3D Mapping Initialization: Using RGB-D Images and Camera Parameters

Table of Links

Abstract and 1 Introduction

-

Related Works

2.1. Vision-and-Language Navigation

2.2. Semantic Scene Understanding and Instance Segmentation

2.3. 3D Scene Reconstruction

-

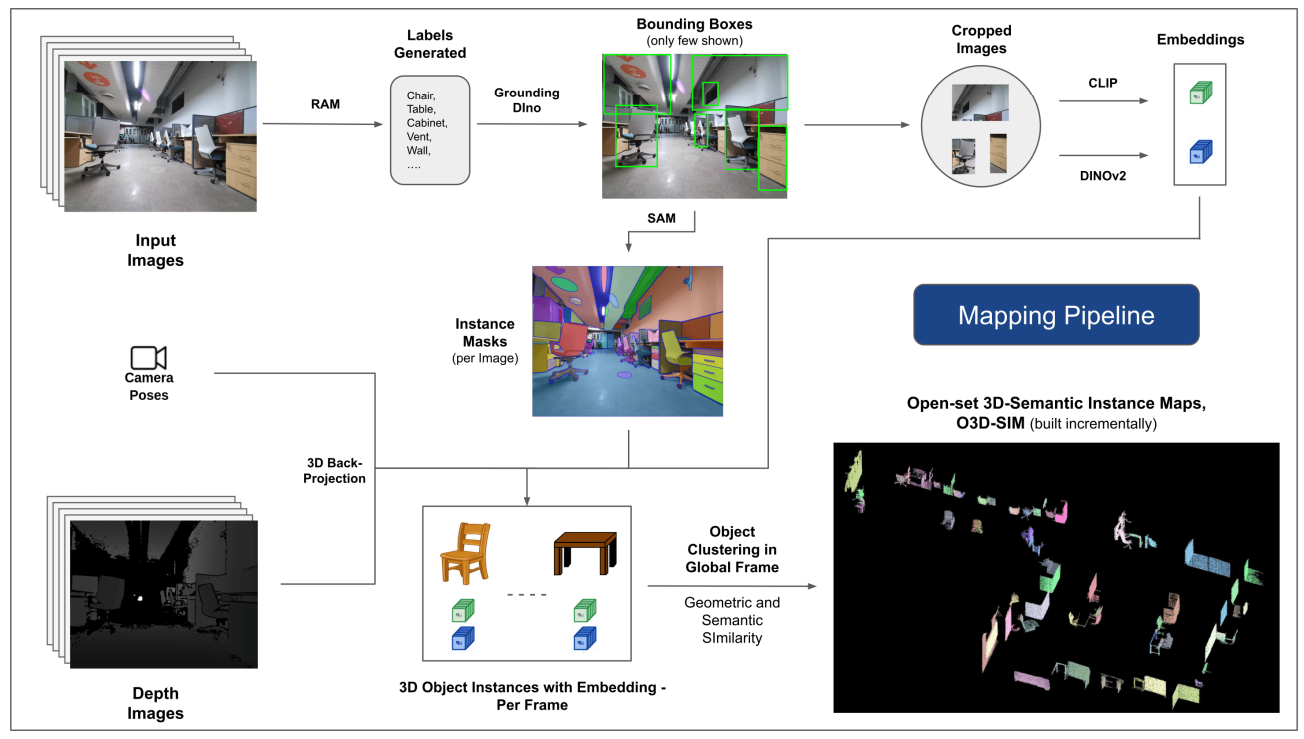

Methodology

3.1. Data Collection

3.2. Open-set Semantic Information from Images

3.3. Creating the Open-set 3D Representation

3.4. Language-Guided Navigation

-

Experiments

4.1. Quantitative Evaluation

4.2. Qualitative Results

-

Conclusion and Future Work, Disclosure statement, and References

3.1. Data Collection

Creating the O3D-SIM begins by capturing a sequence of RGB-D images using a posed camera, with an estimate of the extrinsic and intrinsic parameters of the environment to be mapped. The pose information associated with each image is used to transform the point clouds to a world coordinate frame. For simulations, we use the groundtruth pose associated with each image, whereas we leverage RTAB-Map[30] with G2O optimization [31] in the real world to generate these poses.

\

\

:::info Authors:

(1) Laksh Nanwani, International Institute of Information Technology, Hyderabad, India; this author contributed equally to this work;

(2) Kumaraditya Gupta, International Institute of Information Technology, Hyderabad, India;

(3) Aditya Mathur, International Institute of Information Technology, Hyderabad, India; this author contributed equally to this work;

(4) Swayam Agrawal, International Institute of Information Technology, Hyderabad, India;

(5) A.H. Abdul Hafez, Hasan Kalyoncu University, Sahinbey, Gaziantep, Turkey;

(6) K. Madhava Krishna, International Institute of Information Technology, Hyderabad, India.

:::

:::info This paper is available on arxiv under CC by-SA 4.0 Deed (Attribution-Sharealike 4.0 International) license.

:::

\

Ayrıca Şunları da Beğenebilirsiniz

USD/CAD rises above 1.3750 after rebounding from three-month lows

Bitwise Forecasts Bullish 2026 for Crypto: Bitcoin to Hit New All-Time Highs, ETF Demand to Surge, Institutional Adoption to Deepen