Binance's trading volume has reached a "small goal" of one million, but Richard still wants to look to the future

Author: Nancy, PANews

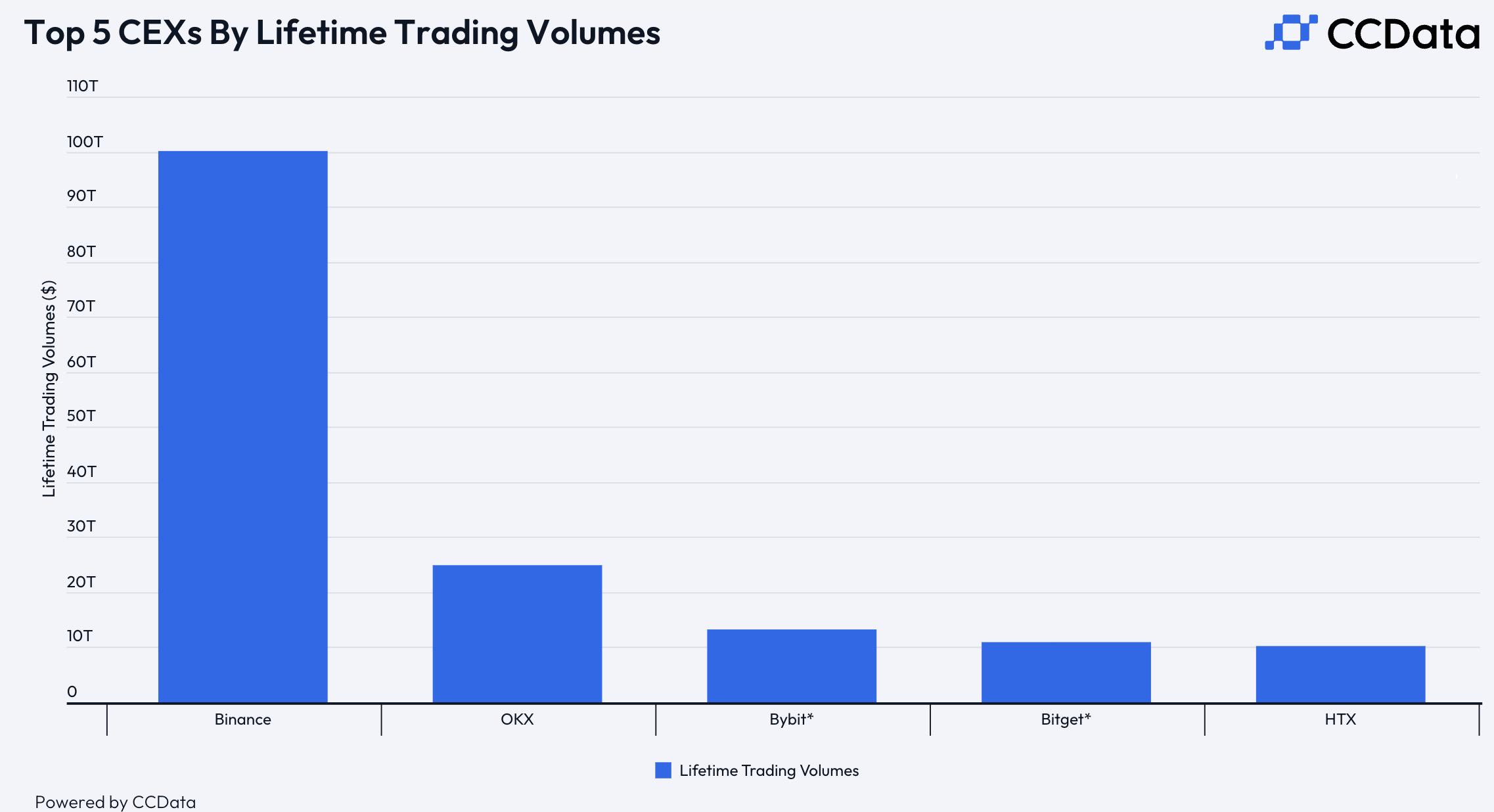

Trading is undoubtedly the main narrative of the crypto industry. Currently, the main users and funds in the industry are all centered around this core. At this stage, the top trading platforms in the industry have achieved a trading volume of up to 100 trillion US dollars. According to data released by CCData recently, Binance's cumulative spot and derivative trading volume has exceeded 100 trillion US dollars. This figure is far ahead of other mainstream exchanges and ranks first in the global crypto exchange list. This not only reflects Binance's strength, but also reflects the rapid development and increasingly widespread recognition of the crypto industry.

The first exchange with a trillion-dollar trading volume: a surge in users and strong market growth

For crypto exchanges, trading volume is an important yardstick for measuring their market influence and user activity. It is not only a barometer of platform liquidity and trading depth, but also a key indicator for market participants to evaluate platform stability and reliability.

According to the latest data from CCData, Binance's cumulative spot and derivatives trading volume has exceeded 100 trillion US dollars. What does this number mean? The US GDP in 2023 is about 27.36 trillion US dollars. For an exchange that has been established for 7 years, the trading volume is four times that of the US GDP, which means that it has extremely high trading activity, huge market capital volume and user base.

Top 5 CEX by historical trading volume Source: CCData

In fact, Binance CEO Richard Teng announced as early as September this year that Binance’s historical trading volume exceeded one trillion US dollars. This trading scale not only demonstrates Binance’s leading position in the market, but also directly reflects the prosperity of the entire crypto industry.

Large-scale trading volume means huge user participation. Binance announced in June this year that its global users had exceeded 200 million, and then further announced in September that the number had exceeded 225 million. This year alone, Binance has added more than 45 million new users, which also shows Binance's strong growth momentum and continued appeal. Prior to this, Binance had spent five years to accumulate the first 100 million users, but in just over two years, the number of users has achieved a leap from 100 million to 200 million.

“This milestone is not only a victory for Binance, but also a sign of strong growth and maturity of the entire crypto industry. In this process, cryptocurrencies have made the transition from ‘early adopters’ to ‘early majority’, indicating that more and more of the global population is beginning to accept cryptocurrencies and their infinite possibilities.” Richard Teng emphasized that looking forward to the future, Binance’s focus remains on leading the promotion of financial inclusion and innovative initiatives.

The key to supporting the dual growth of trading volume and user numbers, in addition to the mainstreaming of the crypto industry, lies in Binance's continuous iteration and innovation of trading products, which is a deep insight into and active response to user needs.

Focusing on user needs, Binance’s trading product evolution and innovation this year

Judging from the history of iteration of trading products of crypto exchanges, it has long evolved from the initial single spot trading and other basic functions to diversified trading options such as contract trading, leveraged trading, futures trading, staking and lending, fixed investment and NFT market to meet the needs of different types of investors.

In addition to the above functions, Binance has also launched many new products this year, including the token issuance platform Megadrop, trading robots, HODLer airdrops, liquidity staking tokens BNSOL, pre-market trading and derivatives trading expansion.

Megadrop : In April this year, Binance launched Megadrop, a token issuance platform that combines Binance Earn and Web3 wallets. It allows users to subscribe to BNB regular products or complete project tasks in Binance Web3 wallets. Direct interaction with selected project parties can obtain airdrop rewards, providing users with a friendly and multi-faceted channel.

Trading robots : Crypto trading robots have significant advantages such as more efficient execution of transactions, elimination of emotional bias in trading decisions, and 24-hour trading, and their popularity has surged. In May this year, Binance also launched a trading robot service that can meet multiple goals, mainly including spot grids, arbitrage robots, smart positions, fixed investment plans, and algorithmic orders. According to Binance's official website, as of October 21, Binance has run more than 112,000 strategies, involving assets worth more than US$6.1 billion.

HODLer Airdrop: To increase the trust and loyalty of BNB holders, Binance has launched an airdrop program for HODLers. Users who subscribe to regular or demand products on the Binance platform with BNB can receive airdropped tokens issued by projects with high circulating supply and planned to be listed on the Binance platform.

· BNSOL : Solana’s liquidity staking market has shown strong growth momentum this year. The rapid growth of funds has attracted participation from all parties. Binance also launched the BNSOL service in September this year. Users can obtain the liquidity staking token BNSOL after staking SOL. They can earn staking rewards and can also use it flexibly on Binance products (such as Binance fixed investment, staking borrowing and one-click buying of coins) and external DeFi platforms.

Pre- market trading: Thanks to the surge in airdrop projects and star projects, pre-market trading has become a popular market feature, allowing users to trade projects that have not yet been launched. For investors, pre-market trading is not only a preview of capital flows, but also crucial for capturing market opportunities and adjusting trading strategies. Binance recently officially launched the pre-market trading function and launched the first pre-market market trading token Scroll, which users can buy and sell before the Launchpool token is listed.

These new products not only enrich Binance's product line, but also reflect its simple, transparent, innovative, high-speed and community-oriented product culture. In addition, in response to the change in market trends, Binance has also launched a number of popular projects such as TON and MEME ecology, actively responding to more user investment needs while exploring more traffic growth space.

The ultimate manifestation of users' demand for the platform lies in the product, and the product itself can most directly reflect the platform's systemic capabilities. From this point of view, Binance's product innovation model based on "user experience" not only broadens users' trading options and significantly improves trading flexibility and efficiency, but also effectively promotes the platform's continued growth and helps the crypto trading market to further mature.

CZ ’s “exit”, Binance’s road to compliance

The word "GM" is not only CZ's freedom, but also the start of a new compliance cycle for Binance. Compliance has always been an important guarantee for products to win user trust and competitive advantages, and it is also a safe foundation for promoting product innovation.

After experiencing the rapid development stage in the early days of cryptocurrencies, Binance has shown amazing growth under the leadership of CZ. However, as global compliance has gradually been implemented, Binance has also experienced tremendous changes in the era of stricter crypto regulation. Today, Binance is led by its new head Richard Teng to respond to the evolving regulatory environment from a new compliance perspective.

For example, this year, Binance has obtained compliance licenses in multiple jurisdictions around the world, including the Virtual Asset Service Provider License issued by the Dubai Virtual Asset Regulatory Authority in April this year; in September, Binance Kazakhstan obtained a full regulatory license officially approved by the Astana Financial Services Authority (AFSA), becoming the first digital asset platform to obtain AFSA's full regulatory license; the following month, Binance was included in the Virtual Asset Service Provider Registration Center of the Argentine National Securities Commission (CNV), achieving the 20th global regulatory milestone... These news all highlight Binance's global compliance momentum.

Not only that, Binance is also working on compliance in its own business. For example, Binance announced in June that it would implement stricter monitoring policies, including technical improvements and the establishment of channels for reporting abuse, to address account abuse on the platform.

To this end, Binance has invested a lot of manpower and financial resources in compliance. According to Richard Teng, Binance plans to have more than 700 compliance employees by the end of 2024, and the annual expenditure to meet regulatory requirements (including US supervision under the plea agreement) will exceed US$200 million.

“A rising tide lifts all boats applies to industry-wide compliance upgrades, meaning that once all major players in the field are fully compliant, irresponsible players will either be forced to meet new standards or exit the market, allowing the industry to enter a virtuous cycle of increasingly consolidated trust, driving increased cryptocurrency adoption. In the long run, abandoning best compliance practices will lead to a loss of user trust and a decline in business. More importantly, no matter how much tactical benefit these players can gain from lax anti-money laundering and identity authentication policies, such behavior will ultimately hinder the development and maturity of the entire industry, resulting in a greater negative impact on all participants and users. The industry should learn from Binance’s past mistakes and not be a boat waiting for the tide to lift it, but become the tide itself.” Richard Teng also reiterated the necessity of compliance on the occasion of Binance’s seventh anniversary.

The tide of the times is still surging. Looking back over the past seven years, with a deep understanding of user needs, a rich product line, flexible adaptability and continuous innovation drive, Binance has always flexibly adjusted its course in the crypto voyage, avoiding the "reefs" and "storms" of the market, and dared to take the initiative to create wind to ensure a smooth sailing. Now, facing the volatile market environment and complex regulatory environment, Binance is welcoming the next development cycle with a more stable and mature attitude.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse