The United States welcomes its first crypto president! A look back at crypto moments on the road to the election

Author: Zen, PANews

At about 3:00 p.m. on November 6, Beijing time, the vote counting for the U.S. presidential election was still ongoing. According to calculations by several U.S. media , Republican presidential candidate Trump has won at least 270 electoral votes and is expected to lock in victory in this U.S. presidential election. He has maintained a leading advantage in the vote counting process of this election. As of 10:30 a.m. on November 6, Beijing time, according to Foxnews data, Trump has won a total of 195 electoral votes and Harris has won 117 electoral votes. Trump's large lead echoed the confidence and enthusiasm of the crypto market, and BTC directly hit a new record high, with the price exceeding $75,000.

After becoming acquainted with NFT, Bitcoin "haters" changed their stance for the election

The first time Bitcoin and cryptocurrencies became an issue in the presidential election was thanks to Trump, even though he was a critic at the time.

In 2019, then-US President Trump tweeted that he was not a supporter of Bitcoin and other cryptocurrencies, criticizing them for not being money, their value being extremely unstable and completely created out of thin air. He also expressed concerns about a series of problems caused by the lack of regulation of cryptocurrencies: "Unregulated crypto assets can facilitate illegal behavior, including drug trafficking and other illegal activities."

Even though Trump showed his disdain for Bitcoin at that time, the cryptocurrency market still regarded it as "auspicious". Circle co-founder and CEO Jeremy Allaire directly tweeted : "This may be the biggest bull market signal in Bitcoin's history. Cryptocurrency has now become a presidential/global policy issue. Coinbase CEO Brian Armstrong also cheered on Twitter : "Achievement unlocked! A few years ago, I dreamed that a current US president needed to respond to the growing use of cryptocurrency. They ignored you first, then laughed at you, then fought against you, and finally you won. 'We have just entered the third step. "

Now it seems that the victory predicted by Brian Armstrong has indeed arrived, at least for Trump. However, the change did not come so quickly. In the first two years of his presidency, Trump still held a critical and negative view of Bitcoin. In June 2021, when the crypto industry was in a bull market, Trump once again blasted on Fox Business Channel : "Bitcoin looks like a scam," and expressed his dislike for it as a currency that competes with the US dollar. At the end of the same year, although his wife, former first lady Melania Trump, launched her first NFT, Trump still disagreed. He reiterated in an interview with Fox Business: "I never liked it because I like the US dollar."

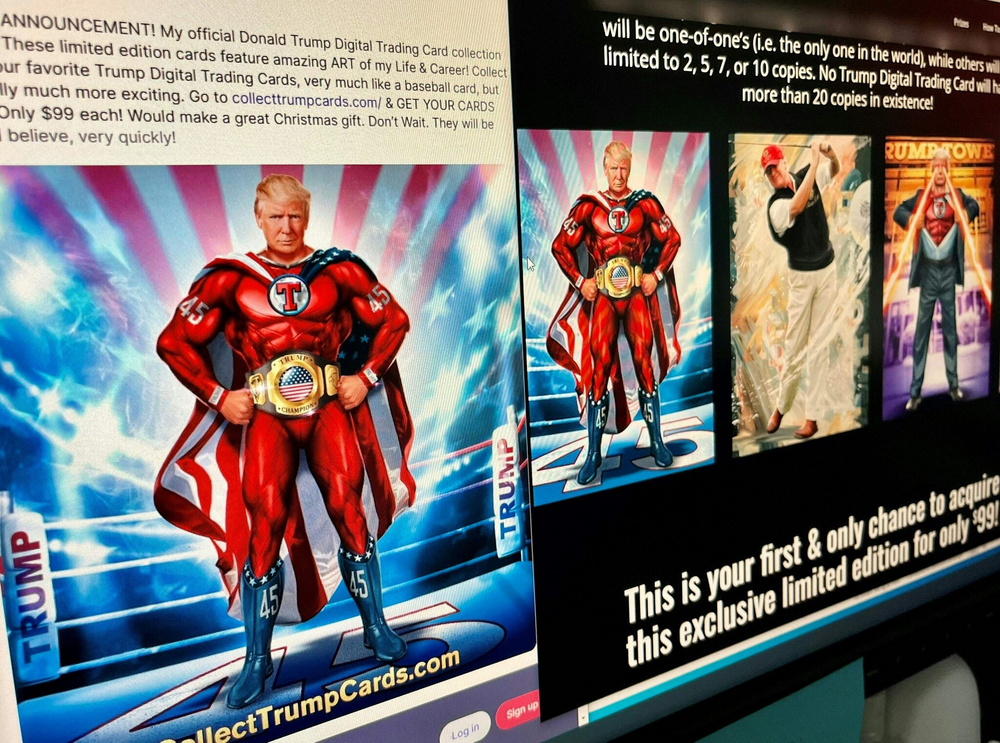

The change in stance and view began with Trump’s release of his own NFT series . Bill Zanker, Trump’s longtime friend and co-author of Think BIG and KickAssin Business and Life, was his initial “guide.” Zanker said in an interview that he pitched an idea to Trump around the beginning of 2022: NFTs of former presidents as artistic images. Zanker recalled that Trump was very interested in this, but did not want to call them NFTs, but called them “digital trading cards on a computer.” Trump said: “If you call them NFTs, people don’t understand.”

In December 2022, when the crypto market entered a super cold winter, Zanker approached Trump again and asked him if he was willing to continue the NFT project. Trump readily agreed, "You know, a lot of my friends said I shouldn't do it. But I like it, let's do it." This may be the beginning of Trump's desire to be the "crypto president". A month ago, he just announced that he would run for president in 2024.

Trump's NFT series was quickly questioned after its release, and those confused by the move included former White House chief strategist Steve Bannon, who claimed that whoever persuaded Trump to enter the digital token business should be fired. In addition, several current and former advisers to Trump said that this seemingly random business venture was a mistake that undermined the identity of the 45th president. However, these critics, including Trump himself, did not expect that this business behavior paved the way for his campaign for "cryptocurrency president."

Cryptocurrency becomes an important issue in the election, and is pushed to a "new height"

In March of this year, Trump began to talk about the advantages of cryptocurrencies: "I make money with it and have fun with it," Trump called them "crazy new currencies" in an interview with CNBC. Two months later, when he hosted "big holders" of his NFTs at Mar-a-Lago, he announced that he would "support" cryptocurrencies and criticized Biden and the Democratic Party for "being against cryptocurrencies." Many people believe that this gathering was a turning point in elevating cryptocurrencies to a key issue in this campaign.

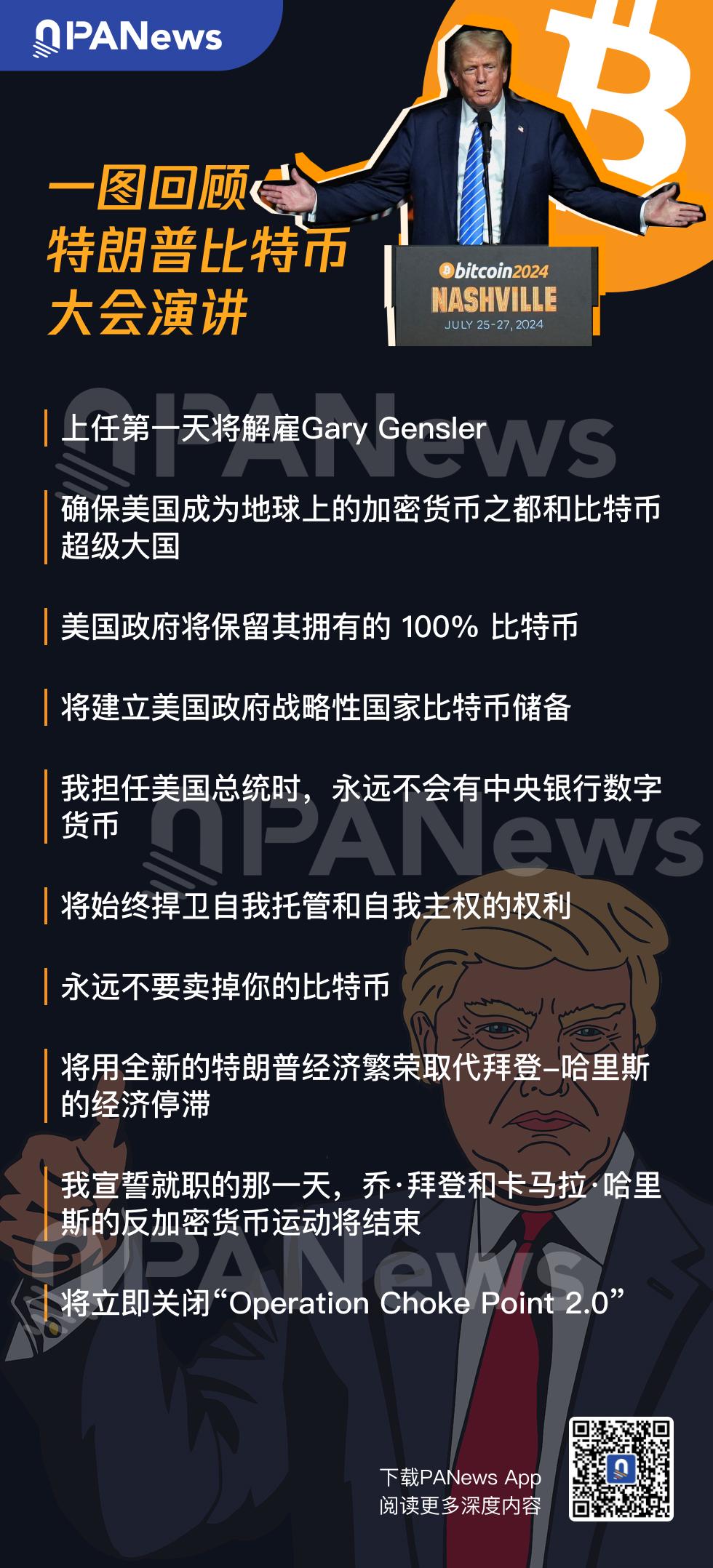

"I promise to the Bitcoin community that the day I am sworn in, Joe Biden's anti-cryptocurrency campaign will end." After escaping the assassination, Trump's passionate speech at the Bitcoin 2024 conference held in July this year ignited this cryptocurrency conference. If it weren't for the words "bitcoin2024" on the background board behind him, you would easily mistakenly think that this was a special rally for Trump.

In this meeting that has completely transformed into a "cryptocurrency president", Trump frequently made "golden sentences", "If Bitcoin is going to land on the moon, I hope the United States will be the country that leads this trend." Trump said that he plans to turn the United States into "the cryptocurrency capital of the earth" and "the world's Bitcoin superpower." When he announced that he would fire Securities and Exchange Commission Chairman Gary Gensler once he returned to the White House, there was an immediate burst of warm cheers and applause from the audience. In addition, he also said that if he is re-elected, he will set up a presidential advisory committee to ensure that the regulatory framework for cryptocurrencies becomes law.

Based on his pro-cryptocurrency stance, Trump has received support from many well-known figures in the cryptocurrency industry, including Kraken founder Jesse Powell and Gemini co-founders Winklevoss brothers. Elon Musk, the "number one fan" of Dogecoin, who has an ambiguous relationship with cryptocurrencies, has become Trump's campaign cheerleader. As the world's richest man, he has invested a lot of time and financial resources to help him campaign.

In the nearly six months before the election, Trump frequently expressed his enthusiasm for Bitcoin. He made a bold statement that he would dominate Bitcoin mining and make "all remaining Bitcoins produced in the United States." He also used cryptocurrency to buy burgers in a Bitcoin-themed bar, becoming the first former US president to pay with Bitcoin, and said "this is the beginning of a new era."

In addition, the Trump family also launched the DeFi project World Liberty Financial (WLFI), which provides lending services for cryptocurrencies on the Ethereum network. Trump himself has repeatedly announced and promoted the project on social media, but the sales of its WLFI tokens were still far below initial expectations, and it had to significantly cut its goals. The final fundraising of $30 million was 90% less than the $300 million initially sought. According to sources, WLFI plans to issue stablecoins.

Can no longer remain silent, Harris makes "limited overtures" to the crypto industry

Unlike Trump's proactive attack, Democratic presidential candidate Kamala Harris was reluctant to devote too much energy to the issue of cryptocurrency. However, in the election struggle, Harris and the Democratic Party had to give up remaining silent and make some compromises and commitments to the crypto industry.

The launch of the "Crypto for Harris" campaign is a sign of the Democratic Party's fight against Trump's appeal in the cryptocurrency industry, which also means that cryptocurrency has begun to become an important issue that cannot be ignored in the confrontation between the two sides. At the Crypto4Harris roundtable held in August, U.S. Senate Majority Leader and Democratic Senator Chuck Schumer said that if Kamala Harris is elected president, his goal is to pass bipartisan legislation to support cryptocurrency by the end of this year and provide clear regulatory norms for the U.S. crypto industry. Several well-known crypto supporters, including billionaire Mark Cuban and SkyBridge Capital founder Anthony Scaramucci, also spoke at the meeting to discuss ways to support Harris' campaign and raise funds.

However, since Harris and her campaign team members were absent from the event, the "Crypto4Harris" event was also questioned by opponents, saying that its goal was to convince the skeptical digital asset industry that they should support Harris for president, and many people believed that this event would basically have no effect.

Harris first mentioned blockchain in a speech at the Economic Club of Pittsburgh in September, but this speech was just a passing mention. "We will invest in biomanufacturing and aerospace, maintain our dominance in artificial intelligence and quantum computing, blockchain and other emerging technologies, and expand our leadership in clean energy innovation and manufacturing." However, according to Bloomberg, Harris mentioned plans to encourage technologies including "digital assets" at a fundraising event before this speech to attract donors.

Additionally, in an 80-page economic plan on Harris’ campaign website, there is a line that says if elected, the vice president will “encourage innovative technologies like artificial intelligence and digital assets while protecting our consumers and investors.”

Entering the final sprint, when Trump has already made a combination of punches to become the "crypto president", Harris's cryptocurrency policy finally came late. On October 14, Harris announced a new policy aimed at providing more economic opportunities and other development opportunities for black men, one of which is to "protect cryptocurrency investments and ensure that black men who invest know that their funds are safe."

Harris's move is clearly intended to attract black male voters, a group that has long been crucial to the Democratic Party. This policy has also encountered many doubts on social media, with some crypto supporters criticizing its use of identity politics. Harris' campaign team had to come out to clarify that such plans will be implemented without any specific racial restrictions.

Compared to Harris's silence on cryptocurrencies, her "campaign team" occasionally reveals more details. For example, Mark Cuban told the media in July that Harris' campaign team had contacted him to ask about digital assets. He later said that Harris' camp was "much more open" to cryptocurrencies than the Biden administration. However, according to Mark Cuban himself, he did not make any donations to Harris.

Chris Larsen, co-founder and chairman of Ripple, is one of the largest individual donors in the crypto industry in this presidential campaign, having donated more than $11.8 million to PACs supporting Harris' campaign. In an interview, he said that his trust in Harris came from his conversations with people within the campaign team, and he believed that Harris could play a key role in correcting the major mistakes made by the Biden administration on cryptocurrency policy.

The Biden administration focuses on encouraging so-called "responsible financial innovation" and "safe and affordable financial services," and calls for reducing the "risks" that digital assets pose to multiple areas, including financial stability, cybercrime, and human rights. In May, Biden vetoed a bill from the Republican-led Congress, arguing that the bill "inappropriately limits the SEC's ability to develop appropriate protections and address future issues related to digital assets."

In addition, although Harris did not publicly express his dissatisfaction with Gary Gensler like Trump, according to people familiar with the matter, his transition team is reviewing candidates to succeed the SEC chairman. Two possible successors are Professor Chris Brummer of Georgetown University Law School and Erica Williams, chairman of the Public Company Accounting Oversight Board (PCAOB), who are rumored to be more optimistic about cryptocurrencies such as Bitcoin than Gensler.

Crypto voters become a key force in US political elections

According to the tracking and statistics of StandWithCrypto, a bipartisan crypto advocacy organization in the United States, there are 355 candidates who support cryptocurrencies in the congressional race, of which 291 have changed from having no stance on cryptocurrencies to a positive stance, and more than 300 have supported at least one bill supporting cryptocurrencies. Candidates across the country have issued more than 1,900 statements in support of cryptocurrencies, proving that this issue is gaining attention across the political spectrum. Based on this, Brian Armstrong, CEO of Coinbase, believes that next year’s U.S. Congress will be very friendly to the crypto market, and “will be the most crypto-friendly Congress ever.”

According to a recent poll conducted by the Digital Chamber, one in seven potential voters (16%) consider themselves to be part of the cryptocurrency voting bloc. Among them, 40% of black voters said that cryptocurrency is "very" or "extremely" important in deciding who to support in 2024. Obviously, cryptocurrency voters are a force that cannot be underestimated in this election, and have had a clear impact on the policy positions of both incumbents and challengers.

Today, there is bipartisan agreement that the government should prioritize policies that encourage growth and protect consumer freedoms. Most Republicans and Democrats say supporting the crypto industry should be at least a moderate priority for the next president and Congress, with nearly a third of Democrats and more than a quarter of Republicans saying it should be a "high" or "very high" priority.

Anthony Scaramucci, who supports Harris, is very optimistic about Bitcoin's predictions, saying that Bitcoin will go higher no matter who is president. He believes that considering the potential market reaction to Trump or Harris's victory, Bitcoin may rise in the short term if Trump wins, because Trump is widely believed to be a deregulator who may overturn many of the Biden administration's policies, but Harris has also expressed support for blockchain and Bitcoin.

Clearly, the cryptocurrency industry and its supporters have won in this election marathon.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse