GameFi

Share

GameFi merges blockchain technology with the gaming industry, enabling Play-to-Earn (P2E) and "Play-to-Own" economies. Through decentralized assets, players have true ownership of in-game items as NFTs. In 2026, the sector has matured into High-Quality AAA Gaming experiences with seamless on-chain integration. Explore this tag for insights into Web3 gaming guilds, metaverse infrastructure, and how blockchain is redefining player incentives and virtual economies in the 2026 gaming landscape.

1180 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

“cnjrefcod” 30% Off Trading Fees

2026/02/07 06:42

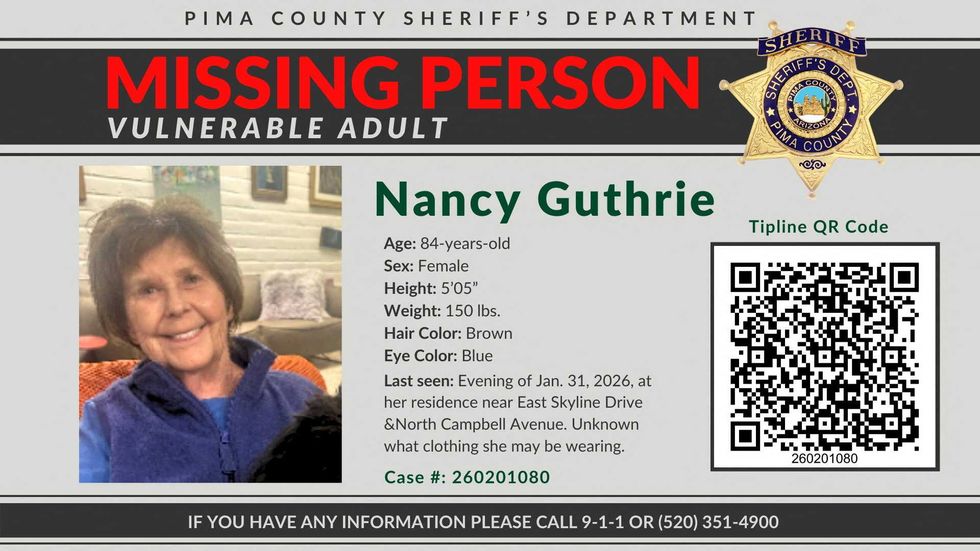

New note emerges in abduction of Nancy Guthrie

2026/02/07 06:32

Stablecoin Inflows Surge as Bitcoin Struggles Under Persistent Selling Pressure

2026/02/07 06:04

XRP snaps back after near-20% sell-off as volatility dominates post-crash trading

2026/02/07 06:03

Stellar (XLM) Jumps 7% as $0.183 Breakout Signals Potential Reversal

2026/02/07 06:00