Electric Capital's annual developer report: 39,000 new developers joined, more than half of Ethereum developers are committed to L2

Author: Electric Capital

Compiled by: Felix, PANews

Key points:

- Cryptocurrency is global, and development momentum has shifted outside of North America

- Developers and use cases are diverse in the ecosystem

- The usage range spans all time zones, indicating global usage

This paper analyzes a record 902 million code commits across 1.7 million repositories.

Overall Trend

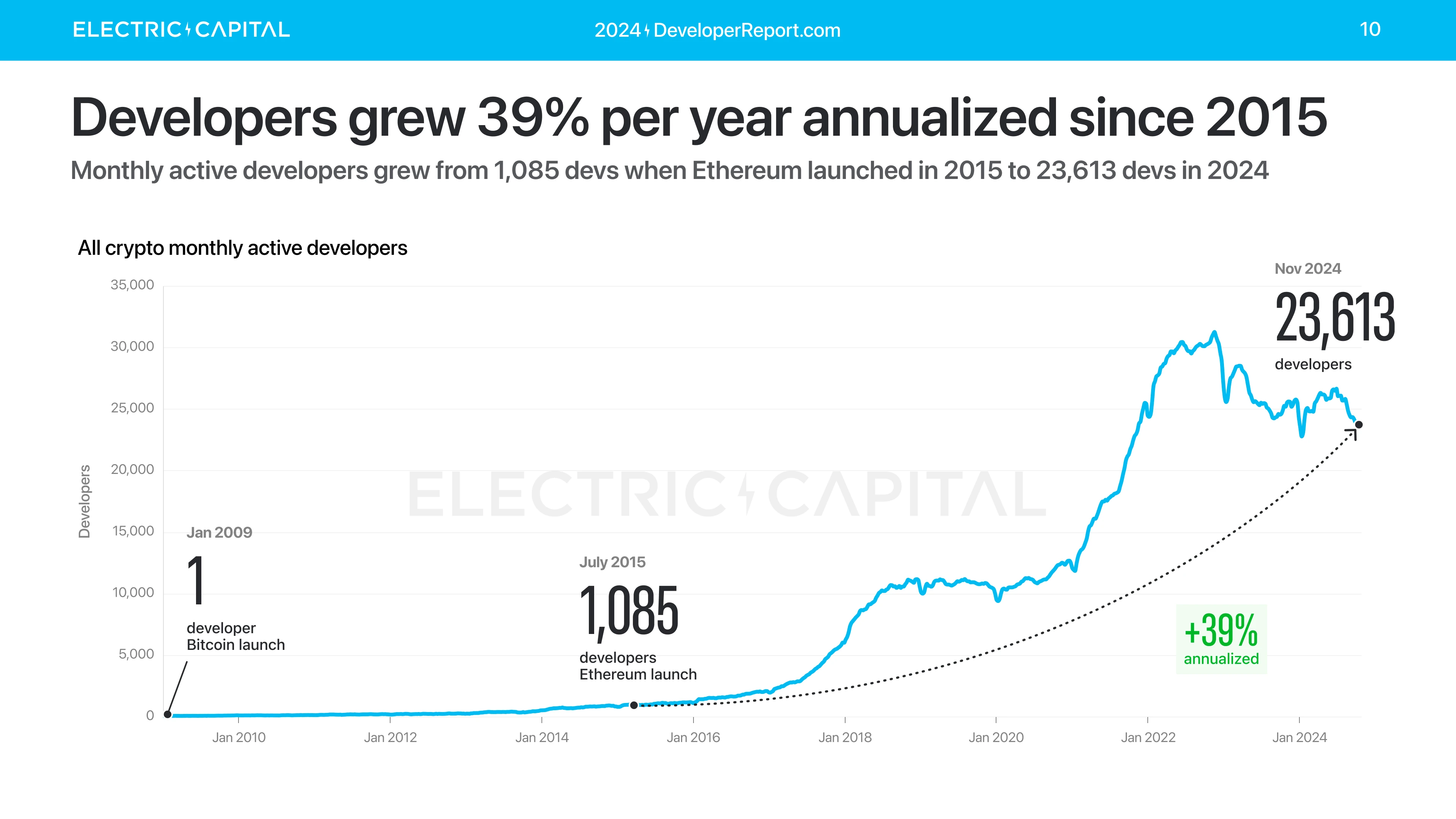

The number of crypto developers has grown 39% annually since Ethereum launched in 2015. There were about 1,000 monthly active developers in 2015. Today, there are 23,613 monthly active developers working on cryptocurrency.

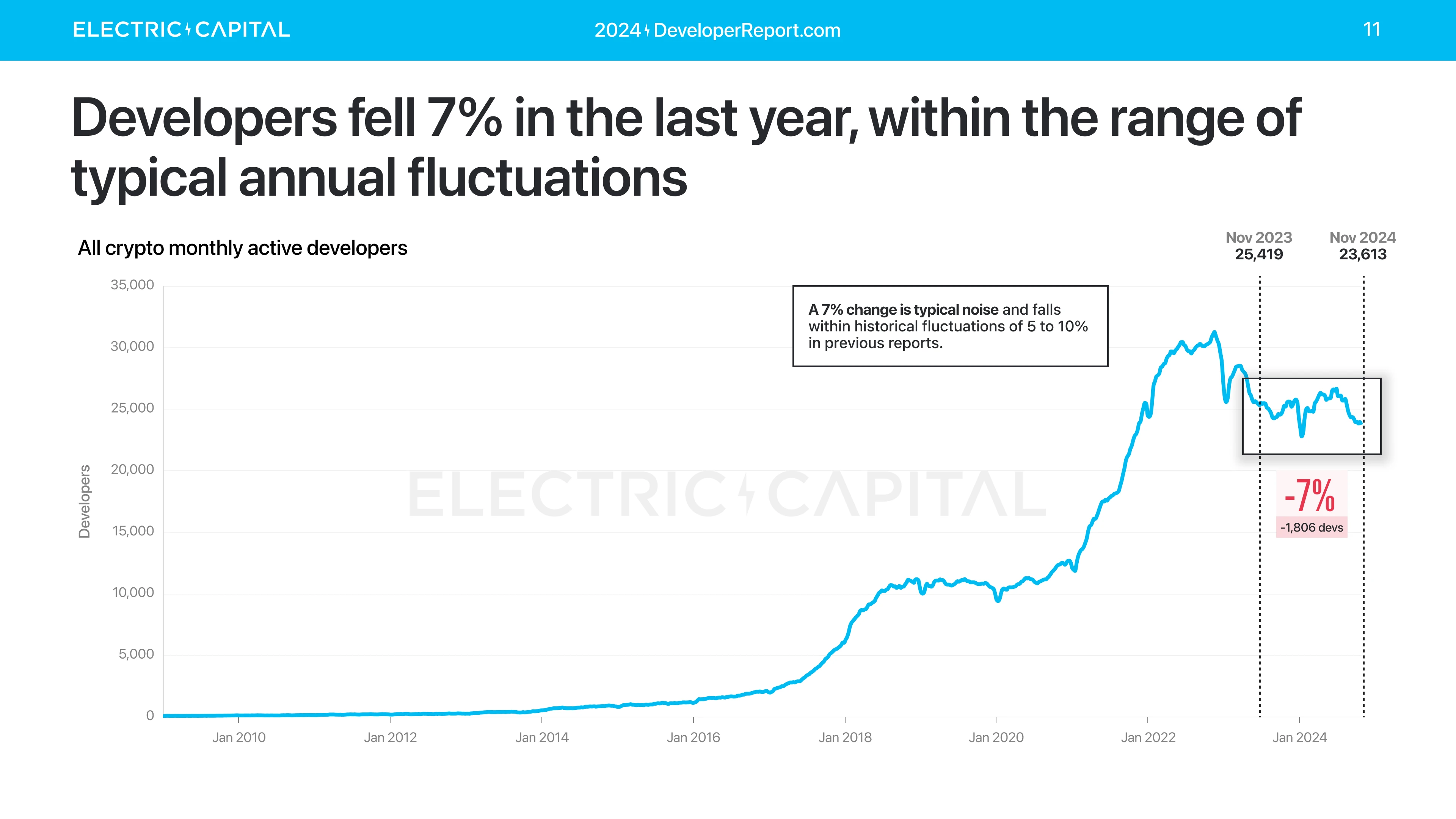

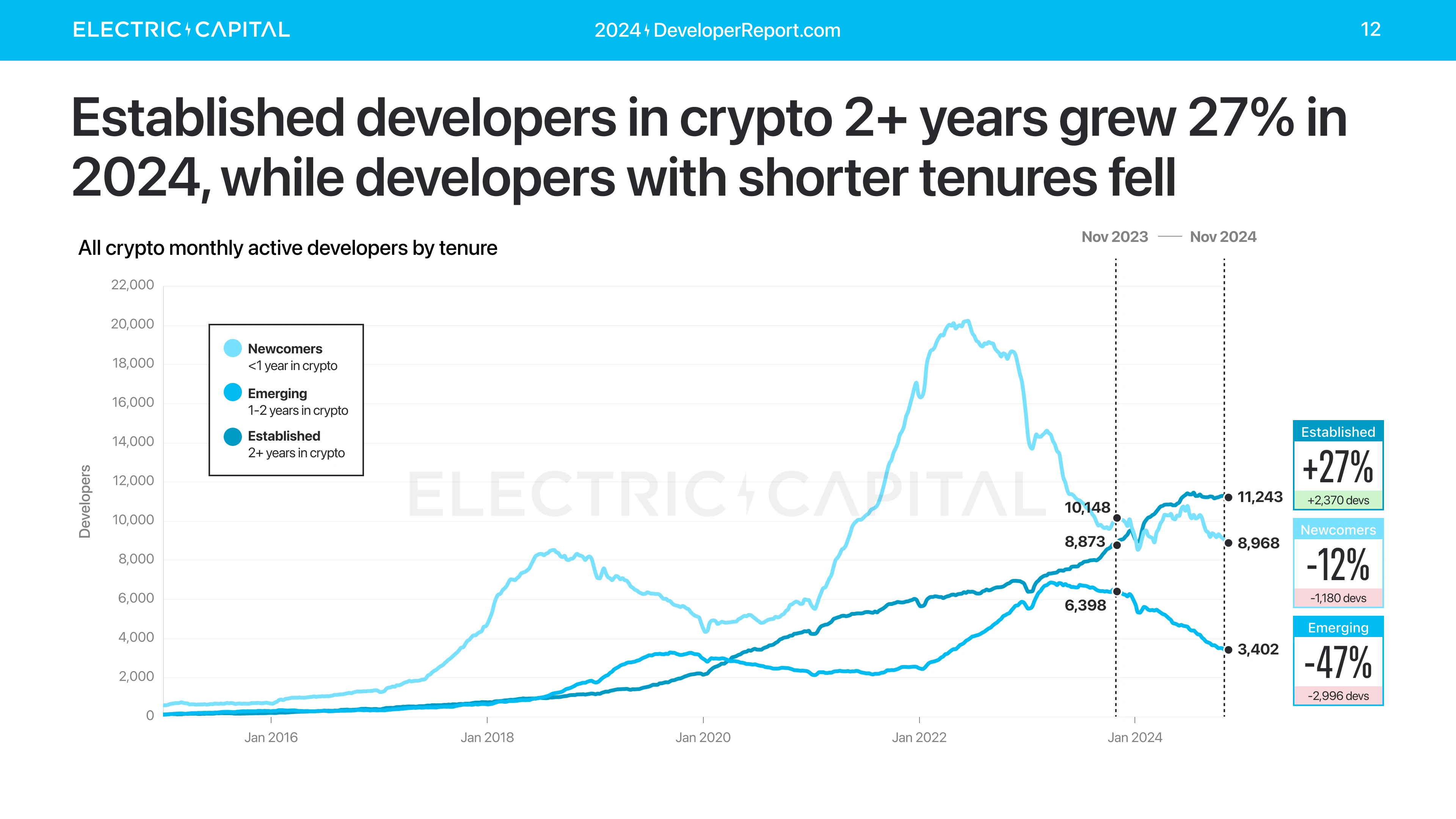

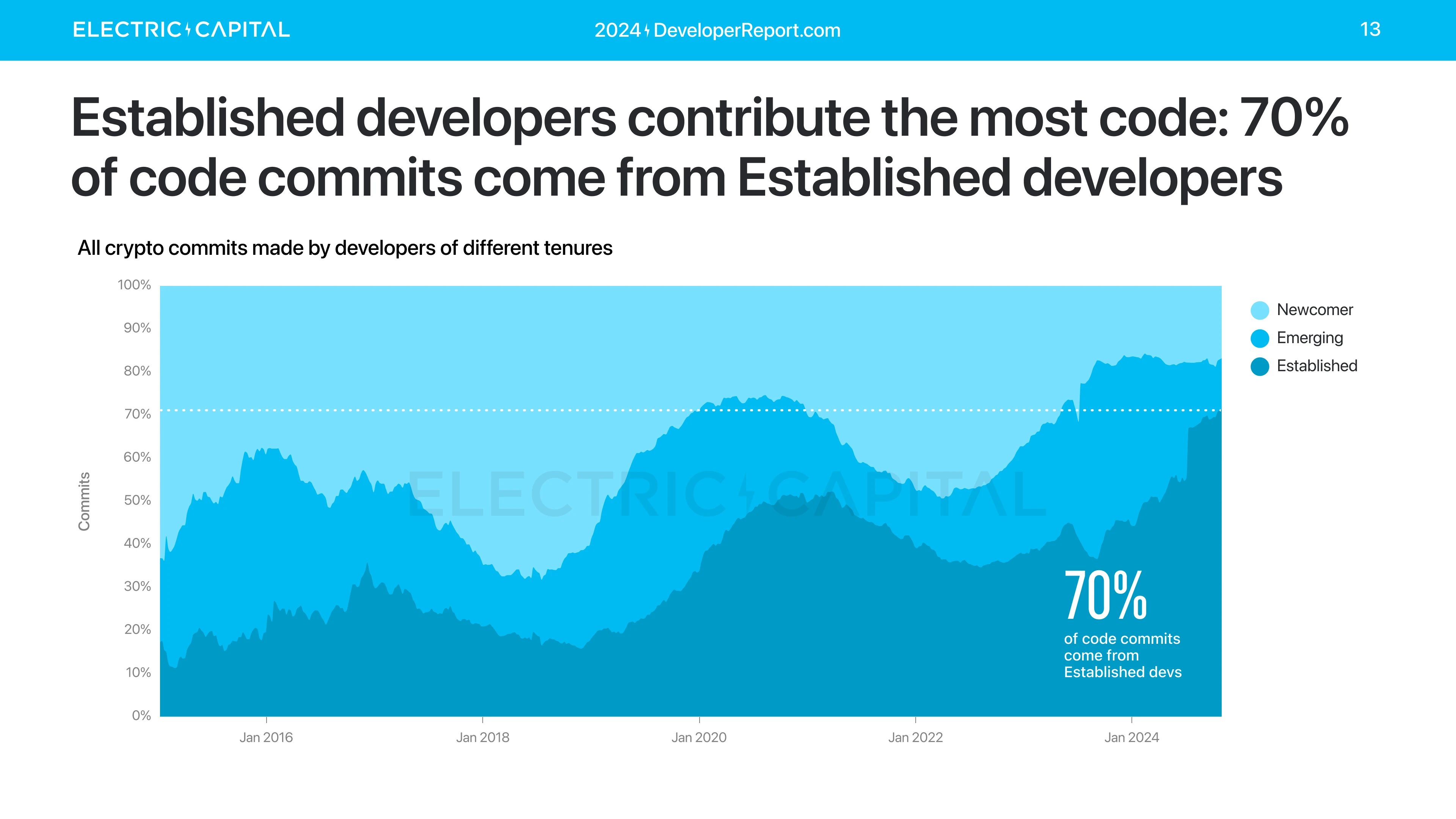

The number of monthly active developers decreased slightly last year, down 7%. The number of developers who have been in the crypto industry for more than 2 years increased by 27%. These senior developers drive the development of the industry as they contribute 70% of code commits.

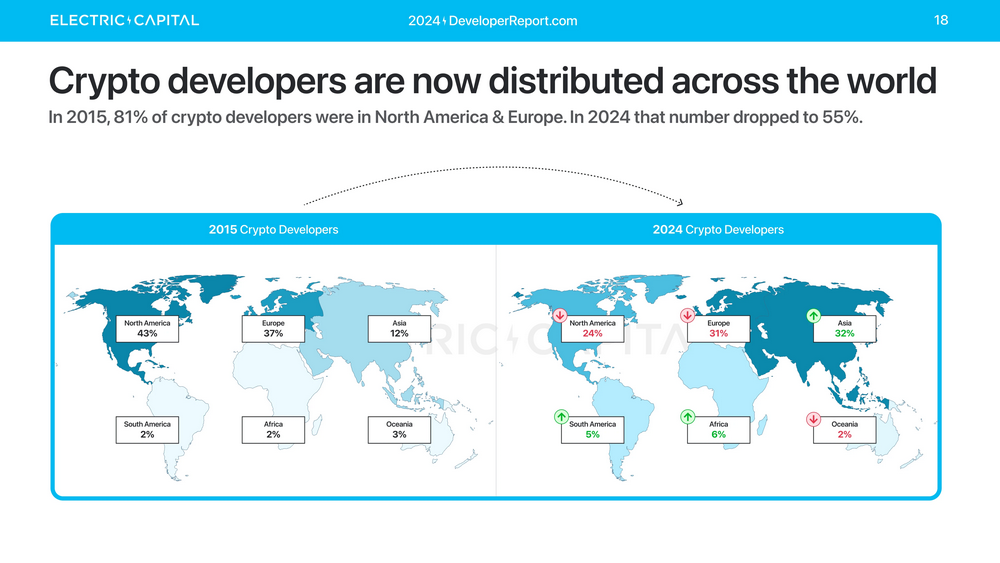

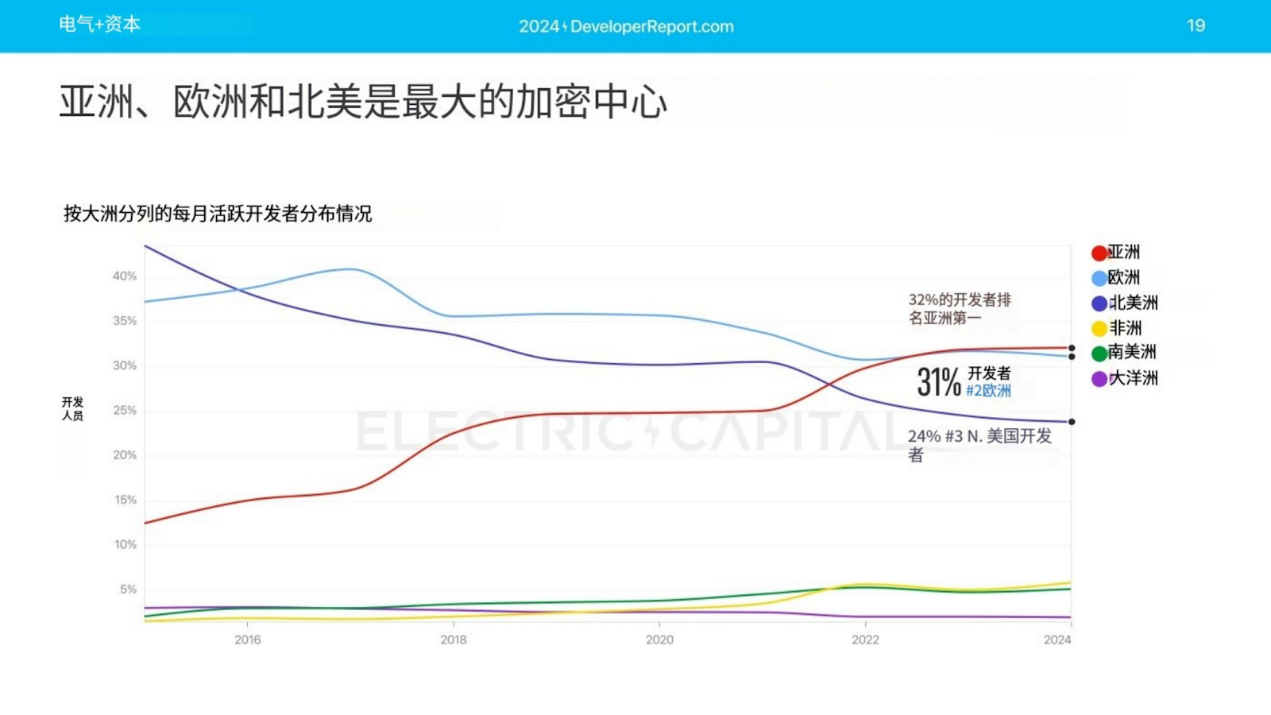

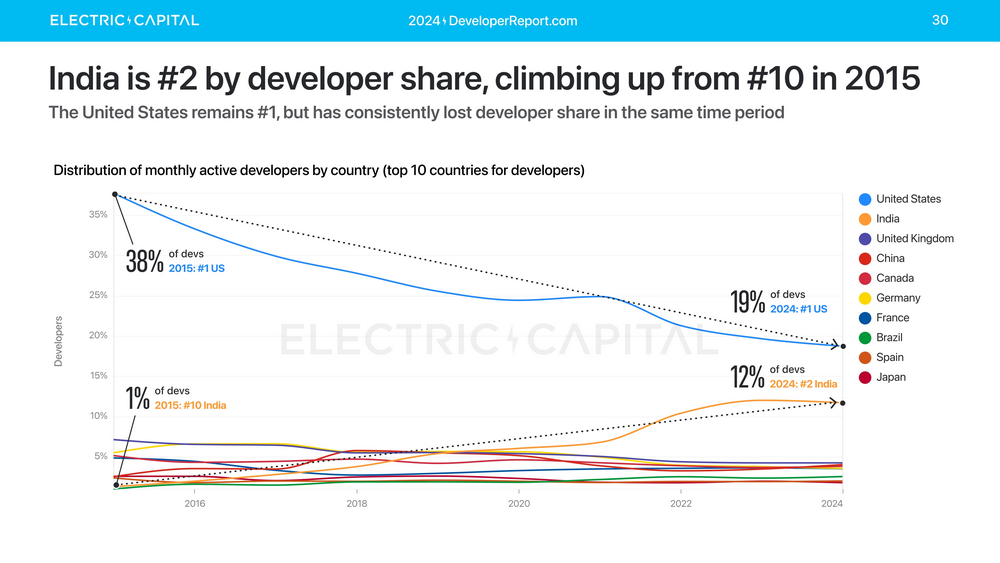

In 2015, 81% of crypto developers were in North America and Europe, falling to 55% in 2024.

Asia is now the top continent by developer share. One-third of crypto developers live in Asia, with Europe in second place. North America has fallen from first to third since 2015.

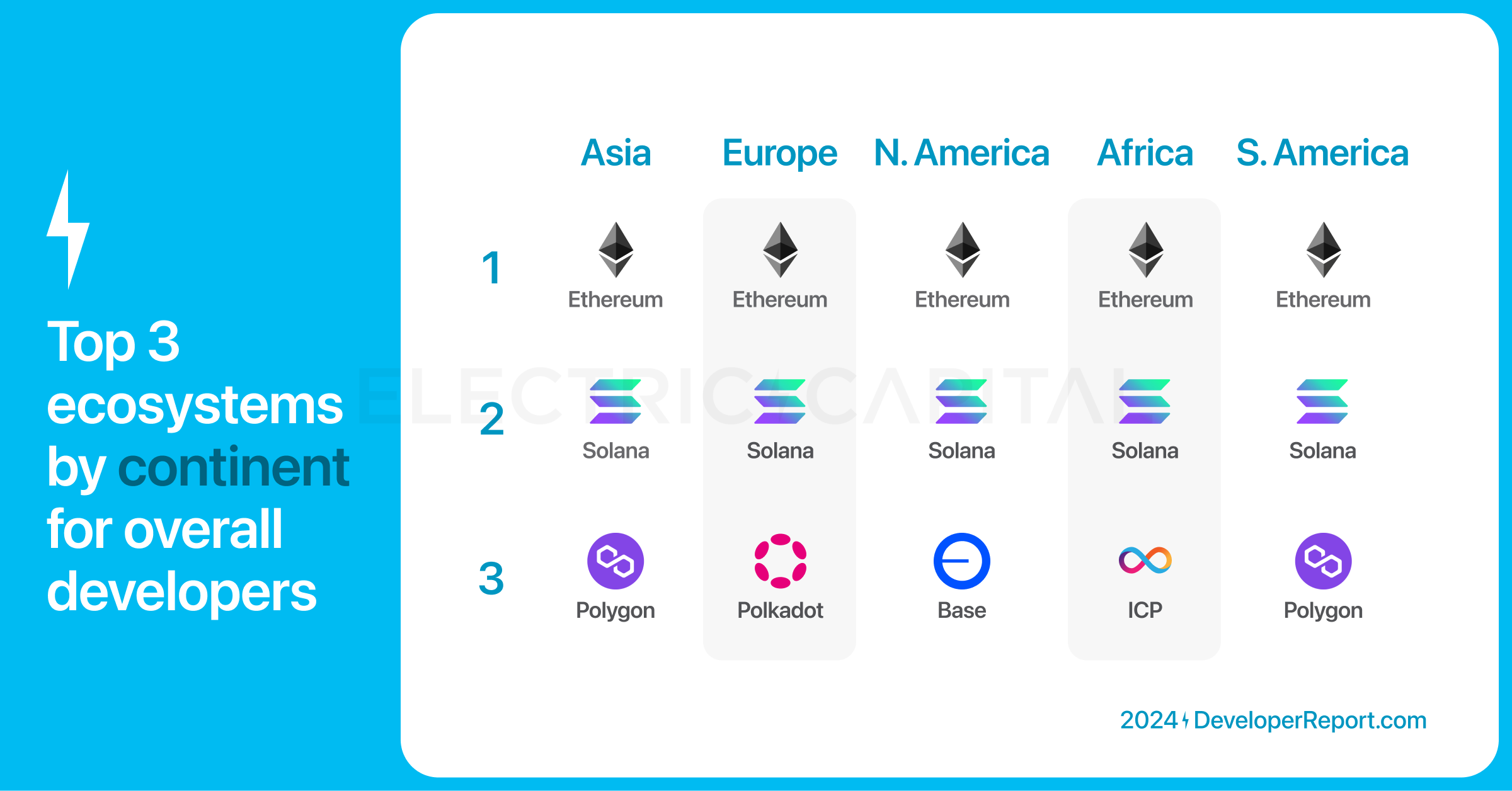

Ethereum is the top ecosystem by developer share across all continents, Solana is second, Polygon is third in Asia and South America, Polkadot is third in Europe, Base is third in North America, and DFINITY is third in Africa.

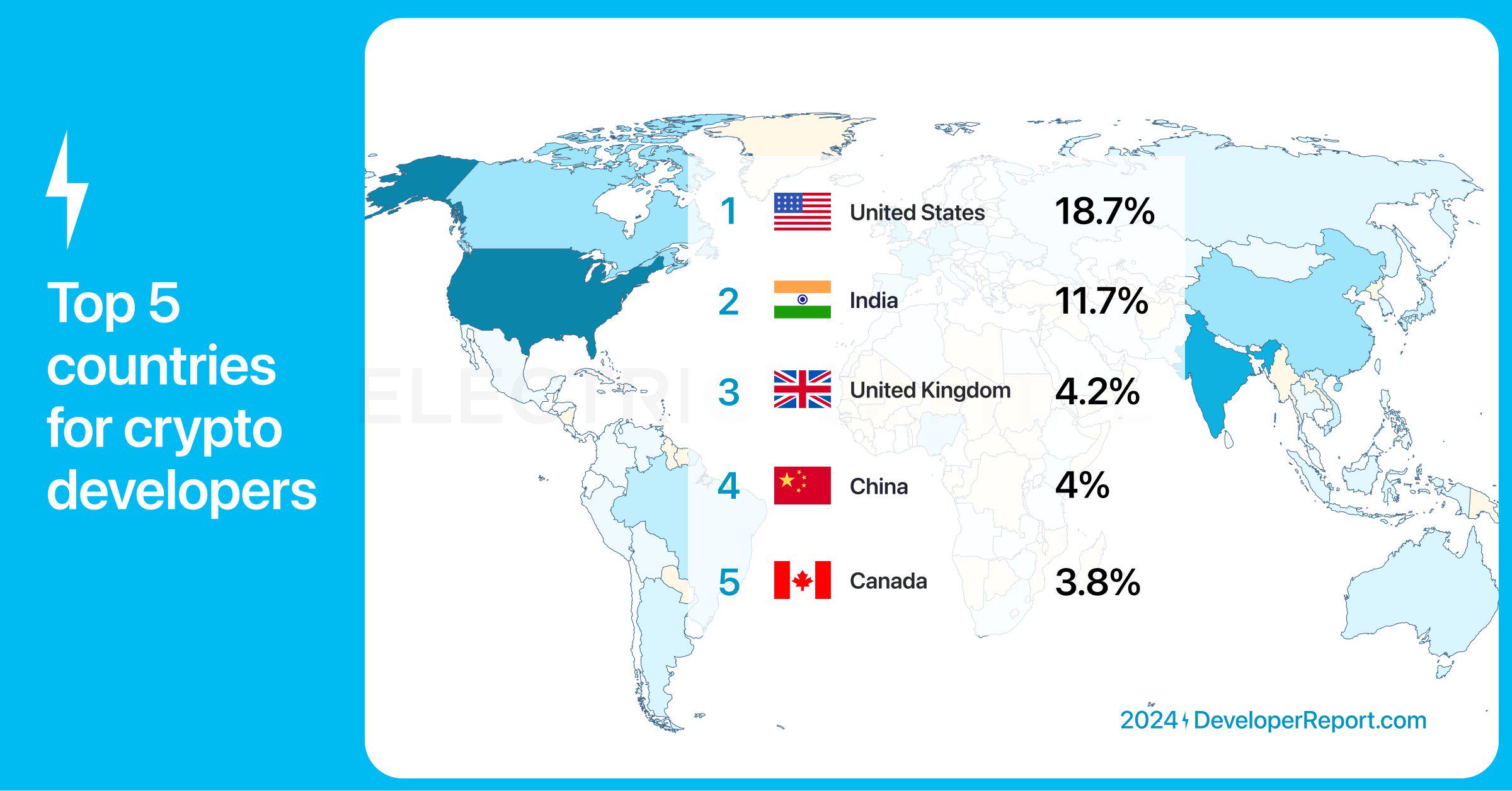

The United States, India, the United Kingdom, China, and Canada have the largest crypto developer communities in the world.

The United States still ranks first in terms of crypto developer share, but has continued to decline since 2015. India jumped from 10th to 2nd place.

Top 3 ecosystems by country developer share:

- Ethereum ranks first in the United States, United Kingdom, China and Canada, and second in India

- Solana is No. 1 in India, No. 2 elsewhere

- Base ranks third in the United States and India

- Polygon ranks third in the UK

- NEAR Protocol ranks third in Canada

- Polkadot ranks third in China

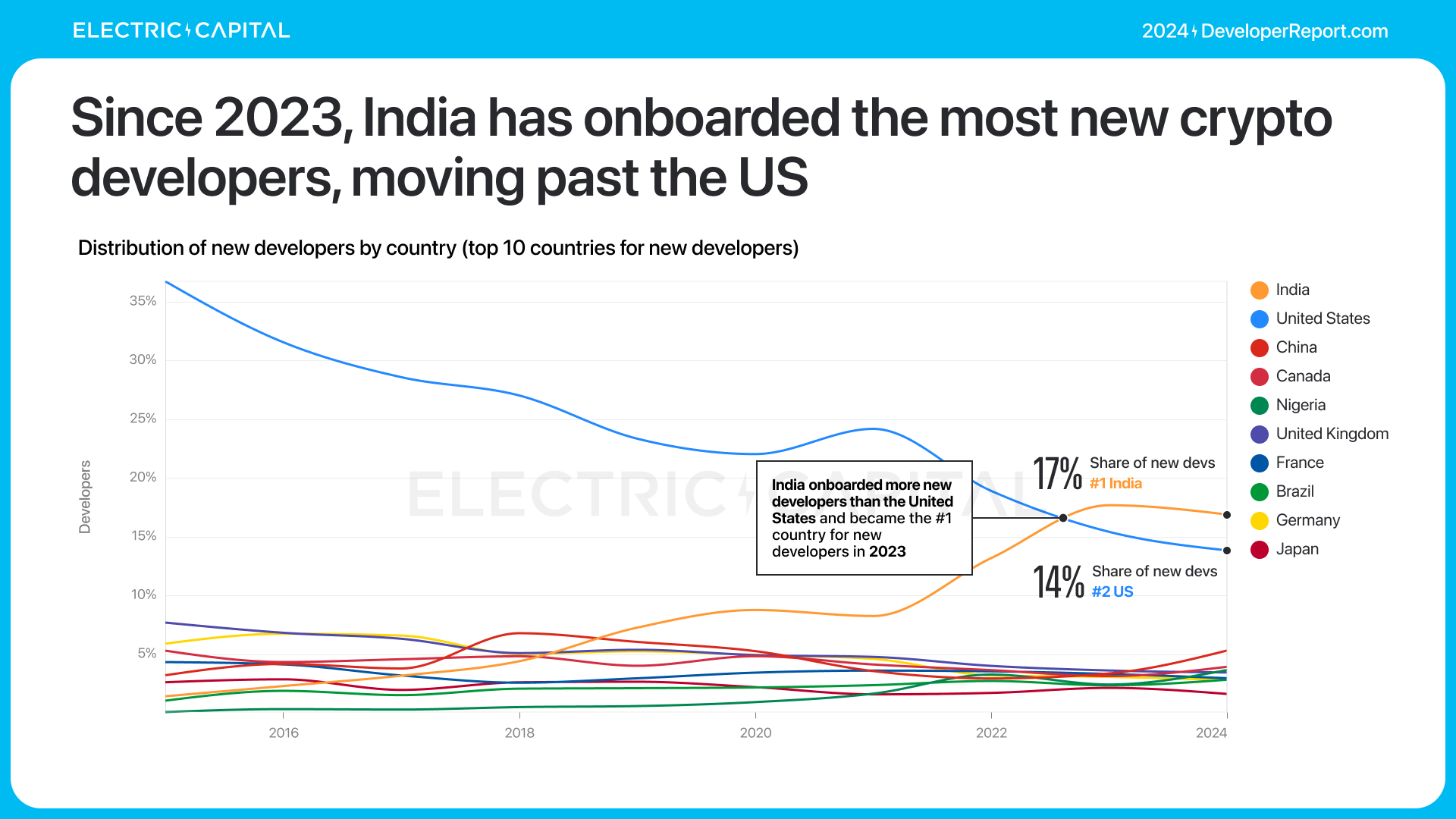

In 2024, India surpassed the United States to become the country with the most new developers, with 17% of new developers coming from India.

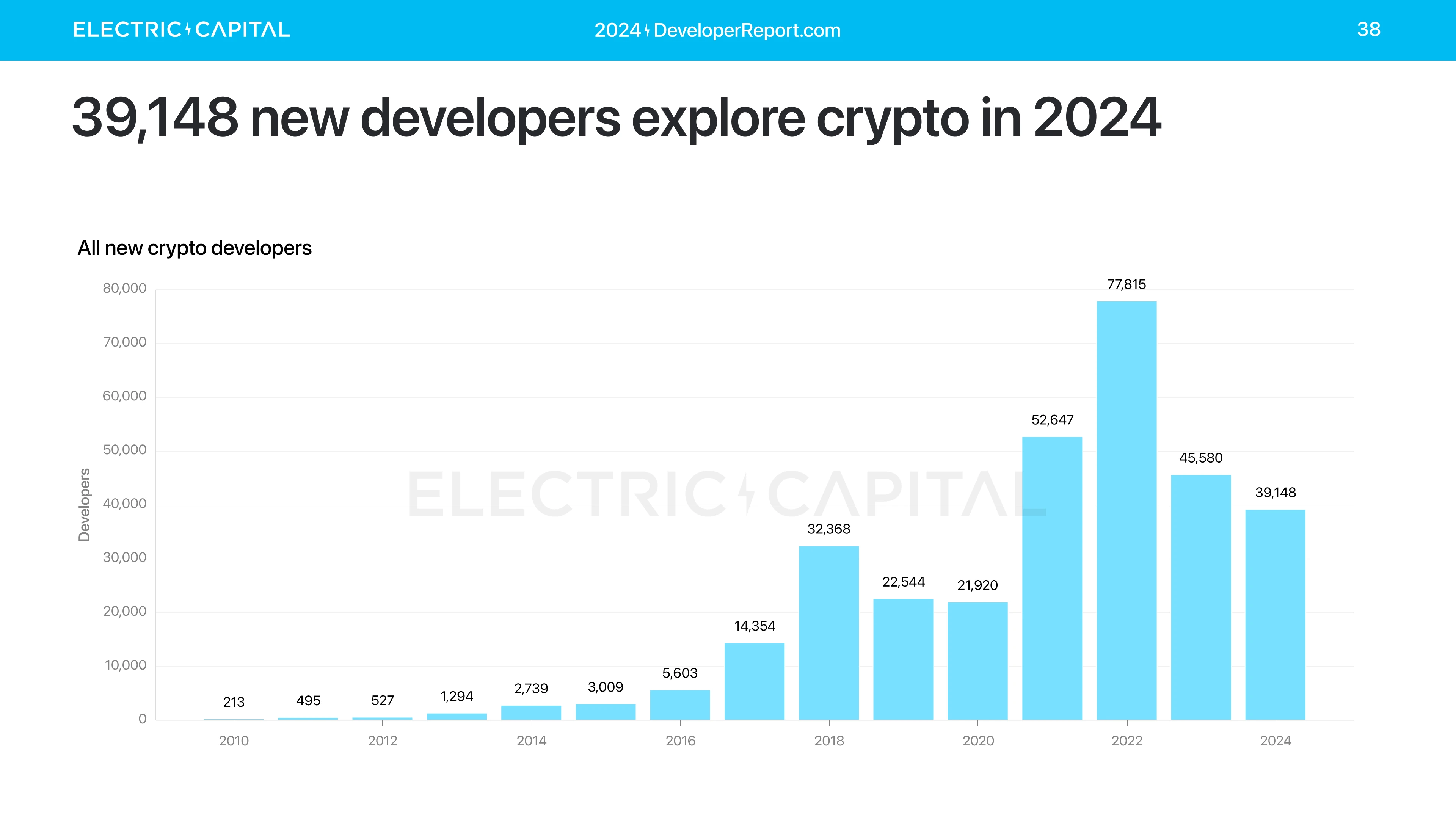

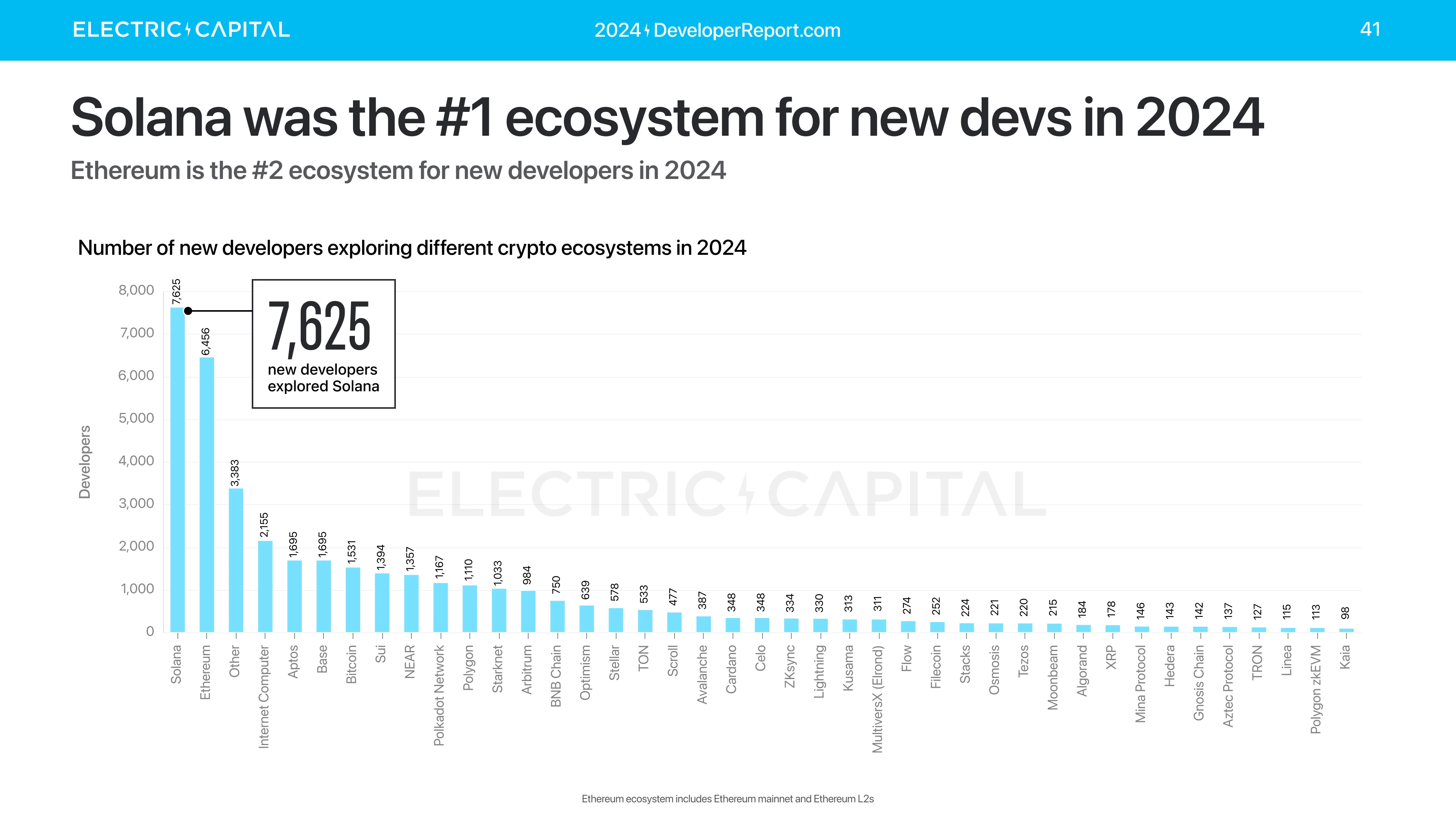

39,148 new developers will be involved in cryptocurrency in 2024.

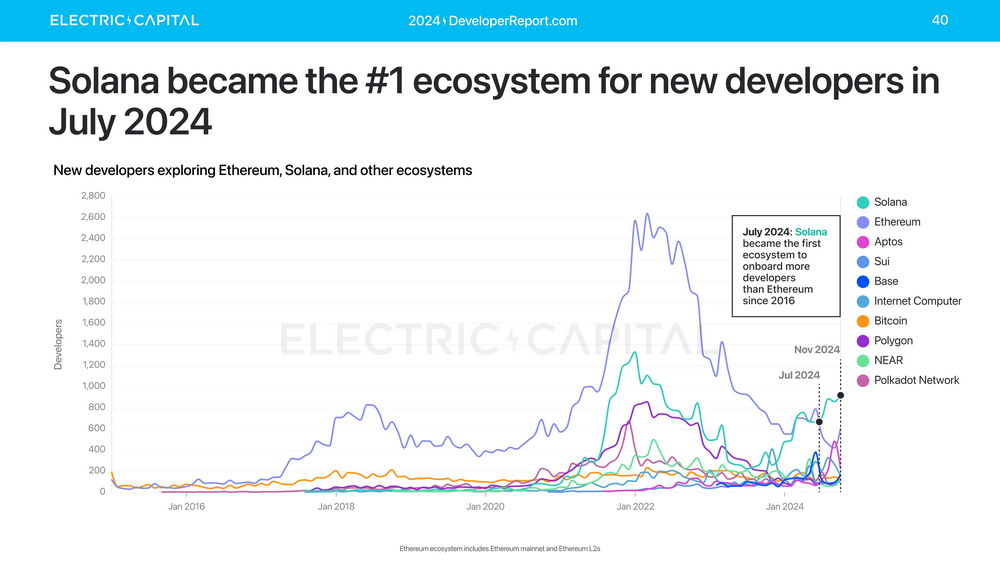

Broken down by ecosystem, Solana became the number one ecosystem for monthly new developers in July 2024.

Overall situation of new developers in 2024:

- Solana is the #1 Ecosystem for New Developers

- Ethereum ranks second

- Dfinity, Aptos, Bitcoin, Base, Sui, NEAR, Polkadot, Polygon, and Starknet will all have 1K+ new developers in 2024

- Arbitrum, BNB Chain, Optimism, Stellar, TON will have 500+ new developers in 2024

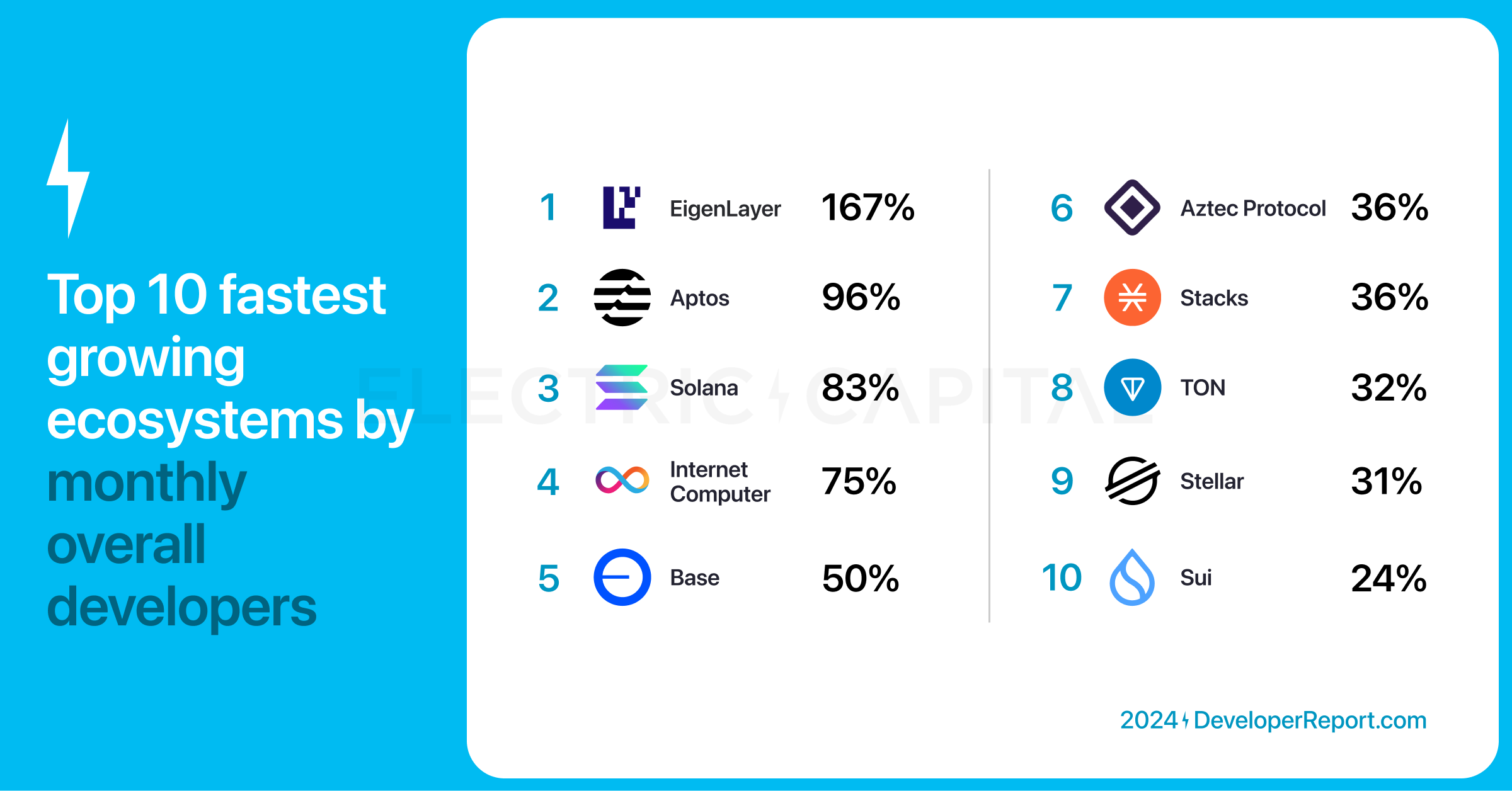

Which ecosystem has the fastest growth in total number of developers? The total number of developers reflects the interest of new developers and hackathon participants. The 10 fastest growing ecosystems in each month from Q3 2023 to Q4 2024 in terms of total number of developers: EigenLayer, Aptos, Solana, Dfinity, Base, Aztec, Stacks, TON, Stellar, Sui.

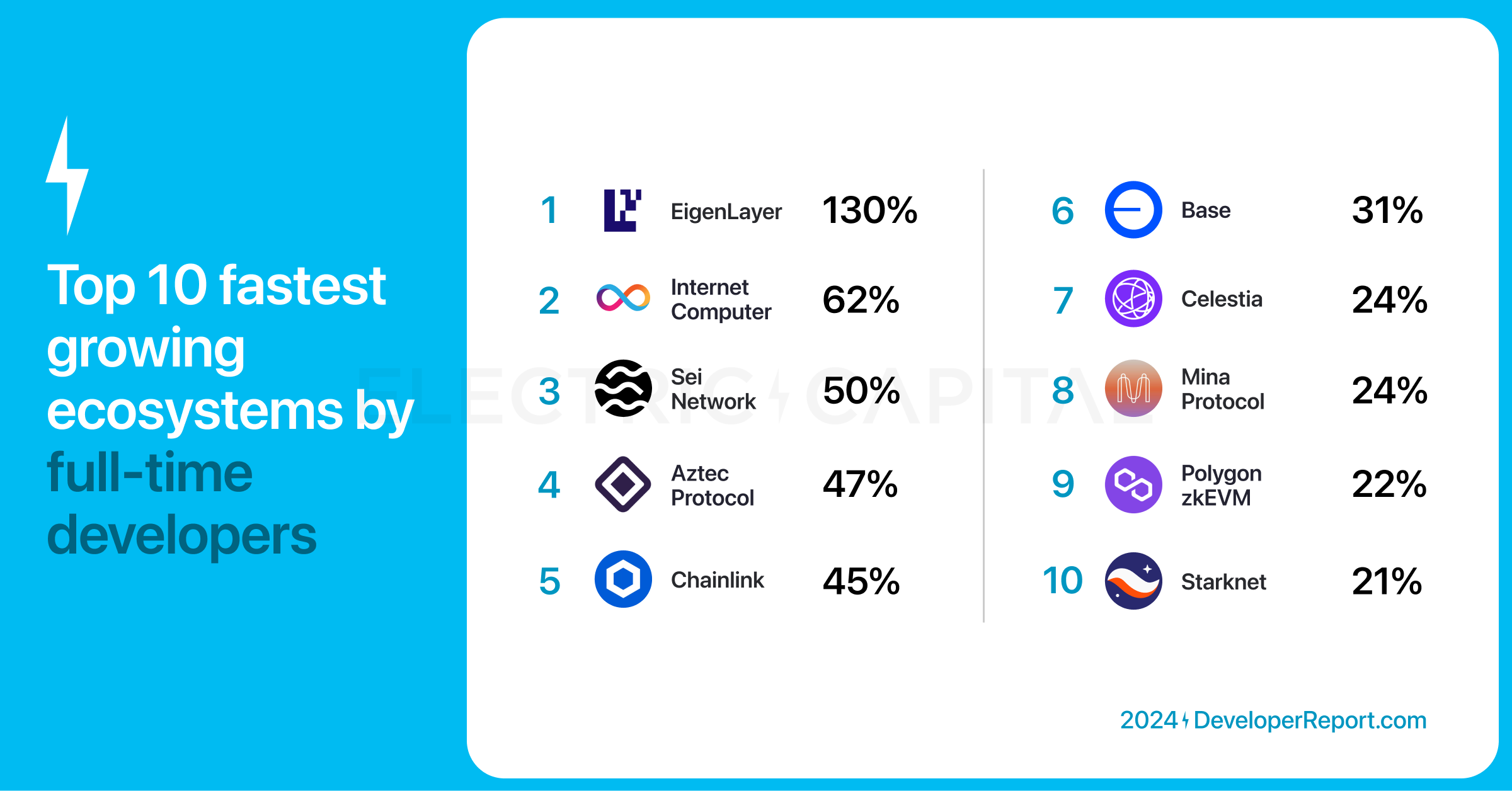

Which ecosystem has the fastest growth in full-time developers? Full-time developers submit code more than 10 days a month, and they make a steady contribution to the ecosystem. The 10 ecosystems with the fastest growth in full-time developers from Q3 2023 to Q4 2024: EigenLayer, Dfinity, Sei, Aztec, Chainlink, Base, Celestia, Mina, Polygon, Starknet.

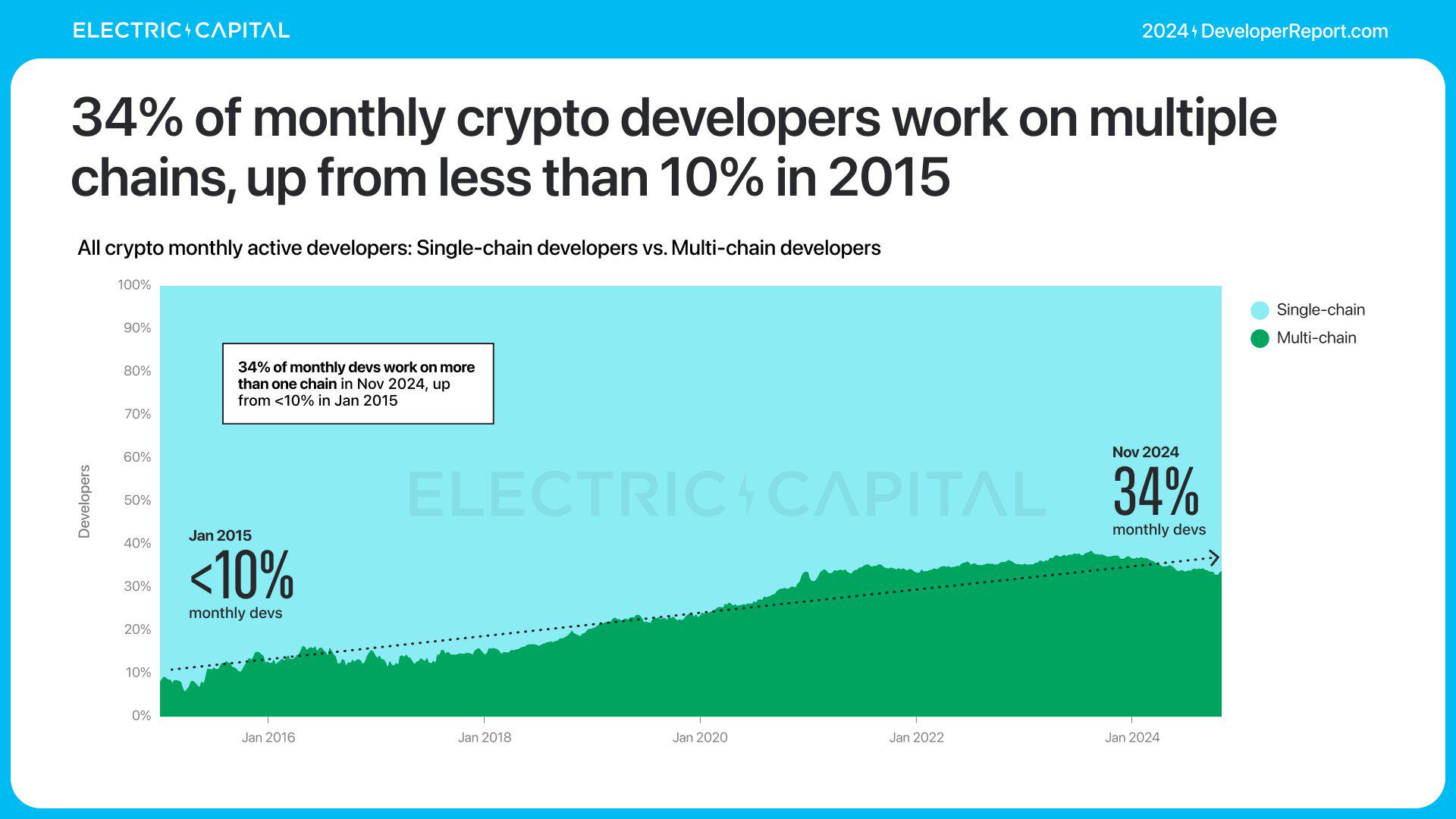

Many developers are working on multiple chains. Today, one-third of crypto developers are working on multiple chains, and this number is growing.

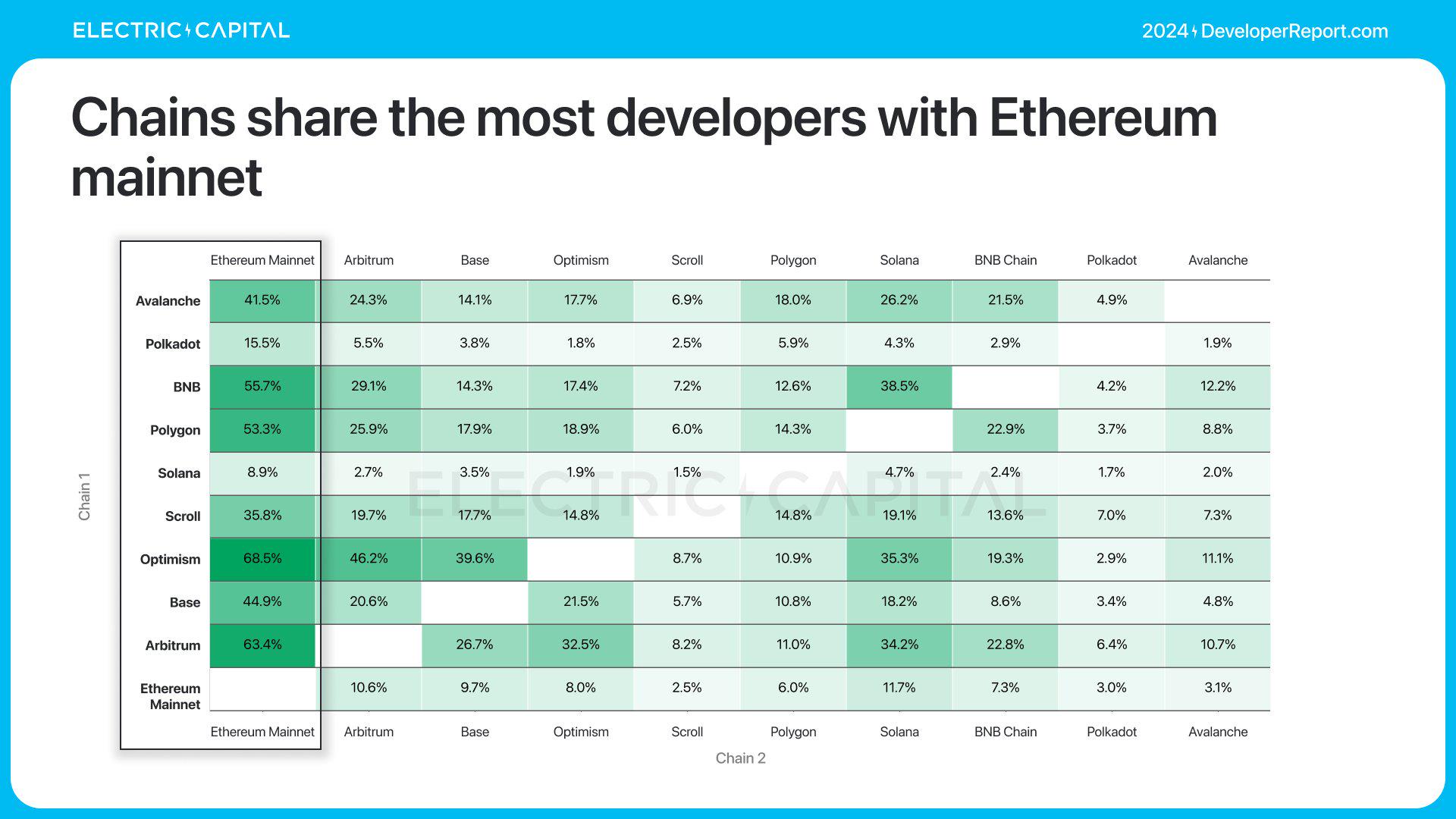

The share of multi-chain developers per month increases from less than 10% in 2015 to 34% in 2024. The chain with the largest share of multi-chain developers shares developers with Ethereum.

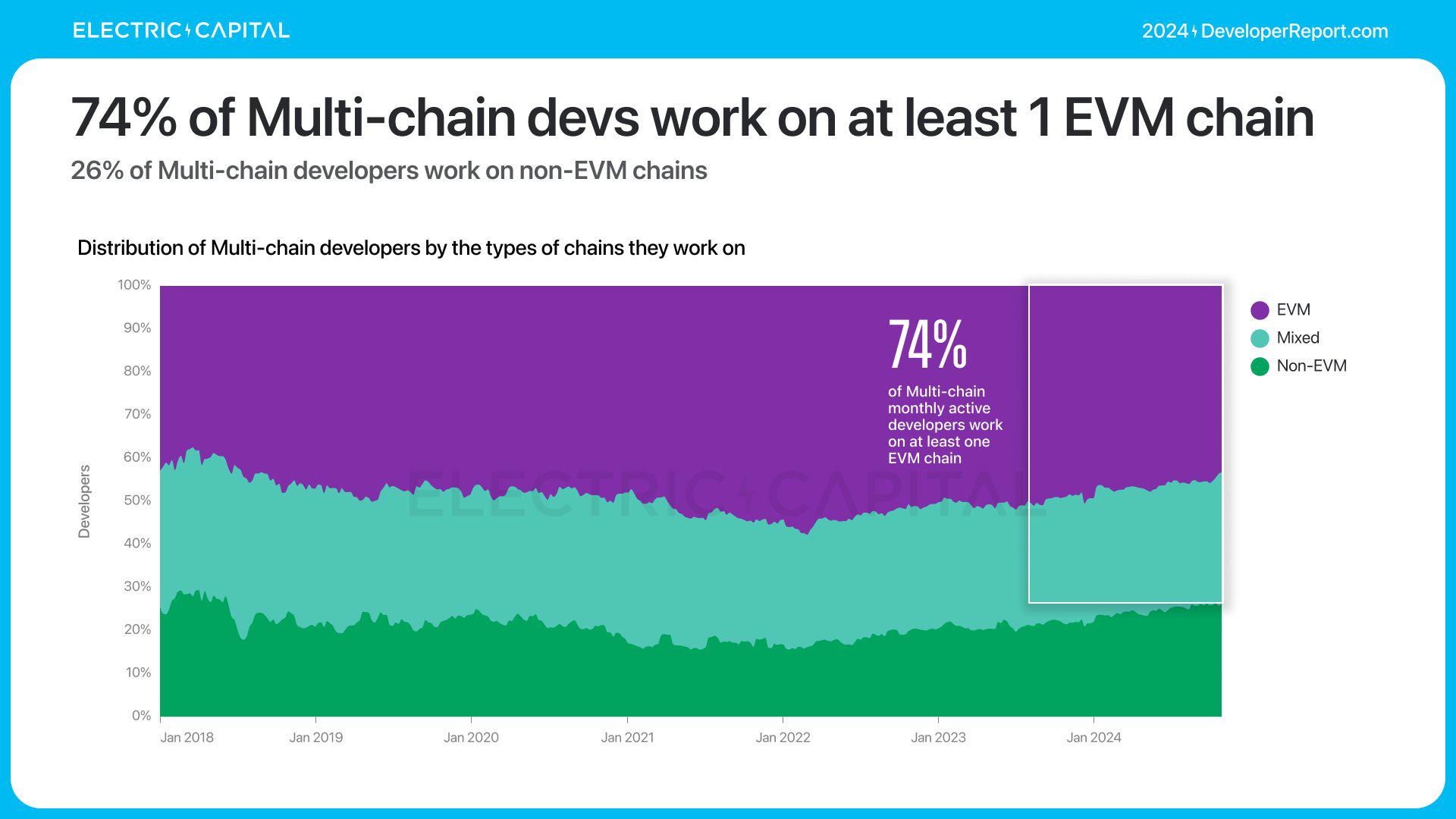

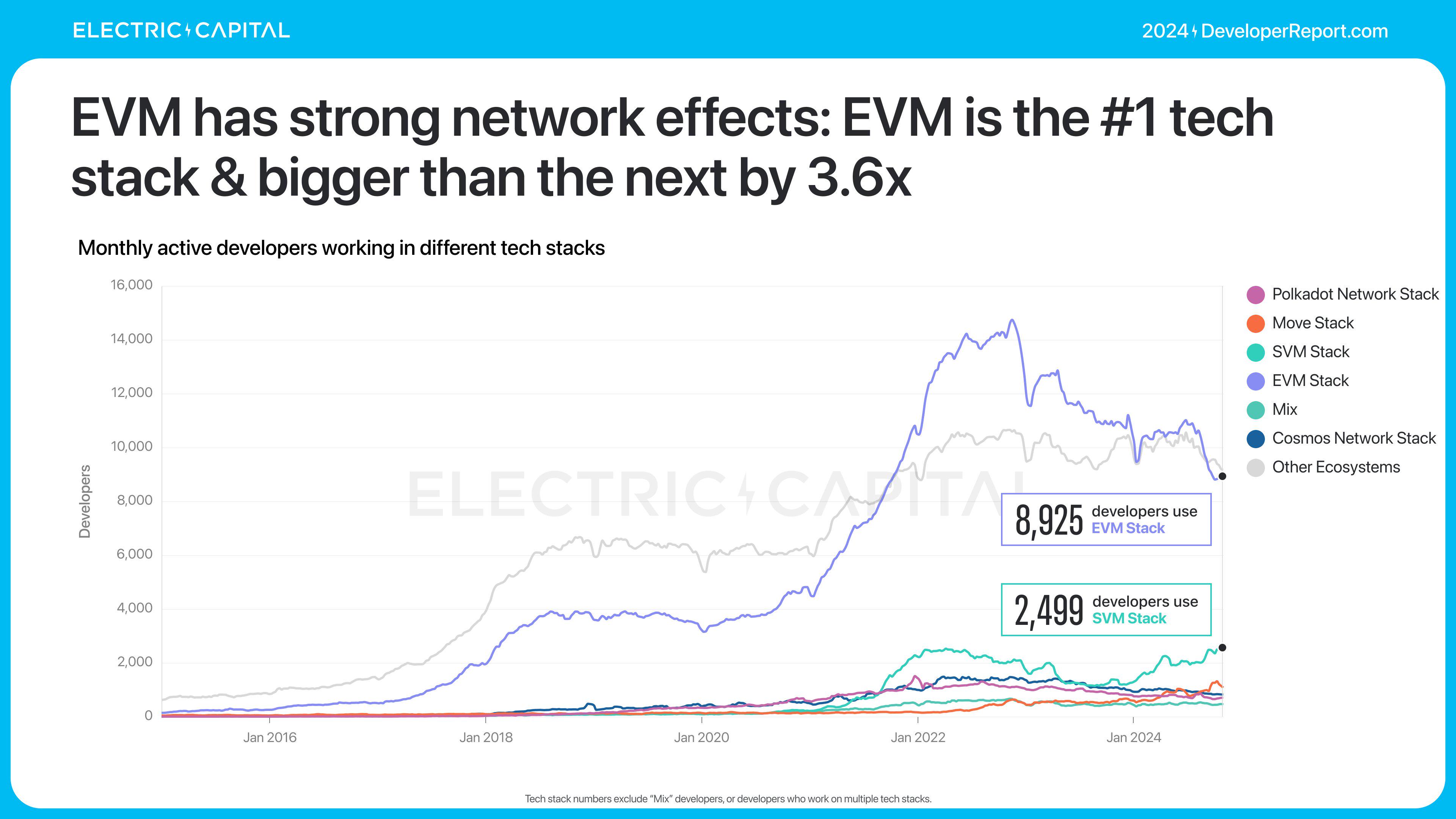

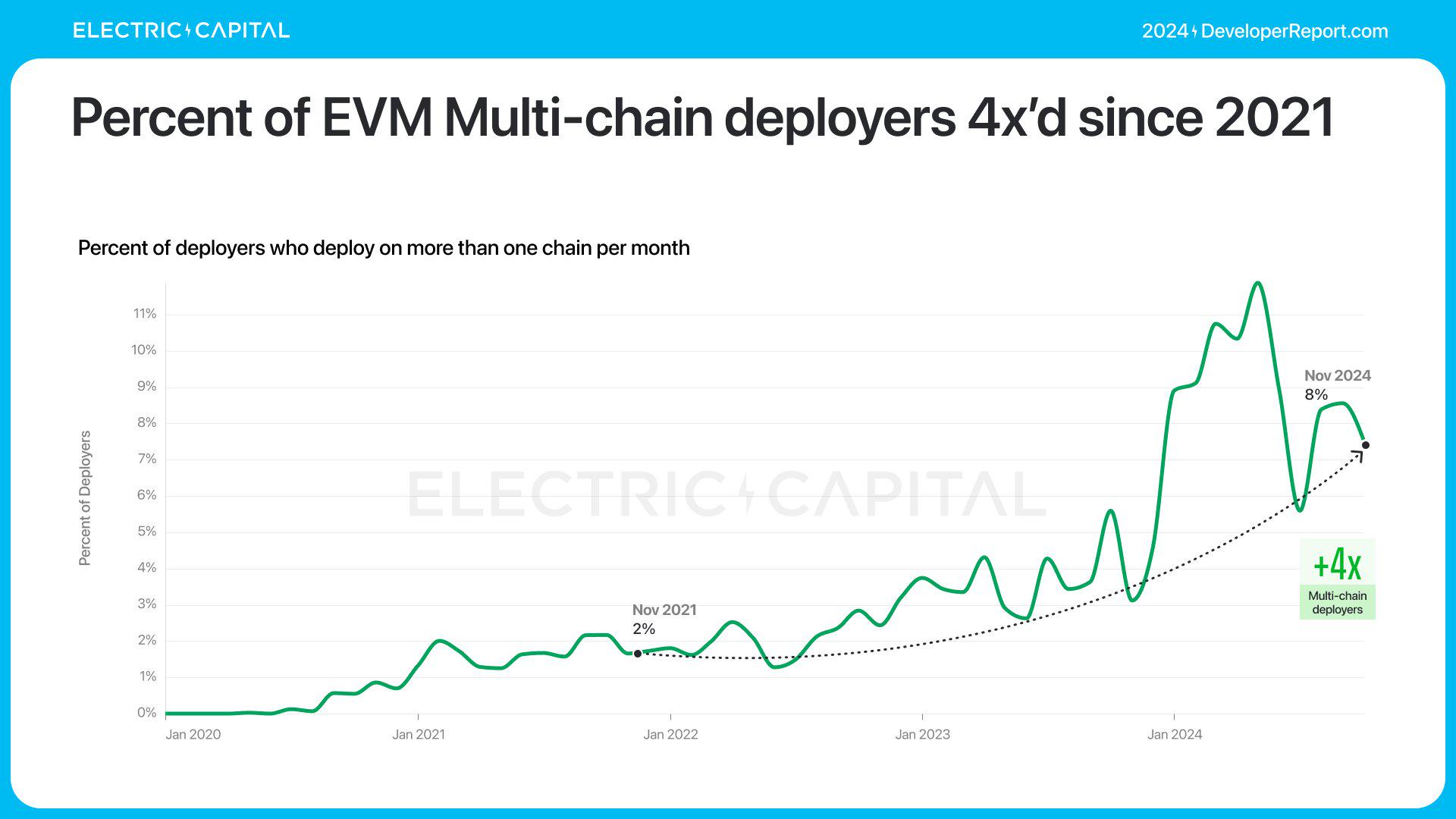

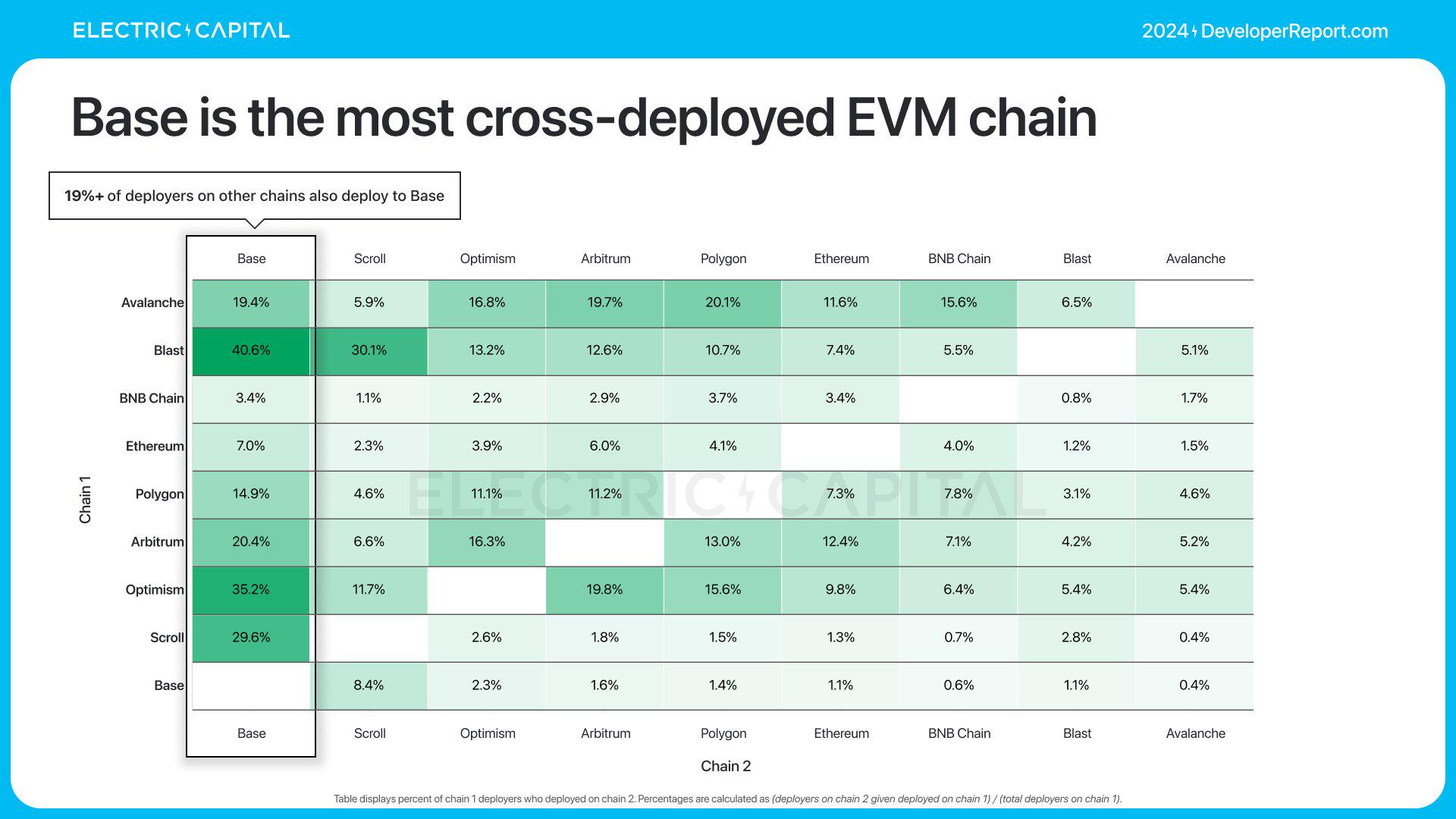

The EVM chain shares the most developers and has a significant network effect: 74% of multi-chain developers work on the EVM chain. The proportion of EVM cross-chain deployers has increased 4x since 2021.

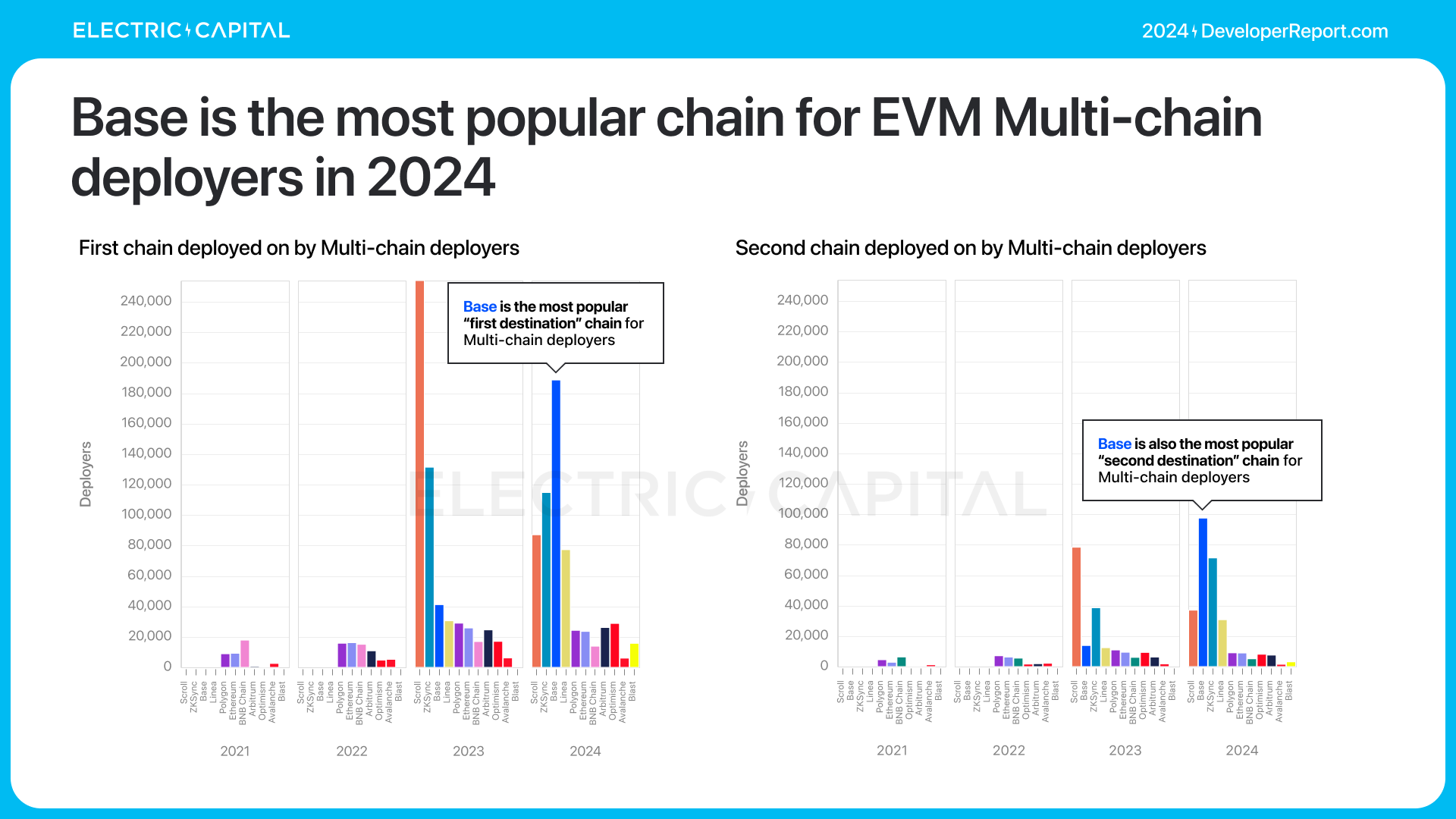

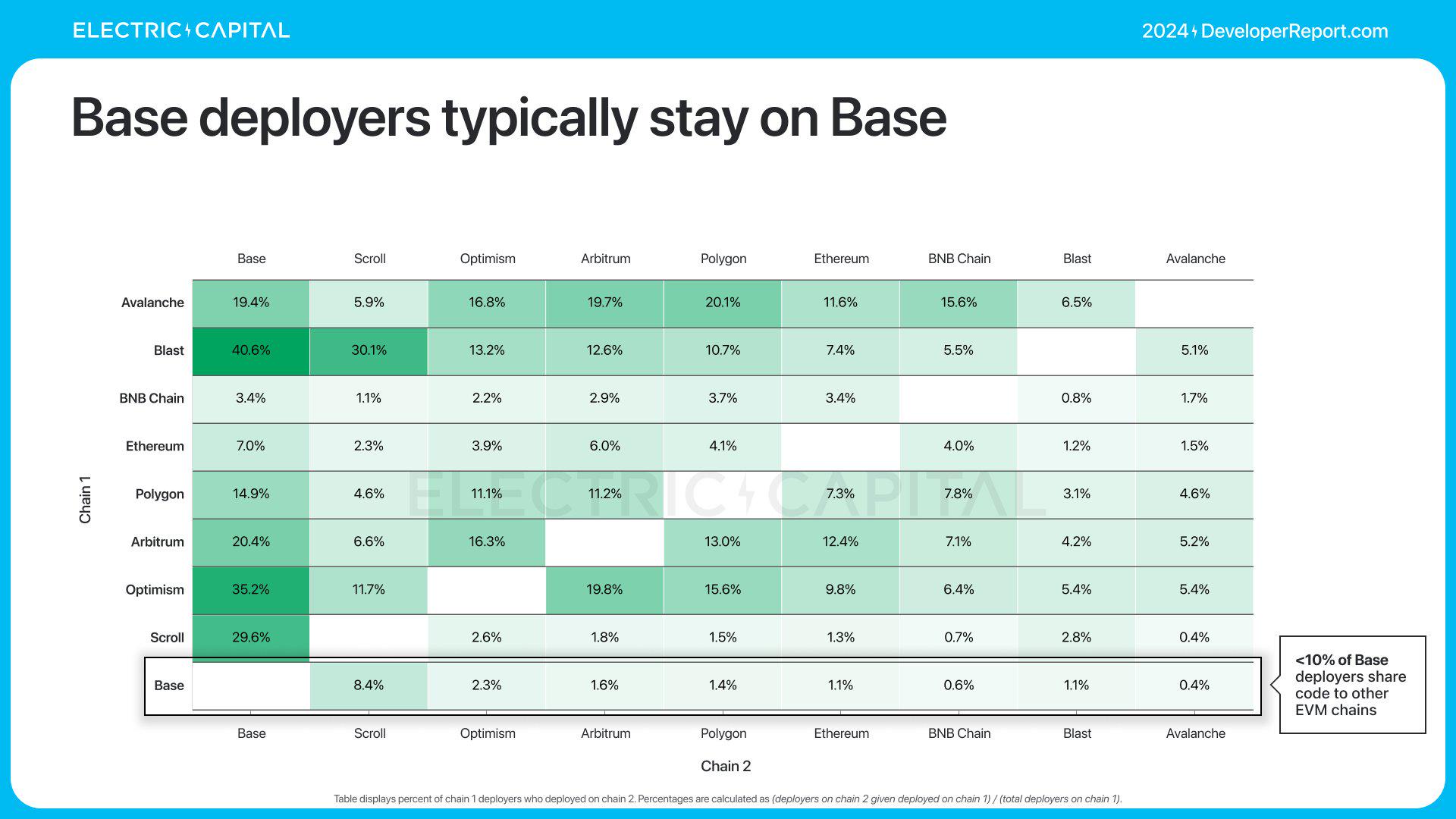

In 2024, Base is the most popular chain among EVM multi-chain deployers, but Base deployers tend to stay on Base.

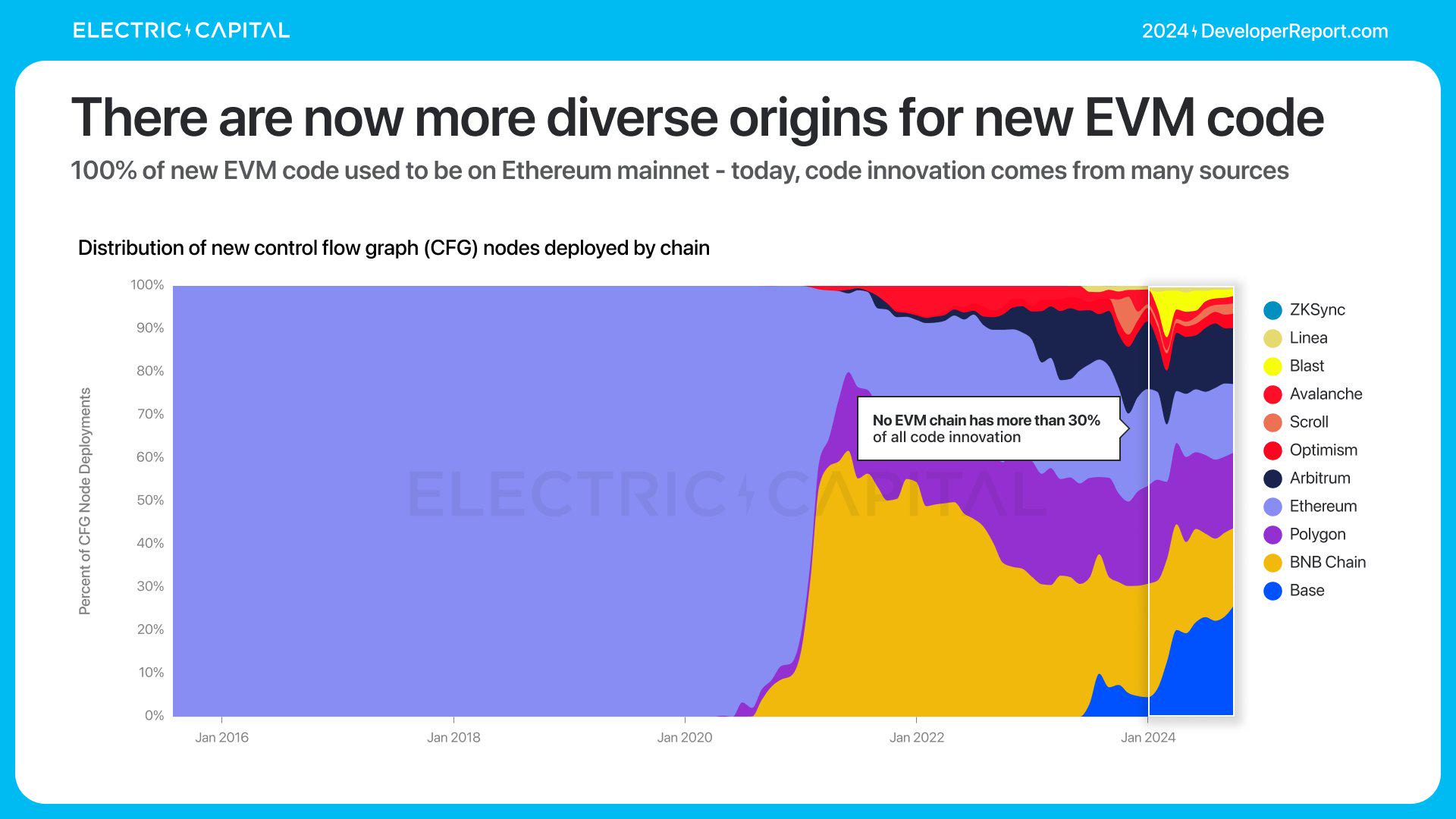

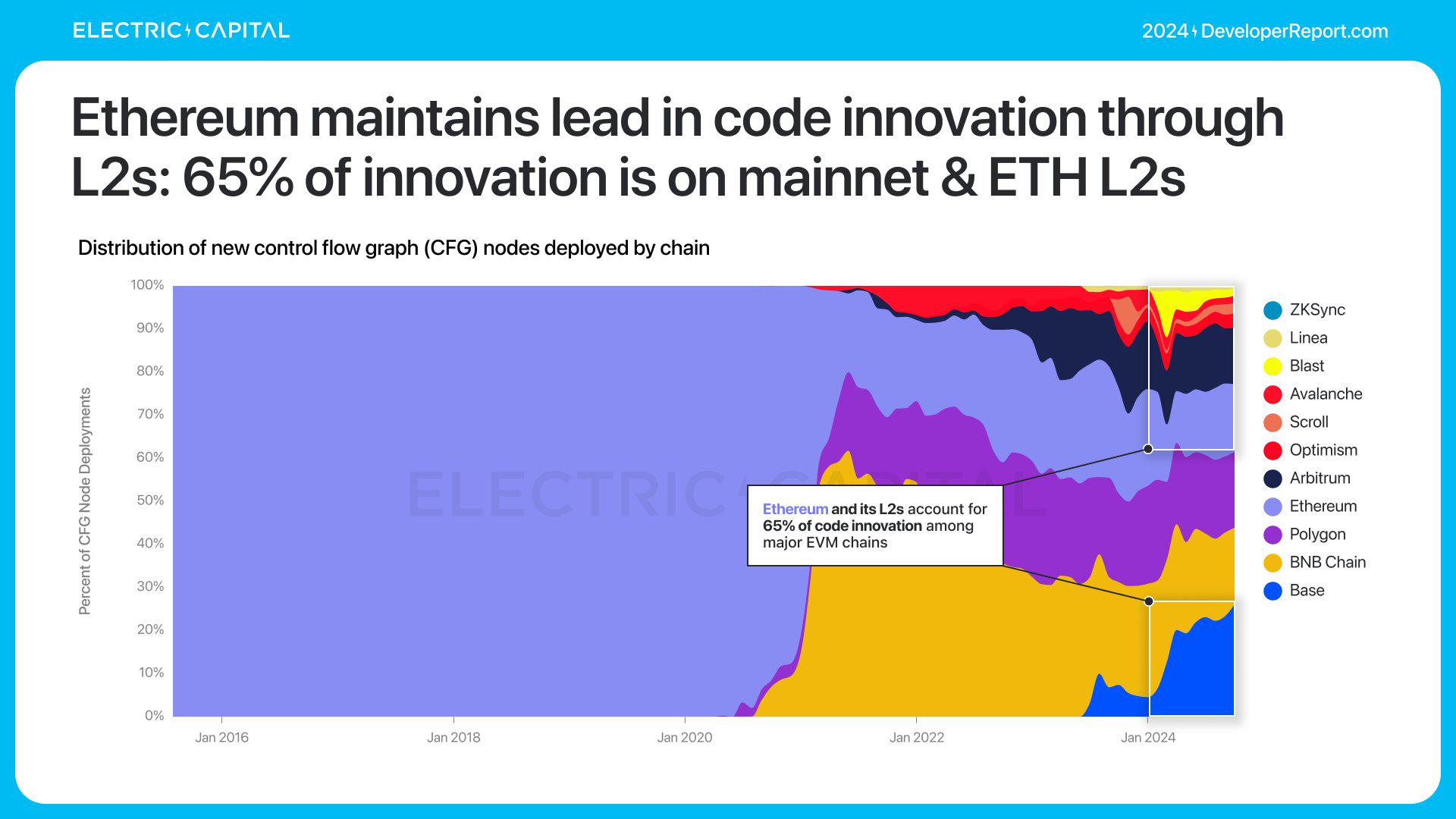

Before 2020, almost all of the original on-chain code logic in the EVM was on Ethereum. Today, no EVM chain has more than 30% of all code innovation.

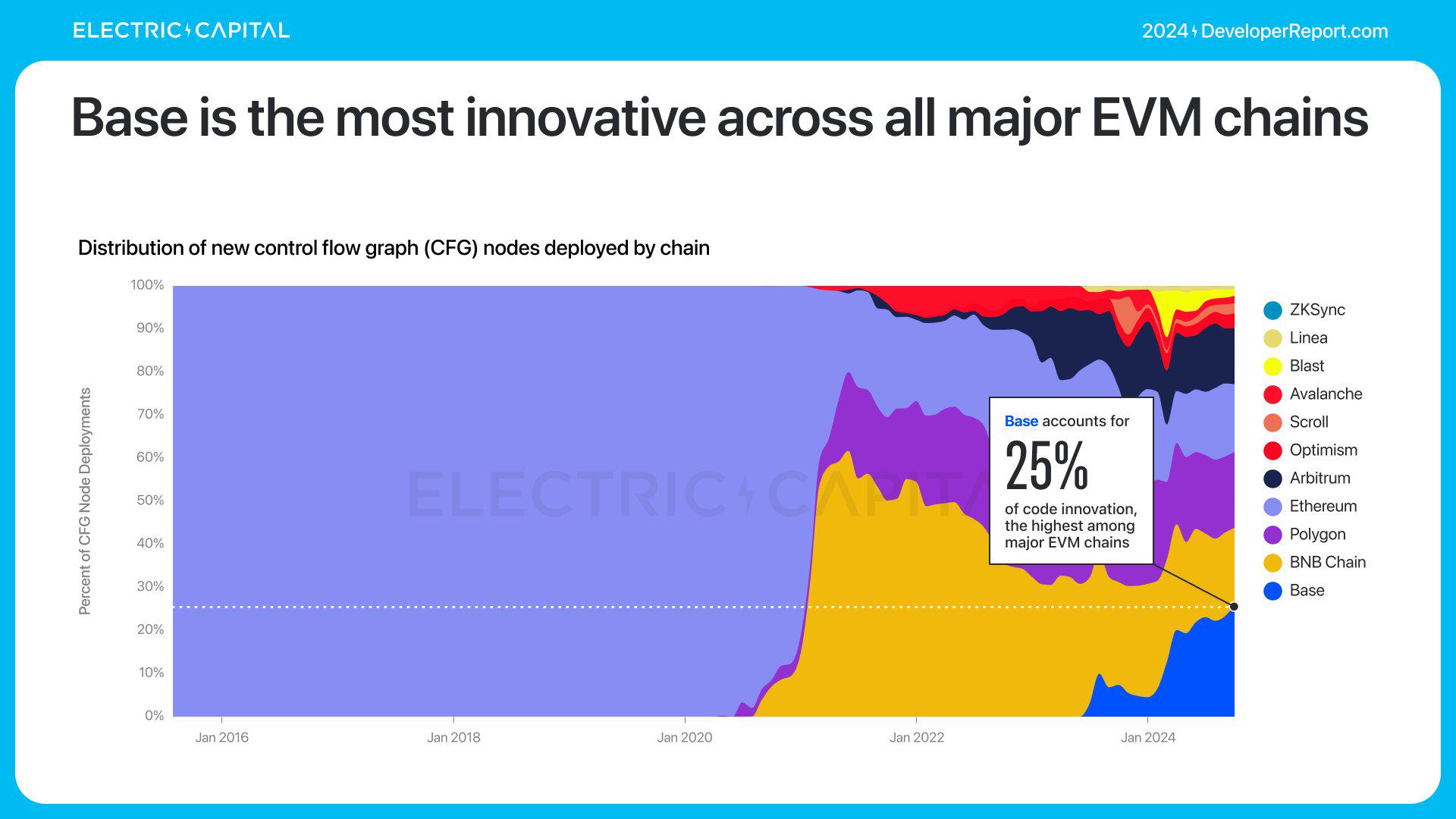

Base accounts for 25% of all original on-chain code logic in the EVM, the most among the mainstream EVM chains.

This is how the Ethereum ecosystem maintains its lead in code innovation through L2s. 65% of innovation happens on the mainnet and ETH L2s.

Ethereum

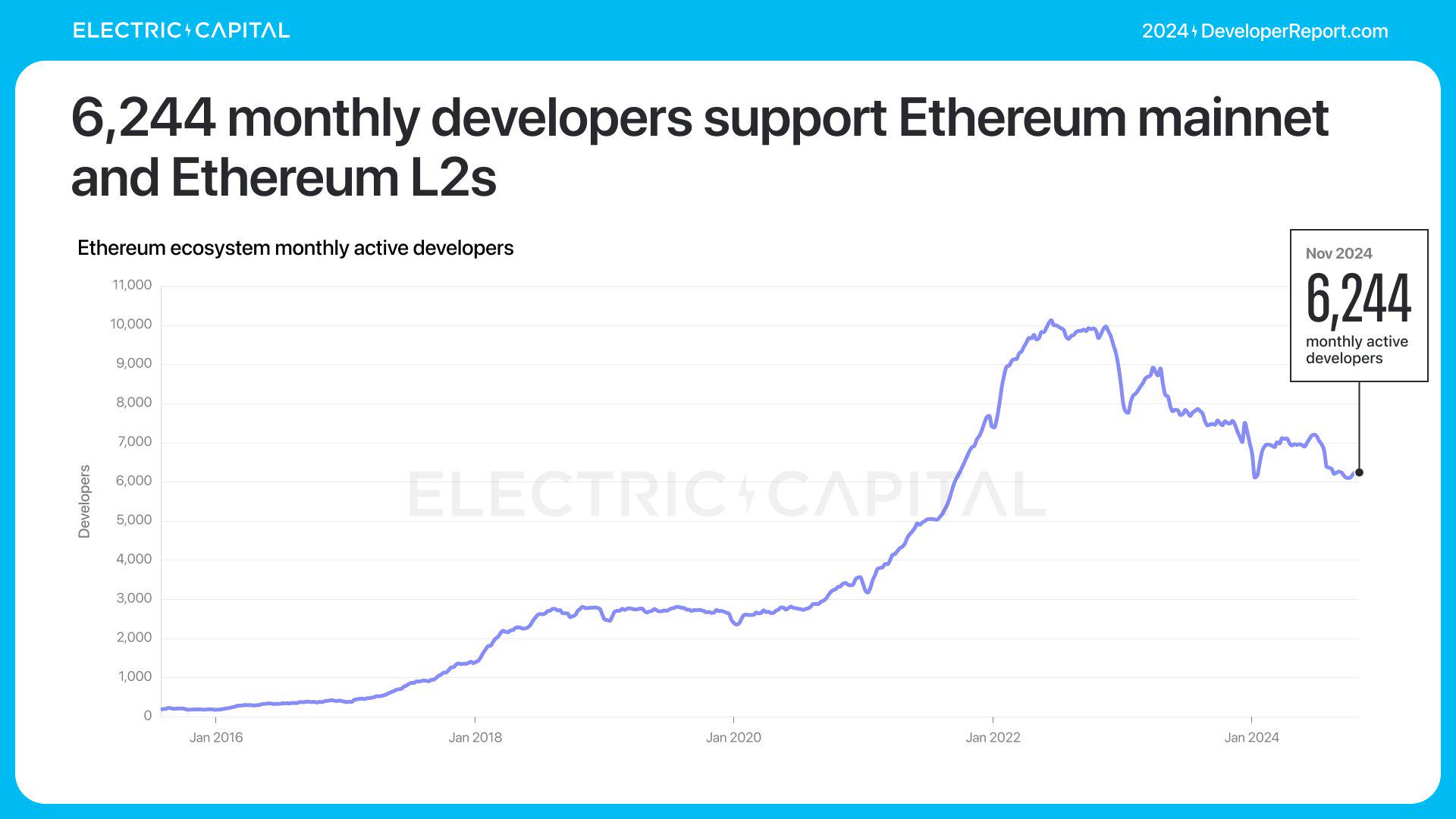

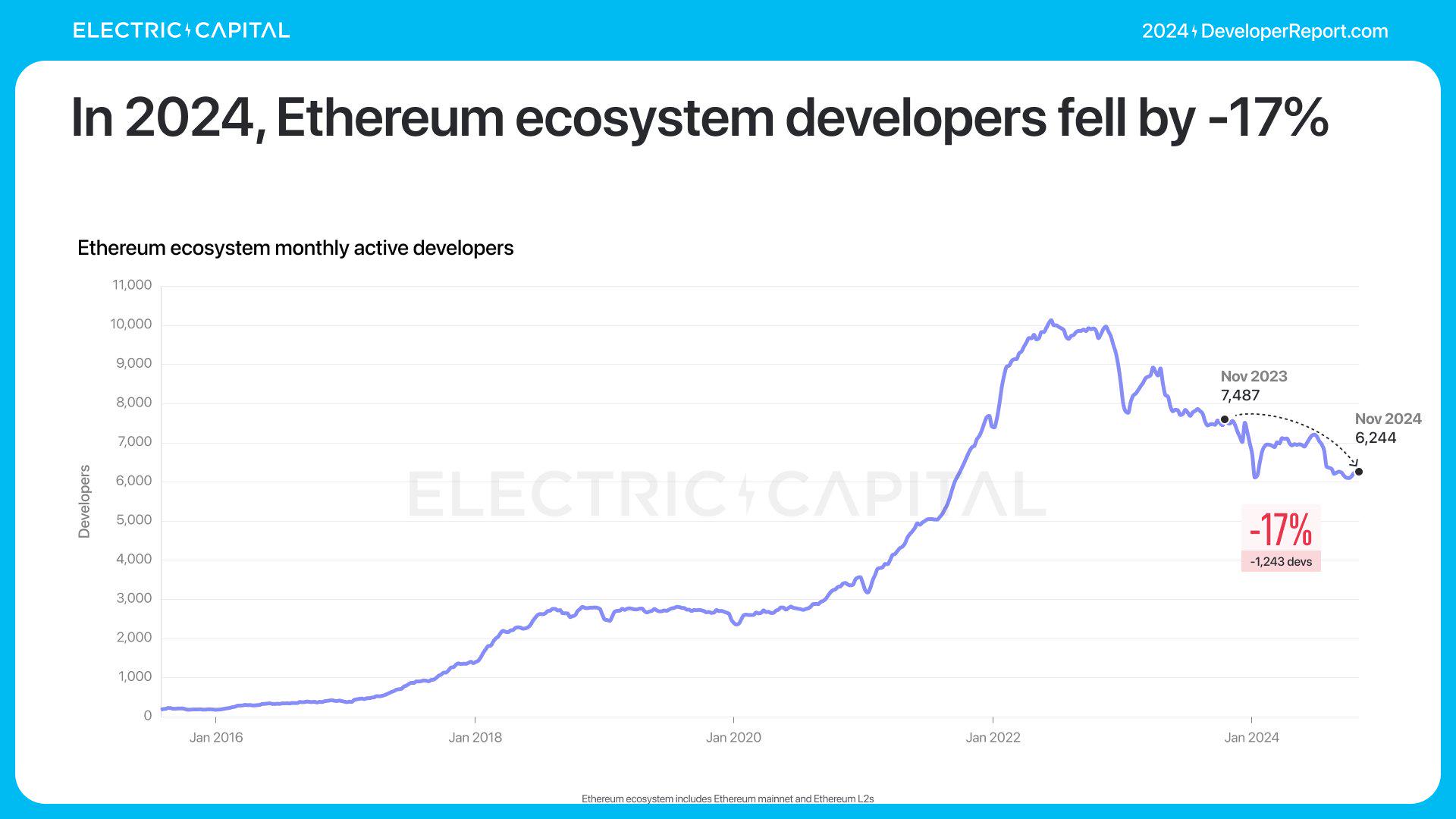

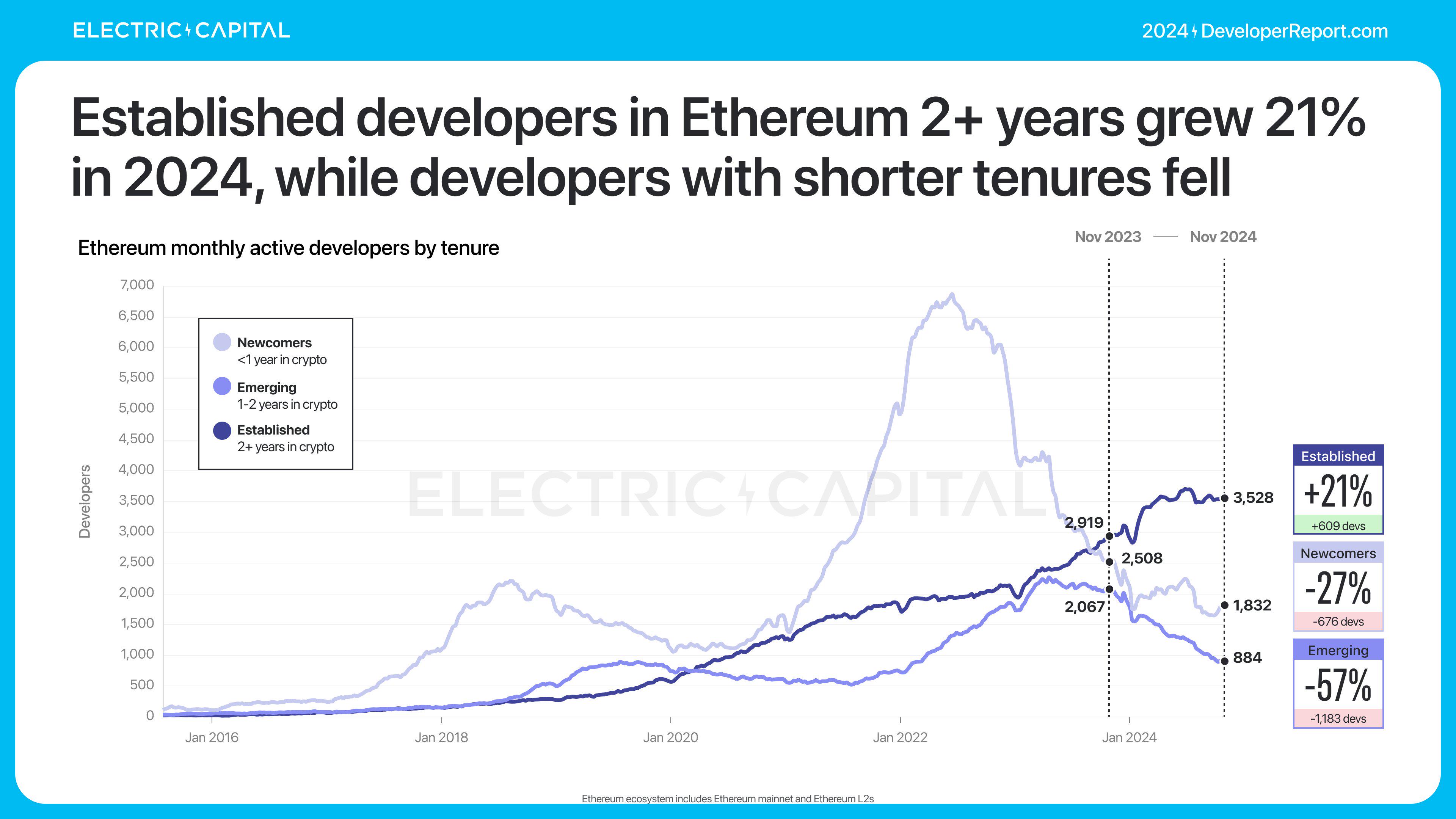

The Ethereum ecosystem demonstrates strong network effects through the dominance of EVM and multi-chain developers. The number of Ethereum monthly active developers is 6,244, down 17% year-on-year. Most of the loss is caused by developers who joined after 2021. The number of Ethereum developers with more than 2 years of experience increased by 21%.

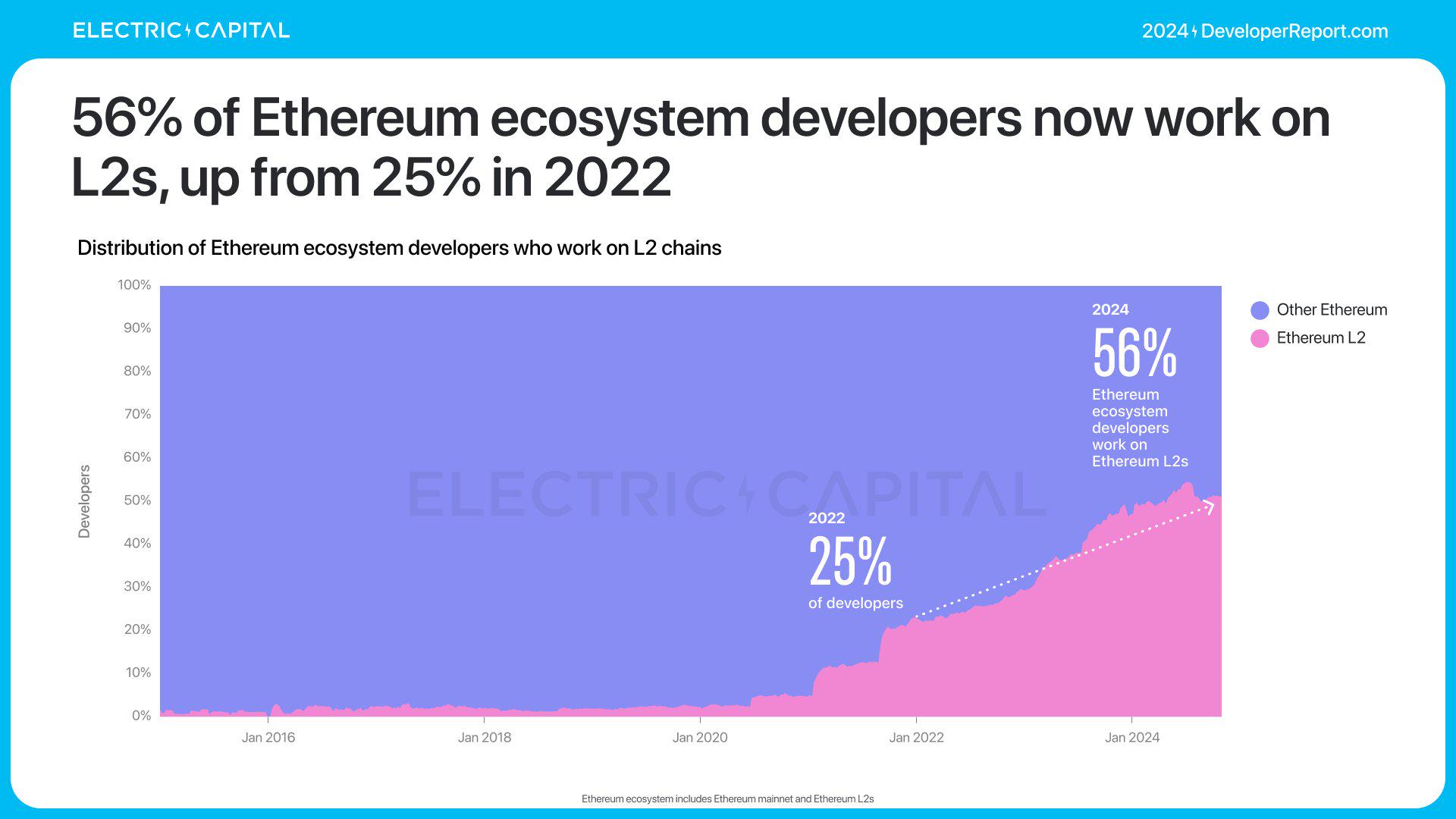

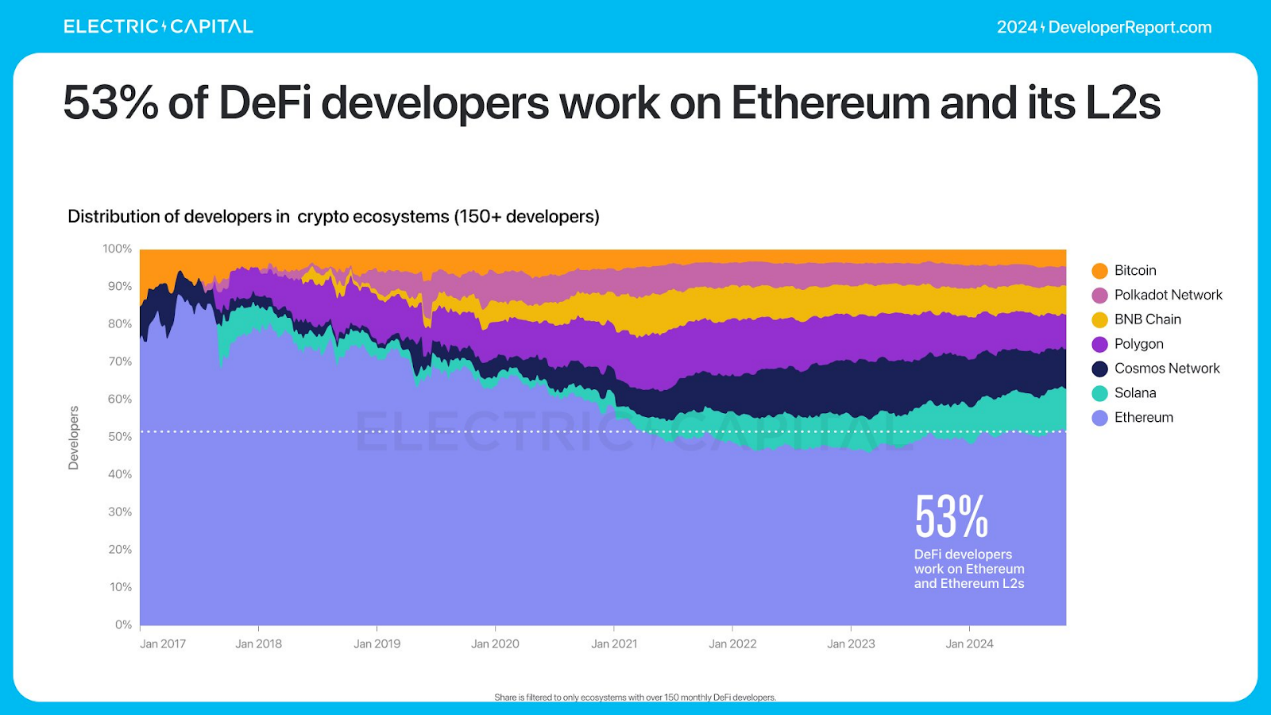

Currently, more than half of Ethereum developers are working on L2s, up from 25% in 2022.

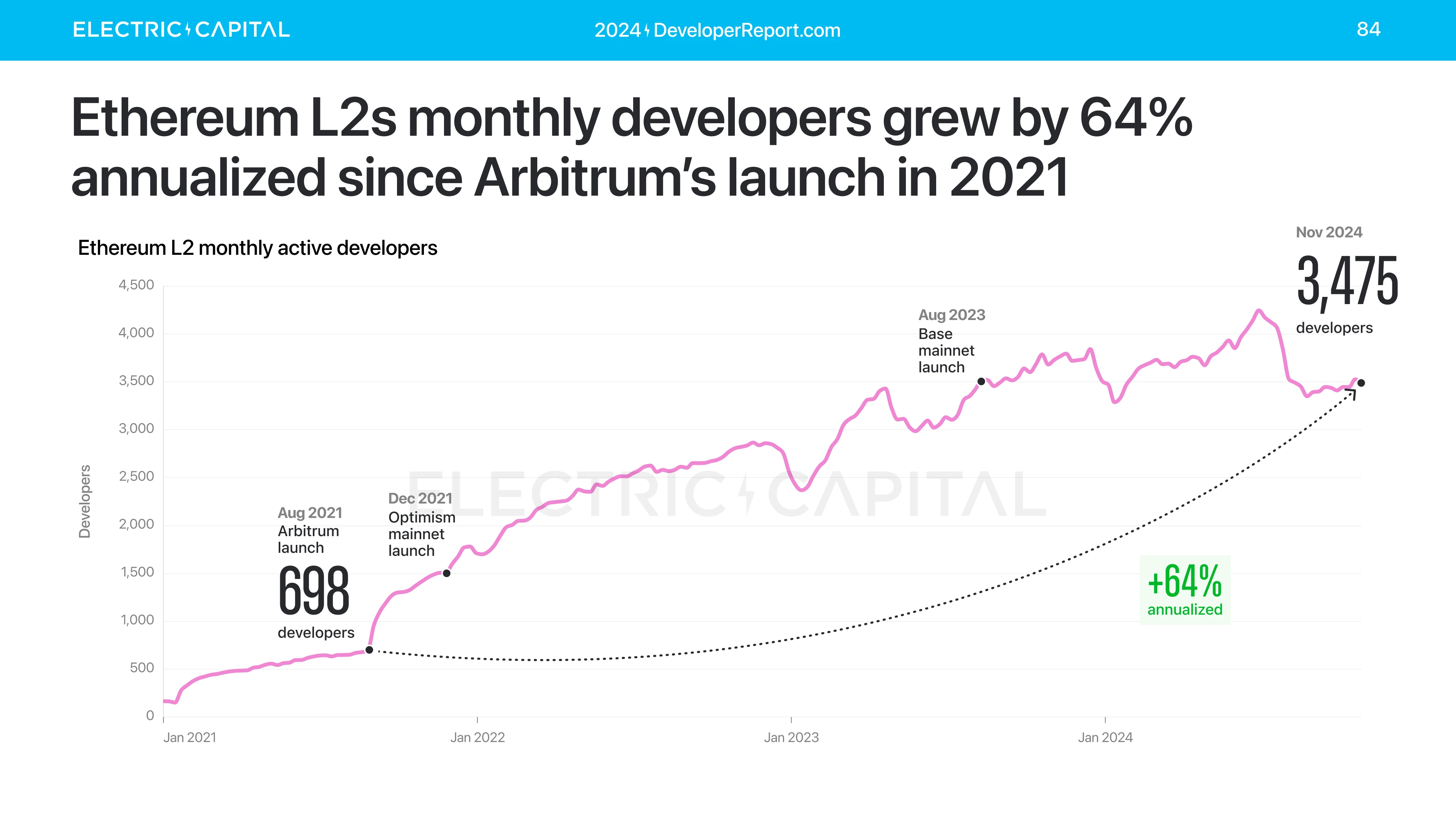

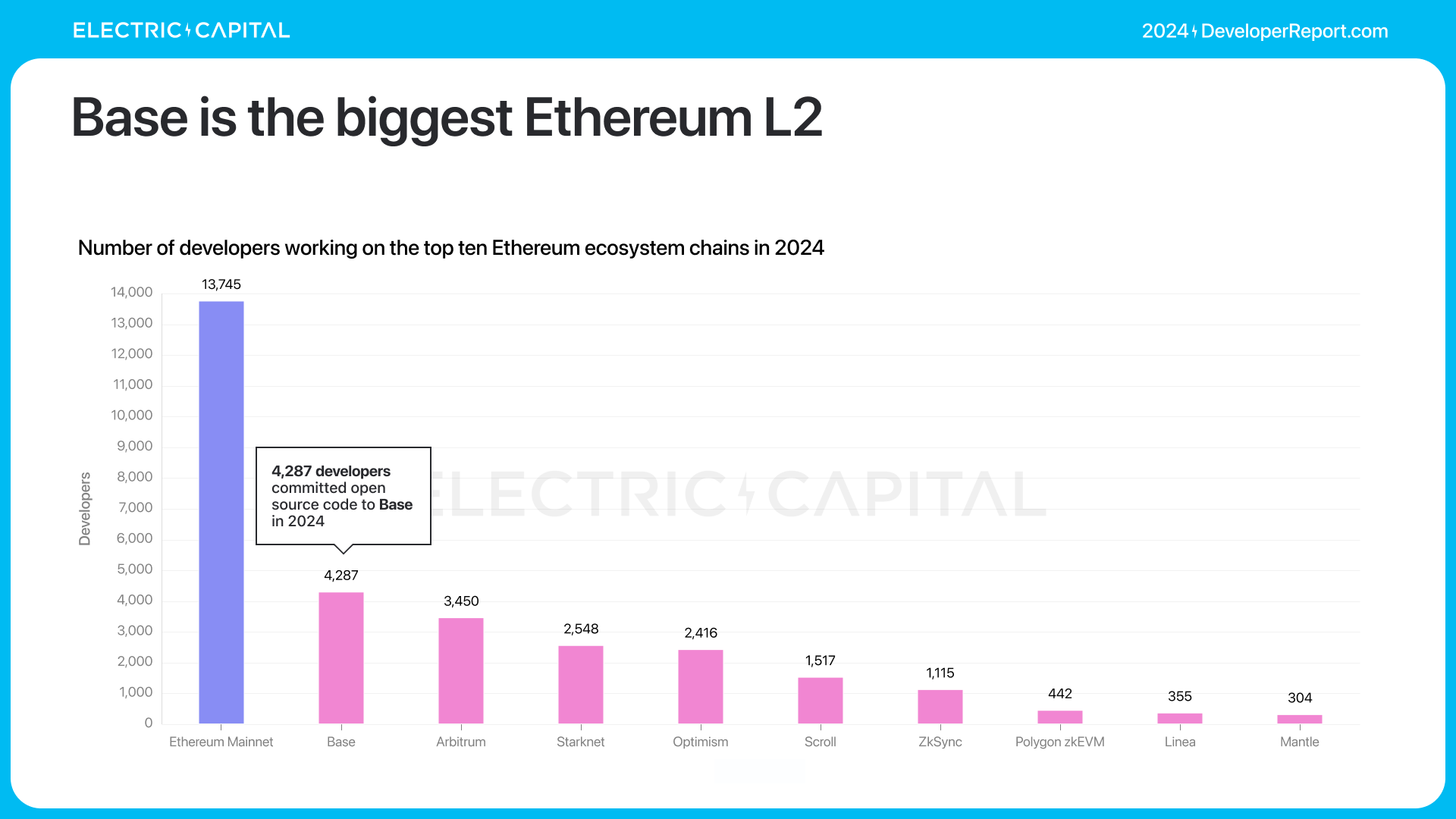

Ethereum L2s has seen a dramatic increase in developers over the past 4 years, with 3,592 active developers per month, an annualized growth rate of 67% since the launch of Arbitrum in 2021.

Base is the largest Ethereum L2. Arbitrum, Starknet, and Optimism will have 2,000+ developers in 2024.

Bitcoin

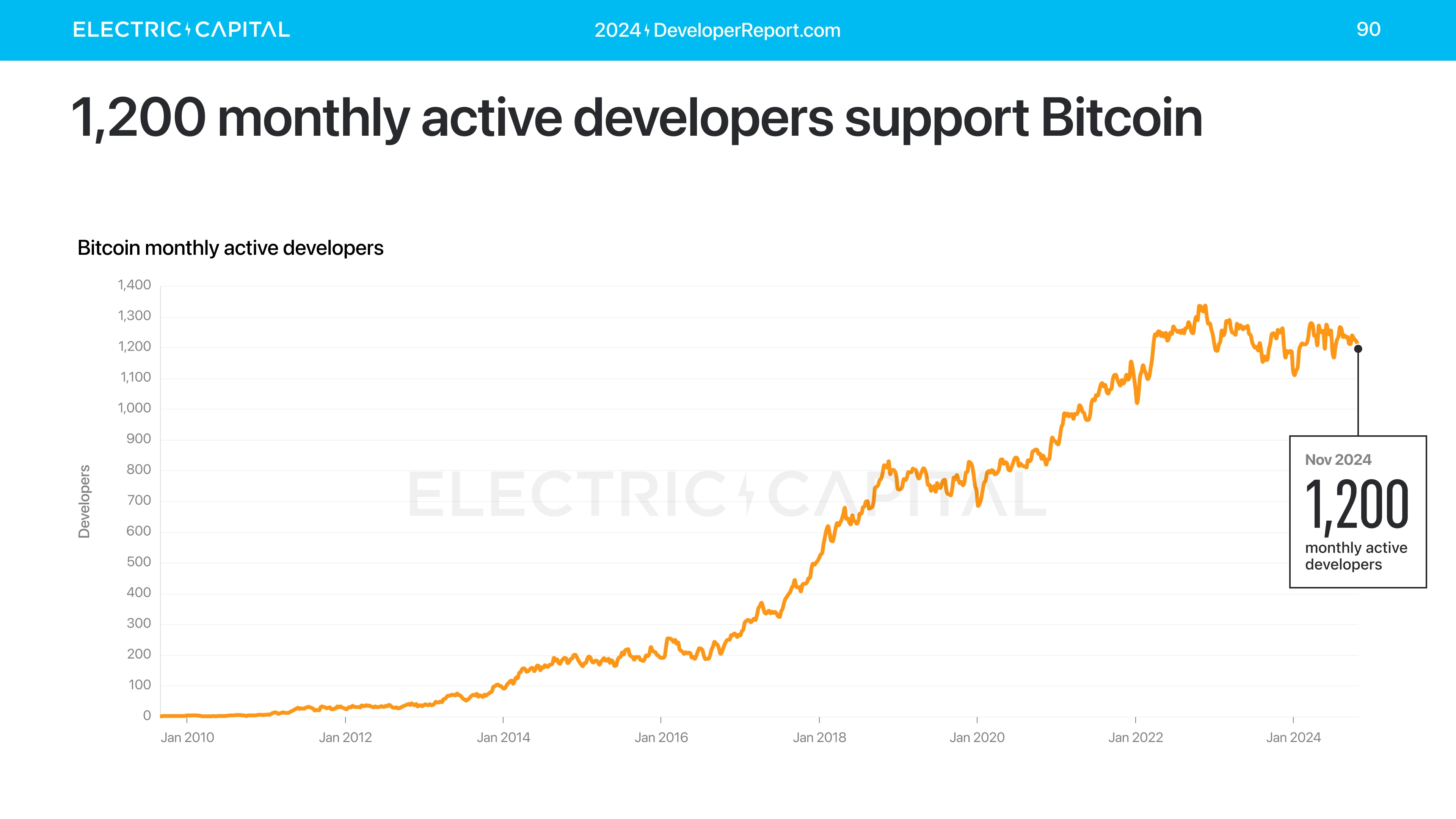

Bitcoin has 1,200 active developers per month, which will remain the same in 2024.

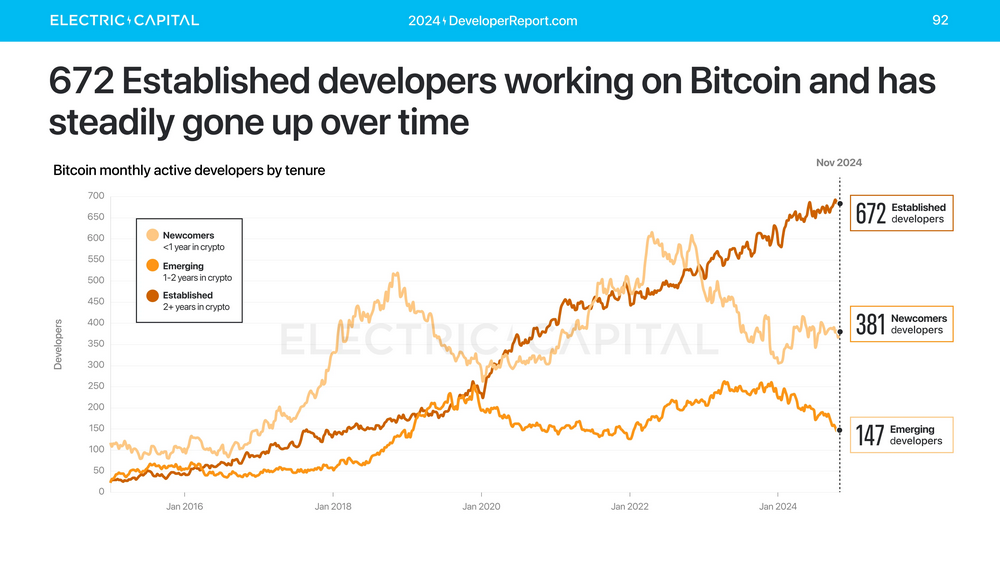

The number of senior Bitcoin developers (working for more than 2 years) has been rising steadily. The highest number of active senior Bitcoin developers per month was 672.

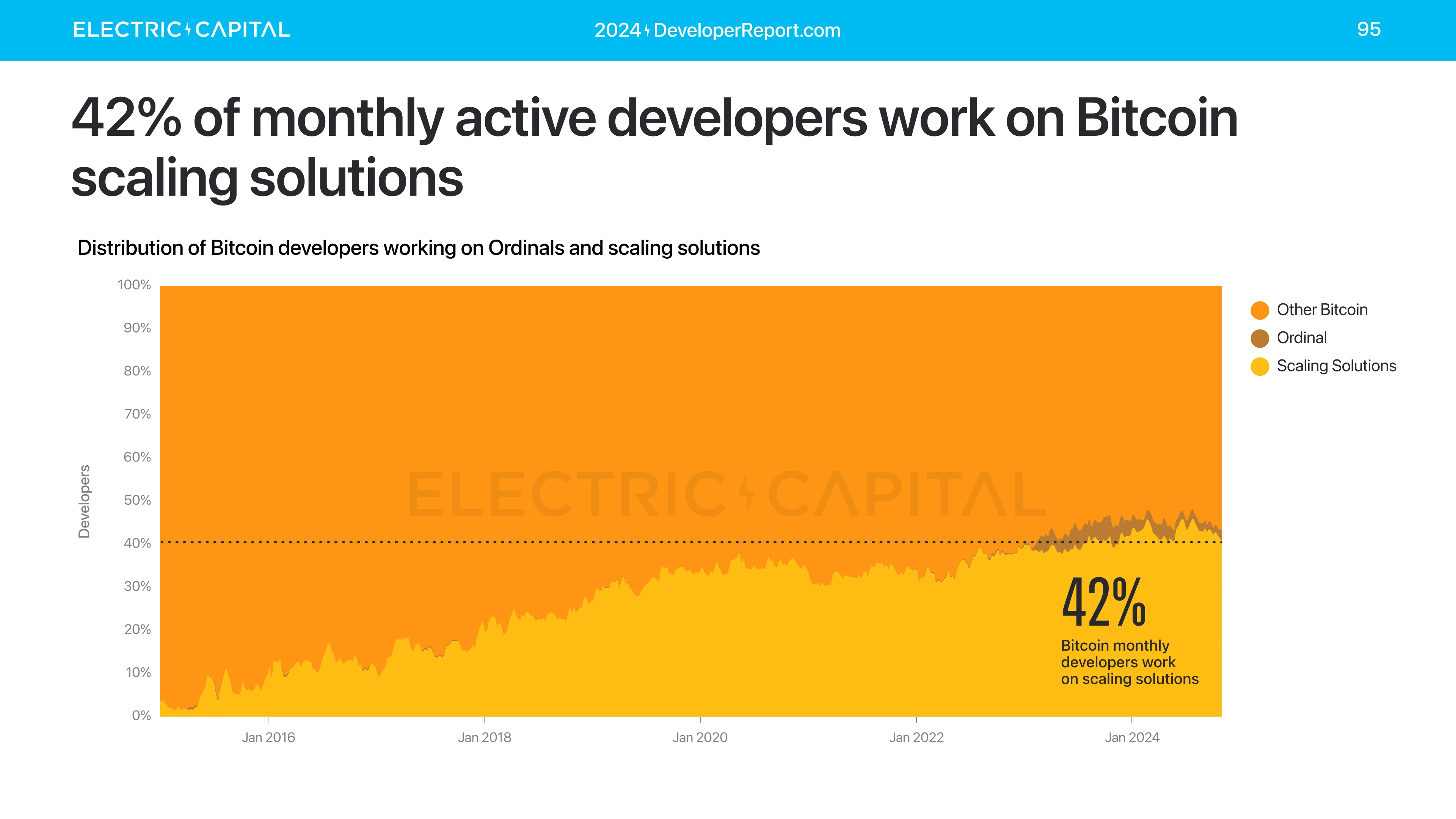

42% of Bitcoin developers (almost half) are working on Bitcoin scaling solutions.

ZK

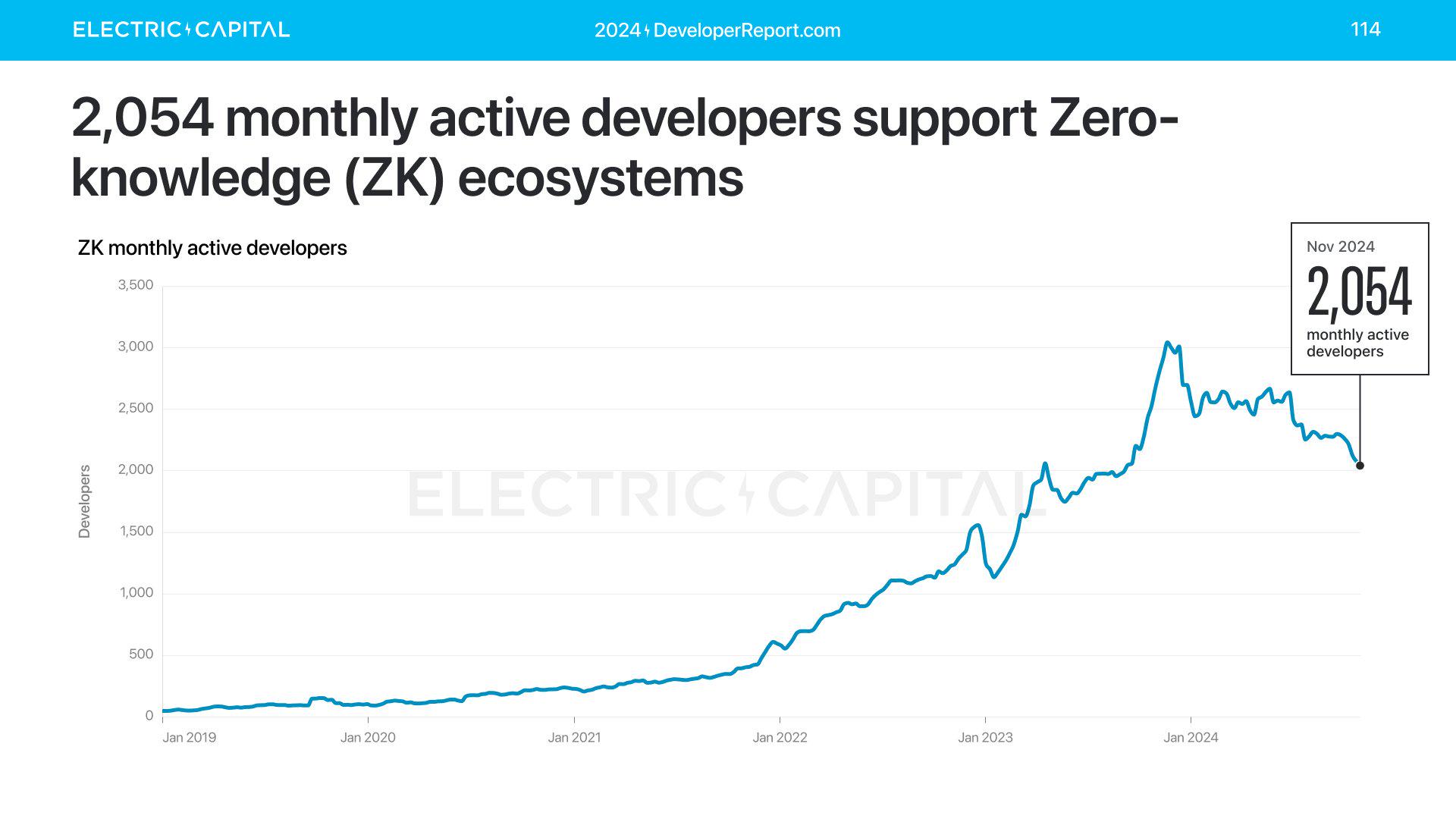

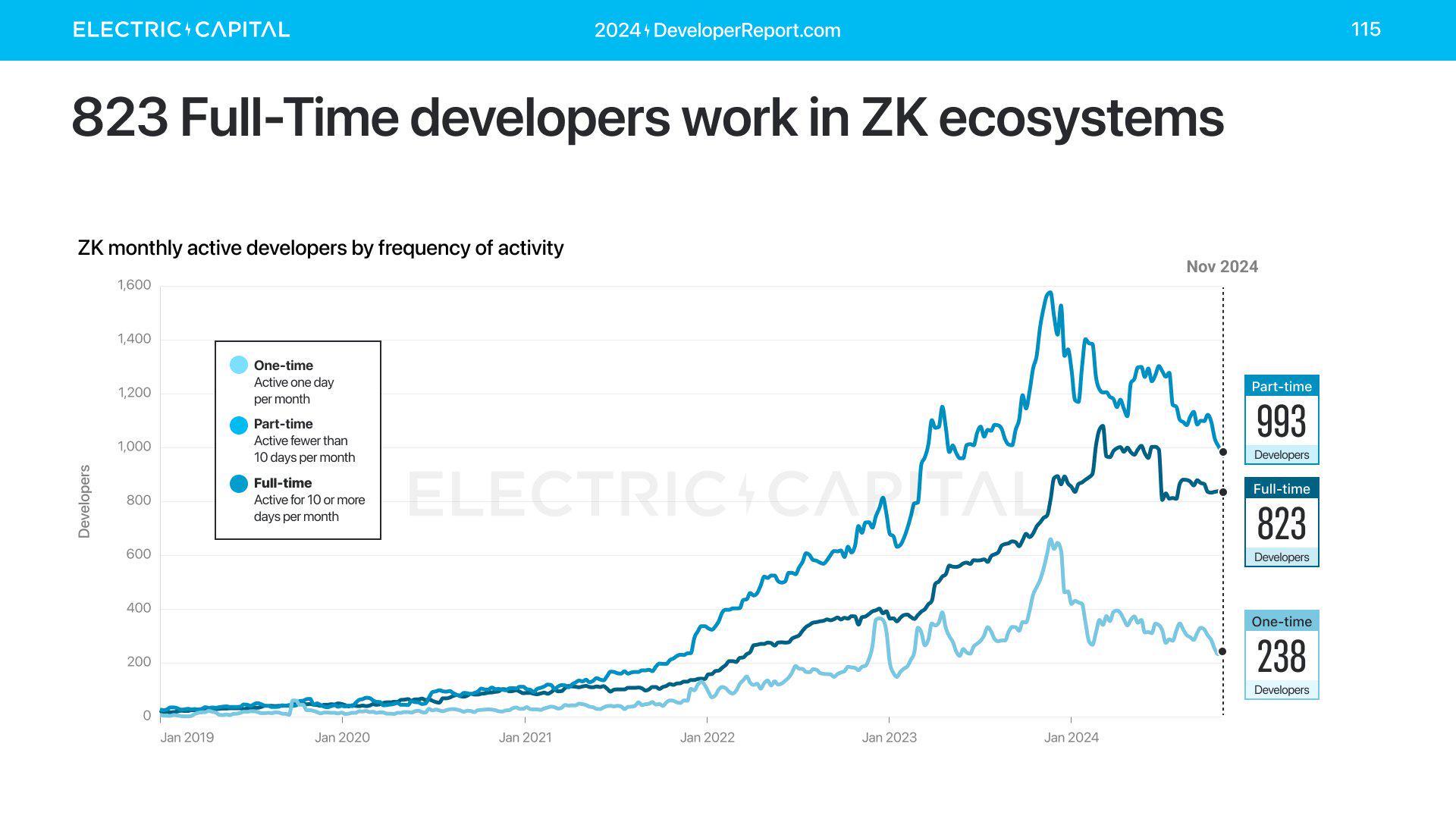

ZK is a developer-centric research area. There are over 2,000 active developers working on ZK each month. 823 of the monthly active developers are full-time, spending more than 10 days per month on it.

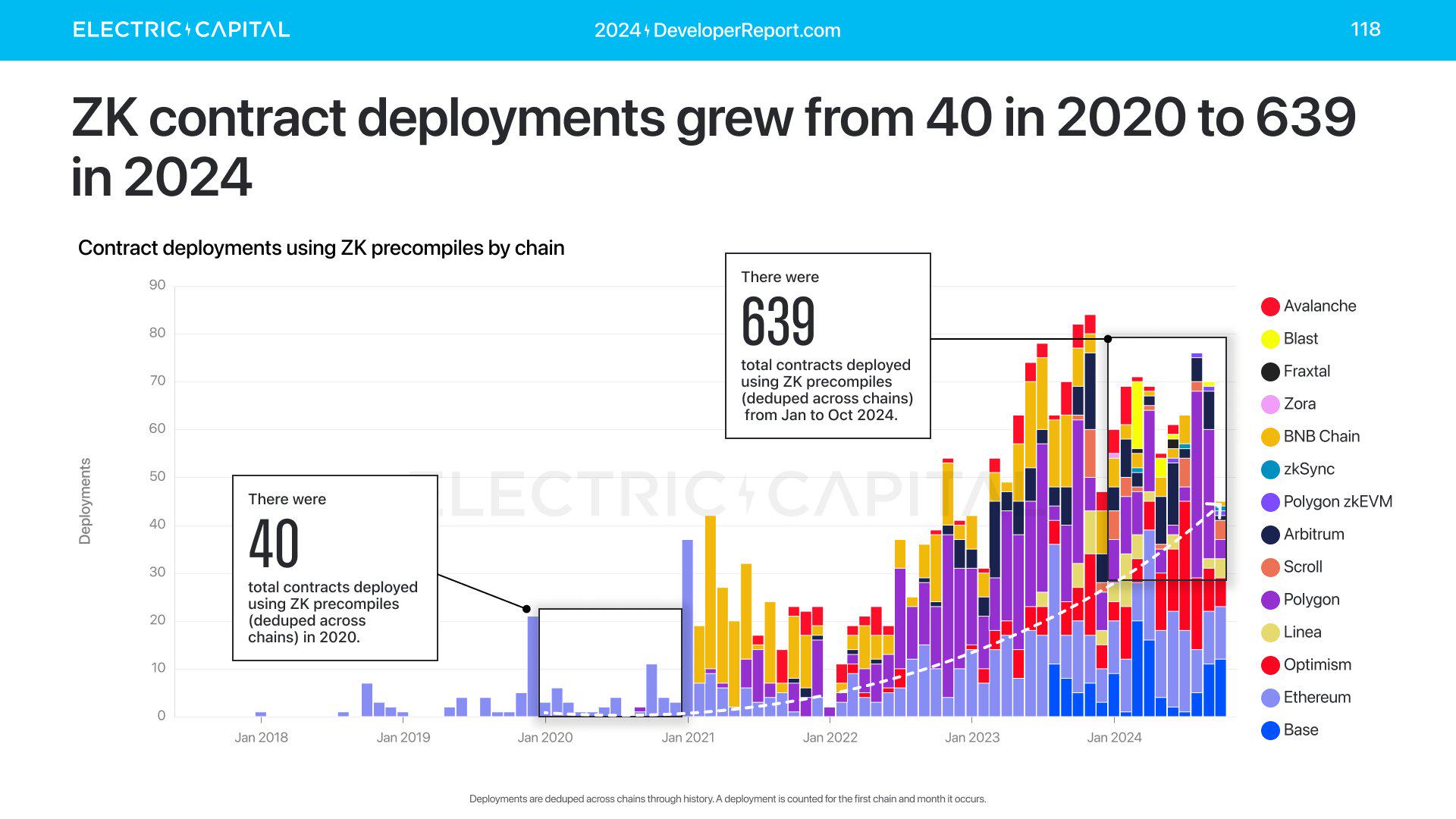

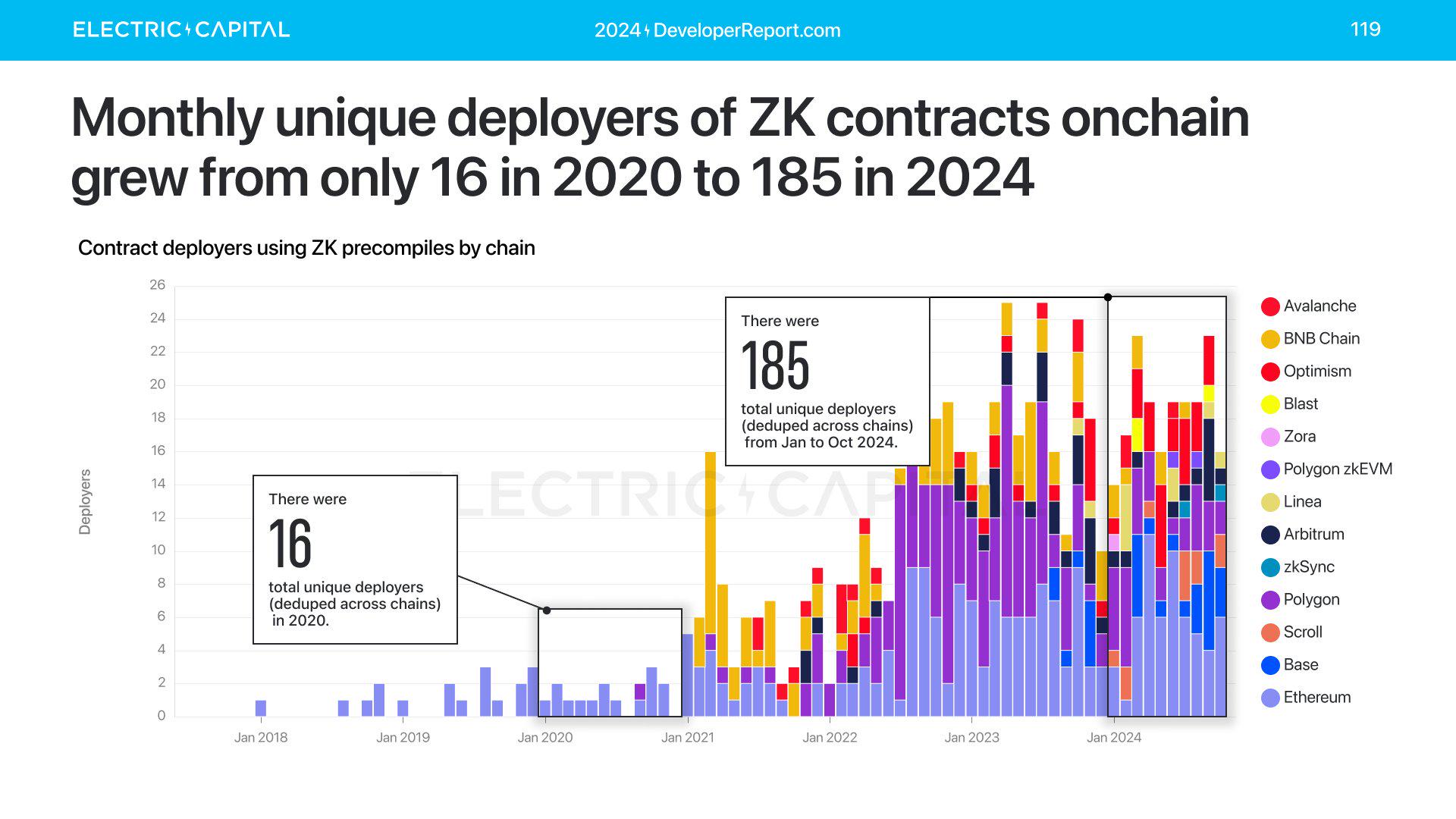

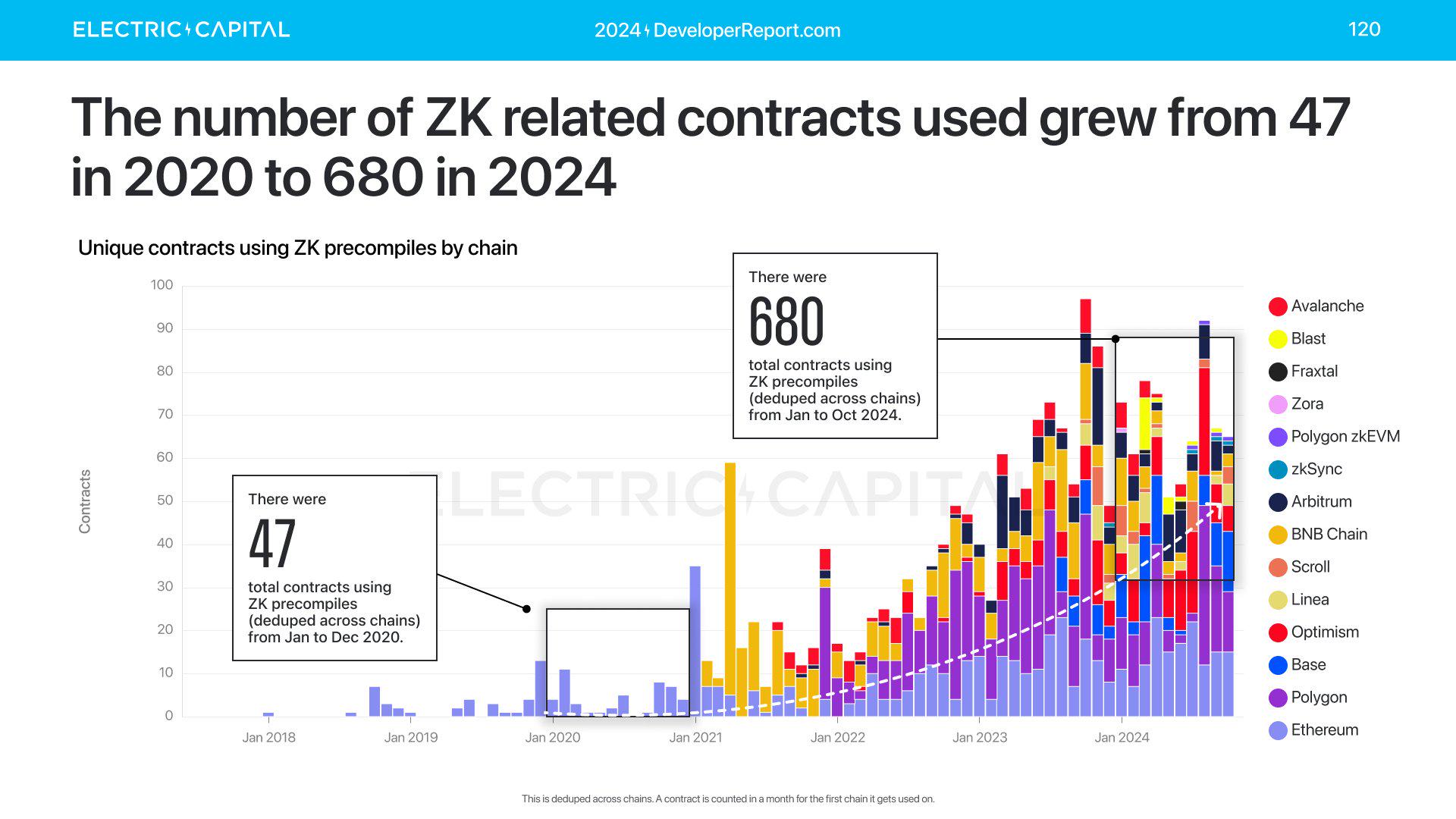

The number of ZK on-chain deployments has also increased from 40 in 2020 to 639 in 2024. The number is not large, but the growth is obvious. The number of deployers is also increasing.

ZK usage is also increasing, with the number of contracts precompiled using ZK growing from 47 in 2020 to 680 this year.

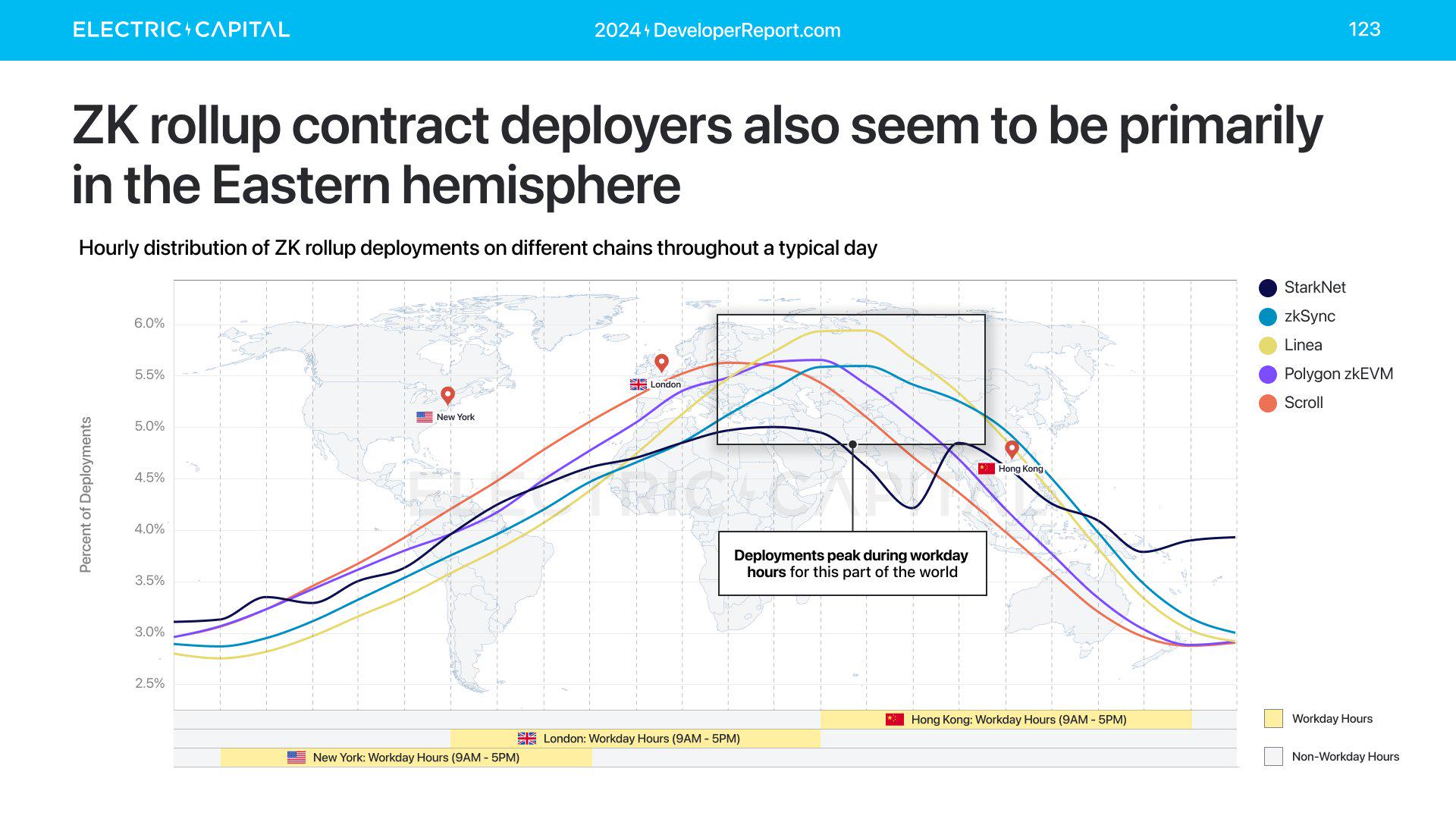

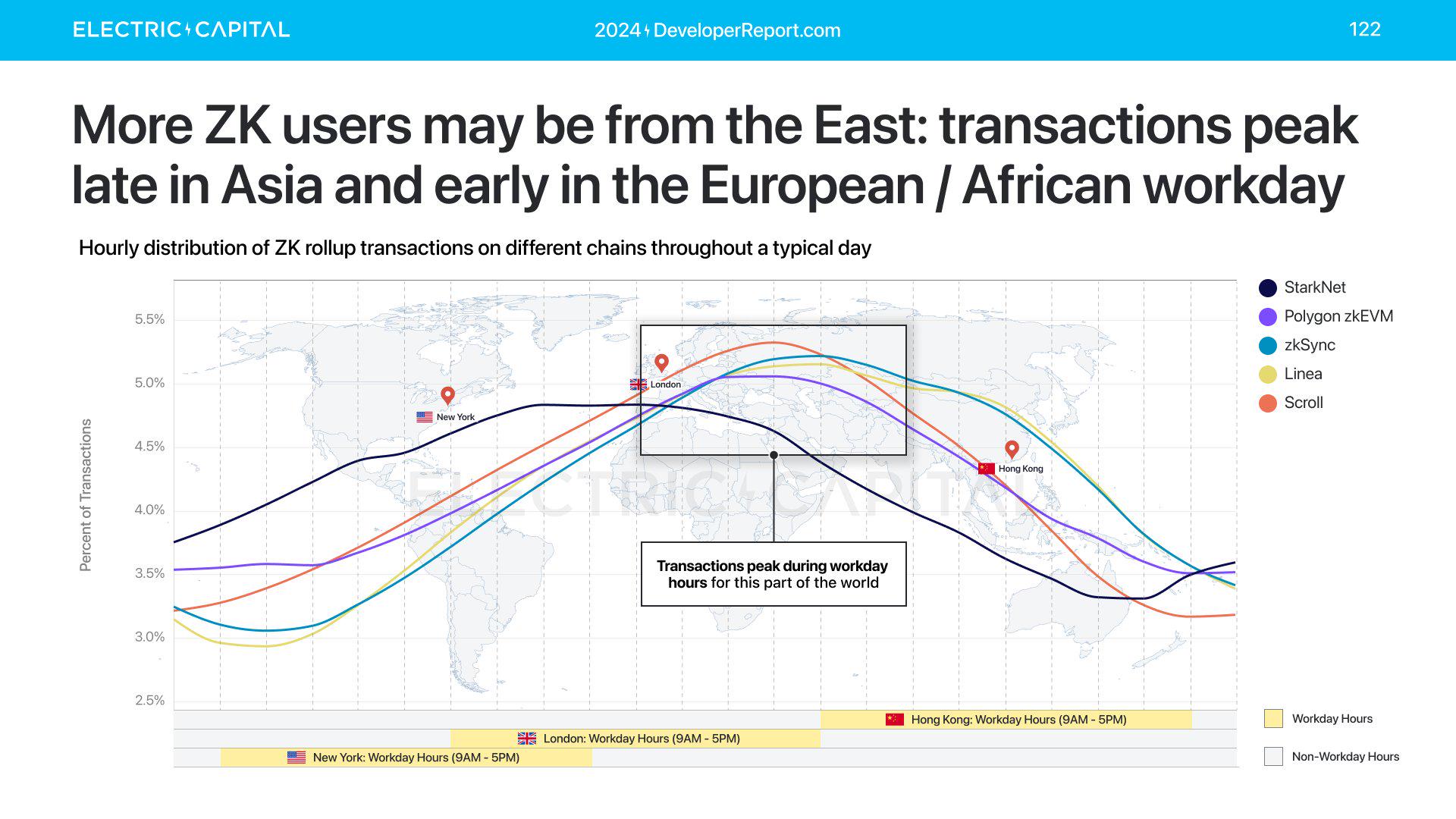

ZK rollup contract deployers are active during Eastern Hemisphere business hours. The same is true for ZK users. ZK users and deployers appear to be concentrated in Eastern Europe, Africa, and Asia in the Eastern Hemisphere.

NFT

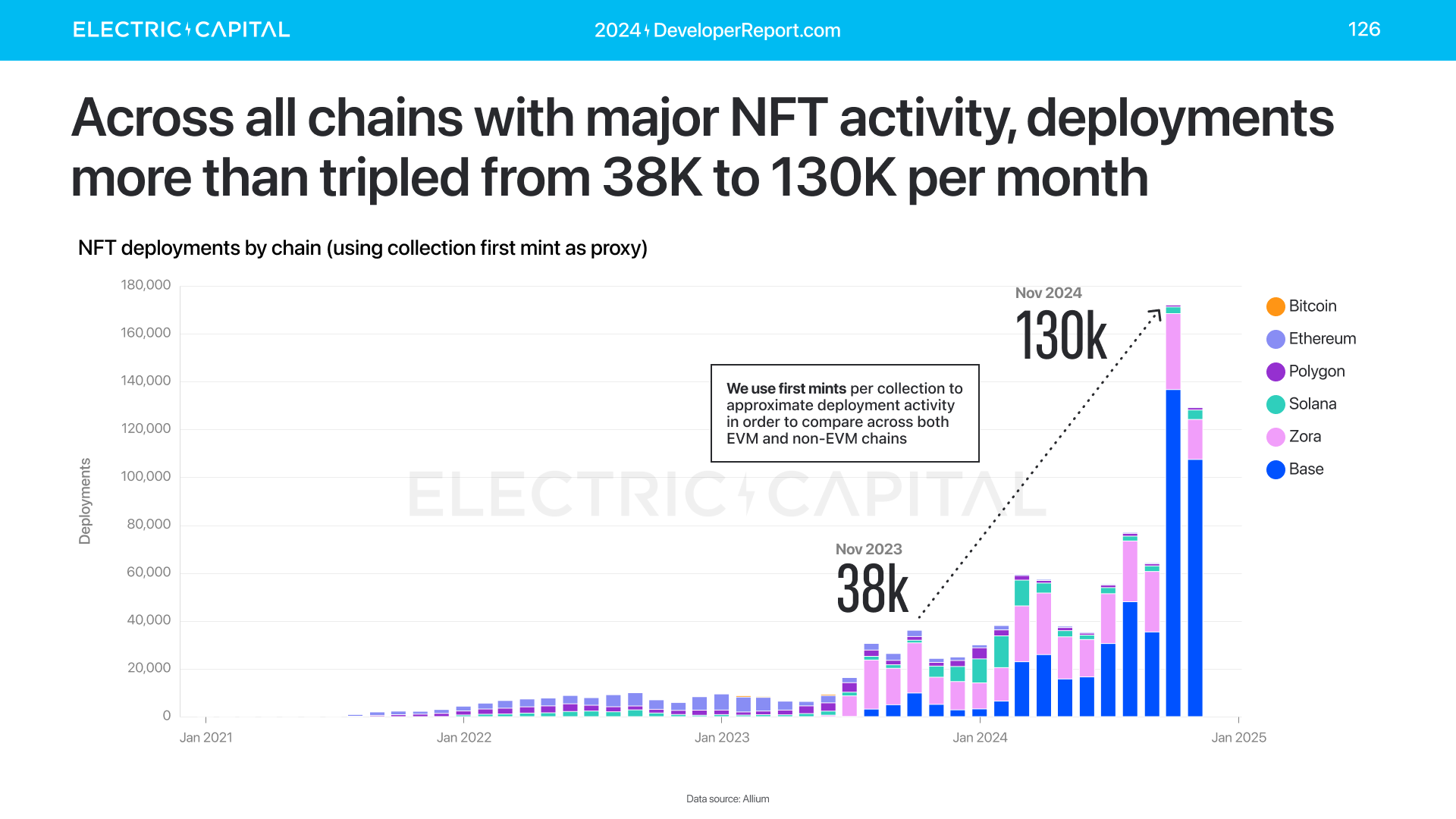

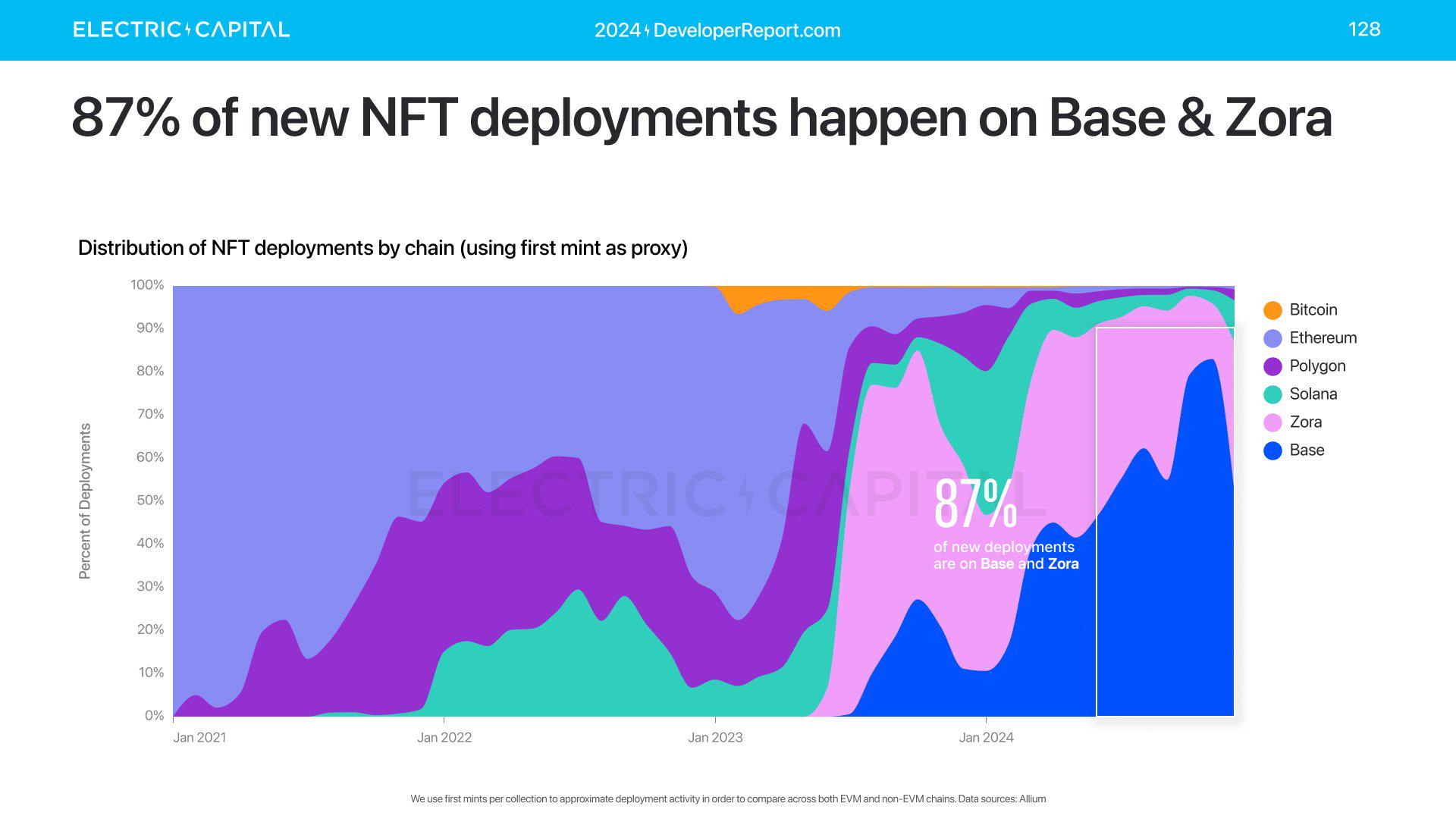

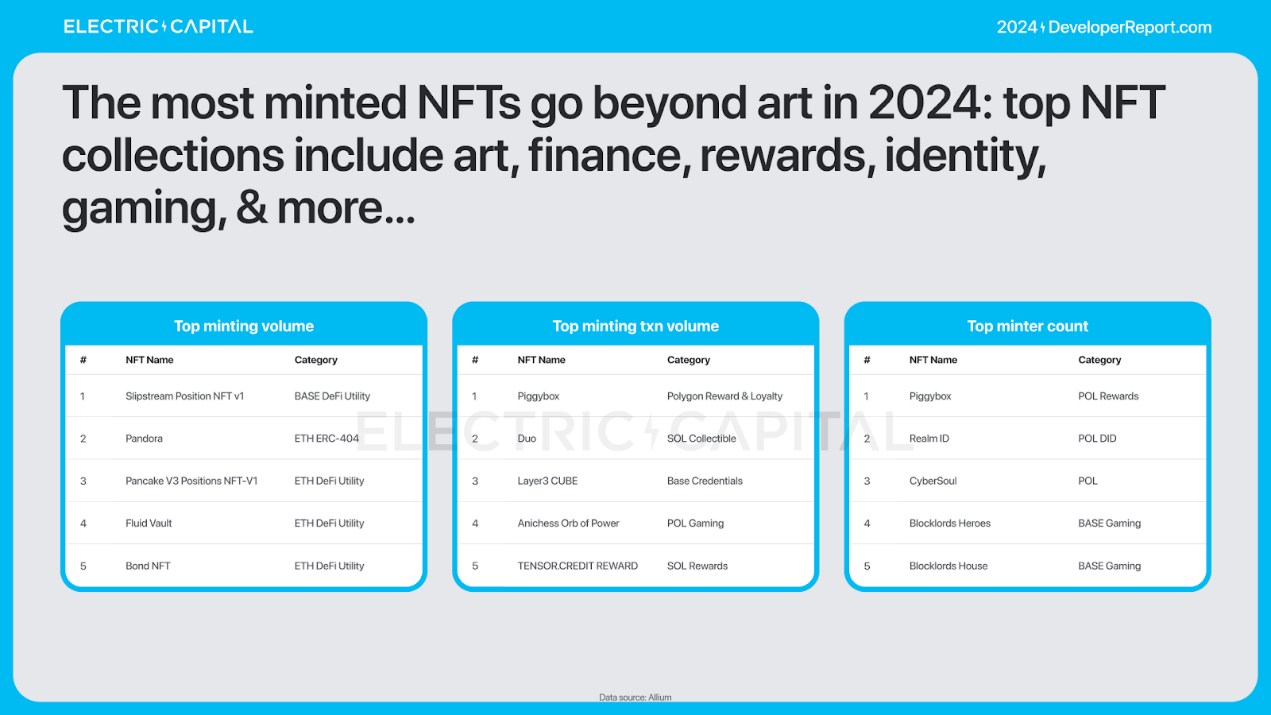

Across all chains with NFT activity (Bitcoin, Ethereum, Polygon, Solana, Zora, Base), NFT deployers grew more than 3x year-over-year. NFT deployers hit an all-time high. 87% of new deployers occurred on Base and Zora.

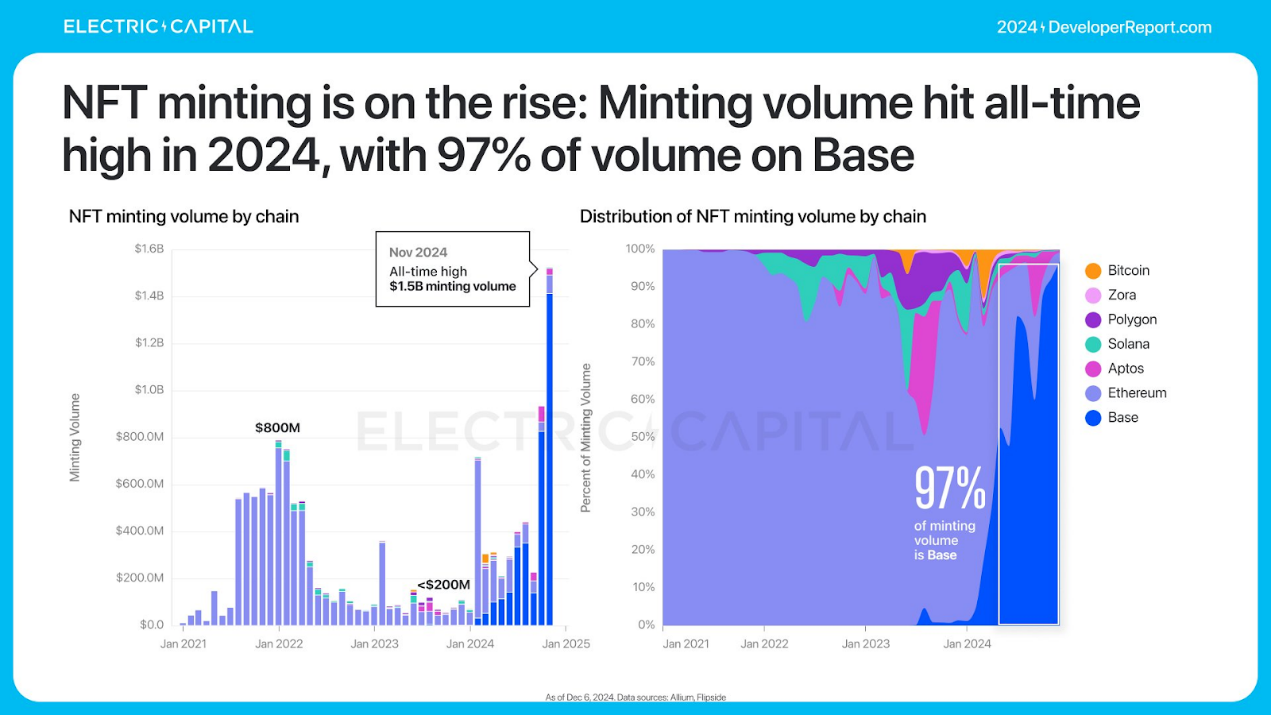

NFT activity has clearly shifted towards minting activity.

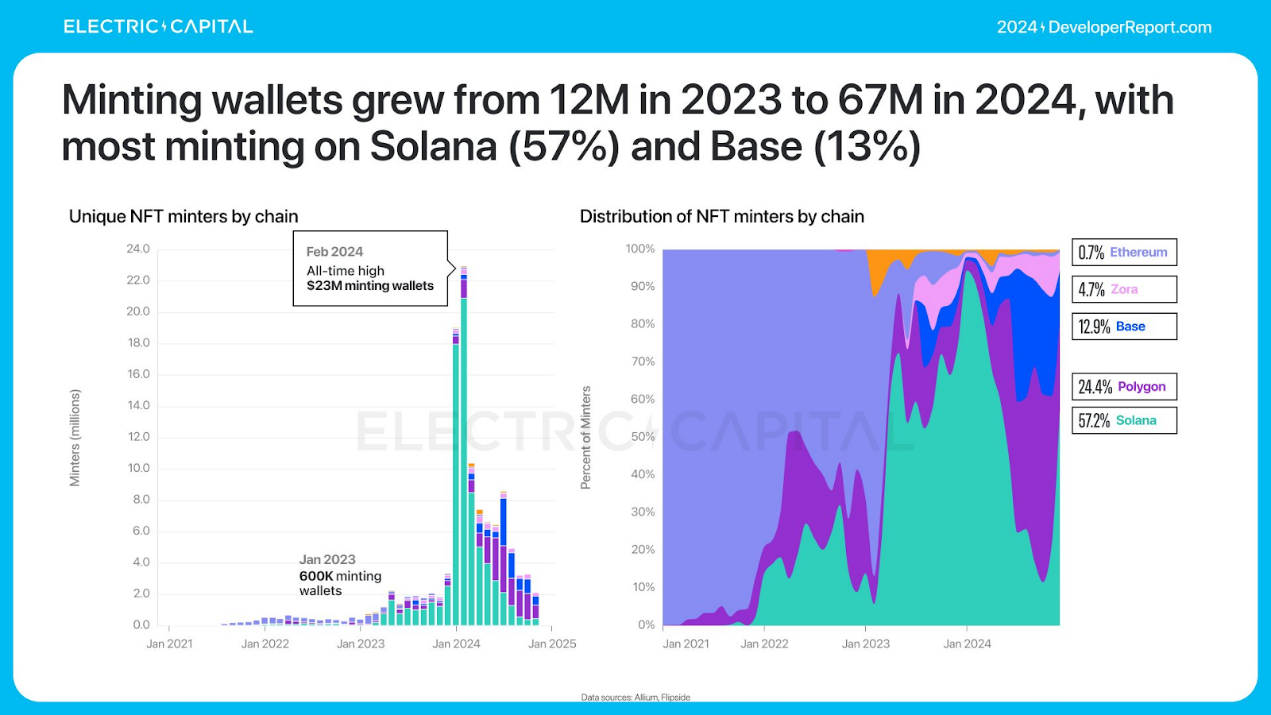

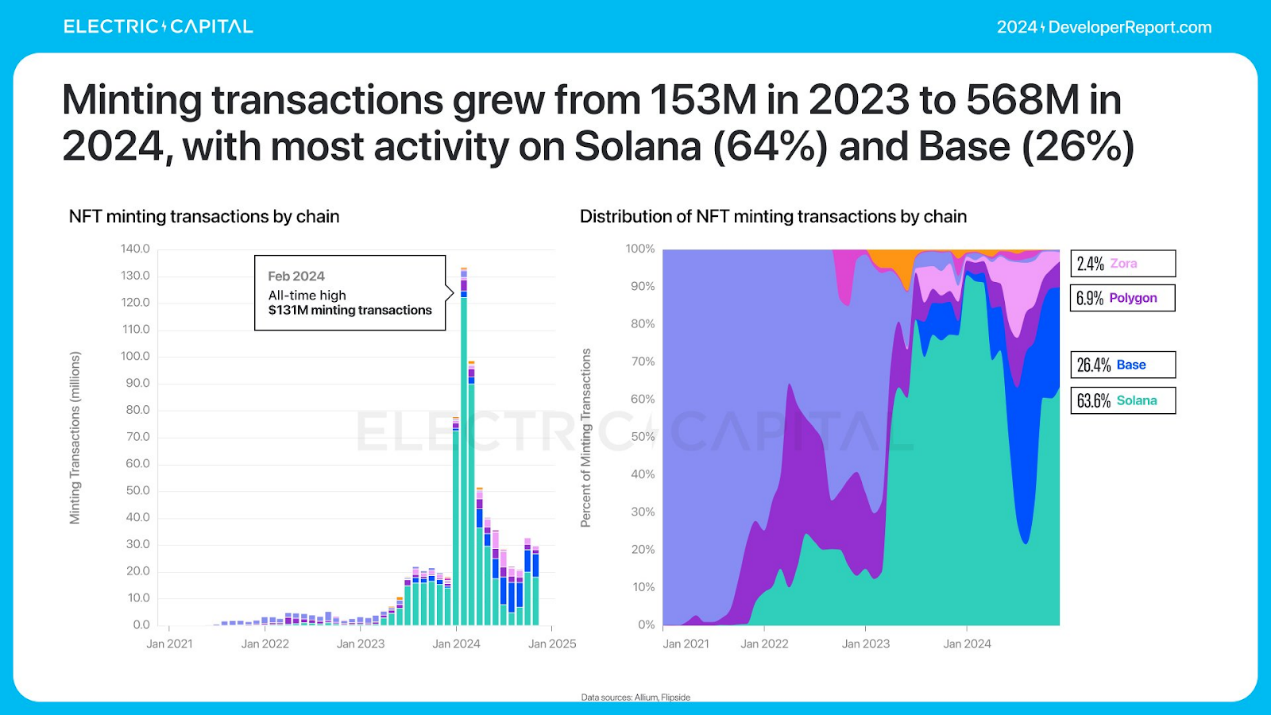

NFT minting hit a new high in 2024, with 97% of it happening on Base. Solana has 57% of minting wallets and accounts for 64% of minting transactions. As NFTs far exceed the scope of art in 2024, minting activity has increased.

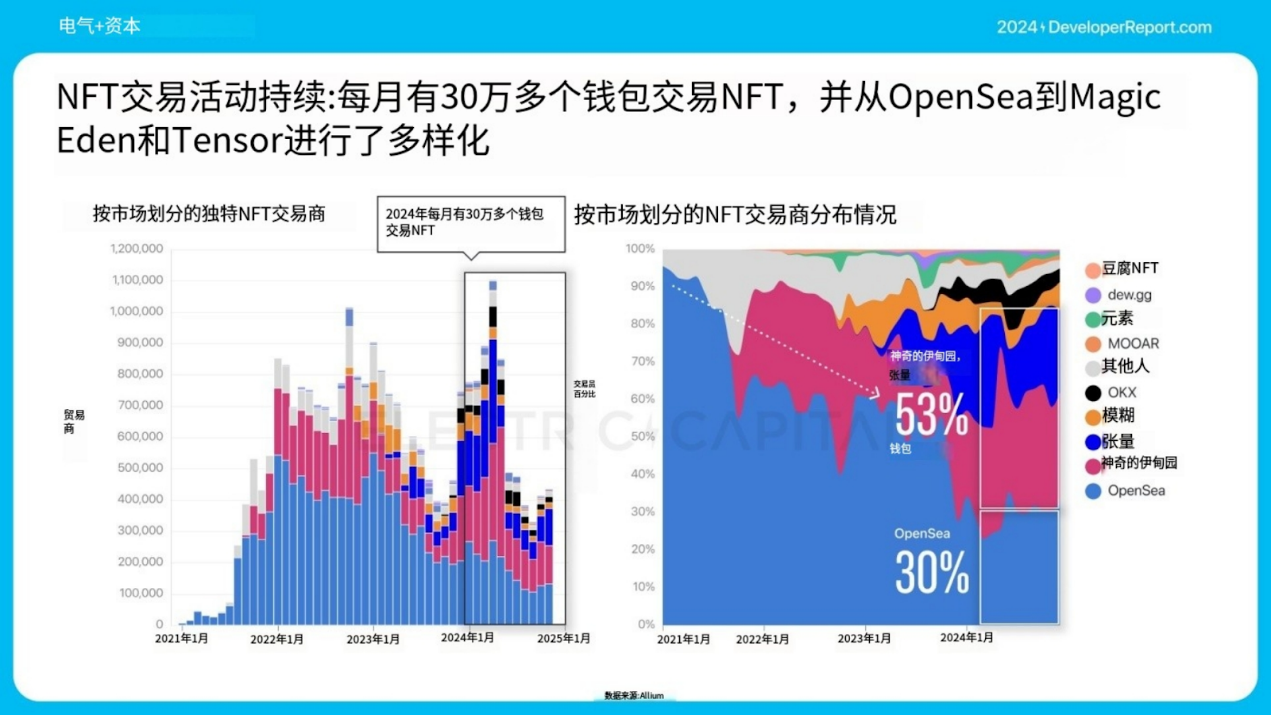

NFT trading remains an important area and has diversified from OpenSea to Magic Eden and Tensor.

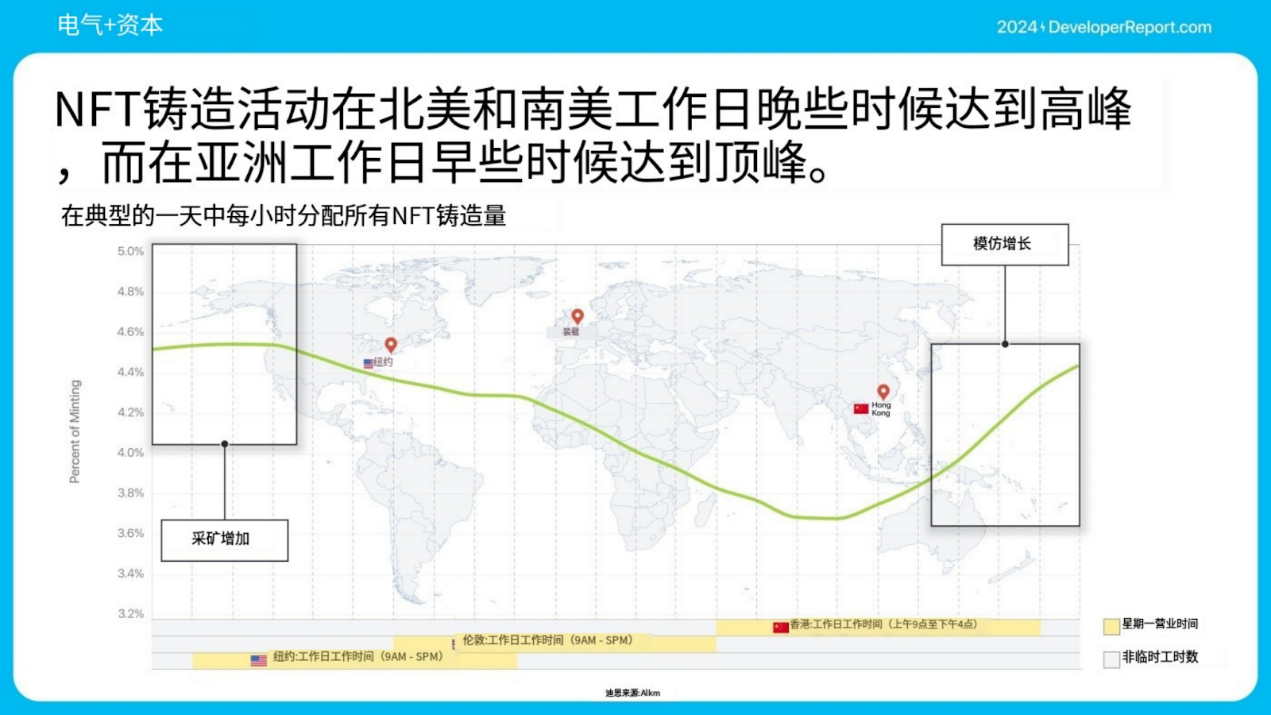

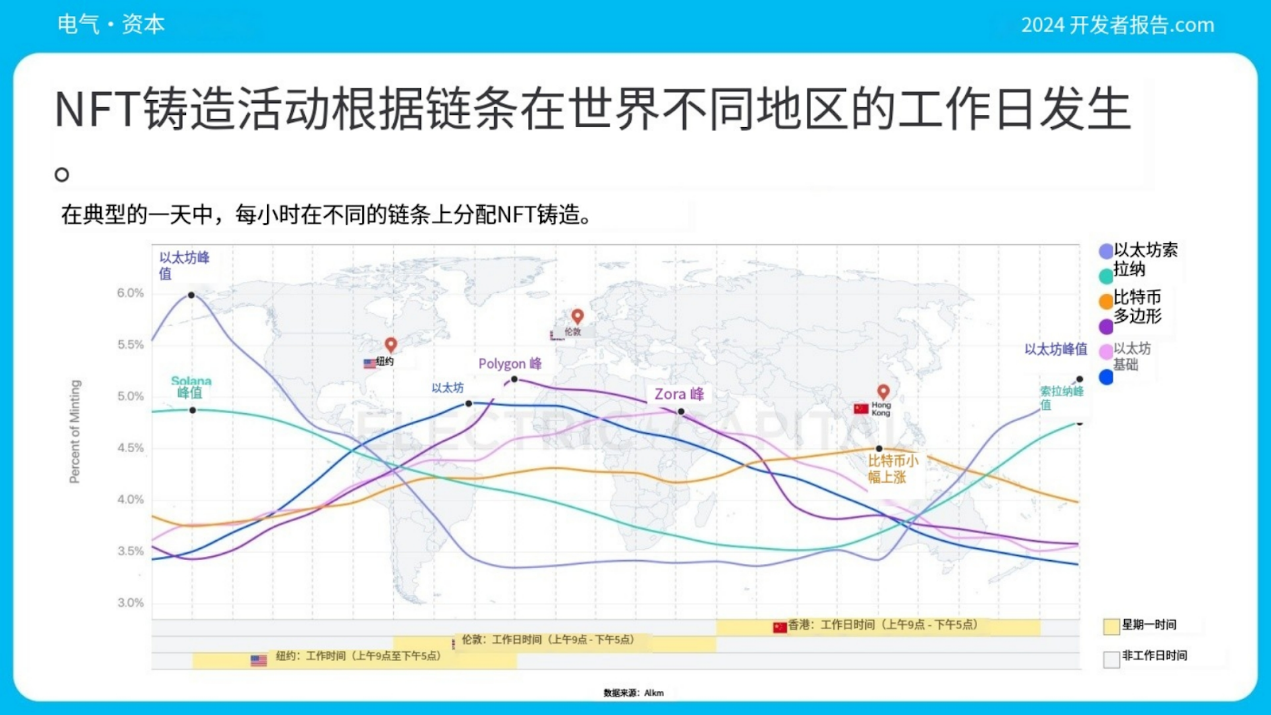

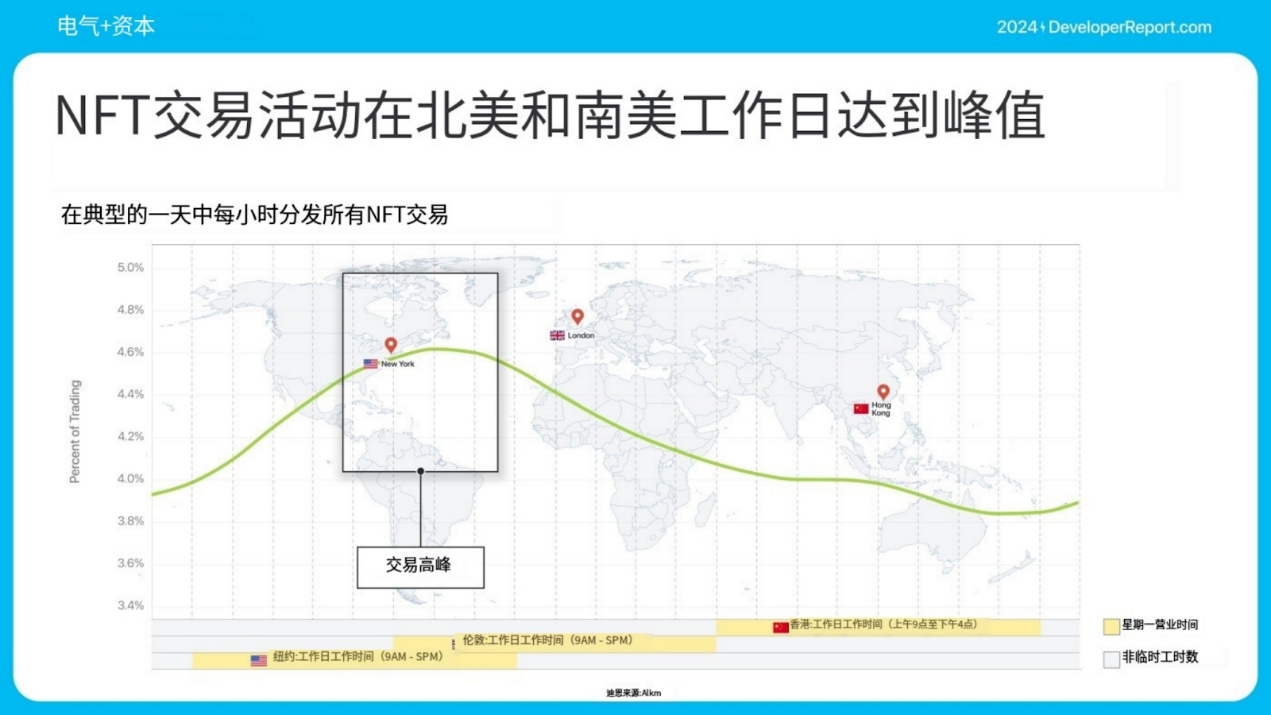

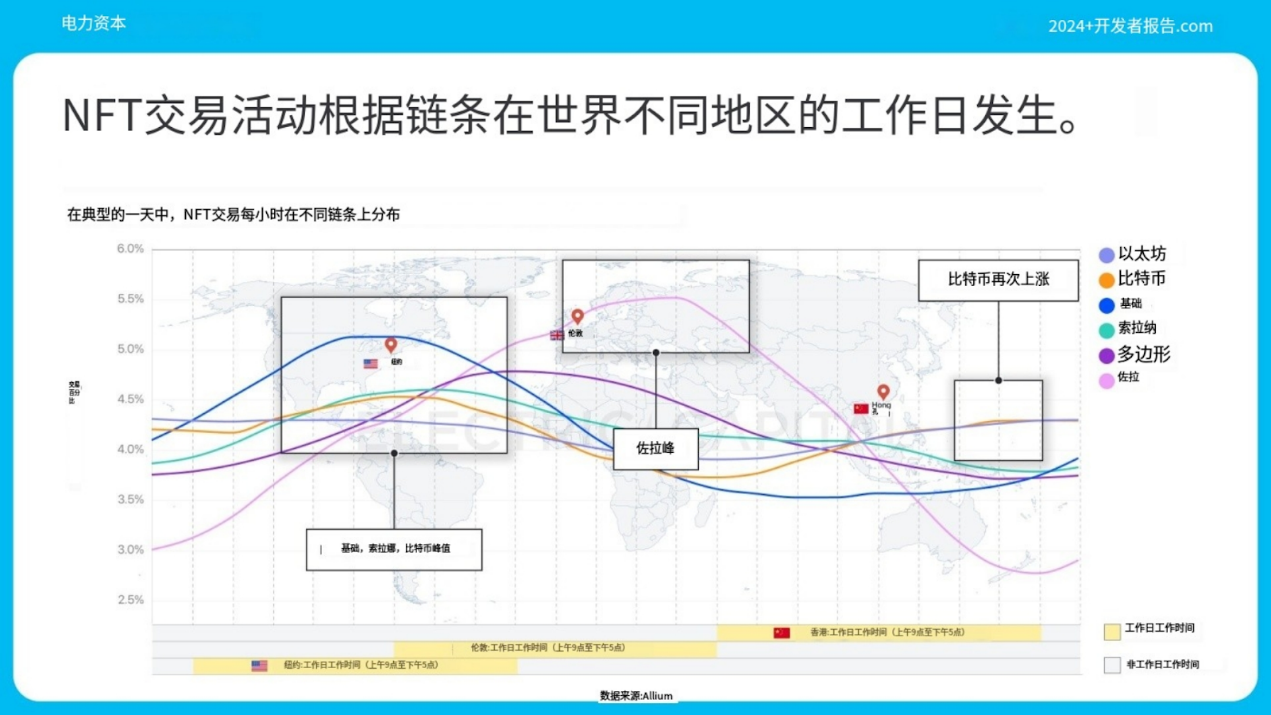

NFT minting and trading volumes peaked in different regions, indicating different user bases.

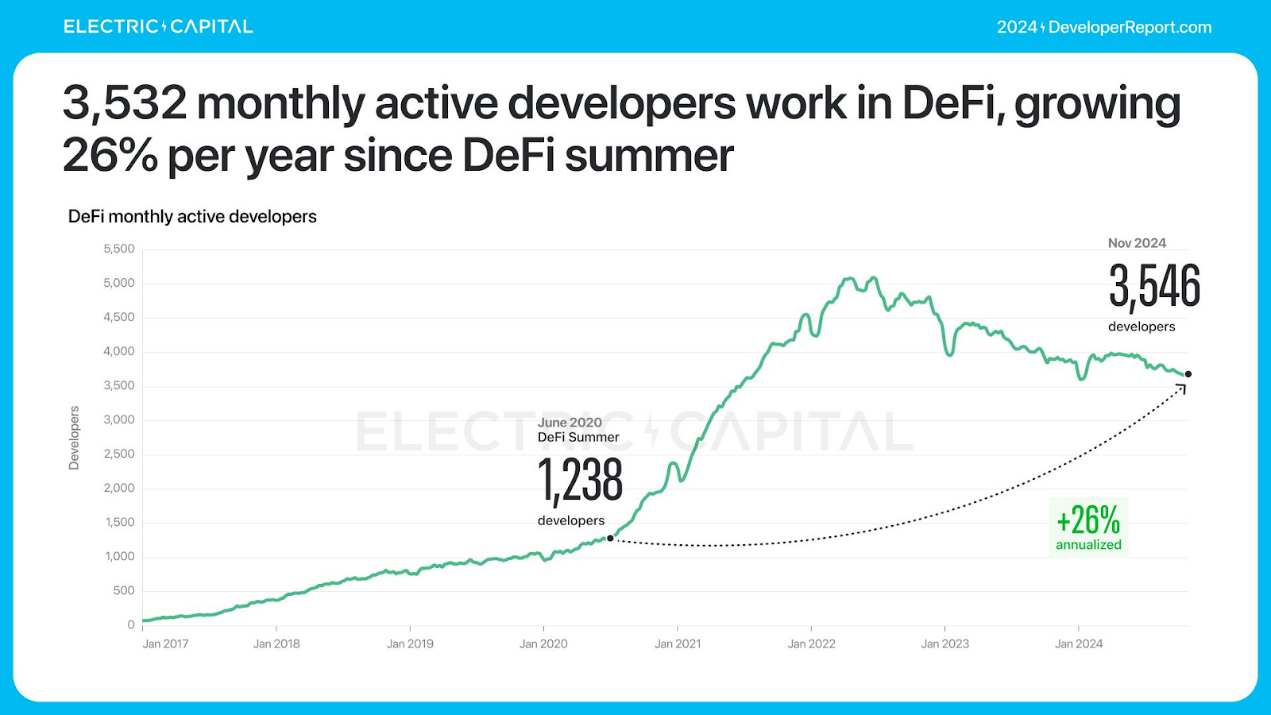

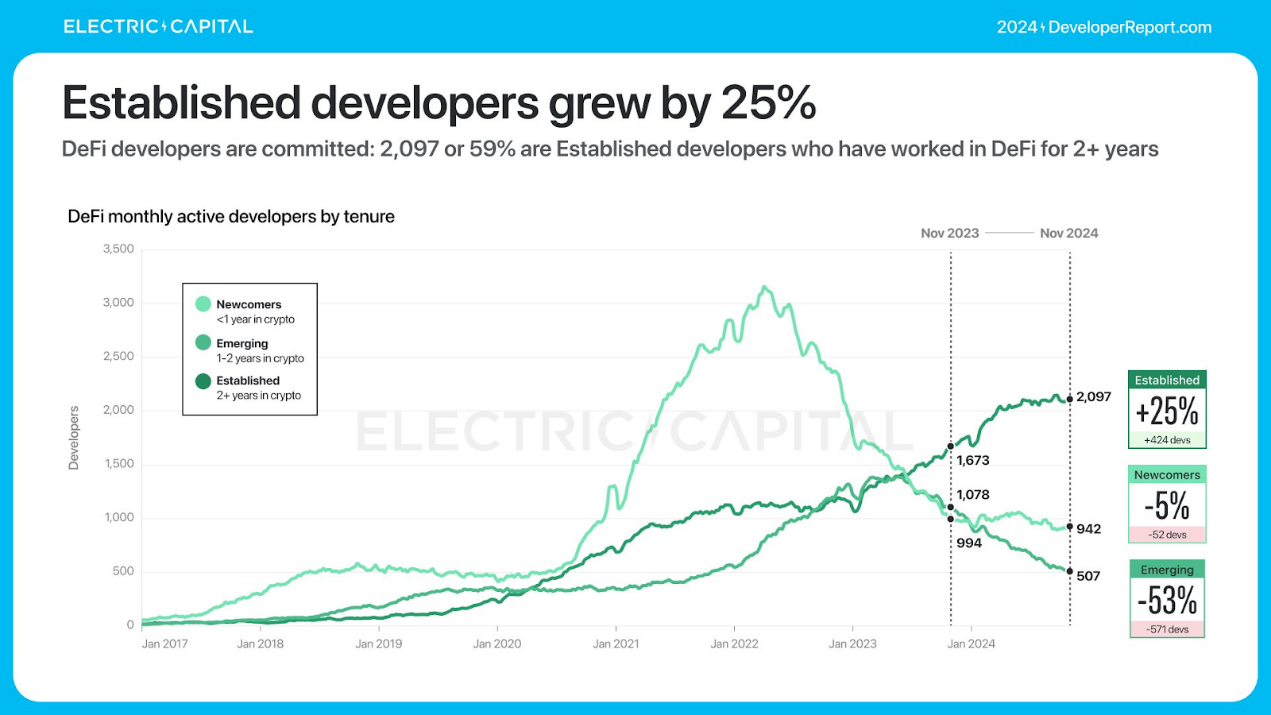

DeFi

There are 3,532 active developers developing on DeFi every month. DeFi developers are experienced, and 2,097 (59%) have been working on DeFi for more than 2 years. 53% of DeFi developers work on Ethereum and its L2.

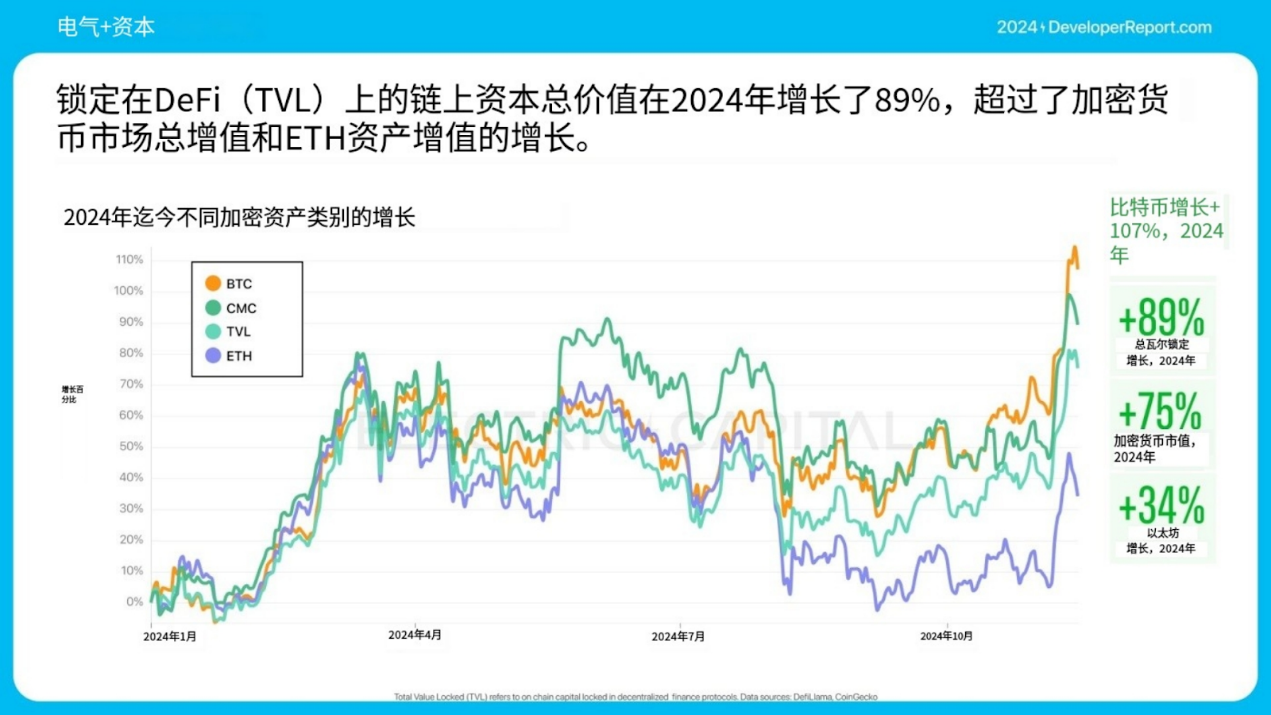

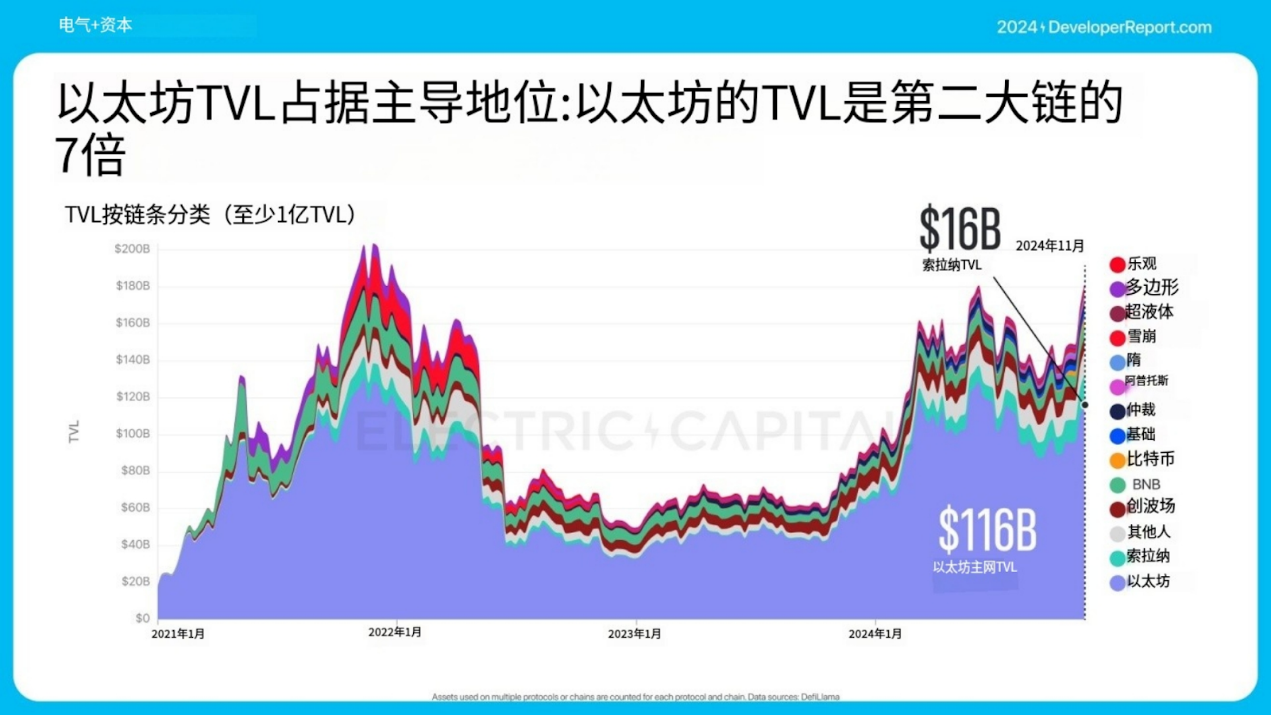

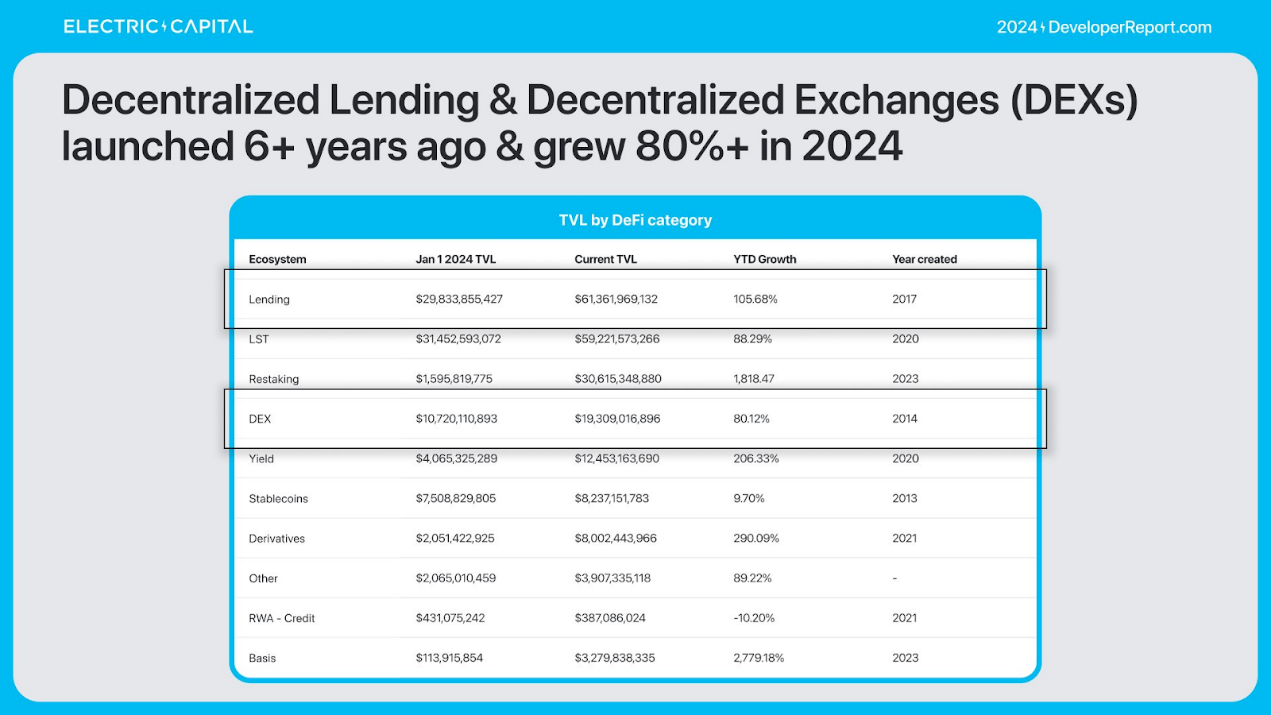

DeFi TVL grew 89% in 2024. Ethereum TVL dominated, 7x the next largest chain. Most TVL has always been on Ethereum.

Non-Ethereum TVL increased from 3% to 36% in 3 years, with Solana seeing the largest increase in TVL share.

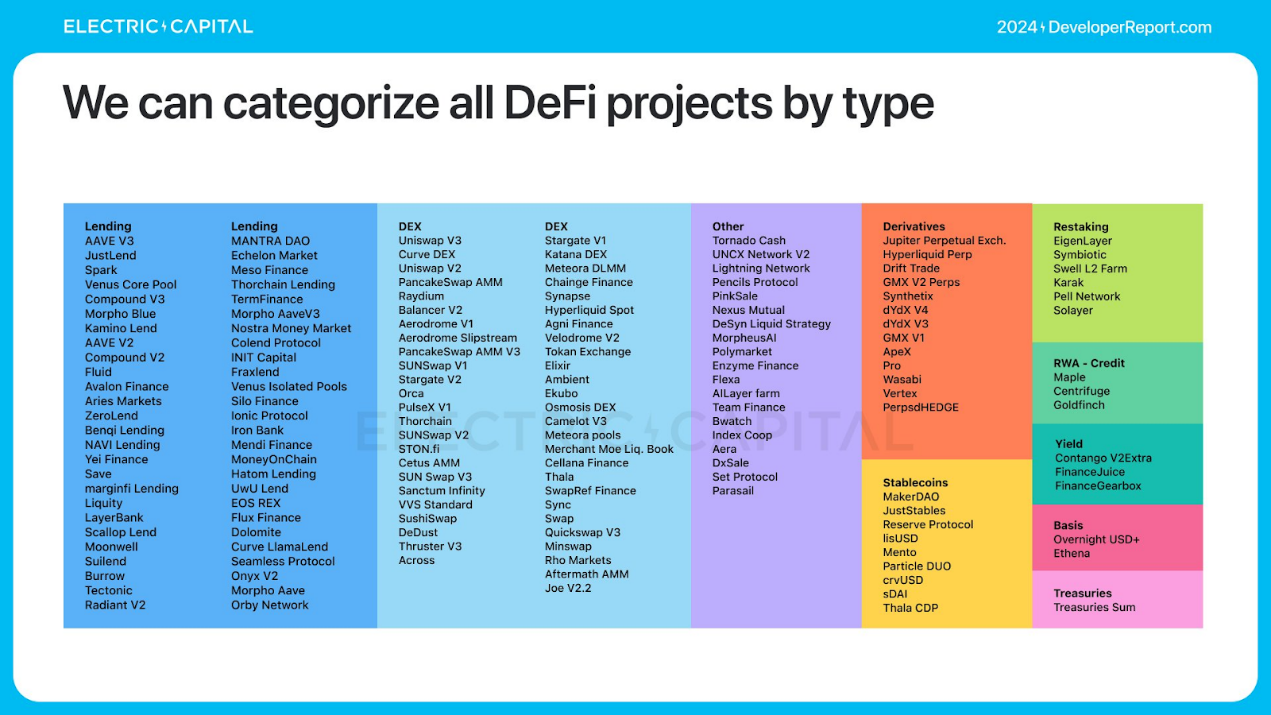

What drives TVL growth? DeFi developers can be categorized by type.

Last year, TVL of re-staking grew by $29 billion. LRT grew to over 3.5 million ETH. 46% of LRT is actively used in DeFi. Most LRT is deposited in money markets, yield, interest rate derivatives, and bridges.

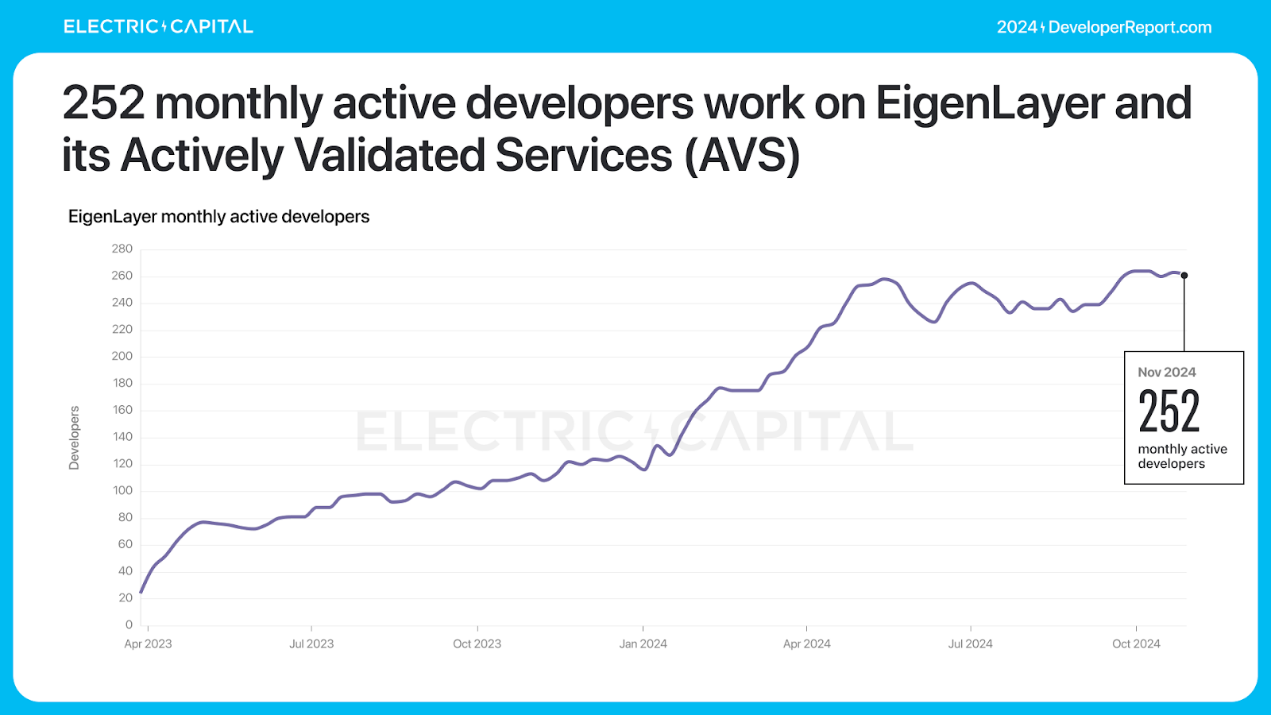

EigenLayer has contributed to the birth of the LRT industry. Eigenlayer ecosystem developers have performed as follows:

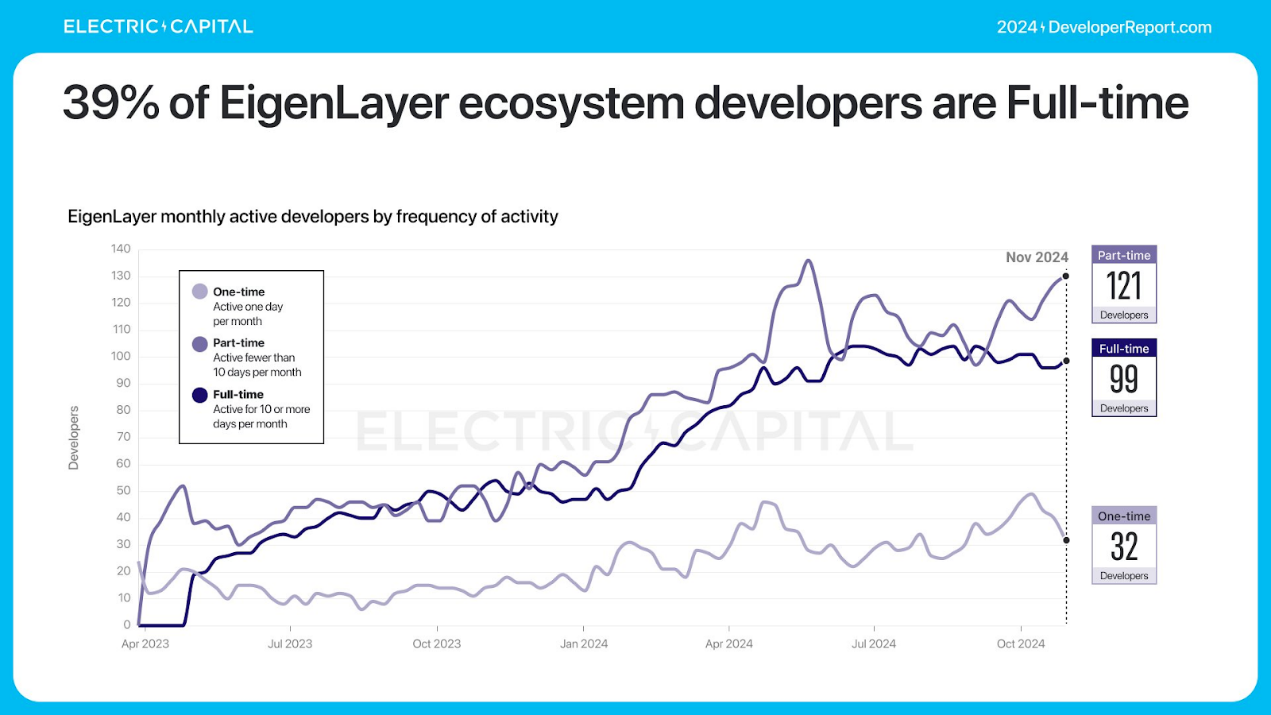

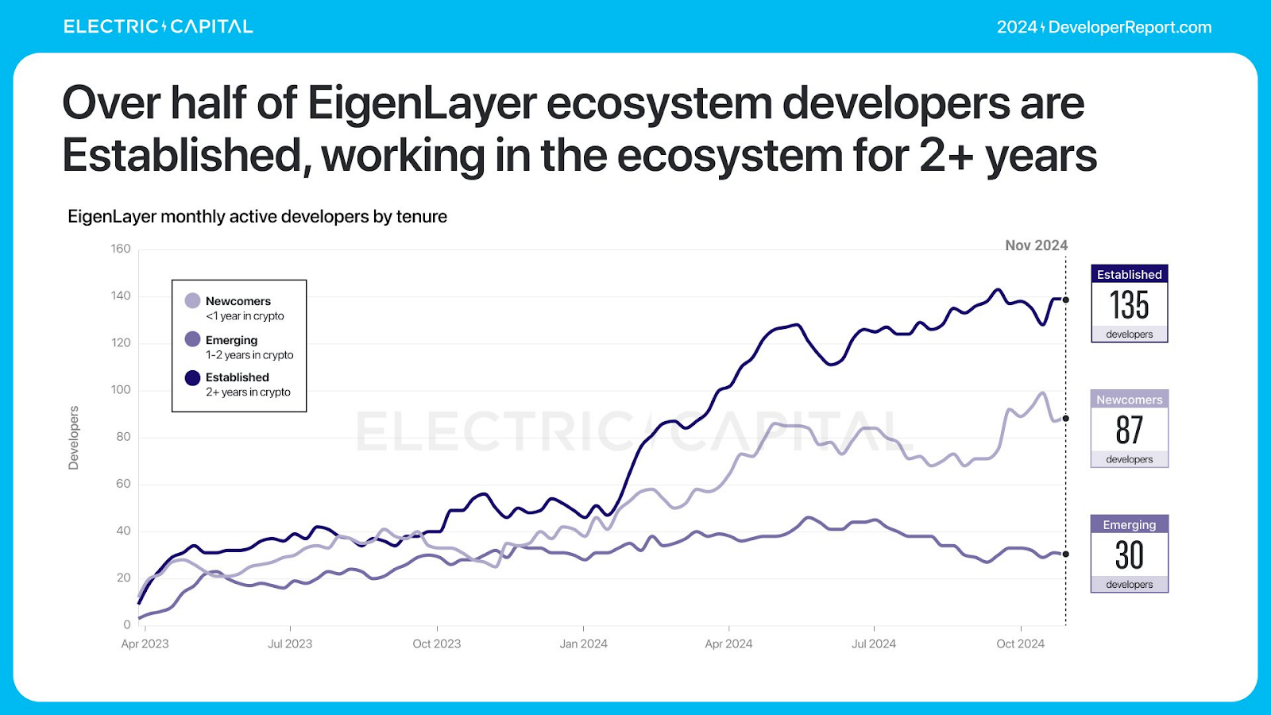

There are 252 active developers per month in the EigenLayer ecosystem. EigenLayer developers are very dedicated: 39% are full-time developers, and more than half of the developers have worked in the ecosystem for more than 2 years.

DEX

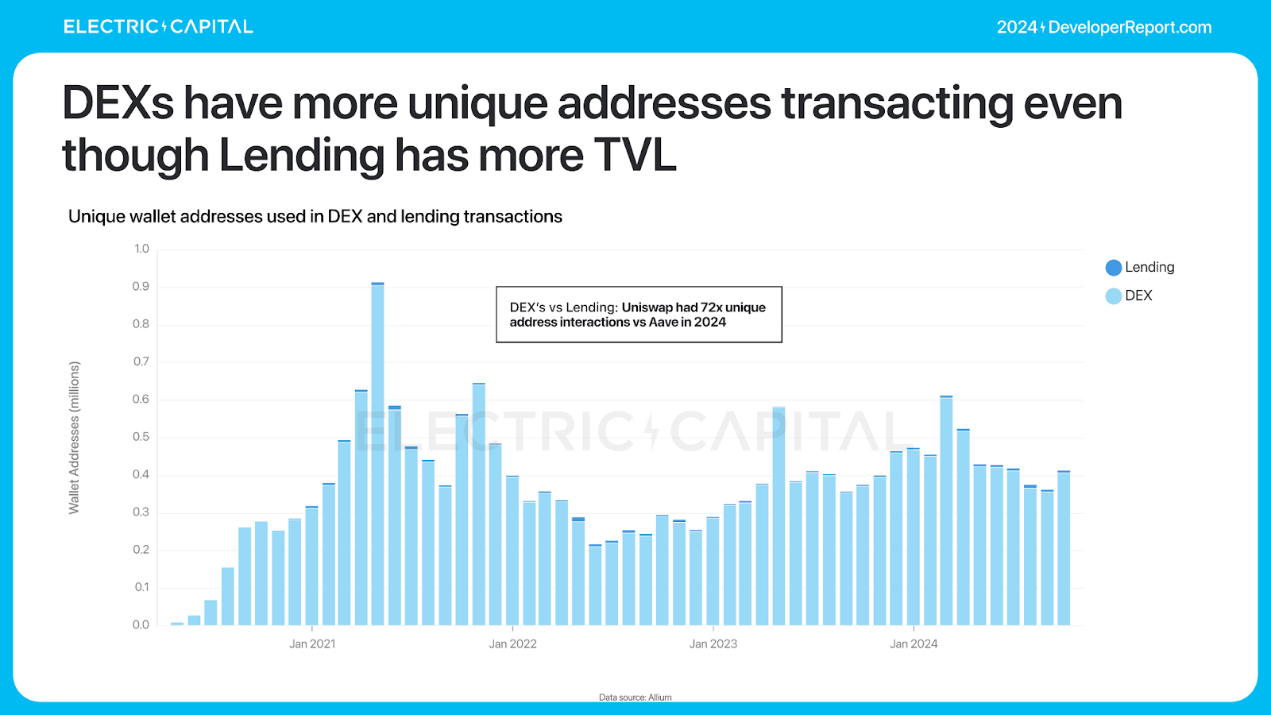

TVL is not the only metric to understand DeFi usage. Despite having 3x more TVL for lending, DEXs have more unique addresses for trading.

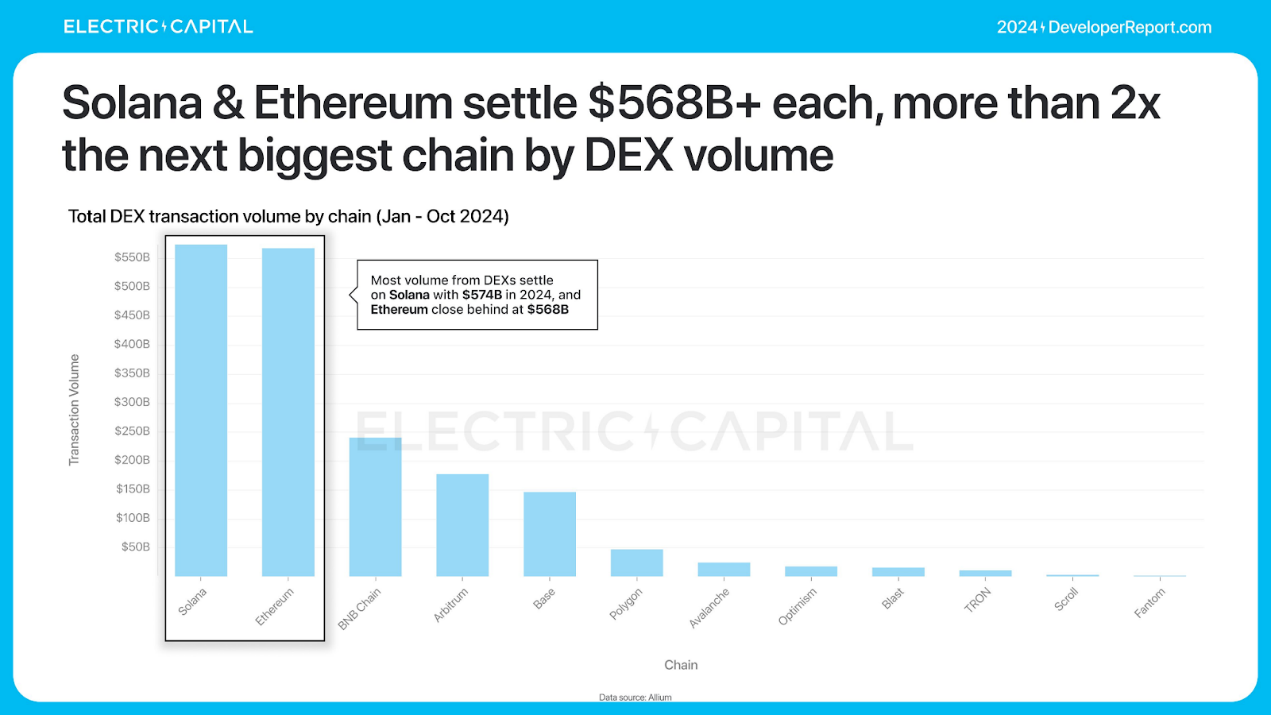

DEX volume nearly doubles to $209 billion per month in 2024. Solana and Ethereum have the largest settlement volumes, more than 2x the next largest blockchain in DEX volume.

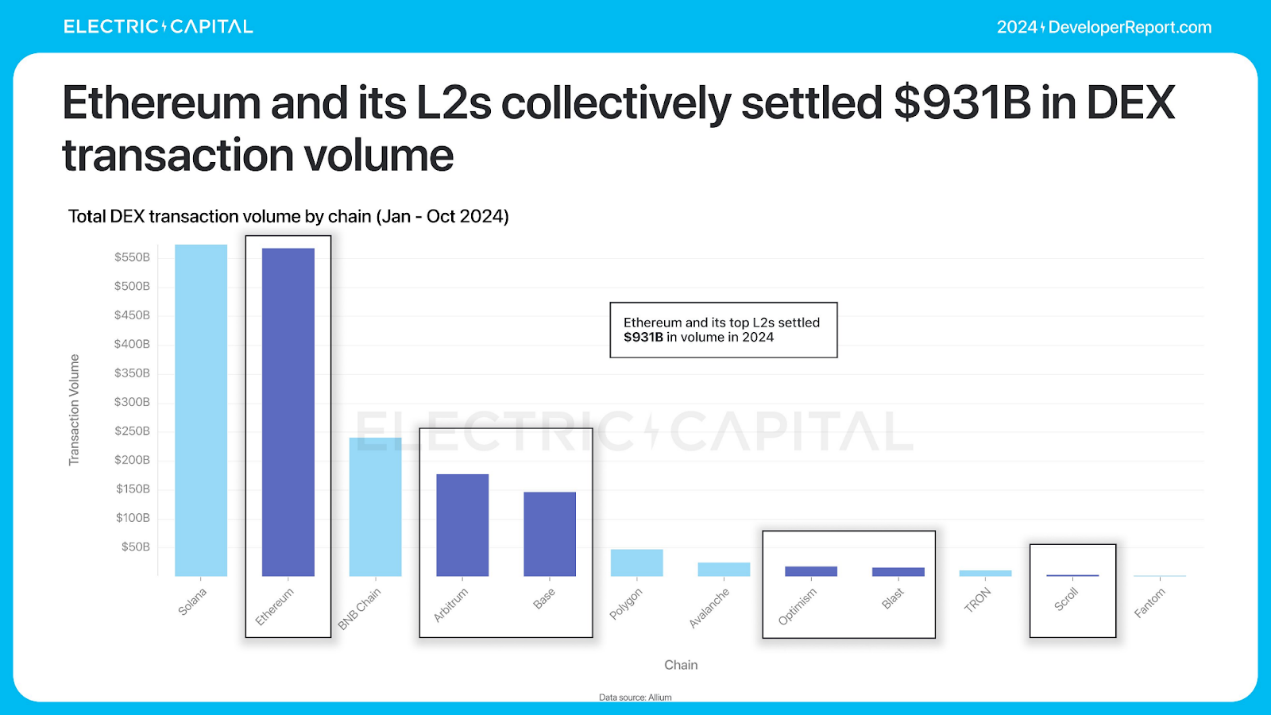

Solana will settle the highest volume at $574 billion in 2024. Ethereum mainnet and its L2 will settle a total of $931 billion in DEX volume.

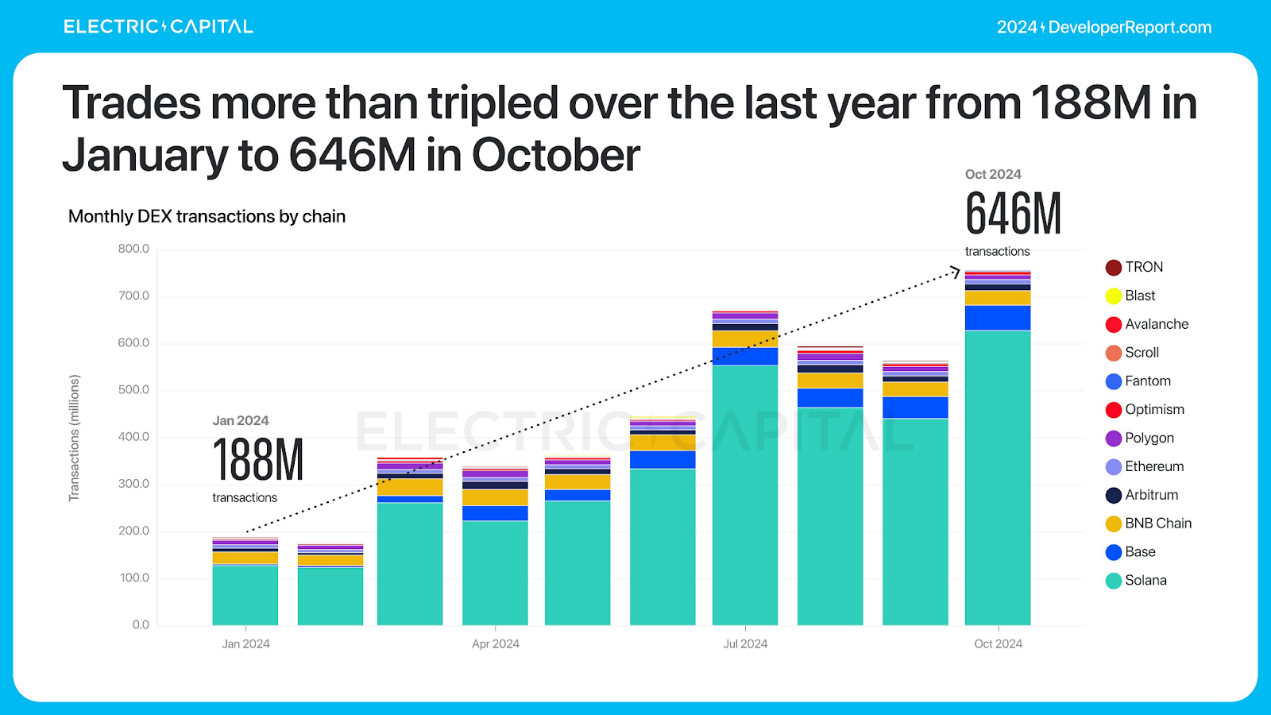

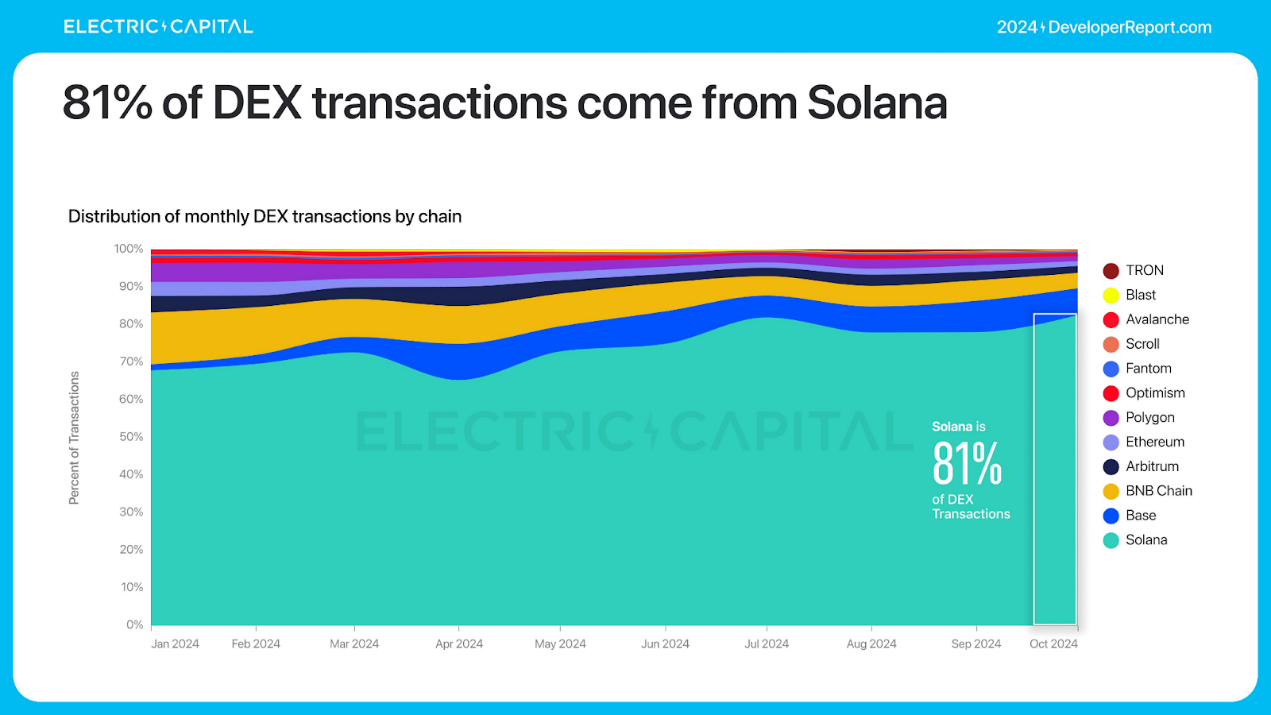

Solana dominates the low-fee DEX use case. Transaction volume more than tripled in 2024, reaching 646 million transactions per month. 81% of DEX transactions come from Solana.

DEX can be used to understand the usage of DeFi because financial activities often start or end with DEX.

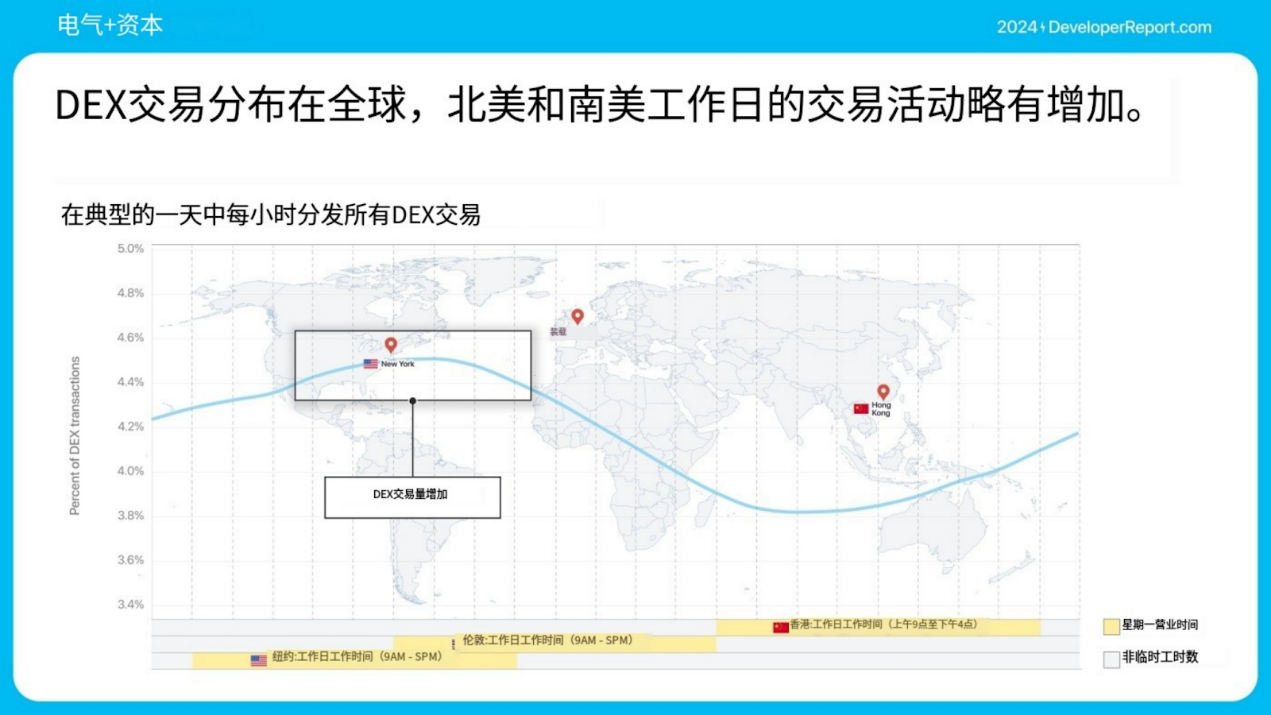

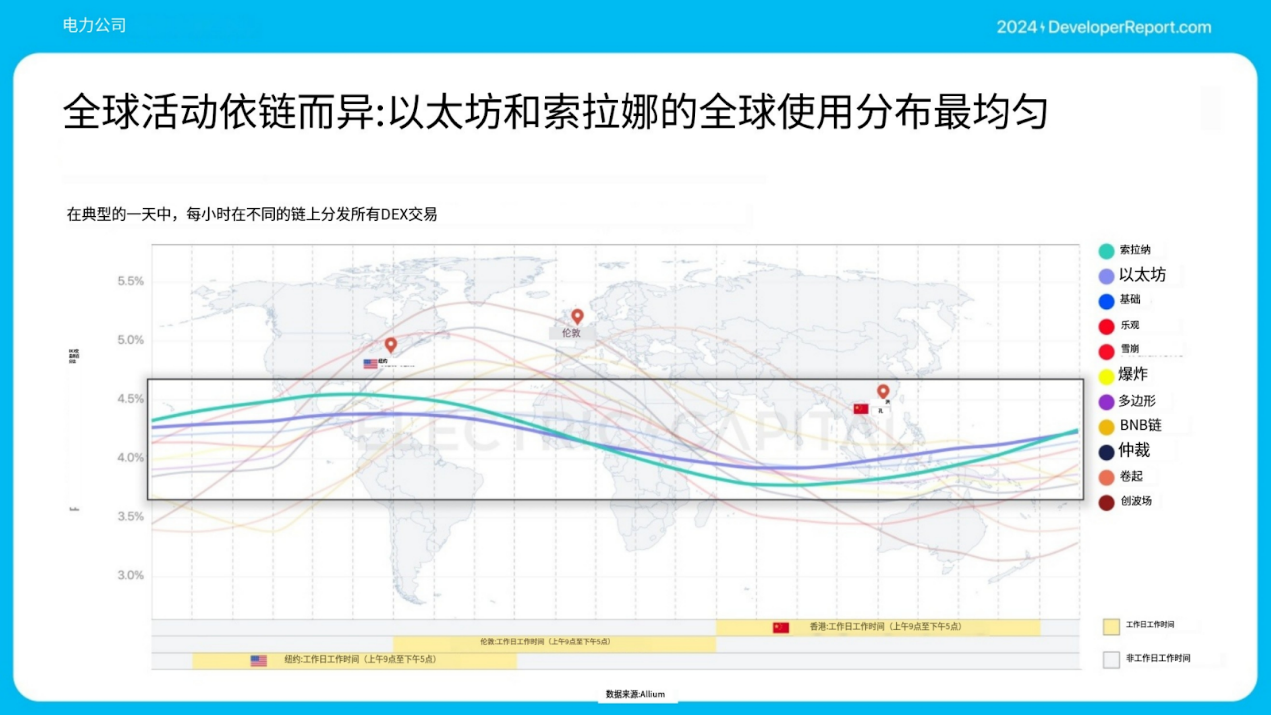

Global activity varies by chain, with the flatter the activity, the more widespread the usage. Ethereum and Solana have the most evenly distributed usage.

Stablecoins

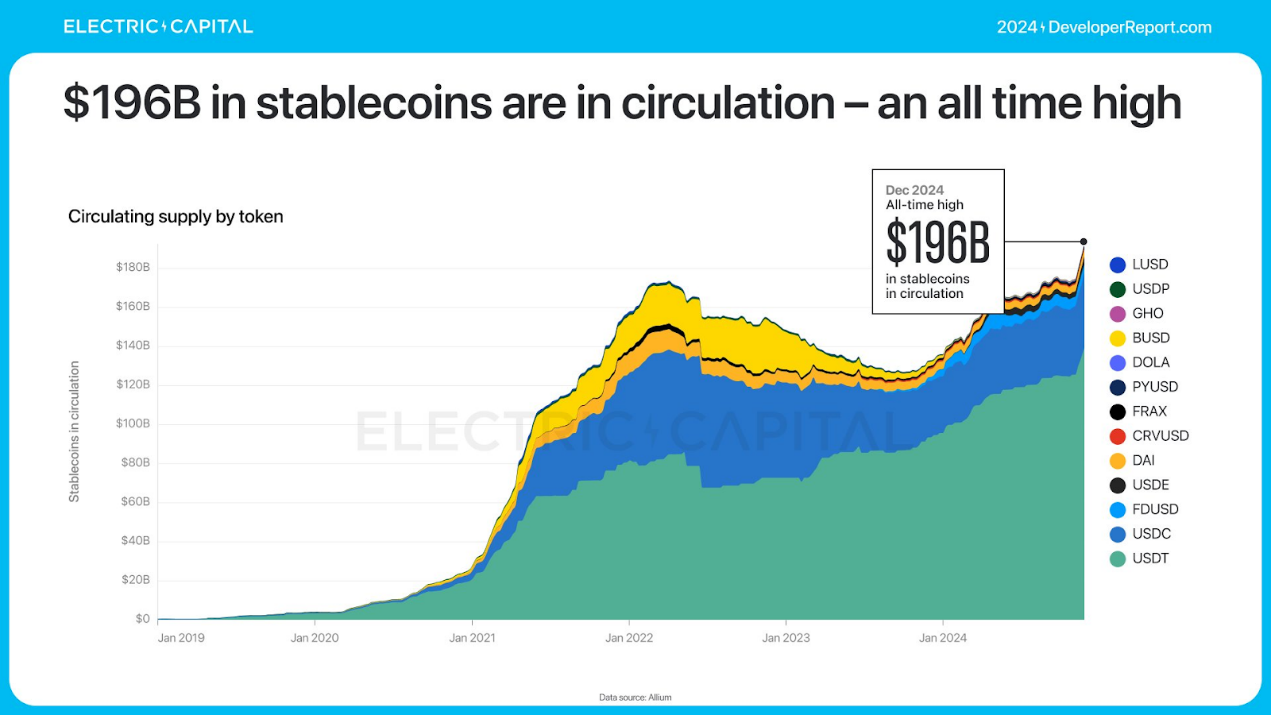

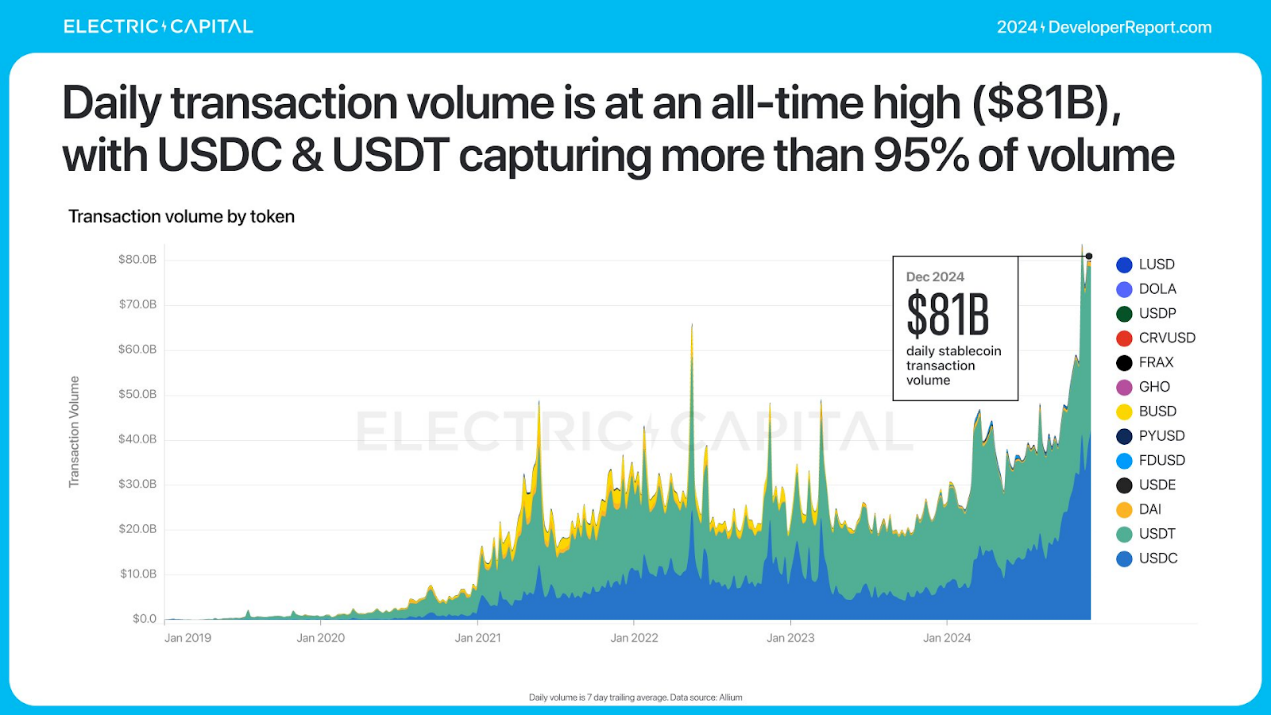

Stablecoins are one of the largest use cases for cryptocurrencies worldwide. Stablecoin usage is at an all-time high: $196 billion worth of stablecoins in circulation and $81 billion in daily trading volume, both of which are all-time highs for stablecoins. USDC and USDT account for 95% of trading volume.

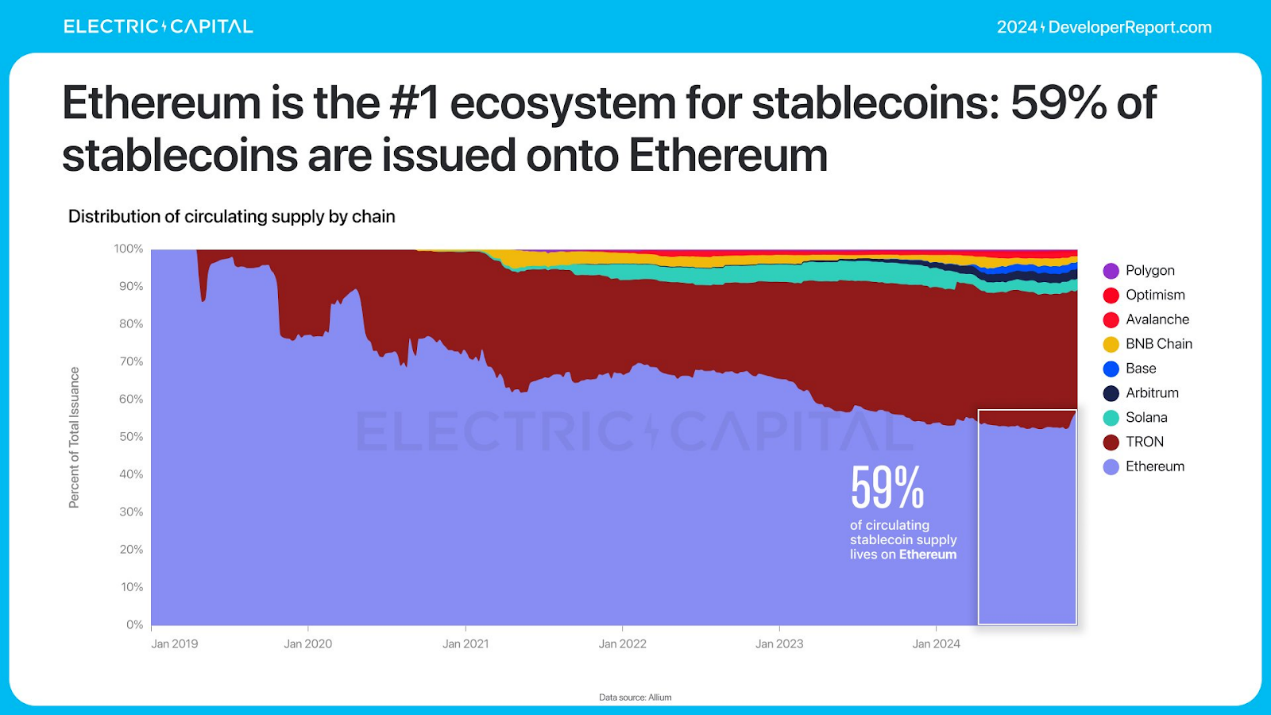

Ethereum is the largest stablecoin ecosystem, with 59% of stablecoins issued on Ethereum.

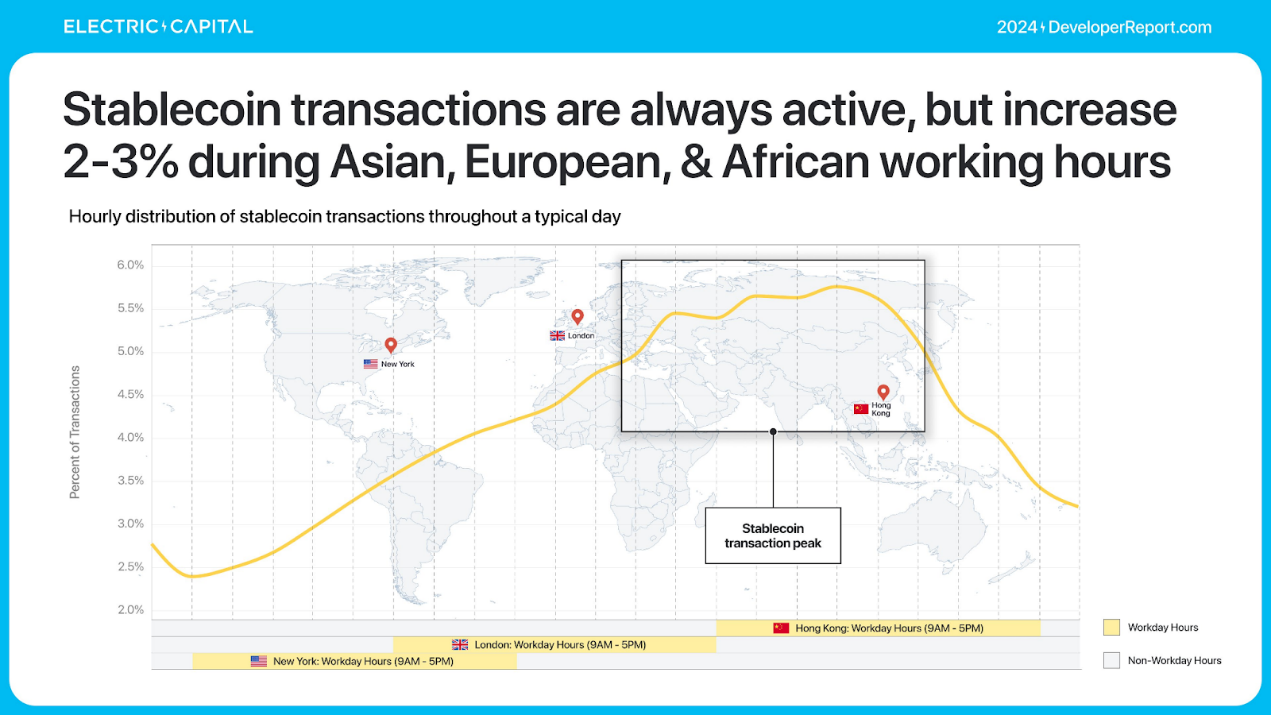

Stablecoins are always active, but are active 2-3% more in Asia, Europe, and Africa.

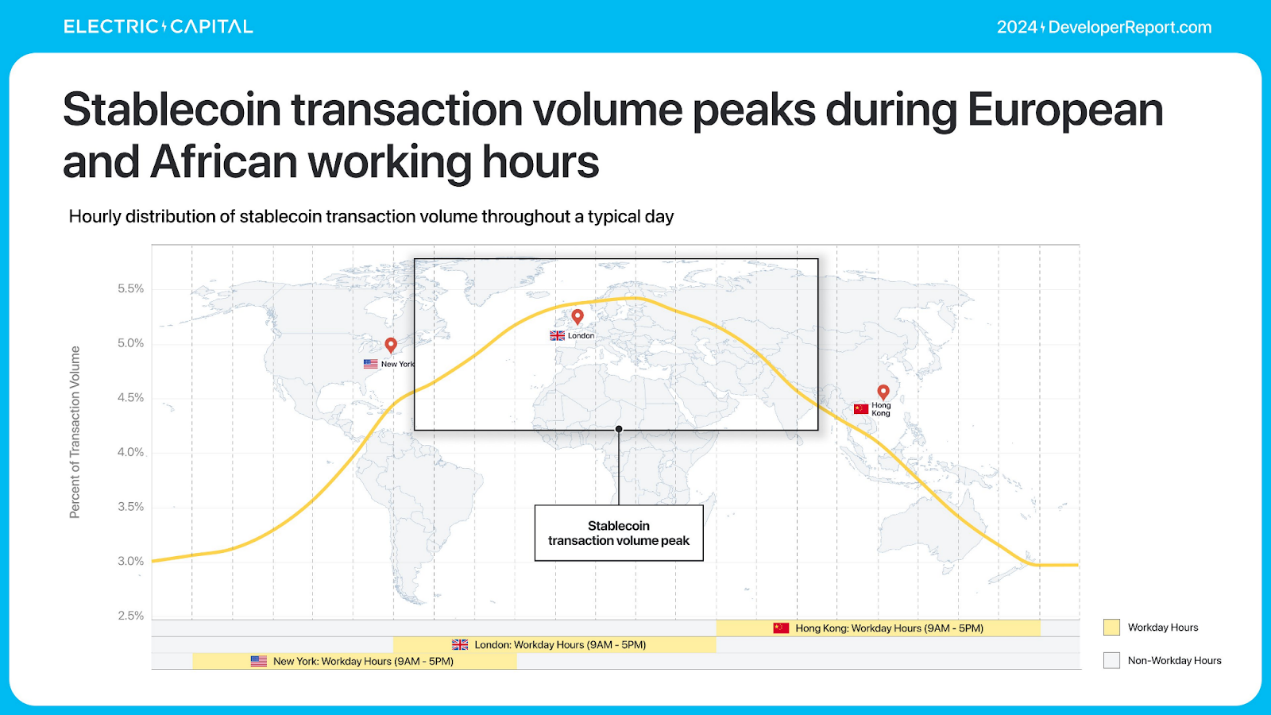

Although stablecoin trading peaks during Eastern time, volume is more skewed toward the West.

ETF

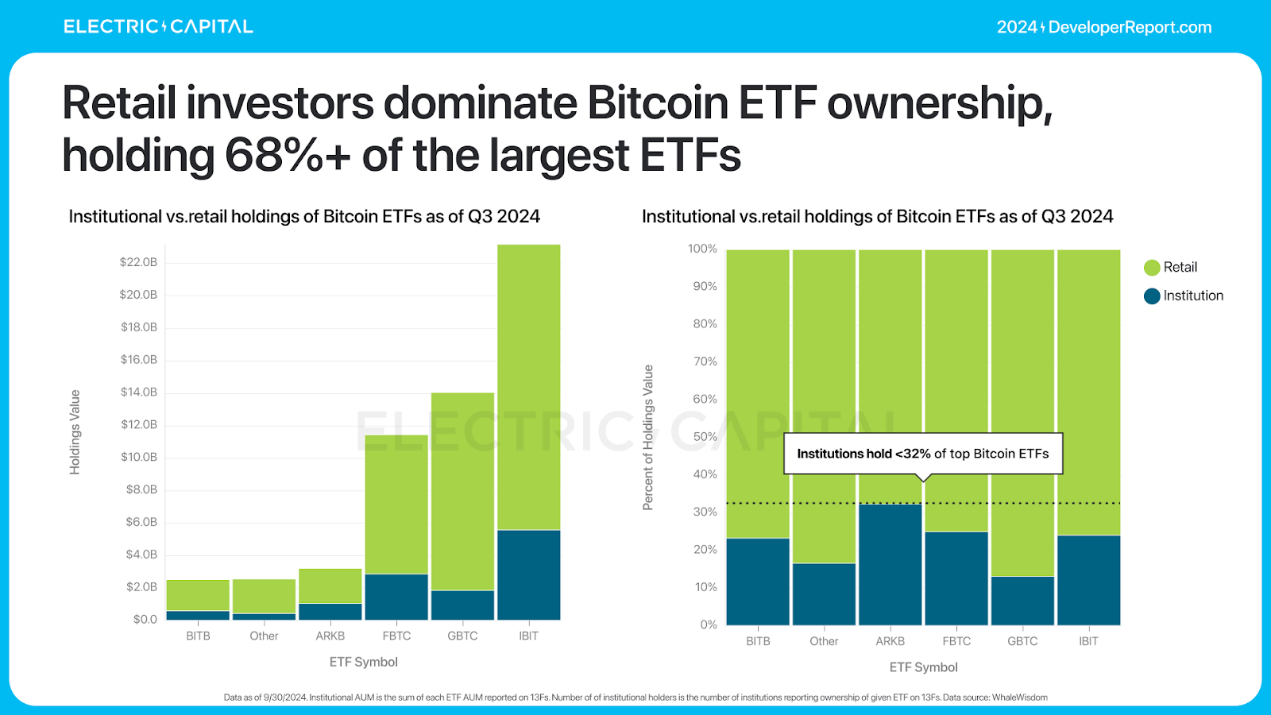

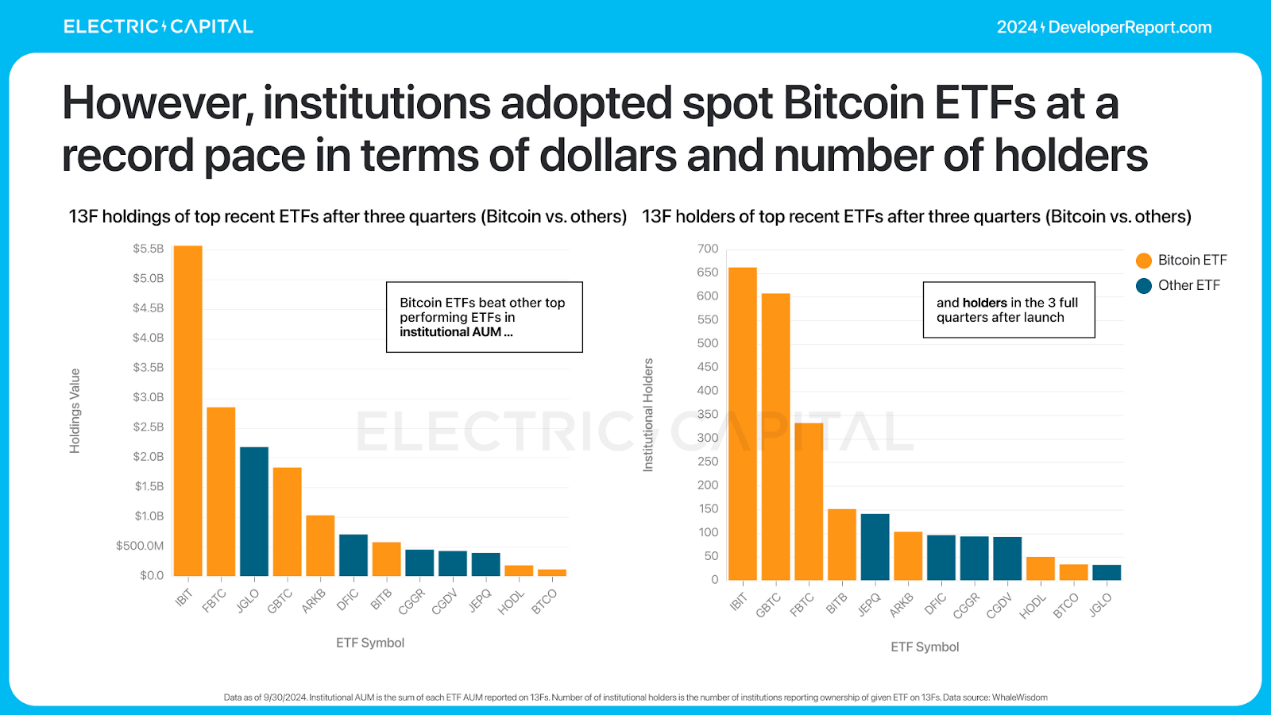

The launch of Bitcoin and Ethereum ETFs this year has made it easy for off-chain capital to access on-chain assets. The Bitcoin ETF has attracted over $50 billion in net inflows, making it one of the most successful ETFs ever.

Most of the Bitcoin ETF trading volume is driven by retail investors. Given that spot Bitcoin ETFs are still in their infancy, institutional investors are still adopting the ETF at a record pace.

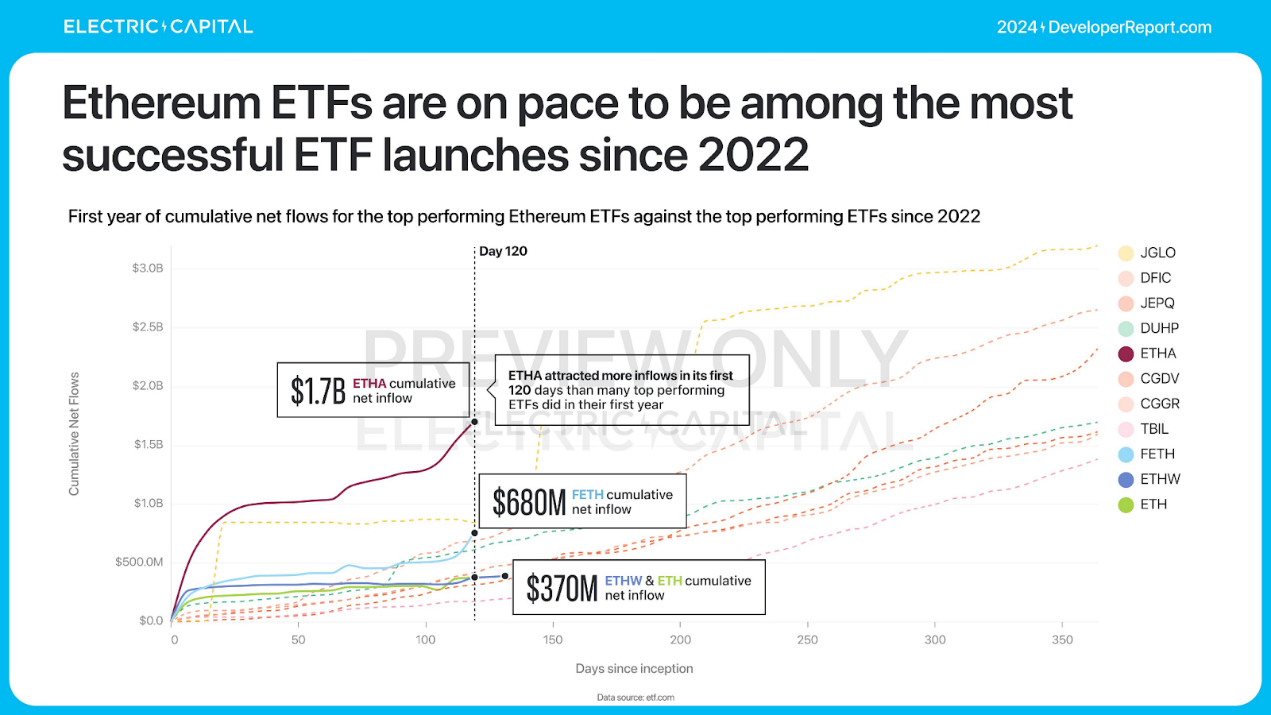

The Ethereum ETF was launched in July this year.

Ethereum ETF currently holds $13 billion in AUM and attracted $3.5 billion in net inflows. This is consistent with the most successful ETF launch pace since 2022 (excluding Bitcoin ETF). This is also mainly driven by retail investors.

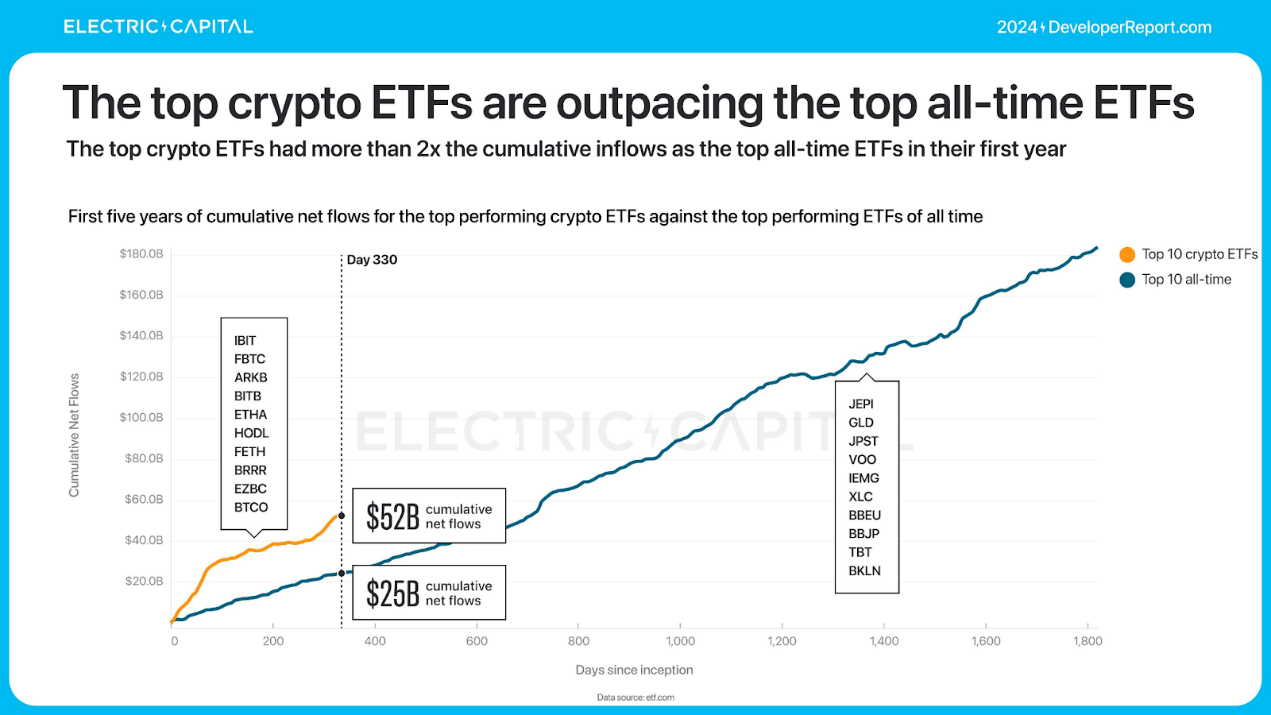

Bitcoin and Ethereum ETFs set records. Their first-year cumulative inflows are now more than double the best ETFs of all time.

Related reading: Electric Capital 2023 Developer Report: 30% choose multi-chain development, Scroll and ICP grow faster

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse