Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

15076 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

“cnjrefcod” 30% Off Trading Fees

2026/02/07 06:42

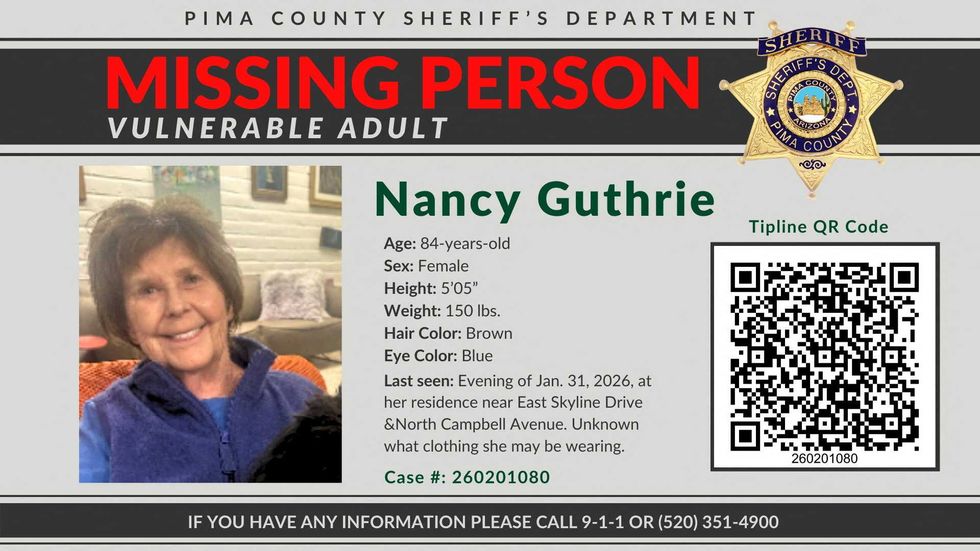

New note emerges in abduction of Nancy Guthrie

2026/02/07 06:32

Stablecoin Inflows Surge as Bitcoin Struggles Under Persistent Selling Pressure

2026/02/07 06:04

XRP snaps back after near-20% sell-off as volatility dominates post-crash trading

2026/02/07 06:03

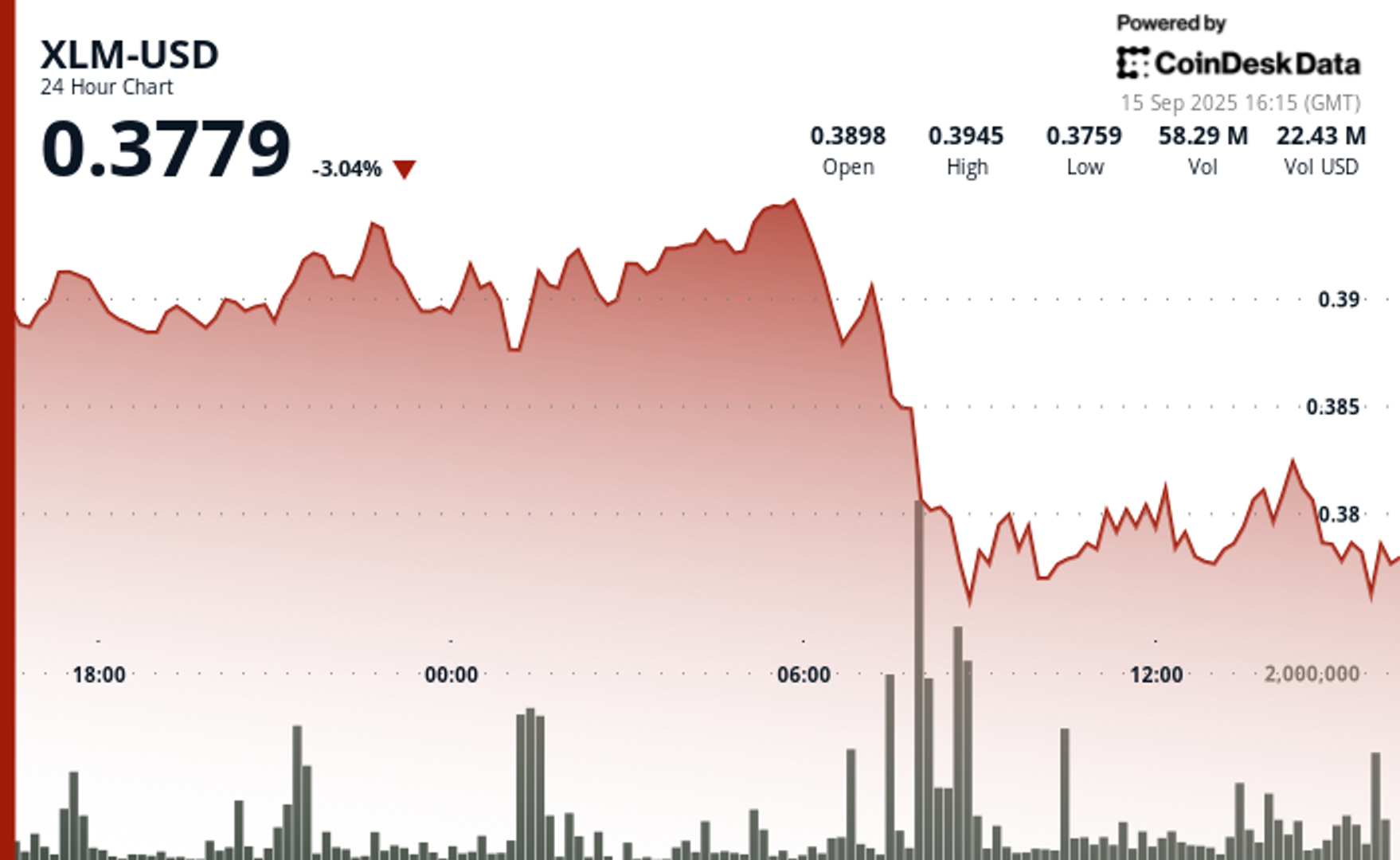

Stellar (XLM) Jumps 7% as $0.183 Breakout Signals Potential Reversal

2026/02/07 06:00