Crypto Industry Recruitment Research Report: DeFi job seekers increase, and marketing positions grow in the Asia-Pacific region

Original author: Zackary Skelly (Head of Talent, Dragonfly)

Compiled by: Zen, PANews

Well-known crypto VC Dragonfly Capital analyzes the crypto industry recruitment market every quarter to provide its portfolio companies with insights into job trends, job seeker perceptions, portfolio company activities and forecasts.

Recruitment Market Trends

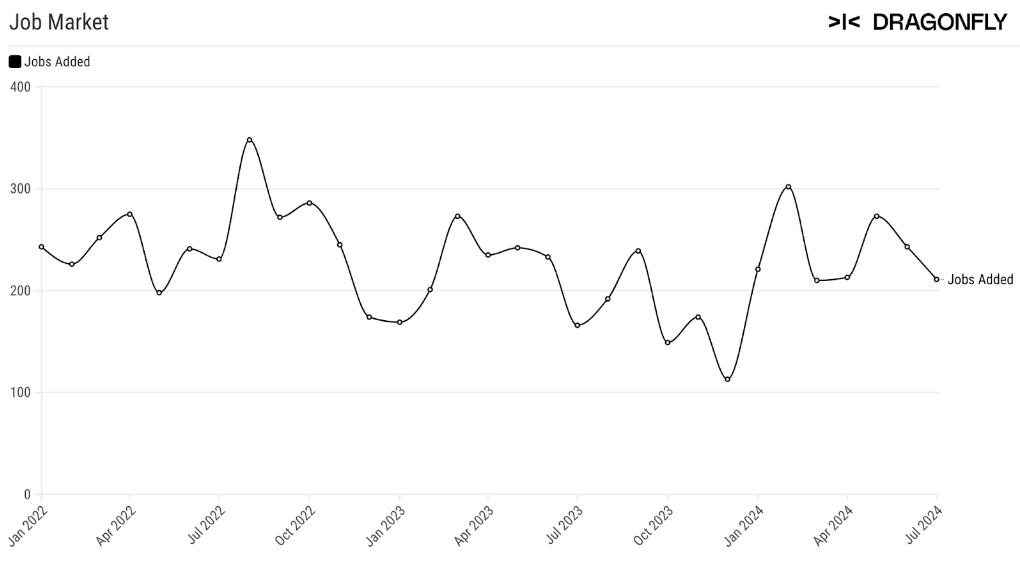

Dragonfly monitors multiple signals when analyzing the market, but "new positions at portfolio companies" best reflects the overall sentiment of the industry. In short, the talent recruitment market in the crypto industry gradually recovered from 2023 until a surge in the first quarter of 2024, but stagnated after entering the second quarter.

Quarterly job changes

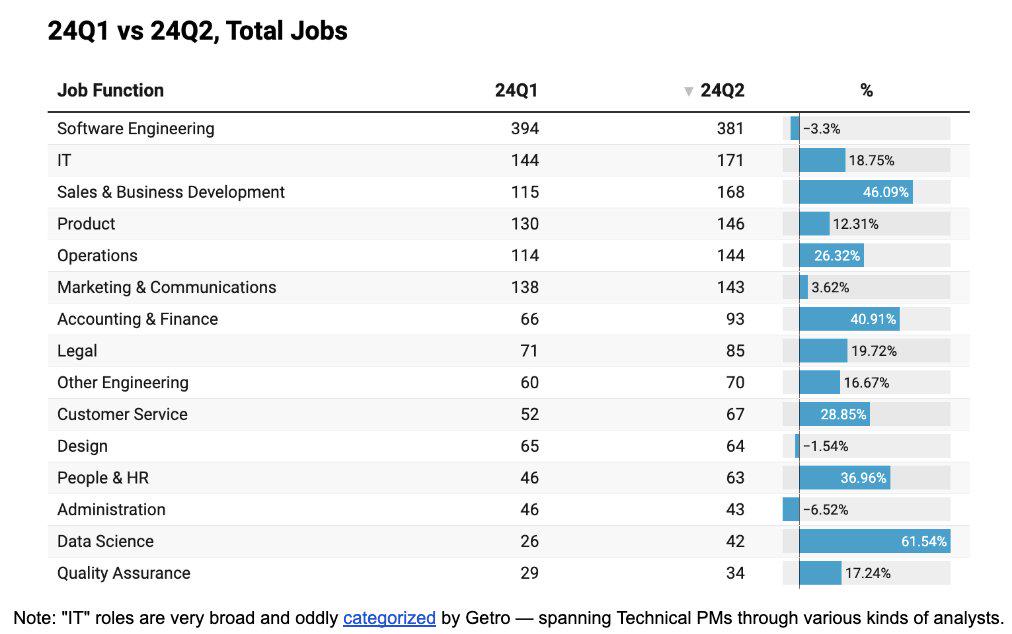

In the second quarter of 2024, engineering and design positions are relatively stable, GTM (GoToMarket) positions surge, and data science positions also grow to a considerable extent. Marketing positions shift to leadership positions.

Year-on-year comparison

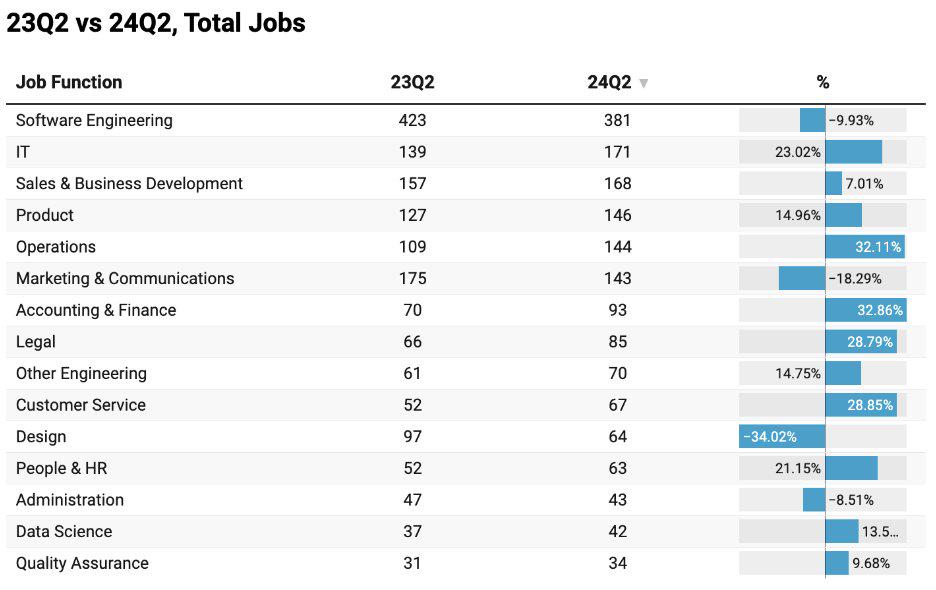

Comparing Q2 2023 to Q2 2024, GTM positions see significant growth, particularly in finance, operations, legal, and customer support.

Engineering positions have become more segmented, Rust language is in high demand, DevRel (Developer Relations) and Protocol Eng (Protocol Engineer) are still popular, while design positions have seen a significant decline.

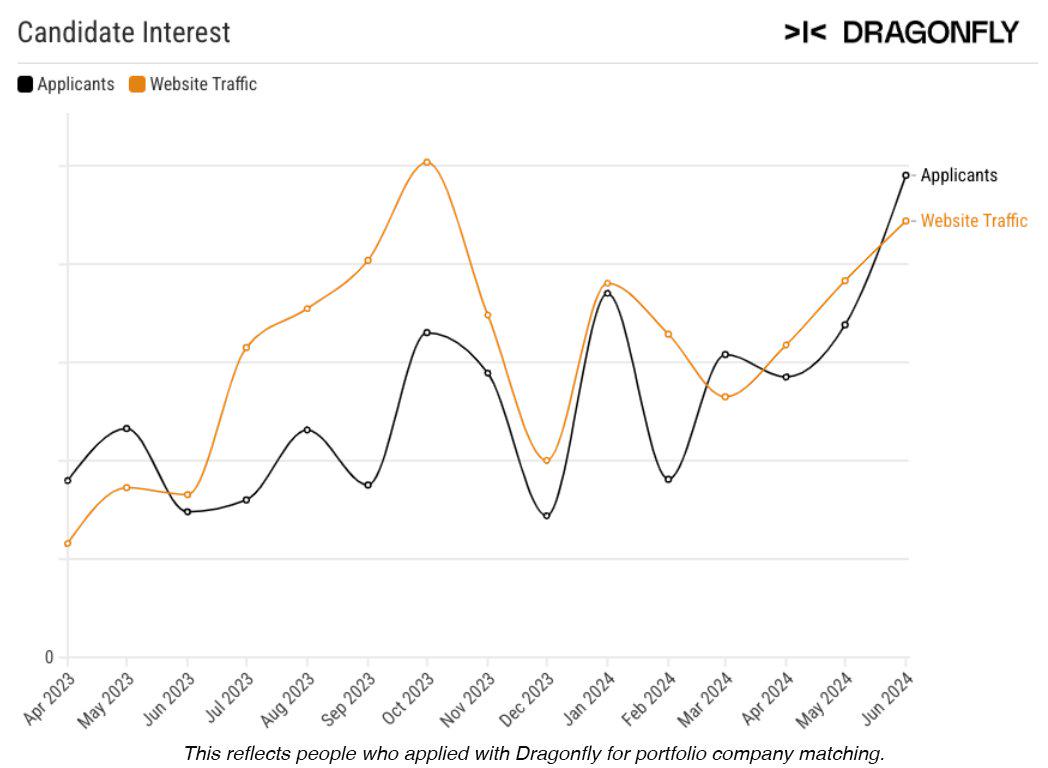

Job seeker interests

In the second quarter of 2024, more DeFi job seekers appeared in the market, while those who focused on infrastructure construction stayed where they were, looking for product-market fit. Many people are skeptically curious about the combination of AI and encryption - exciting, but the use case is uncertain and seems too advanced.

In addition, zero-knowledge proof (ZK) remains a popular technology type among senior software engineers (Sr SWE).

Evolving priorities, increased scrutiny

Job seekers seek project teams that still have a reliable roadmap after TGE rather than empty "ToTheMoon" slogans, and prefer companies with strong ecosystems and well-known brands. Few job seekers are willing to consider jobs that do not match their personal skills and have unclear job descriptions.

Crypto Burnout and the Openness of Web2

More and more crypto-native job seekers are willing to consider Web2 job opportunities while seeking positions in the crypto industry. Conversely, exchange-traded funds (ETFs) and crypto-friendly US policies have attracted more talent from traditional finance and Web2 fields.

Office model and salary conditions

Remote and hybrid working are still the first choice, but more and more companies are beginning to discuss arranging offline physical offices. In terms of salary expectations, job seekers still have high standards and most are unwilling to compromise.

Portfolio Hiring Trends

Several of Dragonfly’s portfolio companies stepped up their hiring efforts in the second quarter, with increased interest in niche, product-focused engineering roles such as front-end development.

GTM hiring has grown in the Asia Pacific region, while engineering positions are expanding in the Europe, Middle East and Africa (EMEA) region. In addition, Layer 1 project parties (Alt L1s) are gaining momentum in hiring.

Recruitment Market Forecast

Hiring is tied to the US election cycle. Trump’s pro-crypto stance and Harris’ evolving attitude have sparked heated discussions, which may drive GTM hiring. Dragonfly expects this trend to continue, and as use cases solidify, job seekers’ sentiment towards the combination of AI and crypto will also shift to excitement.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse