Ethereum (ETH) Momentum Falters: Can It Avoid a Bigger Dip?

- Ethereum is trading around the $2,020 zone.

- The ETH market has experienced liquidations worth $85.29M.

Within the market-wide price suppression, some of the crypto assets are seen in green, which may fade easily. The crypto market cap has shed 1.42%, settling at $2.37 trillion. Bitcoin (BTC), the largest asset, is trading at $69.7K, while Ethereum (ETH), the largest altcoin, is extending its decline and currently registering a spike of over 0.32%.

The price of ETH has been struggling to cross the $2.5K level for the last few days. In the morning hours, the asset trades at around $2,025, and with the bearish pressure, the price has slipped to $1,929. Currently, Ethereum is traded at $2,020, with the trading volume at $24.44 billion. Additionally, the ETH market has seen a liquidation worth $85.29 million.

Assuming the ETH/USDT trading pair’s bearish momentum strengthens, the death cross might take place, and the price could slip toward the support at around $1.9K. Upon failing to hold this range, the bears would open the door wider for more losses.

Ethereum could witness a rebound if its momentum turns bullish. If so, the price could climb to the $2.1K resistance. Breaking above this level might send the price even higher, with the emergence of the golden cross. It also helps to build a more sustained recovery.

Bears Take the Lead: Ethereum Faces Downside Pressure

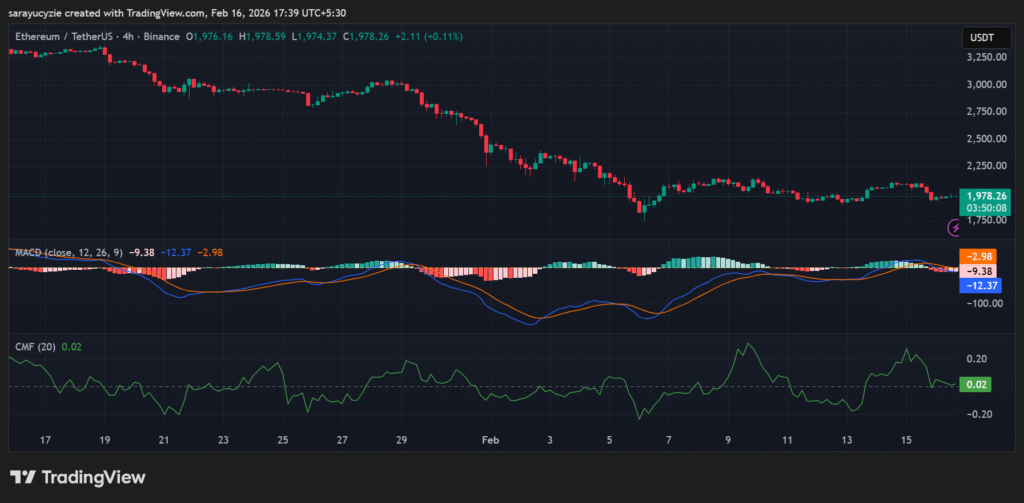

Both the Moving Average Convergence Divergence (MACD) line and the signal line are stationed below the zero line, which indicates that Ethereum is in a bearish phase. The short-term momentum is weaker than the longer-term average.

ETH chart (Source: TradingView)

ETH chart (Source: TradingView)

Besides, the Chaikin Money Flow (CMF) indicator is at 0.02, suggesting very weak buying pressure in the ETH market. The capital inflow is marginally positive, but the strength is minimal, and it is close to neutral with no strong accumulation.

ETH’s Bull Bear Power (BBP) reading of -47.21 signals strong bearish dominance. As the value is deeply negative, the sellers are pushing the price below the average. The downward momentum will continue unless buying strength steps in to absorb the pressure. Moreover, the daily Relative Strength Index (RSI) of Ethereum is staying at 43.38 hints at mild bearish to neutral sentiment. Notably, it is not yet in the oversold zone.

Top Updated Crypto News

Momentum Ignites: Can MUBARAK Extend Its 11% Breakout Into a Stronger Bullish Phase?

You May Also Like

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto

USD/JPY Analysis: Resilient Yen Finds Crucial Support in Japanese Government Bond Dynamics – MUFG Insight