$YZY Falls After a Major Pump of $3B, Faces Insider Trading Allegations

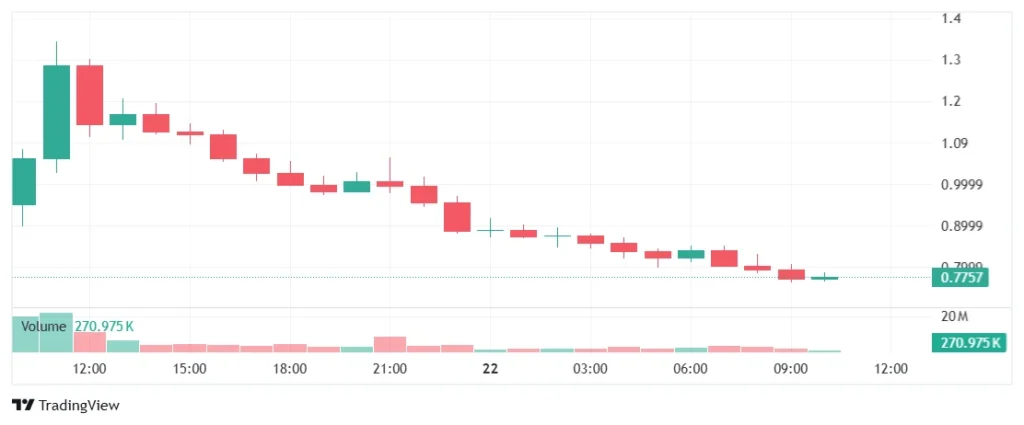

Rapper Kanye West’s recently launched meme token, “YZY,” has gained significant attention after its rapid rise and fall. As per the market data, $YZY massively rose to $3B in market cap within forty minutes of its launch, but shortly after, a huge plunge in its value raised market-wide concerns. In this respect, the market onlookers have highlighted substantial risk concerning $YZY’s trading. Nonetheless, whether this slump deepens or leads to a recovery remains to be seen.

$YZY Memecoin Crashes Following Initial Surge after Launch

Kanye West, who is now famous as Ye, recently launched an exclusive $YZY token via Solana, which soon plunged after a sharp rise within a few moments. The purpose of releasing the memecoin was to bolster the on-chain economy. The respective meme token reportedly powers the financial system, going by “Yeezy Money,” which leverages blockchain technology.

In line with the latest analysis, after reaching the height of $2.0957, $YZY has continuously been dropping with minor fluctuations. At the moment, its price is $0.7822, showing a 29.32% dip over the past 24 hours. However, since its launch, the meme token has slumped by up to 69.69%. Additionally, the market capitalization of $YZY is standing at $233.86B, signifying a 27.1% decrease. Moreover, the 24-hour volume accounts for $182.35M, indicating a 78.82% dip.

Kanye West’s Memecoin Faces Insider Trading Allegations, with Some Saying Multisig Wallet Kept 87%

On the other hand, some market observers have linked this noteworthy drop as a result of alleged insider trading. As per the official data, the Yeezy Money deployed twenty-five contract addresses for the meme token, while one was chosen at random for the official token to dissuade token snipers. Even then, $YZY’s launch has triggered considerable suspicions over potential insider trading, as is the case with several other celebrity memecoins.

In this respect, Coinbase’s director, Conor Grogan, asserted that insiders held up to 94% of the cumulative token supply of $YZY. Along with that, 1 multisig wallet allegedly held up to 87% of the supply ahead of distribution to several wallets. Moreover, one consumer having insider knowledge reportedly purchased the wrong token, resulting in a loss of $710,000. Nonetheless, they later recovered losses by buying the correct token.

You May Also Like

Lyn Alden: The Fed is Printing Money, What Will Happen to BTC?

Goldman Sachs Warns $80 Billion in Forced Selling Could Still Hit U.S. Stocks