Ethereum Fills Crucial CME Gap: Is $10K ETH the Next Target?

TL;DR

- Ethereum filled the $4,050–$4,100 CME gap after heavy liquidations drove prices sharply lower.

- Analysts highlight a confirmed golden cross and breakout above a four-year descending resistance line.

- ETH supply on centralized exchanges has dropped to a nine-year low, signaling strong accumulation.

CME Gap Closed After Market Decline

Ethereum extended its decline this week, with heavy liquidations hitting long positions as the price dropped from above $4,600 to near $4,000. The move completed the closure of the CME futures gap between $4,050 and $4,100, a level closely tracked by traders.

At the time of writing, ETH trades at around $4,200, down 1% in 24 hours and lower by 9% over the past week. Analyst CW commented,

CME futures gaps often act as price magnets. As CryptoPotato reported, the last time Ethereum filled a major gap, the asset gained more than 40% in the weeks that followed.

Order book heatmaps show that liquidity around the $4,200–$4,400 range has been absorbed during the decline. With the gap now filled, ETH has begun to stabilize near support levels, raising the possibility of upward pressure on short positions.

Long-Term Breakout on Monthly Chart

Analyst Merlijn The Trader highlighted a major breakout on the monthly timeframe. ETH has moved above a four-year descending resistance line and formed a MACD golden cross. He wrote,

The breakout ends years of repeated rejections at the same trendline. A confirmed MACD cross is viewed by many chart analysts as a sign of longer-term momentum shifting in favor of buyers.

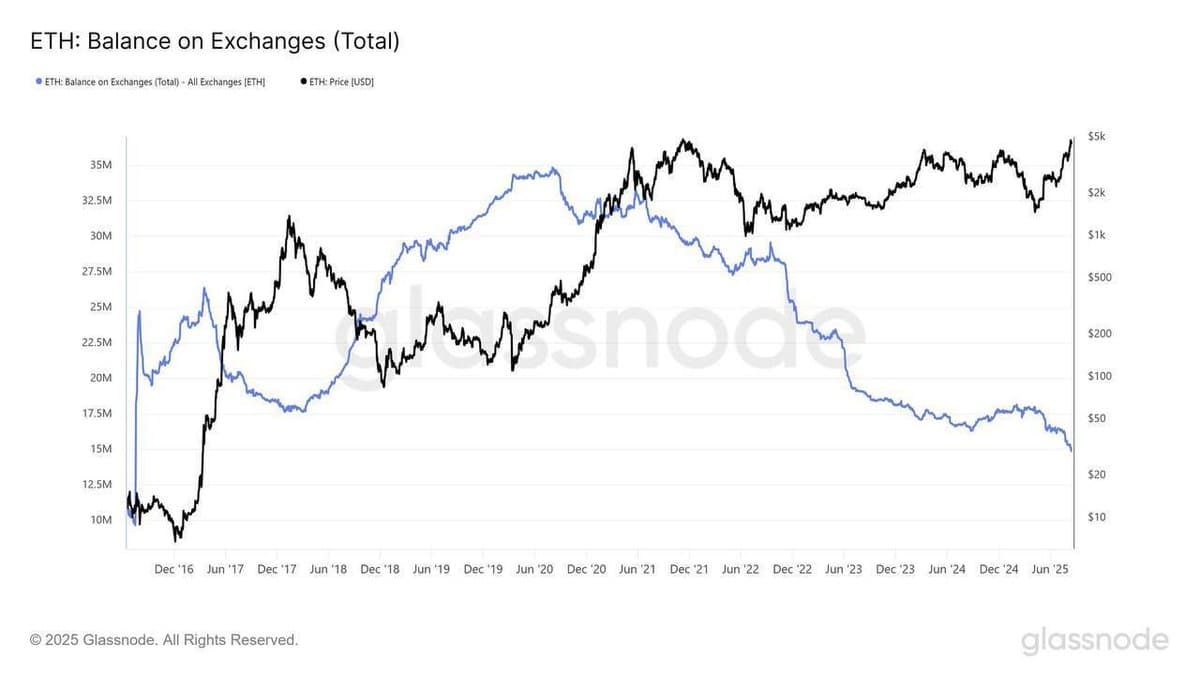

Exchange Supply at Multi-Year Lows

Analyst Cas Abbé pointed to exchange data showing a sharp drop in available ETH.

Source: X

Source: X

According to Abbé, exchange balances are now comparable to levels last seen when ETH traded at $30. They added,

With exchange supply shrinking and technical patterns turning positive, Ethereum’s price action is being closely tracked for signs of a potential rally.

The post Ethereum Fills Crucial CME Gap: Is $10K ETH the Next Target? appeared first on CryptoPotato.

You May Also Like

Shiba Inu (SHIB) Could Hit 2021 Highs Again, But Mutuum Finance (MUTM) is Set to Deliver 10x Higher Returns This Cycle

Russian oil deliveries to China fall in 2025 despite July rebound