Jupiter Price Analysis – JUP Targets $0.19 Following Its $30B Native SOL Staking

Highlights:

- The Jupiter price has increased by 4% to trade at $0.16 today.

- This comes as Jupiter introduces Native Staking, with $30B staked SOL tokens, reinforcing the upside movement.

- The technical picture shows a bullish outlook, as JUP targets the $0.19 zone.

Jupiter price (JUP) has increased by 4% today, trading around $0.166 mark. The lending protocol recently introduced native staking as collateral so that users can borrow against its native staked SOL on some of the vaults. The value locked in Jupiter has been gradually growing, currently above $2 billion, indicating that users are interested again.

Jupiter has revealed that it is commencing to lend out a product called native staking, enabling users to lend in SOL against natively staked positions at up to 87% loan-to-value. The service has six validators and vaults, including Nansen (nsNANSEN), Helius (nsHELIUS), Temporal (nsTEMPORAL), Blueshift (nsSHIFT), Kiln (nsKILN), and Jupiter (nsJUPITER. This enables those who use it to increase the usefulness of natively staked SOL and avoid the necessity of Liquid Staked Tokens (LSTs).

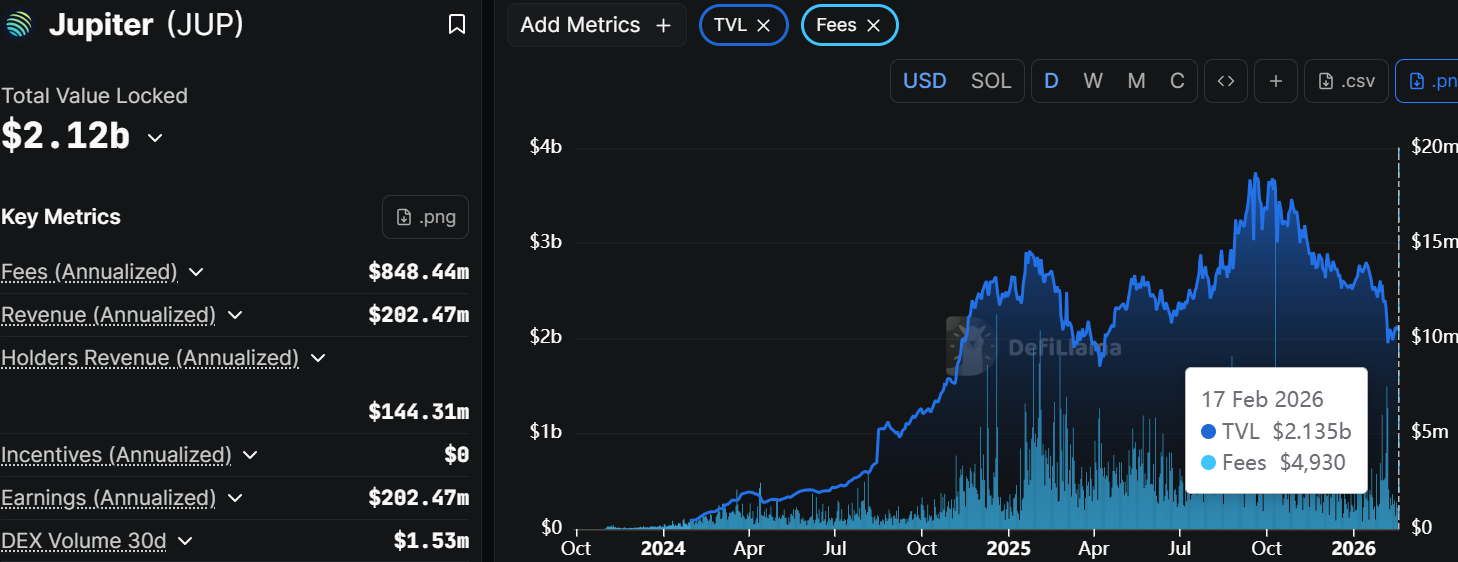

According to DeFiLlama data, Jupiter’s Total Value Locked (TVL) sits around $2.12 billion. This shows a growth in the user deposits on Jupiter, which signifies new inflow and interest of users. With the recent net inflow, this may spark a surge in the Jupiter price market.

Jupiter Total Value Locked: DeFiLlama

Jupiter Total Value Locked: DeFiLlama

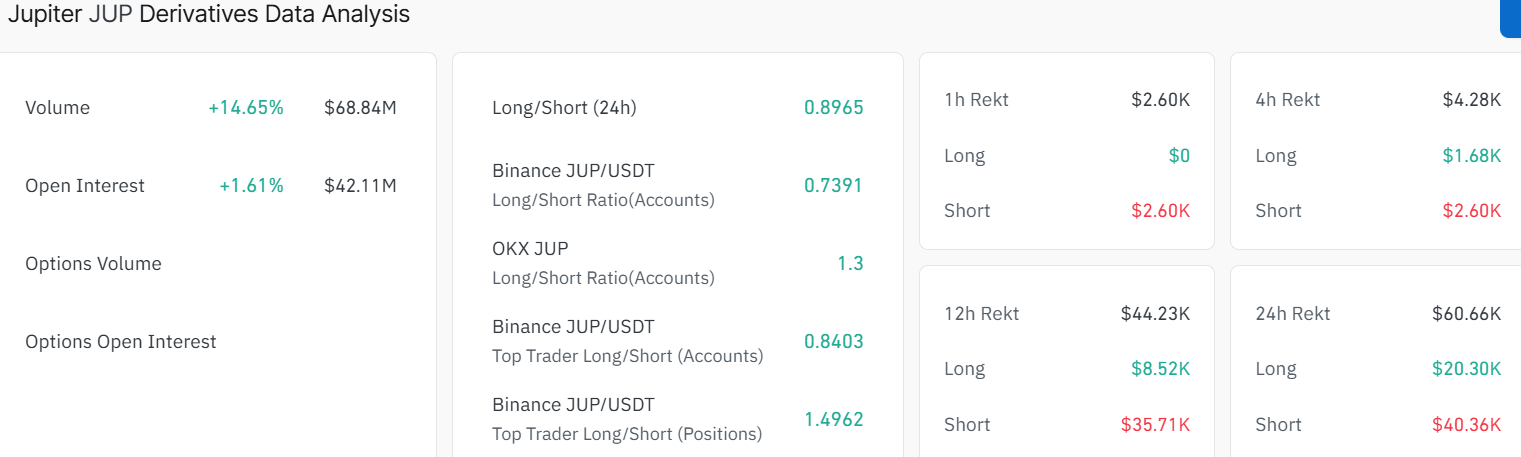

Moreover, Coinglass data shows an increase in volume and open interest, signalling renewed investor confidence. The open interest is up by 1.61% to $42 million, while the volume has risen by 14%. With the momentum building and new money entering the market, JUP may continue the upside movement.

JUP Derivatives Data: CoinGlass

JUP Derivatives Data: CoinGlass

JUP Targets $0.19 as Bullish Momentum Builds

The chart shows Jupiter’s 1-day price action, with the current price hovering around $0.16, up from a recent low of $0.107. The 50-day Simple Moving Average (SMA) sits at $0.19, acting as an immediate resistance zone, with the long-term barrier at the 200-day SMA sitting at $0.33. Meanwhile, JUP’s volume is up 31%, showing the bullish momentum is picking up, amid heightened trading activity.

JUP/USD 1-day chart: TradingView

JUP/USD 1-day chart: TradingView

The momentum indicators, such as the Relative Strength Index (RSI) at 47.05 suggests a potential upward movement. Moreover, the RSI has crossed above the RSI-based MA, and it is curling upwards, as bulls build momentum. The recent 4% pump suggests the bullish trend is building in the JUP market. The consolidation channel may act as an accumulation period before the bulls spike to the upside.

Looking ahead, the upper resistance at $0.19 is testing the coin’s gains. If the token coin sustains above it, it could reach $0.23-$0.33 based on the momentum. A break above the $0.33 will confirm a bullish move, opening the door for more gains. Conversely, if the resistance floor proves too strong, the JUP price may continue to consolidate. In such a case, the $0.13 support level will come in handy. However, if the trading volume stays strong, it could see JUP target $0.19 in the short term.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Zuckerberg denies Instagram was built to hook children

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise