Playing with Cookie Snaps: A hardcore interaction guide for three popular projects

By Stacy Muur

Compiled by: Tim, PANews

This is a hard-core practical guide on how to efficiently obtain Spark, Newton and Union airdrops. The common features of these projects are:

- Pre-TGE stage

- In hot trend

- Supported by capital and narrative

- Early contributors can participate

Spark: On-chain capital allocation and income protocol

Spark is a decentralized lending and savings protocol spun off from MakerDAO.

Currently, Spark has become an important part of the Sky ecosystem, focusing on capital allocation for DeFi and RWA protocols. With more than $2.6 billion in TVL and real cash flow from stablecoin revenue, Spark is considered one of the few early projects that have achieved product-market fit at TGE.

Cookie.fun data indicators:

- Mind share: 1.79%

- Sentiment Index: +53100

- Sectors: DeFi, RWA, Income, Stablecoin

- Current status: Pre-TGE stage

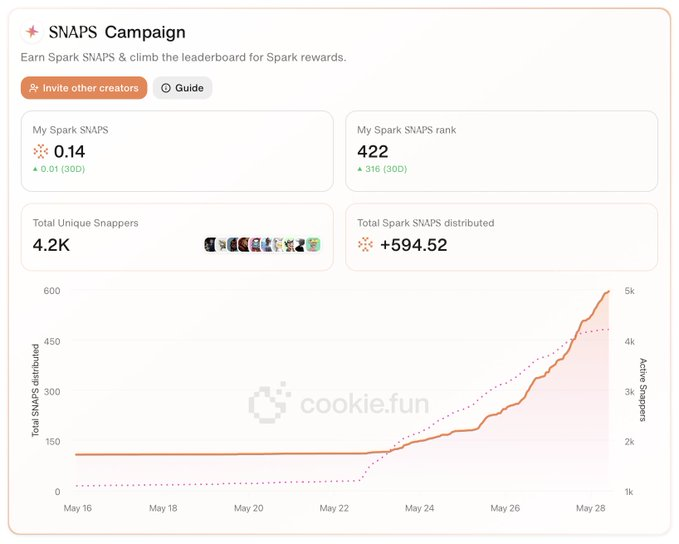

Spark Airdrop Guide: SNAPS Event

Platform: cookie.fun/tokens/spark

How SNAPS works

SNAPS is a contribution-based point system that users can earn by contributing to the development of Spark through content creation, narrative support and community participation. These points will be tracked and ranked on the Cookie.fun platform.

Mining Guide:

1. Register for a Cookie.fun account

Link your X account and start earning SNAPS by posting posts that match the Spark theme.

2. Write Spark content

Content format ideas: topic posts, Twitter Spaces, explainer videos, or educational Medium articles.

Please make sure your posts cover the core topics of Spark: on-chain lending, real-world assets, capital efficiency, and how sDAI works.

3. Keep your narrative consistent

Posts that support a core value proposition perform better in SNAPS rankings. Be sure to reflect the following ideas:

- DeFi Native Savings Layer

- Tokenized RWA Reserve

- MakerDAO’s Vision of Scaling with SubDAO

4. Interaction and communication

Interaction helps improve your SNAPS score. Don't just post - reply, quote, and participate in discussions on relevant topics.

5. Post polishing

Add relevant tags and visual materials, use Spark brand standards (ban Maker title), avoid information bombardment, and prioritize content quality

6. Impact the rankings

When the number of SNAPS reaches more than 10, you can unlock the invitation code and form a "core team" composed of contributors. This is a referral mechanism, and you will receive a 10% reward for the SNAPS generated by the invited users.

7. Optional: Submit a long article or activity idea

Some contributors are experimenting with hackathon initiatives, guide compilations, and cross-content campaigns.

Please note:

- Rewards usually focus more on originality, depth of contribution and authenticity. Please avoid inefficient flooding.

- SNAPS seems to be updated weekly, so you need to evaluate your returns and adjust your strategy in a timely manner.

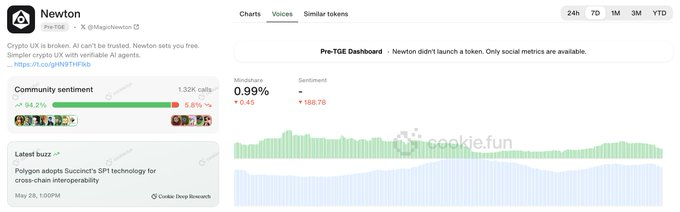

Newton: AI Agent Economic Infrastructure Layer

Newton is building a backend system for an AI-native economy, the core of which is an intelligent entity that can trade autonomously, execute logic, and achieve cross-DeFi platform integration. The project has received over $85 million in financing from top venture capital institutions, becoming one of the star projects in the field of intelligent entities with the highest amount of financing and no tokens issued yet.

Newton is now online:

- A functioning front-end

- "Buy Agent" Function Demonstration

- User dashboard with integrated airdrop data

Newton Airdrop Guide: Credit Points System

1. Create a profile at newton.xyz/app

Connect your EVM wallet and set a nickname

2. Activate the Buy Agent function

Carefully experience the entire operation process and allow your agent to conduct test transactions (some transactions may require a small gas fee).

Optional: Try deeper features (e.g. multi-agent, agent types, cross-task triggering, etc.).

3. Complete weekly tasks

The rewards area will have a regular rotation of tasks: using the app, sharing social feedback, and submitting testimonials.

4. Check your credit score

You can earn points by participating in activities and completing tasks, which will be accumulated on your dashboard.

5. Connect your social accounts

If you have verified your X account or joined Newton's Discord, you can get higher weight by completing some tasks.

6. Keep your points

While you can “withdraw” your points, the airdrop mechanism may be designed to keep your points on the platform as a signal of user loyalty.

7. Stay active every week

Missions and bonus levels are refreshed frequently. Remember to set a reminder to check every few days.

Please note:

- There are signs that on-chain interactions will be given more importance than off-chain interactions.

- If you refer friends, you may be rewarded for their active behavior, which is an additional incentive to build a small team.

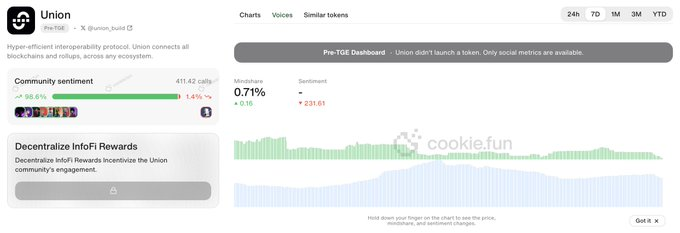

Union: Universal Interoperability Protocol

Union is tackling one of the most vexing problems in the cryptocurrency space: achieving seamless interoperability across EVM, Cosmos, Solana, and other blockchains. The project has received $16 million in funding and launched a new upgraded V2.5 user interface. Union is currently quietly laying the foundation for one of the largest airdrops in the cryptocurrency industry in 2025.

Union Airdrop Guide: Earn XP via the Union App

Platform: app.union.build

1. Connect your wallet

- Using MetaMask (EVM) and Keplr or Leap (Cosmos)

- Connect X account

2. Receive testnet tokens

Get it from the faucet website: app.union.build/faucet. Tokens are required to complete tasks.

3. Complete XP tasks

Tasks include cross-chain, exchange, connecting wallets, verifying accounts or linking Telegram/Discord.

4. Try the mainnet

The mainnet now supports some real-time transactions. If you can accept the gas fee, interacting on the mainnet may increase your eligibility for airdrops.

5. Check the XP leaderboard

Your total XP is visible in the app. There are no public leaderboards yet, but tracking your personal progress is key.

6. Join Discord

The community level of the Union is sometimes taken into account in the evaluation of the test network. Active members please claim your exclusive status in time.

Please note:

- Union will likely favor players who steadily accumulate XP rather than sprint players.

- The user experience has been improved, but you may still encounter sync errors. If the wallet does not show up immediately, just refresh or reconnect.

Summarize

Airdrop mining in 2025 will no longer be just about randomly creating a wallet and taking a chance, but will focus more on:

- Social media metrics, such as mind share

- Events before TGE

- Contribute real value in key areas (X platform, testnet, mainnet activities, community participation)

Spark, Newton, and Union are highly active and well-funded projects that have not yet issued tokens. They are being built around three core tracks: DeFi infrastructure, AI agents, and cross-chain liquidity.

You May Also Like

Mathematical Principle Analysis: How does Curve founder's new project Yield Basis reduce uncompensated losses to 0?