Options

Share

Options are versatile derivative instruments that give traders the right, but not the obligation, to buy (Call) or sell (Put) a digital asset at a specific strike price.Unlike futures, options offer a flexible way to hedge against "black swan" events or speculate on implied volatility. The 2026 landscape features a surge in on-chain options vaults (DOVs) and structured products that simplify complex "Greeks" for retail users. Explore this tag for insights into premium pricing, expiration cycles, and advanced strategic hedging in the decentralized derivatives market.

21051 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Best Chinese Poker Sites in 2025

Author: BitcoinEthereumNews

2025/08/28

Share

Recommended by active authors

Latest Articles

“cnjrefcod” 30% Off Trading Fees

2026/02/07 06:42

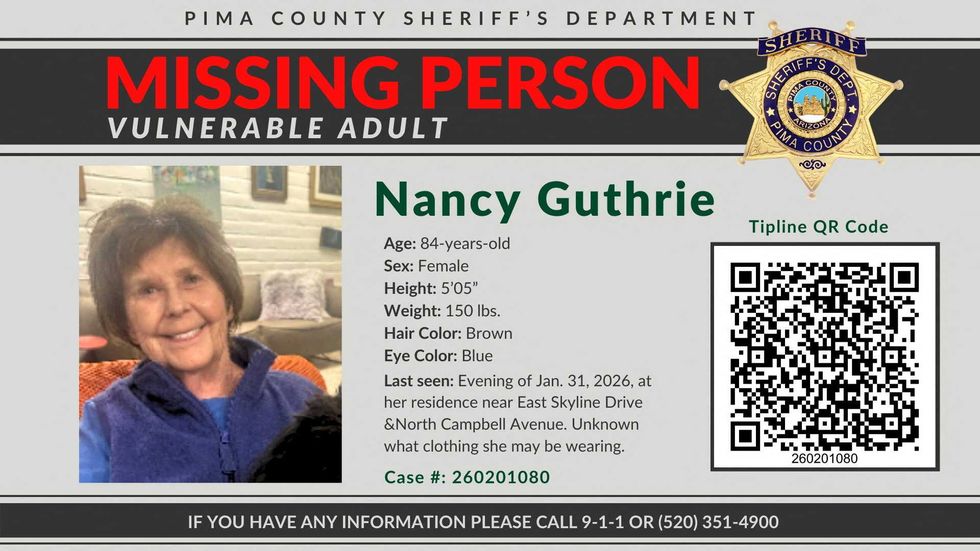

New note emerges in abduction of Nancy Guthrie

2026/02/07 06:32

Stablecoin Inflows Surge as Bitcoin Struggles Under Persistent Selling Pressure

2026/02/07 06:04

XRP snaps back after near-20% sell-off as volatility dominates post-crash trading

2026/02/07 06:03

Stellar (XLM) Jumps 7% as $0.183 Breakout Signals Potential Reversal

2026/02/07 06:00