary, over 60% of participants are still in a loss position, the report noted, with 28.2% of the addresses losing up to $500. By the time of the Defioasis post, one individual had lost over $1 million, while another had lost around half a million.

You May Also Like

XRP Ignites As Spot Volume Skyrockets

Cloud mining is gaining popularity around the world. LgMining’s efficient cloud mining platform helps you easily deploy digital assets and lead a new wave of crypto wealth.