Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

14510 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

What traders need to know in 2025

Author: BitcoinEthereumNews

2025/09/05

Share

Recommended by active authors

Latest Articles

USDT Sets Record as Onchain Transfers Hit $4.4 Trillion

2026/02/08 04:40

Why Is Crypto Crashing in 2026? Trend Research Liquidates $800M in ETH While Aave and XLM Struggle, Making DeepSnitch AI the Potential Best Bet for Recovery

2026/02/08 04:30

Trump’s crypto rally fizzles as $2 trillion market gains vanish

2026/02/08 04:08

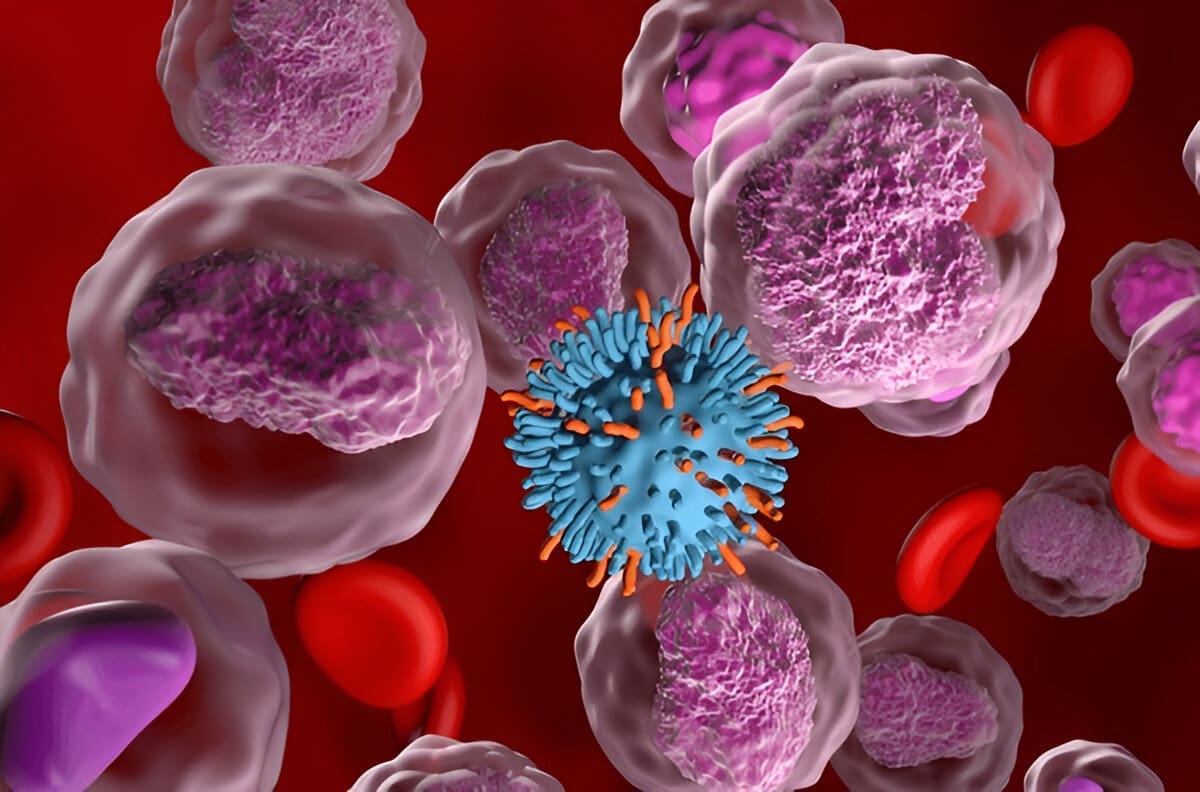

Stem Cell Lymphoma Treatment and Procedures: A Comprehensive Guide

2026/02/08 04:07

Trump’s crypto “golden age” throws away $2 trillion in profits, leaving those holding dollars as winners

2026/02/08 04:05