Amdax Raises $23M for Bitcoin Treasury – Europe’s Bold Bid to Rival MicroStrategy?

Dutch crypto service provider Amdax has secured €20 million ($23 million) in initial funding for its Amsterdam Bitcoin Treasury Strategy (AMBTS), planning to accumulate 1% of Bitcoin’s total supply over time.

AMBTS plans to complete its private funding round at €30 million ($34 million) before pursuing a public listing on Euronext Amsterdam.

The company plans to leverage capital markets to grow Bitcoin per share while building toward the 210,000 BTC target, worth approximately $23 billion at current prices.

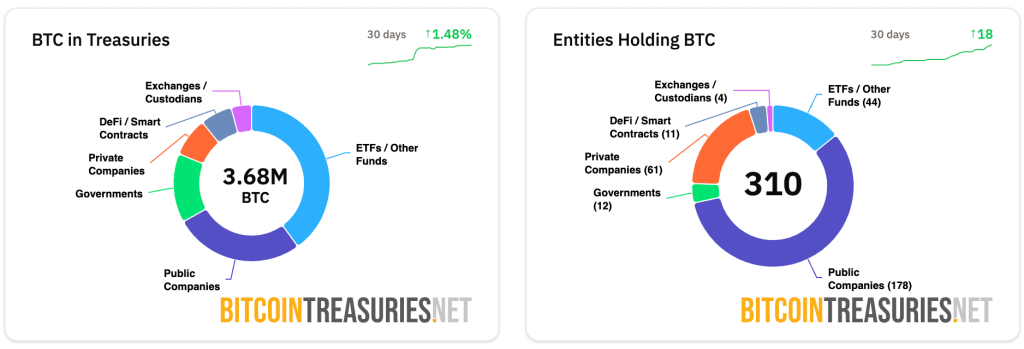

Corporate Bitcoin holdings have exploded to 3.68 million tokens across 310 entities, valued at $408 billion.

Source: Bitcoin Treasuries

Source: Bitcoin Treasuries

MicroStrategy leads with 632,457 BTC, followed by MARA Holdings at 50,639 BTC. Recent corporate entries include KindlyMD’s $5 billion equity offering and the aggressive accumulation by Japanese firms.

Additionally, the healthcare company KindlyMD filed a $5 billion at-the-market equity offering to fund its aggressive Bitcoin treasury strategy, which at the time represented one of the largest corporate crypto accumulation programs.

Europe Enters Bitcoin Treasury Race

Amdax established AMBTS as an independent company following its successful registration with the Dutch Central Bank in 2020.

The firm became one of the first to receive approval under Europe’s Markets in Crypto-Assets Regulation framework, providing an easy and regulated entry point for institutional Bitcoin exposure.

CEO Lucas Wensing cited growing demand within Amdax’s ecosystem for dedicated Bitcoin treasury services.

The company believes Europe needs its own Bitcoin treasury giant to compete with U.S. and Asian corporate adoption rates, in which institutional holdings have reached a large scale.

However, amid this growth, corporate treasury strategies face mounting scrutiny. Morningstar DBRS analysts recently warned that crypto treasury functions heighten credit risks due to Bitcoin’s volatility compared to traditional reserve assets.

The concentration among top holders amplifies systemic exposure, with the top 20 public companies controlling 94% of corporate Bitcoin reserves.

Bitcoin volatility measures are nearly five times higher than those of the S&P 500 in short-term periods and four times higher in the long term.

This volatility fundamentally alters traditional treasury management roles, which are designed to maintain stability and ensure consistent operations.

Additionally, regulatory uncertainty remains a pressing challenge, as there is no uniform global framework governing cryptocurrencies.

Since the beginning of corporate Bitcoin accumulation, unusual stock movements ahead of these treasury announcements have been observed and are prompting scrutiny of insider trading.

For instance, MEI Pharma’s stock nearly doubled before it announced a $100 million acquisition of Litecoin. Similarly, SharpLink’s shares more than doubled three days before the company announced a $425 million Ethereum allocation.

Warning Signs Flash as Institutional Momentum Builds

Earlier this month, Sentora research also warned that Bitcoin treasury strategies are “negative-carry trades” where companies borrow fiat to acquire non-yielding assets.

Unlike traditional carry trades with positive yield cushions, Bitcoin strategies offer no yield protection during adverse conditions.

Rising interest rates amplify negative carry effects, while Bitcoin’s price stagnation over extended periods could erode conviction and make equity issuance dilutive.

The research notes that no lender of last resort exists when Bitcoin carry trades break, making risks “binary and reflexive.”

Companies that use aggressive financing mechanisms face a particular vulnerability.

Mining firms often maintain razor-thin margins while holding 50-80% of Bitcoin assets, creating high liquidation risks during downturns when short-term cash needs emerge.

While treasuries are actively accumulating, ETFs are also dominating the market.

According to a Cryptonews report today, Bitcoin ETFs have captured 13.1% of total spot trading volume since the U.S. presidential election, generating $5-10 billion in daily activity that rivals that of major cryptocurrency exchanges.

Ethereum ETFs experienced strong momentum, with $4 billion in net inflows in August, while Bitcoin ETFs recorded $800 million in net outflows.

Investment advisers emerged as the largest identifiable ETF holders, controlling over $1.3 billion in Ether ETFs and $17 billion across Bitcoin ETFs.

The institutional preference for Ethereum’s rotation accelerated as corporate treasury activity expanded beyond Bitcoin.

You May Also Like

Strategy to initiate a bitcoin security program addressing quantum uncertainty

Copy linkX (Twitter)LinkedInFacebookEmail

Strategic Shift Impacts Crypto Trading Landscape