Shiba Inu Coin price at risk as funding rate, futures open interest dives

Shiba Inu Coin price has crashed into a bear market, moving from a high of $0.00004565 in March 2024 to the current $0.0000060, and activity in the futures market points to more downside.

- Shiba Inu Coin price has dived, with its market cap falling from $41 billion to $3.7 billion.

- The futures open interest has continued falling in the past few months.

- Its weighted funding rate has remained in the red since February 5.

Shiba Inu (SHIB), the biggest meme coin on Ethereum (ETH), was trading at $0.0000060, with its market cap falling from a record high of over $41 billion to $3.7 billion today.

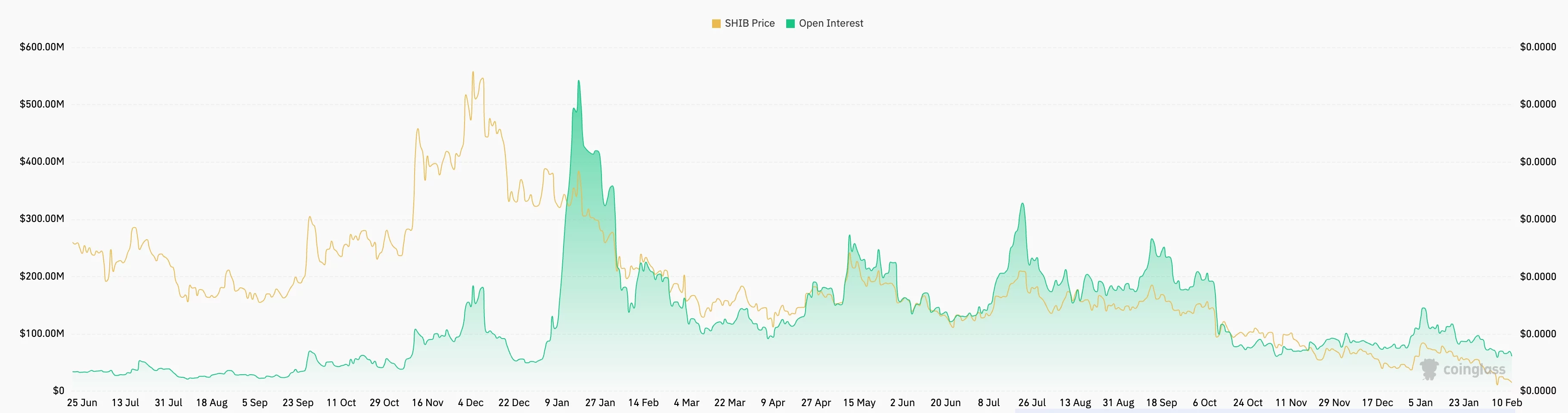

Data compiled by CoinGlass shows that the futures open interest has continued falling this year. It moved to just $61 million, down substantially from last July’s high of over $400 million.

Open interest is a crucial metric that measures unfilled orders in the futures market. A higher open interest when a coin is rising is a sign of increasing investor demand.

The broader open interest in the crypto market has dived in the past few months following the $20 billion liquidation event in October last year. This is one of the top reasons why Bitcoin and most altcoins have dropped.

Meanwhile, Shiba Inu’s weighted funding rate has remained in the red since February 5. A funding rate is a key data that looks at the small fee that longs and shorts in the futures market pay to hold their positions. In most cases, a falling figure indicates that traders anticipate the price will be lower.

Shiba Inu’s burn rate has dropped substantially in the past few days. It fell by over 99% on Thursday to just 483 coins, worth less than $1 were burned in the last 24 hours.

The biggest risk that SHIB faces is that it has now major catalyst that may push it higher. In addition to the falling burn rate, Shibarium’s activity has dwindled, with its total value locked falling to $856,000.

Shiba Inu Coin price technical analysis

The three-day chart shows that the SHIB price has dropped sharply in the past few months. It has constantly formed a series of lower lows and is now hovering at its lowest level since 2023.

The coin has tumbled below all moving averages, while the Relative Strength Index has formed a descending channel. It also remains below the Supertrend indicator.

Therefore, the most likely SHIB price is bearish as demand remains thin. This crash may have it move to the next key support at $0.00000050.

You May Also Like

Ethereum Foundation Leadership Update: Co-Director Tomasz Stańczak to Step Down