Gold Surges in 2025 as BTC-Gold Ratio Declines: What Investors Need to Know

Bitcoin-Gold Ratio Retreats as Gold Outperforms in 2025

The Bitcoin-to-gold ratio has sharply declined to 20 ounces per Bitcoin in 2025, marking a 50% decrease from approximately 40 ounces in December 2024. This significant shift isn’t indicative of waning Bitcoin demand but reflects how macroeconomic conditions favored gold as a preferred store of value this year, overshadowing cryptocurrencies.

Key Takeaways

- The ratio decreased from 40 to 20 ounces per Bitcoin between December 2024 and Q4 2025.

- Central banks accumulated 254 tonnes of gold through October, with global gold ETF holdings rising by 397 tonnes in the first half of 2025.

- Bitcoin demand waned in the latter half of the year, with spot ETF assets under management dropping from $152 billion to $112 billion, amid significant long-term holder sell-offs.

- Gold’s rally persisted despite restrictive monetary policy and rising global uncertainty, highlighting a shift in investor preferences.

Why Gold Dominated the Store-of-Value Sector in 2025

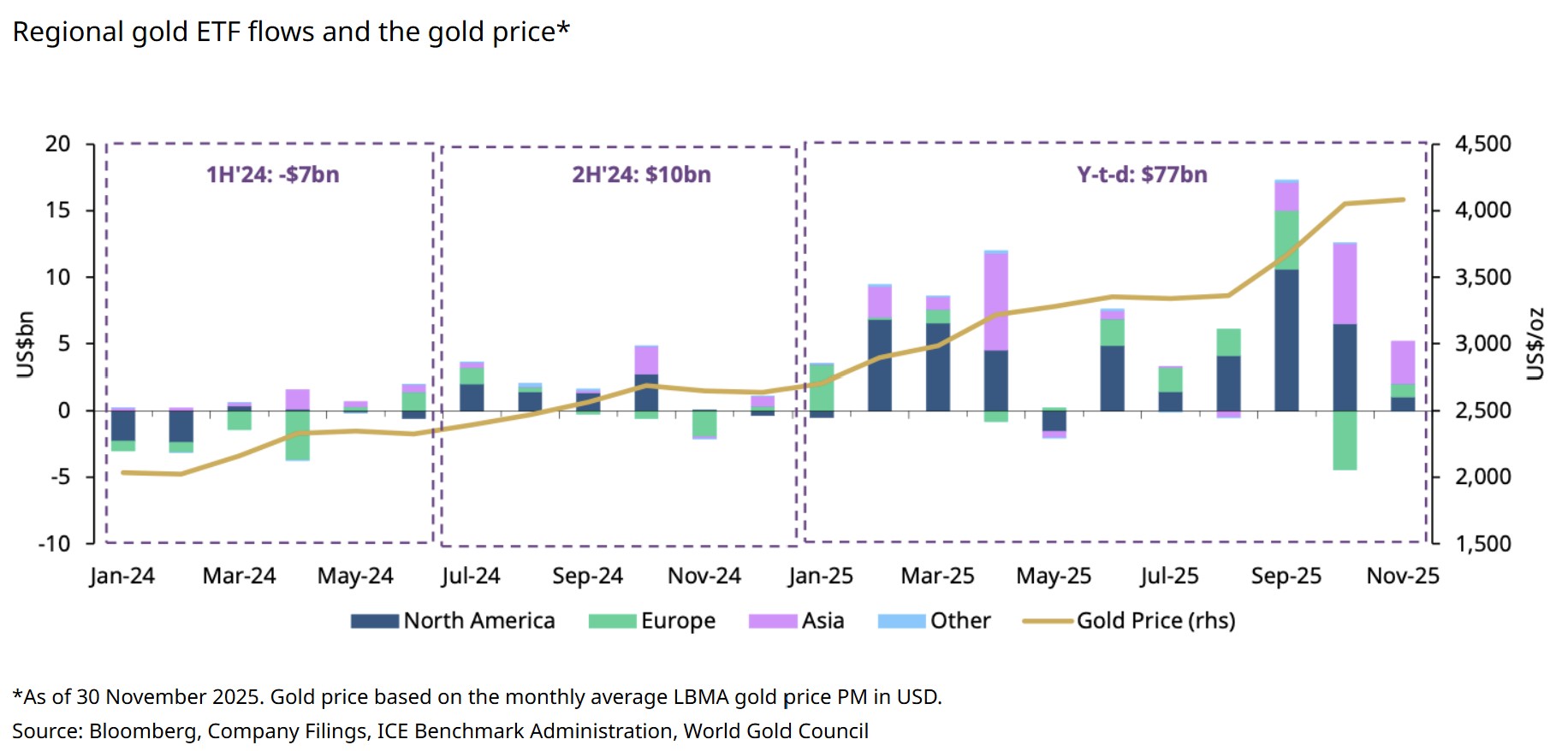

Gold led the global demand for a secure store of value in 2025, gaining 63% year-to-date and surpassing $4,000 per ounce in the fourth quarter. This upward push defied expectations, as monetary conditions remained tight for most of the year, with the Federal Reserve only easing policy in September. Historically, such restrictive environments tend to depress non-yielding assets, but gold’s performance indicated a fundamental change in investor behavior.

Central Banks’ gold accumulation in 2025. Source: World Gold CouncilOfficial sector purchases totaled 254 tonnes through October, led notably by the National Bank of Poland, which added 83 tonnes. Meanwhile, global gold ETF holdings expanded by 397 tonnes in the first half, reaching a record 3,932 tonnes by November. This contrasted sharply with the outflows seen in 2023 and occurred despite real yields averaging 1.8% across developed markets in Q2, during which gold rallied 23%, illustrating a decoupling from traditional negative correlation to yields.

Gold ETF flows and gold price. Source: World Gold Council

Gold ETF flows and gold price. Source: World Gold Council

Heightened geopolitical tensions and increased volatility further reinforced gold’s appeal. The VIX volatility index averaged 18.2 in 2025, up from 14.3 in 2024, while geopolitical risk indices rose 34%. Gold’s correlation with equities dropped to negative 0.12—the lowest since 2008—highlighting its status as a safe haven amidst broader market uncertainty. For many investors, gold functioned more as portfolio insurance rather than solely an inflation hedge, amid tight monetary conditions and delayed easing policies.

Bitcoin’s Relative Underperformance in 2025

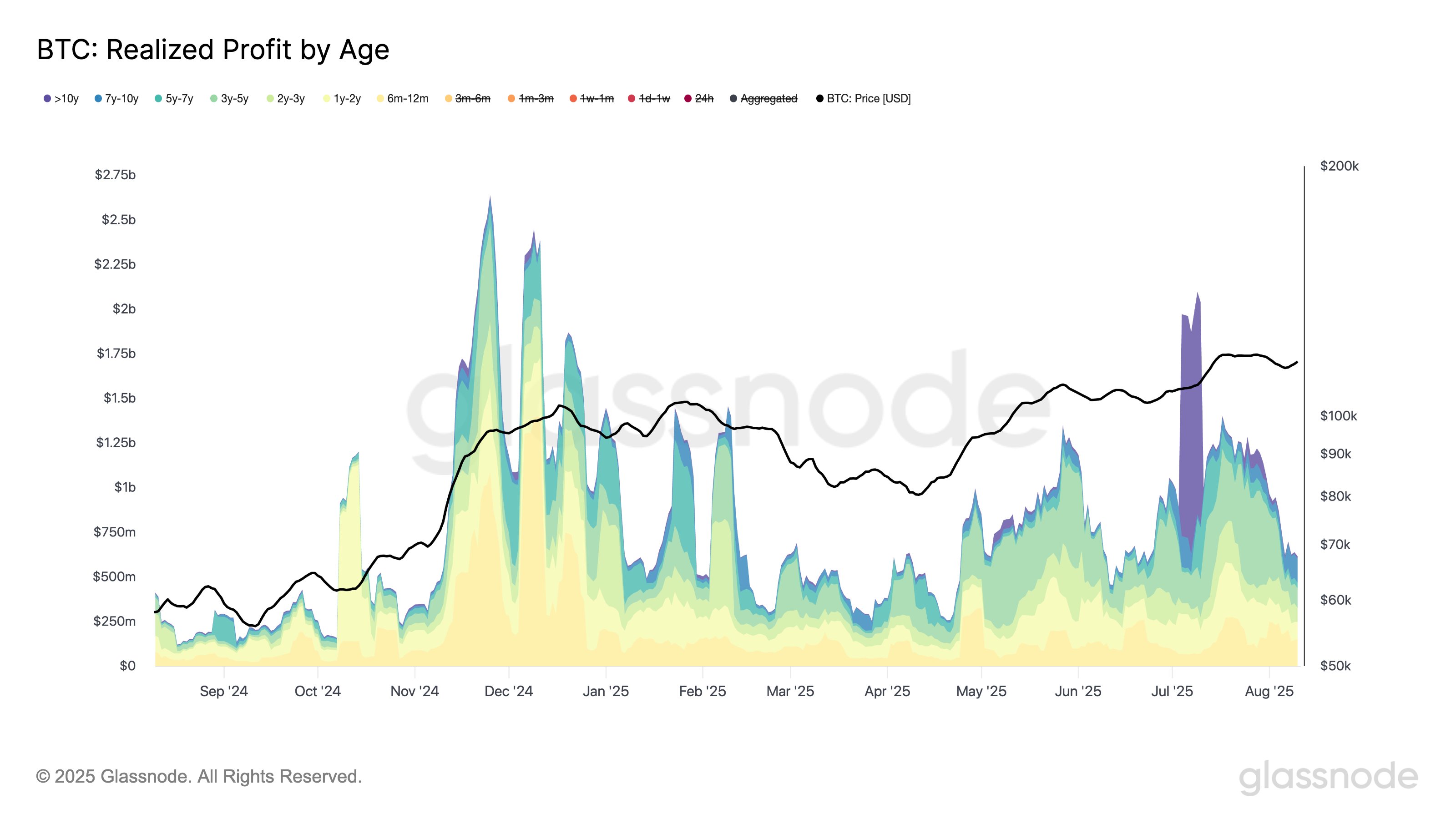

While Bitcoin experienced robust gains, reaching six figures and benefiting from increased demand for spot Bitcoin ETFs, its relative performance lagged due to weakening demand in the second half of the year. ETF assets under management peaked at $152 billion in July but declined to around $112 billion by December, as outflows outpaced new capital inflows during price corrections.

Total net assets in spot BTC ETFs in 2025. Source: SoSoValue

Total net assets in spot BTC ETFs in 2025. Source: SoSoValue

On-chain data indicated significant profit-taking, with long-term holders realizing over $1 billion daily in July alone. Selling intensified towards year-end, with about 300,000 Bitcoin sold in October, equating to approximately $33 billion. This marked the most aggressive long-term holder distribution since late 2024. As a result, the supply held by long-term investors declined from 14.8 million BTC to about 14.3 million.

Bitcoin profit-taking peak by long-term holders in July. Source: Glassnode

Bitcoin profit-taking peak by long-term holders in July. Source: Glassnode

Persistently elevated real yields throughout much of the year dampened Bitcoin’s attractiveness, as its correlation with equities remained high. In contrast, gold continued benefiting from its safe-haven status and central bank buying, leading to the compression of the Bitcoin-gold ratio, which signals cyclical re-pricing rather than a breakdown in Bitcoin’s long-term fundamentals.

This article was originally published as Gold Surges in 2025 as BTC-Gold Ratio Declines: What Investors Need to Know on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Ayrıca Şunları da Beğenebilirsiniz

Solana Faces Massive DDoS Attack Without Performance Issues

A ‘Star Wars’ Actor Rewrites The Entire New Trilogy They Starred In