Binance Research: Total Capitalization of the Crypto Market Dropped by 15% in November

- November was the second weakest month of the year for the crypto market, according to Binance Research.

- Bitcoin ETFs lost $3.5 billion over the month, while DeFi TVL dropped by 20%.

- The Fed’s policy change is expected to have a positive impact on liquidity and investors.

The analytical division of the Binance crypto exchange, Binance Research, published a review of the crypto market for November 2025, which recorded a decrease in total capitalization by 15.43%. Representatives of the platform shared the report with Incrypted.

According to the report, this is the second month in a row in the red zone, signaling that the market is entering a deeper correction phase after a strong rally in the first half of the year.

Crypto market capitalization by month, 2021-2025. Source: Binance Research.

Crypto market capitalization by month, 2021-2025. Source: Binance Research.

According to experts, in November, the share of bitcoin in the total capitalisation decreased to 58.7%, and Ethereum — to 11.6%. Market participants were influenced by several key factors:

- Uncertainty about the December meeting of the Federal Reserve and the schedule of rate cuts

- Expectations of a 25 basis point increase in the Bank of Japan’s rate, which creates risks of unwinding carry trades

- A correction in the fake stocks sector, where scepticism about the return on large investments led to a sell-off in crypto assets.

On December 1, the Fed’s quantitative tightening program (QT) ended. Starting in January, the Fed is expected to switch to “balance sheet growth” with the purchase of $20-25 billion of short-term Treasury securities per month — technically, this is “QE-Lite,” which returns liquidity to the system and forms the basis for the future growth cycle of the crypto market.

In particular, the price of bitcoin in November dropped to the $80,000 range and ended the month at around $87,000 (-16.7%). Unlike the price, ETF flows were the key factor:

- Spot ETFs based on the first cryptocurrency recorded the largest outflows in history — about $3.5 billion for the month

- For several weeks in a row, net outflows exceeded $1 billion per week

- On November 21, the trading turnover of bitcoin ETFs reached a record $11 billion

The market has demonstrated that for ETF investors, bitcoin is now a full-fledged risky asset that is sensitive to changes in macro expectations.

Dynamics of capital inflows and outflows in US spot bitcoin ETFs. Source: Binance Research.

Dynamics of capital inflows and outflows in US spot bitcoin ETFs. Source: Binance Research.

The behaviour of new altcoin ETFs was also indicative: funds based on Solana (SOL), XRP (XRP) and Litecoin (LTC) started with net inflows, despite the negative trend in bitcoin ETFs, which indicates cautious institutional diversification.

Ethereum dropped by 21.3% — in addition to the market correction, the movement was influenced by the expected December Fusaka update, which is being implemented by PeerDAS and Verkle Trees. Some participants recorded profits before it.

The situation among the largest cryptocurrencies was as follows:

- BCH: -0.7%, TRX: -4.2% — the smallest drawdown among the leaders

- XRP: -11.5%, while ETFs from Franklin and Grayscale raised almost $60 million on the first day of trading

- DOGE: -19.3% — a weak start for the DOGE ETF

- BNB: -18.4%

- SOL: -25.5%, despite inflows to the SOL-ETF

- HYPE: -26.7% due to the expected unlocking of tokens

- ADA: -31% after the chain split incident

The correction covered the entire range of assets, from high-risk to the most liquid.

Top 10 crypto assets: from moderate drawdowns to 30 per cent drops. Source: Binance Research.

Top 10 crypto assets: from moderate drawdowns to 30 per cent drops. Source: Binance Research.

In addition, the DeFi sector has reduced the volume of blocked funds (TVL) by 20.8% compared to October. The reasons:

- Local depegs of several stablecoins

- Hacking of the Balancer protocol

- General risk-off mode

Among the large ecosystems, only BNB Chain and Arbitrum increased their share.

There is an ongoing discussion about the fee switch mechanism proposed by Uniswap, which involves the redistribution of a portion of fees from liquidity providers to UNI token holders and the possible burning of fees. This may increase the scarcity of the token, but at the same time worsen the liquidity economy.

As for the total capitalization of stablecoins, it decreased by 0.37%. This was influenced by:

- Rising yields on traditional instruments

- Investors going into full cash during the correction

- Liquidation of leverage positions that caused massive redemptions

The USDT stablecoin continues to grow moderately, while the share of USDC is declining.

Meanwhile, NFT sales volume decreased by 48.2%. The most popular cryptocurrencies were:

- Ethereum-NFT: -70%

- BNB Chain: -74%

- Bitcoin-NFT: -43%

- Base: -67%

DMarket (Mythos) became the leader in the collections, overtaking Pudgy Penguins and CryptoPunks. DX Terminal (Base) showed a 77% drop in volume.

Monthly trading volume of NFTs. Source: Binance Research.

Monthly trading volume of NFTs. Source: Binance Research.

At the same time, companies holding large crypto portfolios (Digital Asset Treasuries, DAT) faced a sharp decline in share prices in November:

- Strategy: -36%

- Bitmine: -38%

The key risk is a possible decision by MSCI to exclude companies with 50% of their assets in digital by 15 January 2026. At the same time, JPX is tightening its own requirements.

The market is already pricing in these risks: many DAT companies have moved from a premium to fair net asset value (mNAV) to trading at a discount.

Performance of DAT companies. Source: Binance Research.

Performance of DAT companies. Source: Binance Research.

Analysts stressed that December is traditionally less liquid, which can increase volatility. After the aggressive November fixing, a short-term technical rebound is possible.

In the longer term, the Fed’s shift from QT to regulatory easing and the development of crypto ETFs, including altcoin products, remain key drivers. DeFi and NFTs are expected to go through a period of cleansing, while crypto treasuries will be tested for the adaptability of their business models.

As a reminder, on 10 December, the Fed cut its interest rate by 0.25% to 3.5%-3.75%.

Its impact on the crypto market was analyzed by Incrypted. Read more in a separate article:

Ayrıca Şunları da Beğenebilirsiniz

Acurast Airdrop Guide | How to Participate in the Acurast Questing?

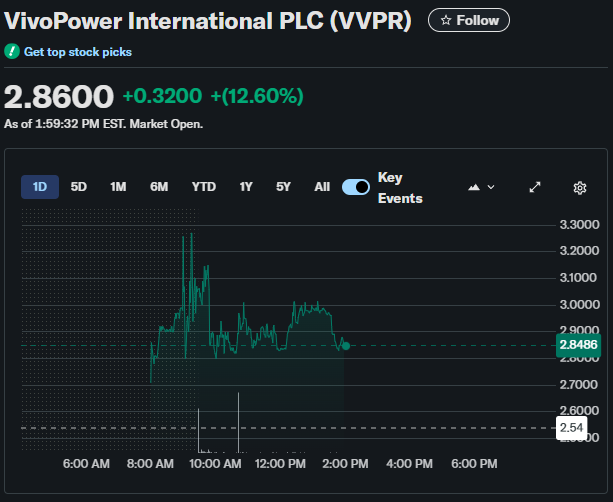

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally