Gold’s Record Highs Put Bitcoin in the Spotlight for Q4 Rally

The post Gold’s Record Highs Put Bitcoin in the Spotlight for Q4 Rally appeared first on Coinpedia Fintech News

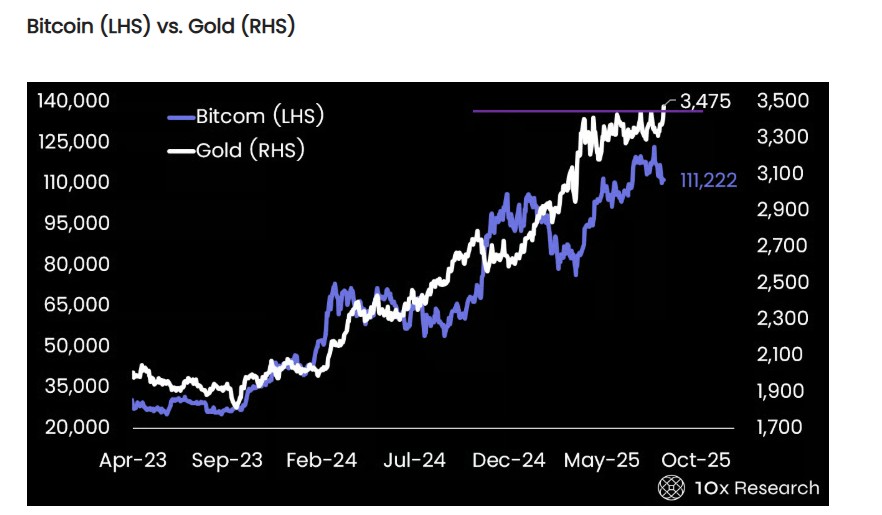

As gold edges near record highs $3475 this August 2025, crypto traders are watching closely. The world’s oldest safe-haven asset is soaring again, and its rise could set the tone for Bitcoin’s next big move.

The question now is whether this gold rally is just a safe-haven play or the quiet signal that Bitcoin’s strongest quarter is about to begin.

Gold’s Breakout and the Bitcoin Connection

Gold recently touched an all-time high of $3,475 per ounce, fueled by sticky inflation, expected rate cuts, and global tensions. While the metal has seen short pullbacks, it remains well supported near record levels of $3416.

Markus Thielen, the head of 10x Research, shows how this steady breakout could become a mirror for Bitcoin. While both assets are often viewed as safe havens in uncertain times, and when gold moves first, Bitcoin sometimes follows with more force.

His chart comparing the two suggests that Bitcoin could be preparing for a similar breakout if macro conditions continue to intensify.

Bitcoin Mirrors Gold’s Moves

Bitcoin, often called “digital gold,” has shown a clear correlation with physical gold in 2025. Both assets have climbed in parallel, with Bitcoin hitting $124,000 in July before correcting to around $111,000.

Analysts like Markus Thielen of 10x Research argue that gold’s quiet breakout could soon echo in Bitcoin, given how both react to macroeconomic shifts such as U.S. debt issuance and monetary easing.

Crypto Rotation Back To Bitcoin

At the same time, options markets are flashing unusual signals. The gap between Ethereum’s volatility pricing and Bitcoin’s is now at one of the widest levels seen in years.

Such extreme spreads often mark a turning point, hinting that traders expect more stability in Bitcoin compared to Ethereum.

With macro conditions tightening and traders rotating into new narratives, Q4 could mark the beginning of Bitcoin’s next strong rally.

You May Also Like

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

BlackRock Increases U.S. Stock Exposure Amid AI Surge