Etherealize raises $40 million in funding, Vitalik Buterin participates, and aims to be the face of Ethereum.

By Eric, Foresight News

Fortune magazine reported on the evening of September 3rd (Beijing time) that Etherealize had secured $40 million in funding, led by Electric Capital and Paradigm, with participation from Ethereum co-founder Vitalik Buterin and the Ethereum Foundation. Electric Capital and Paradigm have been known to invest heavily in Web3, particularly in the Ethereum ecosystem, and both are key players in supporting Ethereum DATs going public. However, the involvement of both Vitalik Buterin and the Ethereum Foundation is a rare occurrence.

Etherealize is very concise in its self-introduction, describing itself as "the institutional-grade product, business development, and marketing arm of the Ethereum ecosystem" in its X profile. Its website only mentions its vision of "reinventing Wall Street" and "bringing the world to Ethereum through research, content, and products." Regarding its products, Etherealize is targeting institutional-grade infrastructure, providing the issuance, management, and settlement of tokenized assets, as well as the corresponding automated compliance infrastructure. It also plans to introduce privacy features through zero-knowledge proofs.

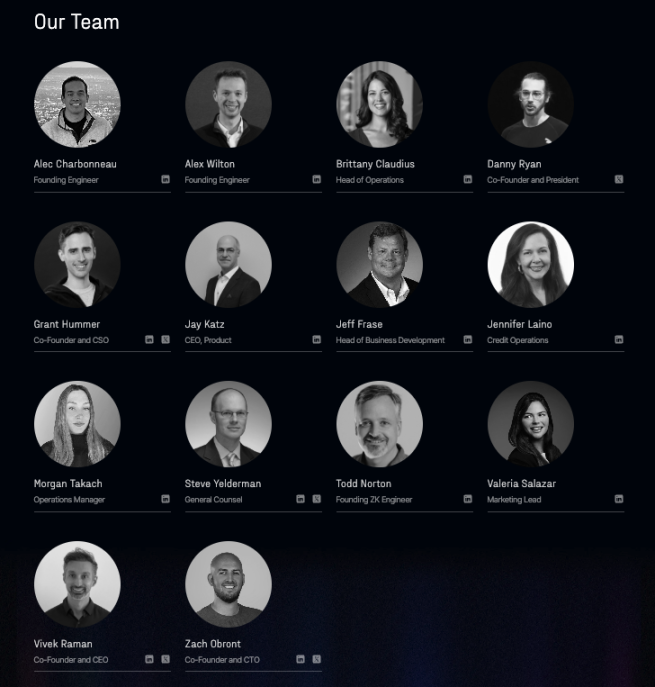

Etherealize claims to have an engineering team with extensive Ethereum expertise, a leadership team with decades of experience in financial institutions, and access to the SEC, Treasury, and Congress to shape rulemaking. Western investment institutions have always been generous with their bets on large-scale B2B businesses, but investing substantial capital in a startup like this is clearly a "people" investment. The author has also uncovered some clues in the team's composition.

The most notable figure on the Etherealize team was co-founder Danny Ryan, who made significant contributions to The Merge and the launch of the Ethereum Beacon Chain, but left the Ethereum Foundation last September. In a farewell letter posted on Github, Ryan explained his departure as due to personal reasons. Perhaps at that moment, he realized that simply nitpicking on technical issues would not advance Ethereum further, and that the right approach was to leverage his technical expertise to support teams that could bring Ethereum to the world.

In terms of technology, Zash Obront, co-founder and CTO of Etherealize, was the co-founder of Scribe Media, a book publishing service provider. In August 2021, he joined Snowcap Technology as a security researcher. The company focuses on the security field and provides security services in areas such as AI, VPN, WIFI, and enterprise systems.

The other two founding engineers, also responsible for technical aspects, have distinguished backgrounds. Alec Charbonneau previously served as a product manager at Circle, the first publicly listed stablecoin, and later as a software engineer at Stellar, a similarly focused settlement platform like Ripple. Alex Wilton previously held product management positions at Tesla and Rivian, another electric vehicle company that raised over $10 billion in funding in 2021.

Jay Katz, Product CEO, has a resume closely tied to strategy, having held positions in finance, software, smart hardware, law firms, and consulting firms. His LinkedIn listing indicates his actual position as CEO of Lending Market Solutions. Collaborating with him in Credit Operations is Jennifer Laino, a veteran of the financial industry, having previously served as Assistant Vice President at Lehman Brothers, Vice President at Bank of America Merrill Lynch, and Advisor to Blackstone Group.

Co-founder and CEO Vivek Raman, who also has years of experience in the financial lending sector, previously held senior credit management positions at Morgan Stanley, UBS, Deutsche Bank, and Nomura. In September 2021, he joined Celsius, which collapsed during the 2022 bear market, as a senior DeFi researcher. He then joined BitOoda, a digital asset investment bank that completed its Series A funding round in early 2023, as General Manager. At BitOoda, he focused on bringing institutions into the Ethereum and L2 ecosystem.

Clearly, Etherealize's plan to "bring Wall Street to Ethereum" initially targeted the credit sector. I suspect its implementation will involve integrating stablecoins with an on-chain lending system. Of course, this type of product, unlike DeFi, may simply provide solutions for financial institutions.

In terms of marketing and operations, Etherealize selected candidates with extensive experience in Web3. Marketing Director Valeria Salazar previously served as Head of Marketing Strategy and Head of Developer and Ecosystem Relations at Phi Labs. Business Operations Manager Morgan Takach, formerly Head of Strategy and Operations at Polyhedra, was selected.

Etherealize's claim of extensive experience in both Web3 and finance is well-founded, capitalizing on the growing trend of institutional investors experimenting with asset tokenization. Using Ethereum to reshape finance has been a well-told story since the beginning of DeFi Summer. Even as traditional institutions are experimenting with on-chain asset transfers, the true scale of this business remains uncertain. However, building a bridge between Ethereum and Wall Street is a worthwhile direction for Ethereum to explore.

Beyond its specific business, Etherealize also explicitly stated on its website that it aims to serve as Ethereum's "spokesperson" to promote global adoption of Ethereum and its Layer 2 ecosystem. Overall, Etherealize is taking over the "go-to-market" aspects of the Ethereum Foundation, which were previously underperforming, through a commercial company. The specific results are worth anticipating.

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC