A quick look at the eight contenders for the Solana spot ETF

Author: Blockworks

Compiled by: Felix, PANews

The U.S. Securities and Exchange Commission’s (SEC) approval of a spot Solana exchange-traded fund (ETF) appears to be in the final stages, with an initial group of seven potential issuers filing revised S-1 filings in recent days and a new entrant, CoinShares, joining the fray.

Notably, each document includes references to pledges, which, as previously reported, is required by the SEC to be included by issuers.

As the crypto industry prepares for a third possible SEC-approved crypto ETF, here are the eight companies that have applied to launch a Solana ETF, ranked in order of first filing:

VanEck

VanEck was the first company to file for a Solana ETF about a year ago this month. At the time, some compared the filing to a call option on Trump’s victory in the November election, despite the SEC’s insistence that Solana was a security.

The bet paid off, but it could be a Pyrrhic victory if the SEC follows its precedent and approves bitcoin and ethereum exchange-traded funds (ETFs) simultaneously, rather than in the order in which they were submitted.

The bet paid off, but it could be a Pyrrhic victory if the SEC follows precedent and approves bitcoin and ether ETFs all at once, rather than in the order in which issuers first file.

To this end, VanEck has been advocating that the SEC adopt a "first-to-file" principle, believing that this is more conducive to innovation and competition.

VanEck taps Kiln to provide Solana staking services for its European exchange-traded products (ETPs).

Related reading: Institutional entry, tokenized stocks and liquidity changes: VanEck investment managers look forward to the future of the crypto market

21Shares

Two days after VanEck’s application, 21Shares also submitted an application for the Solana ETF, and it also hopes that the SEC will adopt the “first to file” principle.

21Shares’ planned Core Solana ETF will trade on the Cboe BZX exchange, and redemptions will be made in the form of SOL tokens.

Coinbase is listed as a staking services provider mentioned in 21Shares’ base prospectus filed in Europe.

Related reading: Spot ETF will be launched as early as July. Can Solana repeat the BTC script?

Canary Capital

Canary Capital filed for the SOL ETF just days before the U.S. election.

Canary Capital is smaller than some of the funds on this list, but has recently gained notoriety for filing for a variety of altcoin ETFs, including SUI, SEI, INJ, TRX, PENGU, HBAR, LTC, and XRP.

Related reading: Canary Capital frequently submits ETF applications. Has the copycat ETF application become a disguised advertising business?

Bitwise

Bitwise first filed for an exchange-traded fund (ETF) shortly after Trump’s election. In an interview, the company’s CEO Hunter Horsley called Solana an “incredible emerging asset and story.”

Bitwise also launched a Solana-based collateralized ETP in December, with Marinade providing collateral services. If the U.S. approves collateralized ETFs, this could bode well for Marinade.

Related reading: Bitwise Chief Investment Officer: Former skeptics now want to buy BTC

Grayscale

Grayscale is looking to convert its SOL Trust into a spot ETF, similar to how it does with its Bitcoin and Ethereum Trusts. Currently, the GSOL Trust is trading at a premium to its net asset value, meaning investors are willing to pay a higher price for the product than the underlying SOL.

Last month, the SEC delayed its decision on Grayscale’s exchange-traded fund (ETF), saying it had “not reached any conclusion” on the 19b-4 filing for the proposed spot SOL ETF.

Related reading: Grayscale's latest report: Q1 inventory performed poorly, Q2 focuses on RWA, DePIN and IP tokenization

Franklin Templeton

Franklin Templeton Investments offers exchange-traded funds (ETFs) for Bitcoin and Ethereum, and has filed paperwork for exchange-traded funds (ETFs) for SOL and XRP.

The $1.5 trillion fund has other crypto initiatives, including a small allocation to SOL in its Digital Asset Core SMA. Its Tokenized Money Market Fund also added support for Solana earlier this year.

The $1.5 trillion fund has also invested in a number of other crypto projects, and its crypto separately managed accounts (SMAs) have a small allocation to SOL. Its tokenized money market fund also gained support from Solana earlier this year.

Related reading: Behind the “undervalued” Solana DeFi: How to break the “ecological internal friction” between high-yield staking and lending agreements?

Fidelity

In the current competition, Fidelity is the giant. The assets under management of its Bitcoin exchange-traded fund (ETF) are second only to BlackRock, and the assets under management of its Ethereum ETF lag behind BlackRock and Grayscale's Switch Trust.

Fidelity, a major provider of brokerage, trust and individual retirement accounts, will likely be a key driver of inflows into an approved SOL exchange-traded fund (ETF).

Related reading: The current state of the alt-ETF boom: a detailed look at crypto ETF applications for 2025

CoinShares

CoinShares is the latest to join the race for a Solana exchange-traded fund (ETF), joining the fray as existing issuers race to file amended S-1 forms.

This European asset management company focusing on cryptocurrencies has currently launched an ETP for BTC, ETH and a series of altcoins - Tezos ETP. Does anyone want to try it?

The European cryptocurrency-focused asset manager has launched exchange-traded products (ETPs) for BTC, ETH, and a range of altcoins.

Related reading: Solana spot ETF has made substantial progress again, SEC focuses on evaluating the pledge and redemption mechanism, and will be implemented as early as July

You May Also Like

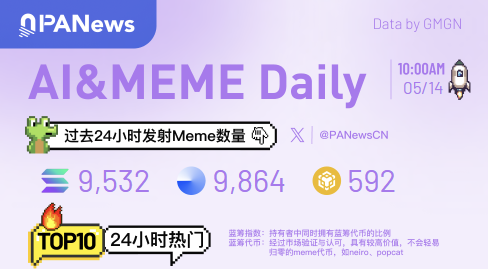

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.5.14)

Trump Jr Backed Thumzup Dogecoin Mining Deal Stuns Investors