Fluid: Redefining the capital efficiency benchmark for DeFi lending and trading

Author: Castle Labs

Compiled by AididiaoJP, Foresight News

Money markets are at the heart of DeFi, allowing users to gain exposure to specific assets using a variety of strategies. Over time, this vertical has grown in both value locked (TVL) and functionality. With the introduction of new protocols like @MorphoLabs, @0xFluid, @eulerfinance, and @Dolomite_io, the range of functionality available through lending protocols has expanded.

In this report, we focus on one of these protocols: Fluid.

Fluid has launched several features, the most interesting of which are smart debt and smart collateral. It cannot be regarded as an ordinary lending protocol because it also combines its DEX functionality to provide users with more services.

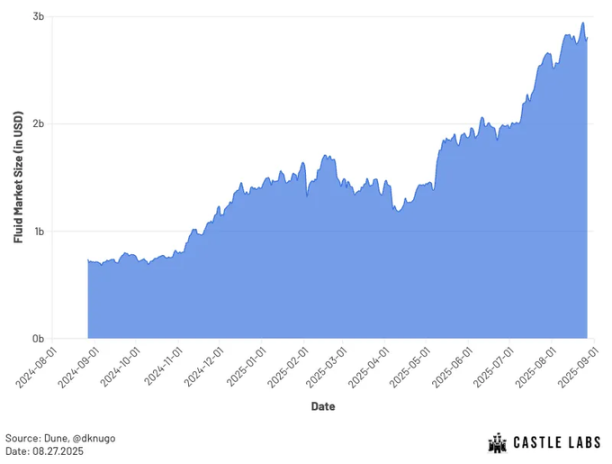

Fluid is showing significant growth in both DEX and lending verticals, with a total market size (in terms of total deposits) exceeding $2.8 billion.

Fluid market size, source: Dune, @dknugo

Fluid Market Size represents the total deposits in the protocol. This metric was chosen over TVL because debt is a productive asset in the protocol and contributes to exchange liquidity.

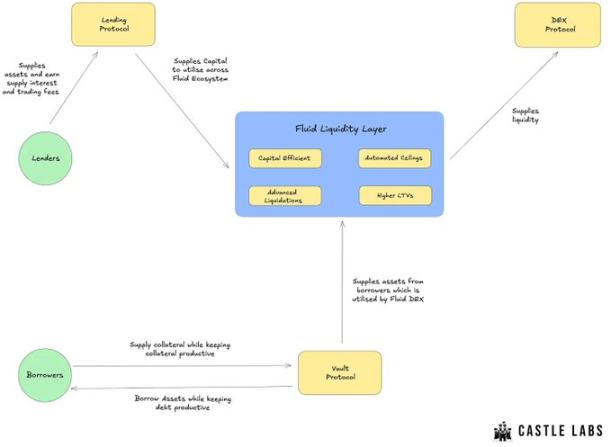

Overview of Fluid components and how it works

This section briefly outlines the components of the Fluid protocol and explains how it operates, with a focus on why it is a capital-efficient protocol.

Fluid uses a unified liquidity model where multiple protocols can share liquidity, including the Fluid lending protocol, Fluid Vaults, and DEX.

Fluid Lending allows users to provide assets and earn interest. The assets provided here are used throughout the Fluid ecosystem, improving their capital efficiency. It also opens up long-term yield opportunities as the protocol continuously adapts to changes in the borrower and lender market.

Fluid Vaults are single-asset, single-liability vaults. These vaults are extremely capital-efficient because they allow for high LTVs (loan-to-value ratios), up to 95% of the collateral value. This number determines a user's borrowing capacity, as opposed to the deposited collateral.

Fluid also employs a unique liquidation mechanism that reduces liquidation penalties to as low as 0.1%. The protocol only liquidates the amount necessary to restore a position to a healthy state. Fluid's liquidation process is inspired by the design of Uniswap V3. It categorizes positions by scale or range of their LTV and executes batch liquidations when the collateral value reaches the liquidation price. DEX aggregators then use these batches as liquidity: liquidation penalties translate into discounts for traders when they swap.

Fluid DEX earns an additional layer of income for the liquidity layer through transaction fees generated by exchanges, further reducing borrowers' position interest while improving the capital efficiency of the entire protocol. Different DEX aggregators, such as KyberSwap and Paraswap, use Fluid DEX as a liquidity source to obtain deeper liquidity and increase trading volume.

On Fluid, users can deposit their collateral into a DEX and earn both lending fees and trading fees, making it a Smart Collateral.

If users wish to borrow against their collateral, they can borrow assets or open a Smart Debt Position, making their debt productive. For example, users can borrow from a pool of ETH and USDC/USDT. They can deposit ETH as collateral and borrow USDC/USDT. In exchange, they receive USDC and USDT in their wallets, which they can use as they wish, while the trading fees earned from this liquidity pool are used to reduce their outstanding debt.

Fluid's latest progress and expansion

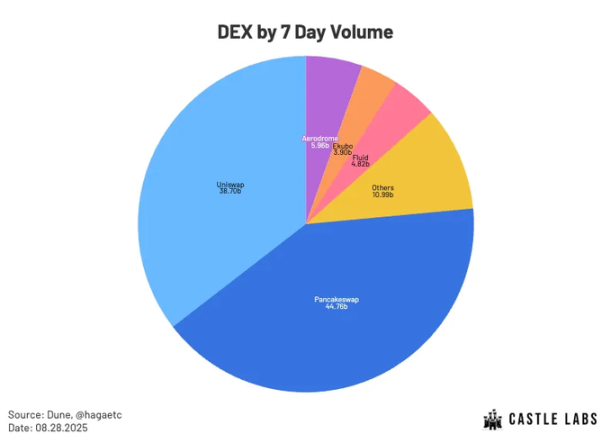

Based on trading volume data over the past seven days, Fluid DEX ranks #4, behind only @Uniswap, @Pancakeswap, and @AerodromeFi. Fluid's partnership with Jupiter Lend has launched, a feature that has been in private beta since the beginning of the month, and Fluid DEX Lite has already launched.

Additionally, Fluid DEX v2 will be available soon.

DEXs ranked by 7-day trading volume. Source: Dune, @hagaetc

In addition to this, the protocol also anticipates a token buyback as its annual revenue exceeds $10 million. Fluid recently published a post on its governance forum regarding this, which opened a discussion about the buyback and proposed three approaches.

See the different proposed approaches here:

Subject to governance approval (after discussion), the buyback will begin on October 1st, with a 6-month evaluation period.

Jupiter Lend: Fluid Enters Solana

Fluid’s expansion to Solana is in partnership with @JupiterExchange.

Jupiter is the largest DEX aggregator on Solana, with a cumulative trading volume of over $970 billion. It is also the leading perpetual contract exchange and staking solution on Solana.

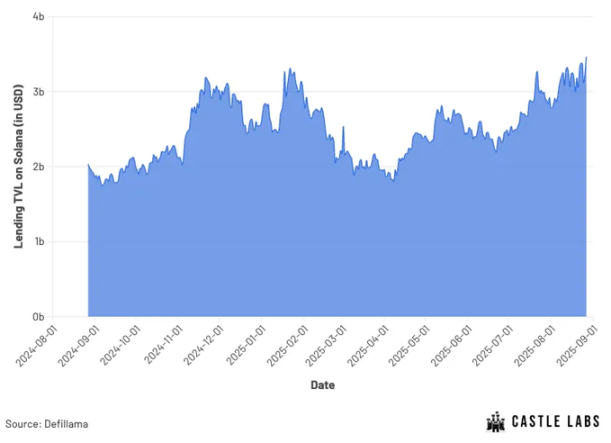

The TVL of Solana lending now exceeds $3.5B, with @KaminoFinance being the primary contributor. The lending vertical on Solana offers significant growth potential for Fluid.

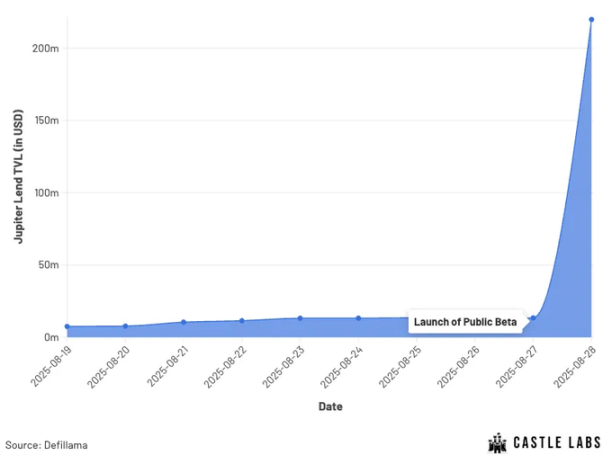

@jup_lend recently launched its public beta after a few days of private testing. Its TVL has surpassed $250 million, making it the second-largest money market on the Solana blockchain, behind only Kamino.

Jupiter Lend, launched in partnership with Fluid, offers similar functionality and efficiencies, with smart collateral and smart debt expected to launch on the platform later this year.

Additionally, 50% of the platform's revenue will be allocated to Fluid.

Fluid DEX iteration

Fluid has already launched its DEX Lite and plans to launch V2 soon. This section will cover both and explain how these iterations will help Fluid grow further.

Fluid DEX Lite

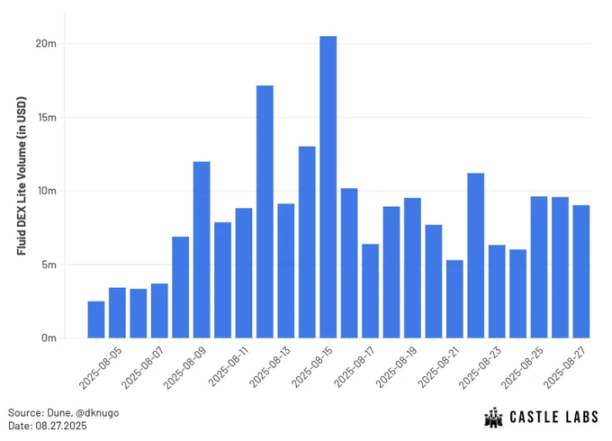

Fluid DEX Lite launched in August and serves as a credit layer on Fluid, enabling borrowing directly from the Fluid liquidity layer. It has begun providing trading volume services for relevant trading pairs, starting with the USDC-USDT pair.

This version of Fluid DEX is extremely gas efficient, reducing the cost of performing swaps by approximately 60% compared to other versions. It was created to capture a larger share of trading volume in the relevant trading pairs, where Fluid is already the dominant protocol.

In its first week, Fluid Lite generated over $40 million in trading volume, with initial liquidity of $5 million borrowed from the liquidity layer.

Fluid DEX Lite trading volume. Source: Dune, @dknugo

Fluid DEX V2

Fluid DEX V1, launched in October 2024, surpassed $10 billion in cumulative trading volume on Ethereum in just 100 days, faster than any other decentralized exchange. To support this growth, Fluid is launching V2, designed with modularity and permissionless scalability in mind, allowing users to create multiple custom strategies.

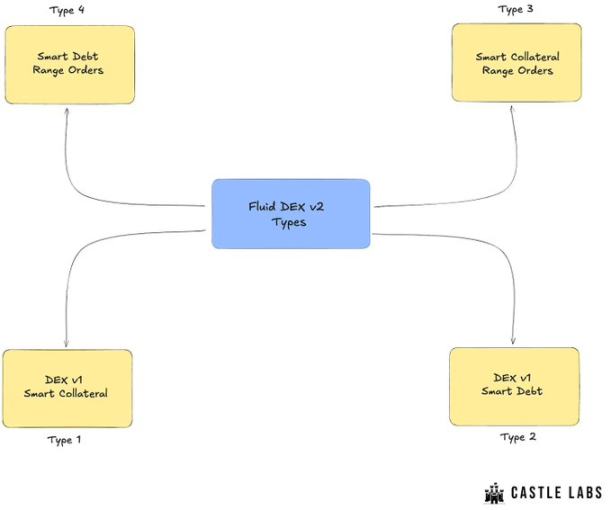

First, V2 will introduce four different types of DEXs within the protocol, two of which are inherited from V1. Fluid will support more DEX types than just these four, with more types being deployable through governance.

The two new types introduced are Smart Collateral Range Orders and Smart Debt Range Orders, both of which allow borrowers to help improve their capital efficiency.

Smart Collateral Range Orders function similarly to Uniswap V3, allowing users to provide liquidity by depositing collateral within a specific price range while also earning an annualized percentage rate (APR) on the borrowed funds.

Smart Debt Range Orders work similarly, allowing users to create range orders by borrowing assets on the debt side and earn an annual percentage rate (APR) on the trade.

Additionally, it introduces features like hooks (similar to Uniswap V4) for custom logic and automation, flash accounting to improve fee efficiency for CEX-DEX arbitrage, and on-chain yield accumulation limit orders, which means limit orders can earn annual lending rate (APR) while waiting to be filled.

in conclusion

Fluid continues to grow and improve by offering a unique set of features to become more capital efficient.

Smart Collateral: Collateral deposited on the platform can be used to earn lending interest and transaction fees.

Smart Debt: Smart Debt reduces debt by paying off part of it using transaction fees generated by the debt, making the debt borrowed by users productive.

Unified Liquidity Layer: Fluid’s unified liquidity layer improves capital efficiency across the ecosystem by providing features such as higher LTV, advanced liquidation mechanisms, and automatic capping for better risk management.

Its recent expansion into Solana through its partnership with Jupiter has broadened its market share in the lending category to non-EVM networks. Meanwhile, Fluid DEX Lite and DEX V2 aim to enhance user experience and increase transaction volume on EVM chains.

Additionally, DEX V2 is expected to launch on Solana later this year, which will enable Fluid to enter Solana’s lending and exchange verticals.

You May Also Like

Unleash Potential: Flare Network’s FXRP Revolutionizes DeFi Access for XRP

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next