Is the crypto privacy track welcoming good news? Tornado Cash's sanctions case was overturned, but the developer still faces criminal charges

Author: Nancy, PANews

The encryption and privacy track has ushered in a key turning point.

Recently, the US court overturned the decision that Tornado Cash's smart contract was sanctioned, which not only brought a huge market rebound to the platform's token TORN, but also marked a milestone in defending the privacy rights of the crypto industry and preventing excessive government intervention. However, despite Tornado Cash's temporary legal victory, its developers still face criminal charges, and the platform will still face a series of market and regulatory challenges in the future.

OFAC sanctions ruled to be excessive, developers still face criminal charges

In August 2022, the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) announced sanctions on the mixer Tornado Cash, pointing out that the platform was used to launder cryptocurrencies worth more than $7 billion, and demanded that all U.S. individuals and entities be prohibited from providing related services for the Tornado Cash protocol, as well as prohibiting interaction with Ethereum wallet addresses sanctioned by the protocol. The U.S. regulatory crackdown not only caused many platforms to terminate their business dealings with Tornado Cash, but also dealt a severe blow to the development of the crypto privacy track.

However, the Tornado Cash lawsuit was subsequently supported by appeals from Coinbase and crypto advocacy group Coin Center, which claimed that the sanctions were illegal. Among them, six people, including Coinbase employees, with financial support from Coinbase, filed a lawsuit against the decision to include Tornado Cash in the sanctions list, and were reheard by the U.S. Fifth Circuit Court in January this year. Coin Center also filed a lawsuit against the U.S. OFAC over the sanctions on Tornado Cash, accusing the agency of sanctions exceeding its statutory authority, but the lawsuit was ultimately dismissed this month.

After two years of legal battles, the appeal case of Tornado Cash’s sanctions finally received the latest verdict. On November 26, the U.S. Federal Court of Appeals for the Fifth Circuit overturned the decision of the lower court, determining that the Office of Foreign Assets Control (OFAC) exceeded its authority when sanctioning Tornado Cash’s immutable smart contract.

In the judgment document, not only are the legitimate reasons for multiple plaintiffs to use Tornado Cash listed, such as protecting privacy, avoiding cyber attacks, anonymous donations, etc., but also whether smart contracts can be regarded as "property" or "entities" and whether OFAC has the right to impose sanctions on them. In the end, the US court held that although the Treasury Department has the right to take action against "property", Tornado Cash's smart contracts are immutable and cannot be controlled or owned. Therefore, according to the International Emergency Economic Powers Act (IEEPA), it does not meet the traditional definition of "property", and the legislation on smart contracts should be led by Congress.

In fact, in response to OFAC's sanctions, Haun Ventures, a venture capital firm owned by former a16z executive Katie Haun, previously published an article pointing out that OFAC's blocking of open source and self-executing software is an overreach at the legal level. These software are neither the "property" of any foreign individual or entity, nor do they belong to anyone. No matter how noble OFAC's intentions are, it does not grant such broad powers to crack down on open source software architecture. OFAC should focus its sanctions on malicious actors who abuse open source software, not the tools themselves.

Affected by this, Tornado Cash token TORN surged in the early morning of November 27. CoinGecko data showed that TORN increased by more than 9.6 times in 24 hours.

It is worth mentioning that the victory of this appeal does not mean that Tornado Cash developers will be released. Among them, Tornado Cash co-founder Roman Storm was charged with three crimes including money laundering and sanctions violation this year. His trial has been postponed to April next year. The defense cost is estimated to be as high as $500,000 per month, but his legal defense fund has received donations from Vitalik and others; another developer Alexey Pertsev was sentenced to 64 months in prison by a Dutch court for money laundering this year. He is appealing the guilty verdict and seeking to raise funds. He will continue to be detained while awaiting trial.

Legal victory boosts confidence in the privacy sector, but still faces many market challenges

Tornado Cash’s important legal victory has undoubtedly injected new confidence into the field of crypto privacy.

“This is a historic victory for cryptocurrency and all those who care about defending freedom,” said Paul Grewal, chief legal officer at Coinbase. “Now, these smart contracts must be removed from the sanctions list, and U.S. users will once again be allowed to use this privacy-preserving protocol. In other words, government overreach will not stand.”

ConsenSys General Counsel Matt Corva also believes that this is a huge victory. This judgment once again strikes against the U.S. executive branch's arbitrary exercise of power without updated and direct congressional authorization. "This marks another major victory for the encryption industry and a victory for the United States' right to develop privacy technology. This judgment sets an important precedent for future cases involving privacy-enhancing tools." The encryption lobbying group Blockchain Association said.

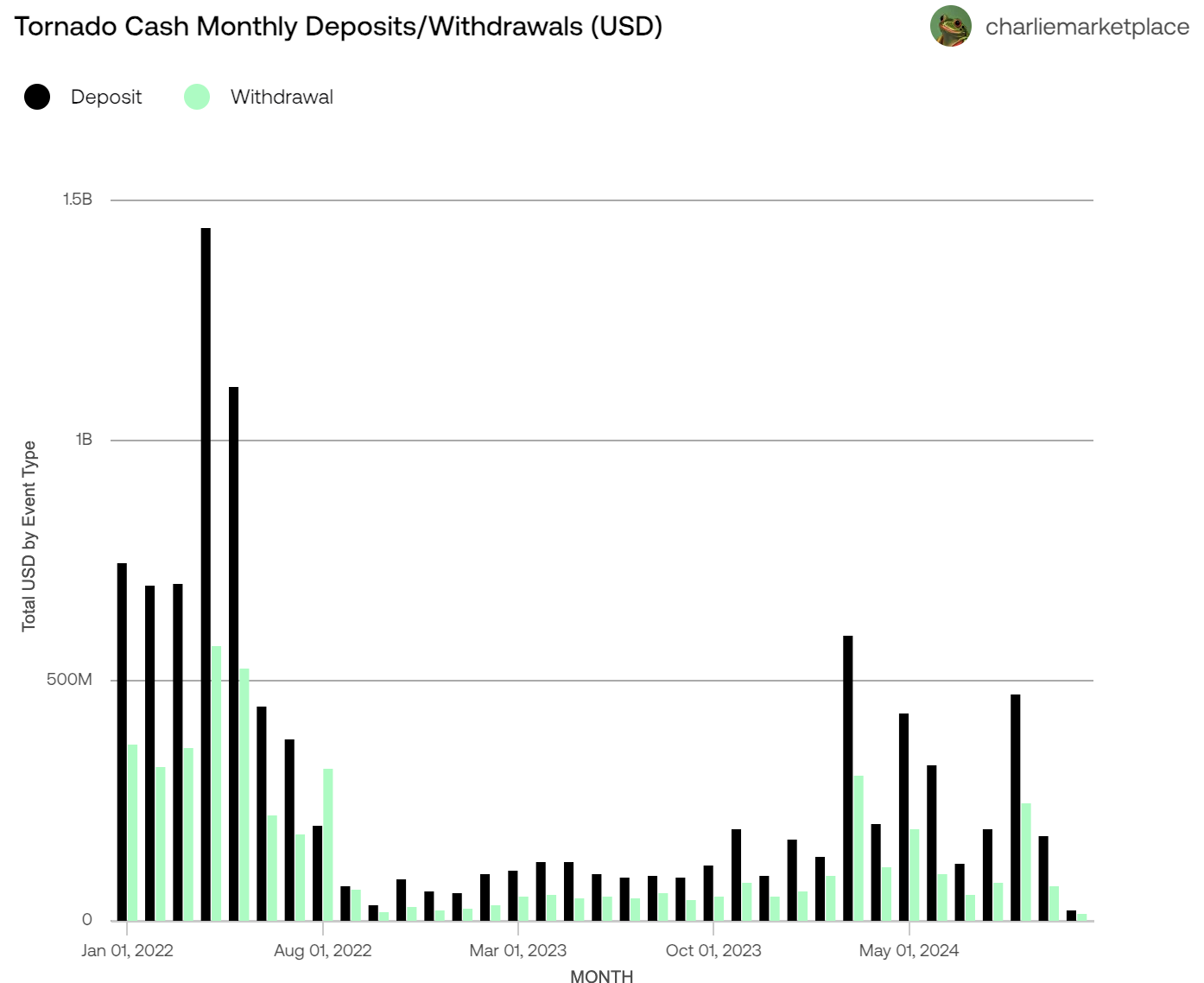

Judging from market data, Tornado Cash is still one of the more popular privacy platforms in the crypto space. Although Tornado Cash's deposit volume was sluggish after being sanctioned, according to Flipside Crypto statistics, Tornado Cash's deposit volume has recovered significantly since the beginning of this year, receiving $1.9 billion in deposits in the first half of this year alone, a significant increase of about 50% from the total deposit volume for the whole year of 2023.

However, the challenges facing privacy projects such as Tornado Cash are far from over. On the one hand, Tornado Cash is still closely related to a large number of criminal activities, including the frequent incidents of hackers using the platform to launder funds this year. For example, in May this year, North Korean hackers used Tornado Cash to launder stolen crypto assets worth $150 million, and Poloniex attackers transferred a total of 17,800 ETH to Tornado Cash; in July, UwUlend attackers transferred about $4.28 million worth of ETH to Tornado Cash; in September, WazirX hackers had laundered more than $160 million through Tornado Cash; in the same month, DeltaPrime hackers had bridged all stolen funds (about $4.5 million) to the Ethereum network and deposited them in Tornado Cash; Indexed Finance attackers transferred more than $4.5 million through Tornado Cash in October this year, etc.

On the other hand, many platforms have previously refused to have any financial interactions with Tornado Cash, and the policies of these institutions also need to be adjusted as the US regulatory attitude becomes clearer. For example, OKX founder Star publicly stated this year that any user who interacts directly with Tornado Cash will face account withdrawals. The Federal Reserve Bank of New York also disclosed in its report this year that Ethereum builders have largely cooperated with the sanctions against Tornado Cash. These measures show that even if the court rules that OFAC's actions are beyond its authority, the use and popularization of privacy tools such as Tornado Cash still faces huge resistance from regulators and the market.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse