Analyst Foresees BTC Reaching $125K This Month – HYPER Presale Nears $14M to Upgrade Bitcoin

Compared to last year, its price has nearly doubled to $110K, underscoring the strength of renewed institutional and retail demand.

Changelly now predicts $BTC to jump to $125K by the end of September, offering investors a potential ROI surpassing 14%.

But when $BTC grows, its long-standing network issues often become more apparent.

Despite not being live yet, investors already have high expectations for the L2, as evidenced by its native token – $HYPER – nearly attracting $14M on presale. It might even be the next 1000x crypto.

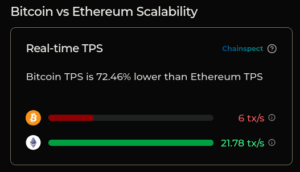

Bitcoin Transaction Speeds 18x Slower Than Ethereum

Unlike Ethereum, Bitcoin wasn’t built for smart contracts, dApps, or DeFi ecosystems. Instead, it was initially designed as a decentralized system for sending funds. The biggest perk? Not relying on banks or intermediaries.

As a consequence, the network still prioritizes security and decentralization over speed and programmability to this day.

It’s highly resilient in the blockchain space, thanks to its Proof-of-Work (PoW) mechanism secured by a vast network of miners. Together, they make it virtually impossible for the network to be compromised or manipulated.

But the network’s super slow, currently only processing 6 transactions per second (tps), around 80% lower than Ethereum’s 21.78 tps.

Its gas fees are also rather pricey. Right now, the average Bitcoin transaction costs $1.703, nearly triple the amount of Ethereum’s $0.588.

Ethereum also dominates global DeFi activity, boasting a hefty $91.55B in Total Value Locked (TVL). In comparison, Bitcoin accounts for just $7.899B, a massive $83.401B less.

Bitcoin Hyper aims to change all of this.

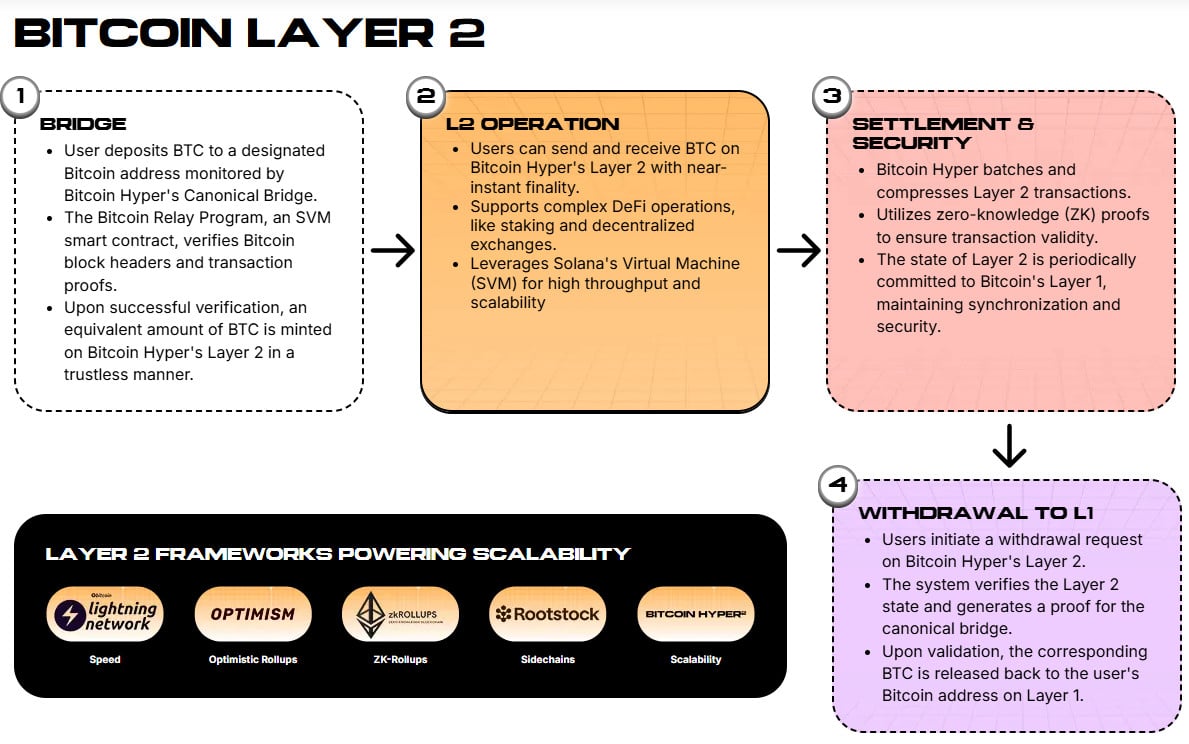

Bitcoin Hyper to Uplift Bitcoin With Canonical Bridge & SVM

As a novel L2 Bitcoin solution, Bitcoin Hyper is designed to significantly enhance the network’s power and versatility, even during peak demand.

By introducing a Canonical Bridge, the L2 aims to unlock Bitcoin’s full potential without being shackled by its slow base layer.

The bridge will enable you to deposit $BTC on the L1 and receive wrapped $BTC, which is backed 1:1 by the original crypto’s price.

And you need not worry about the Bitcoin mainnet becoming clogged. These transactions will be batched off-chain before being secured to the L1 network, which helps boost speeds and slash costs.

Source: Bitcoin Hyper

The L2 will also leverage the Solana Virtual Machine (SVM) to bring Solana’s steadfast programmability into the Bitcoin ecosystem.

Finally, developers will be able to launch smart contracts and build dApps on the Bitcoin network while handling thousands of tps.

In turn, this could significantly boost its TVL; Bitcoin will have the functionality to become an active hub for DeFi, NFTs, Web3 innovation, and even top meme coins without facing congestion woes.

To reap Bitcoin Hyper’s full benefits, you’ll want to scoop up some $HYPER. It grants lower gas fees on the L2, unlocks staking rewards at an 80% APY, and will give you a voice in governance decisions.

Following the L2’s mainnet launch, Bitcoin Hyper will transition into a DAO, fully decentralizing the network’s future by giving you control over its future trajectory.

Join $HYPER Presale Before Tomorrow’s Price Rise

$BTC is widely known as the most valuable crypto worldwide and Bitcoin is celebrated as a highly secure blockchain. But its utility is no stranger to slow speeds, steep fees, and limited programmability. So much so that it risks being left behind while Ethereum and Solana thrive.

Thankfully, Bitcoin Hyper is getting ready to launch its L2 solution to address Bitcoin’s long-standing usability issues.

For the ecosystem’s full perks, you can purchase $HYPER on presale for $0.012855, using either $ETH, $USDT, $USDC, $BNB, or fiat. But act fast: this price will go up tomorrow.

With demand growing and the presale heating up, $HYPER could be your gateway to Bitcoin’s next era.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.