CryptoPunks changes ownership again, with Ribbit Capital as the financial backer behind the scenes. Can it usher in new development opportunities?

Author: Zen, PANews

The originator of NFT, CryptoPunks, has officially changed hands again after being sold to Yuga Labs, the developer of BAYC.

On the evening of May 13, CryptoPunks, the iconic work of NFT and crypto art, officially changed hands - a foundation called Infinite Node ("NODE") acquired it from Yuga Labs. Although the terms of the transaction have not yet been disclosed, according to the media "NFT Now" citing multiple insiders, NODE paid about $20 million for the acquisition. Influenced by this news, the floor price of CryptoPunks also rose from 42 ETH to 47.5 ETH.

CryptoPunks and their new “home” NODE

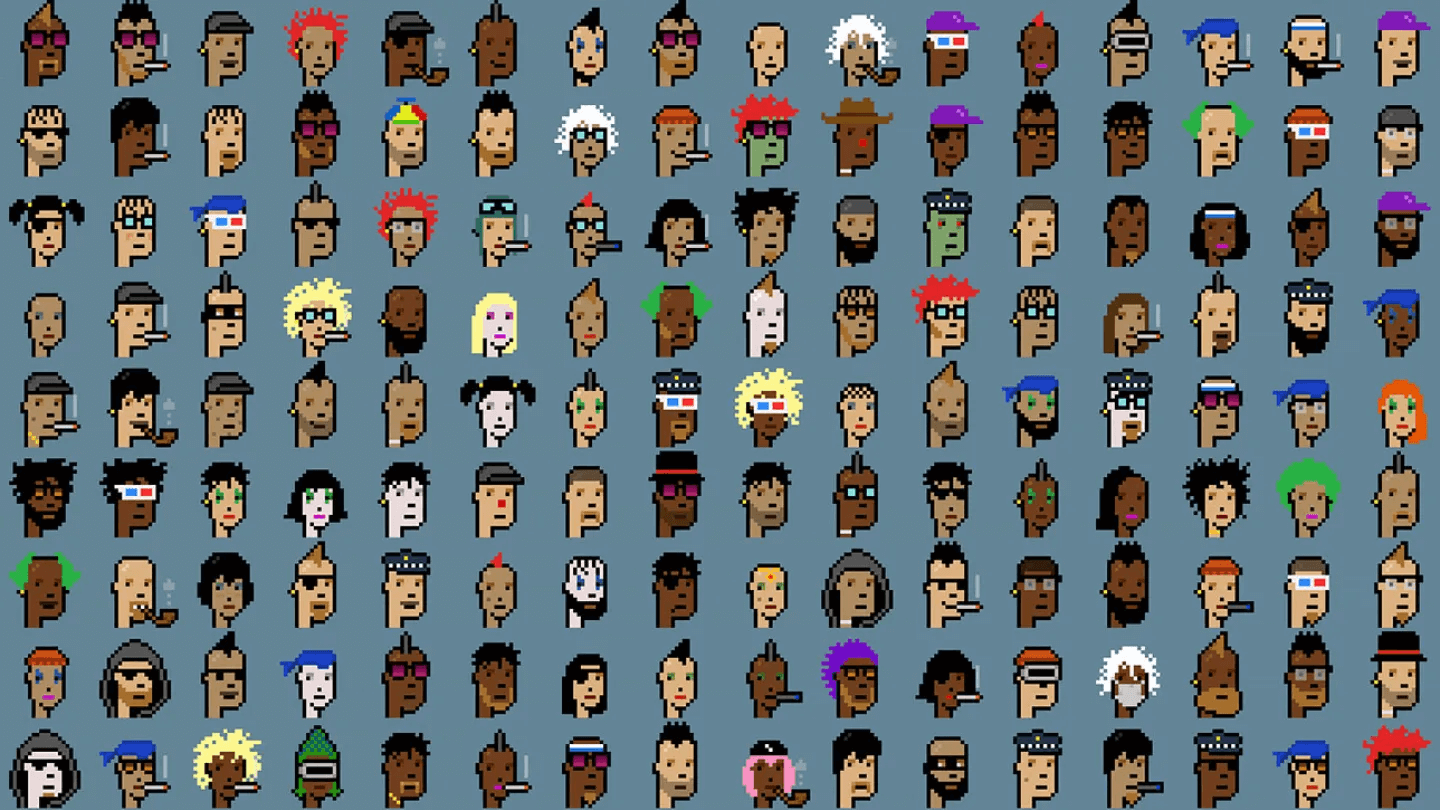

CryptoPunks, the "ancestor of NFTs", was launched by Larva Labs in 2017 and is widely regarded as a catalyst for the modern digital art movement. Larva Labs is a creative technology company founded by Matt Hall and John Watkinson. Thanks to the significance and far-reaching impact of CryptoPunks, the cumulative transaction volume of over US$3.07 billion has also made the two creators among the best-selling living artists.

In March 2022, Larva Labs transferred the intellectual property rights of CryptoPunks and its other work Meebits to Yuga Labs. Three years later, CryptoPunks changed hands again and settled in its new home NODE.

Yuga co-founder Wylie Aronow, aka Gordon Goner, commented: “We have always been committed to promoting and preserving their cultural heritage, but we always knew that the Punks needed a permanent home. Seeing this vision come to life with the help of the Node Foundation feels like coming full circle. They are in the best position to preserve the Punks’ cultural heritage.”

Founded by Ribbit Capital founders Micky Malka and Becky Kleiner, NODE Foundation is a non-profit organization dedicated to the preservation, research and exhibition of digital art. It aims to enhance the status of Internet-native artworks and integrate them into broader cultural and academic discussions.

In April, the NODE Foundation announced a $25 million grant from Malka and Kleiner to advance its vision for the future of digital art. The organization, which calls itself a "perpetual fund and mission-driven," said the acquisition "opens up a new model for protecting native Internet culture."

Opening the way to mainstream art

Even though CryptoPunks’ sales have surpassed those of all living contemporary artists, it has never made it onto the traditional art rankings or entered the mainstream discourse system. NODE believes that solving this cultural gap first requires redefining the way digital art is experienced.

“Our goal is to build a networked architecture that allows digital art such as CryptoPunks to flourish in the digital field and be included in the grand narrative of art history.” NODE said it will continue and carry forward the Punk spirit and achieve this through three pillars:

-

Preservation: Relying on advanced blockchain infrastructure to ensure the technical integrity and long-term availability of CryptoPunks;

-

Community: Build an active ecosystem connecting digital innovators and art lovers;

-

Extension: Create new scenarios so that CryptoPunks can be studied and displayed as both examples of technological innovation and artistic achievements

NODE plans to build a permanent exhibition hall in Palo Alto to display all 10,000 CryptoPunks. The exhibition hall will also run an Ethereum full node to improve the accessibility and sustainability of the works in the collection. Micky Malka said: "Through museum-level preservation methods and the cooperation of perpetual donation funds, we aim to establish future-oriented guarantees for this landmark work and make it easier for scholars, curators and collectors to interact with it."

To achieve the above goals, NODE has formed an advisory board whose members are all well-known figures in the CryptoPunks community and crypto art, including Matt Hall and John Watkinson, Wylie Aronow, and Art Blocks founder Erick Calderon (also known as "Snowfro"). During the transition period, Natalie Stone will be hired as an advisor to the NODE team to be responsible for the management of the project.

Protecting cultural fundamentalism

After the acquisition announcement was released, the community generally interpreted it as a positive, and the floor price of CryptoPunks also rose from 42 ETH to 47.5 ETH.

"This is undoubtedly good news for punks," CryptoPunks holder @VonMises14 expressed high praise for the acquisition. He believes that "this means that the punks IP has found its "end point", where it can grow and develop without any form of monetization or corruption."

Due to the "self-destruction" of some blue-chip NFTs and the fact that CryptoPunks was almost "contaminated", the Punks community is particularly concerned about brand value and cultural purity.

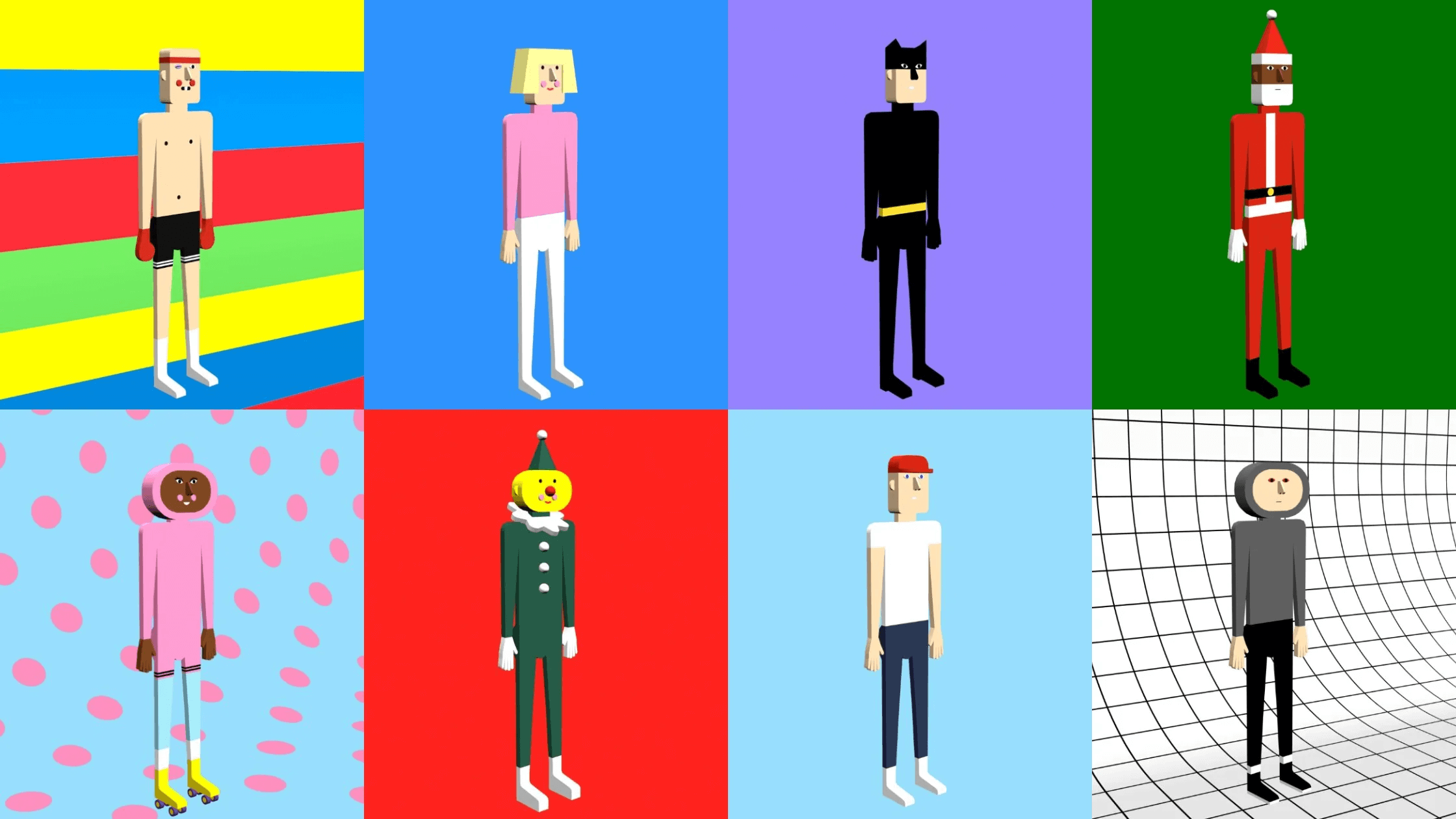

A year ago, Yuga Labs launched the Super Punk World NFT series based on CryptoPunks, which was strongly opposed and criticized by the community. Most people believed that the excessive "awakening culture" displayed by Super Punk World seriously deviated from the original core of punk, and many people even said that Yuga Labs was ruining Punks. After the strong opposition, Yuga Labs co-founder Greg Solano immediately said: "We will no longer touch CryptoPunks, but will only decentralize it and keep it on the blockchain", and said that he planned to support museums and institutions to purchase it to promote the original work to the public.

However, protecting the cultural value of CryptoPunks as works of art may require controlling their use, reproduction or monetization. As @jabranthelawyer, a lawyer specializing in the Web3 field, pointed out: "If NODE follows the traditional "cultural protection strategy", it is not difficult to imagine new restrictions: Will the freedom of punk commercialization be reduced? Will the control of derivative projects be stricter? Will restrictions be imposed in the name of "cultural integrity"? "

Yuga Labs granted IP usage rights and commercialization licenses to NFT holders immediately after acquiring CryptoPunks, allowing them to freely create, display and monetize on a personal and commercial level. After this acquisition, it is still unknown whether NODE will retain these commercial rights.

Then again, this is probably not the main concern of the punk community. For them, perhaps not making any effort is the best option.

You May Also Like

DOGE to $1 Still Possible, But This Meme Coin Could Turn $20 Into $2,000

Bitcoin Selling Pressure: Crucial Analysis Reveals Short-Term Holder Impact