Strategy (MSTR) Stock Falls as Bitcoin Hovers Around $87K

Strategy (MSTR) shares fell sharply on Dec. 16 as BTC $87 075 24h volatility: 3.0% Market cap: $1.74 T Vol. 24h: $53.32 B hovered around the $87,000 mark. It is a rough stretch for crypto-exposed equities.

The drop came even as Michael Saylor’s company disclosed a fresh, billion-dollar allocation to BTC. Earlier this week, Strategy bought 10,645 Bitcoins for about $980.3 million, lifting its treasury to 671,268 BTC.

Strategy’s Massive Bitcoin Purchase

Strategy’s newest weekly purchase of 10,645 BTC at an average price of ~$92,098 is its largest since late July and follows another sizable addition the prior week.

With this haul, total holdings reached 671,268 BTC, with an average cost of roughly $74,972 per coin. The two moves made MSTR the largest holder of Bitcoin on the market.

Largest Bitcoin holders | Source: bitcointreasuries.net

Crypto Market Snapshot

BTC has been trading near $87,000 in recent sessions after dipping below $86,000 intraday on Dec. 16.

Bitcoin price in 24 hours | Source: CoinMarketCap

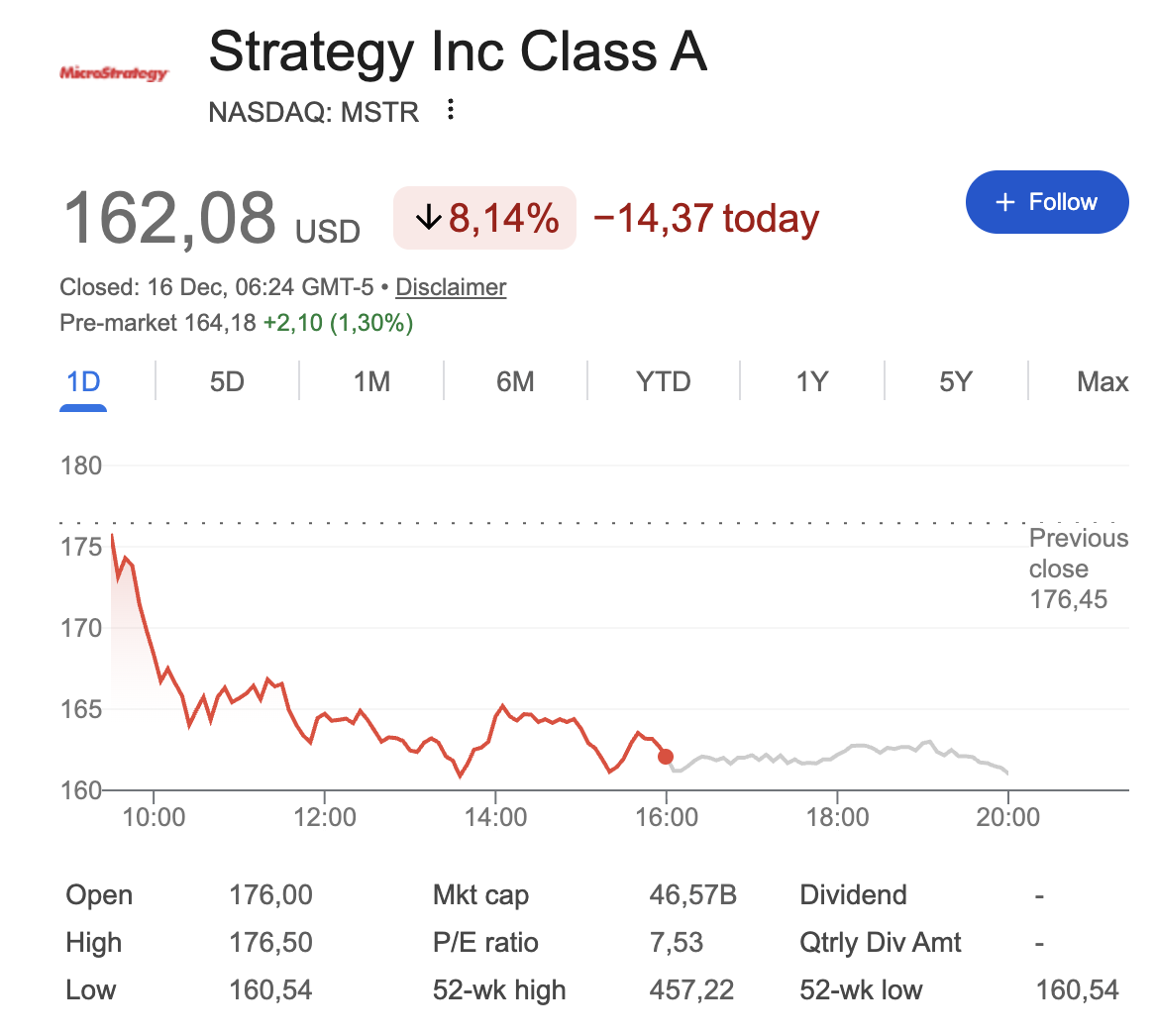

Strategy (MSTR) shares fell 8.4% on Monday and are down meaningfully year-to-date, reflecting leverage to BTC’s downside.

Strategy (MSTR) shares | Source: Google Finance

Why the Stock’s Still Heavy

MSTR’s equity typically amplifies Bitcoin’s direction because BTC dominates its balance sheet. When spot weakens, and macro risk appetite fades, that embedded “BTC beta” pulls the stock lower, even during aggressive accumulation streaks. Barron’s also notes BTC has shed more than 30% since its October peak, weighing on sentiment toward the whole crypto-proxy complex.

Despite that, Strategy keeps buying. 10,645 BTC this past week alone brings its stash to 671,268 BTC. But with Bitcoin near $90K and risk appetite shaky, MSTR remains under pressure, underscoring how tightly the stock’s fortunes are tied to the coin’s next move.

nextThe post Strategy (MSTR) Stock Falls as Bitcoin Hovers Around $87K appeared first on Coinspeaker.

Ayrıca Şunları da Beğenebilirsiniz

Kalshi Jumps to 62% Market Share While Polymarket Eyes $10B Valuation

Visa Expands USDC Stablecoin Settlement For US Banks